317-912-1000

317-912-1000

Nelson Nash, the creator of the Infinite Banking Concept (IBC), strongly advised against incorporating Indexed Universal Life (IUL) insurance into this strategy. He recognized that IUL policies might ultimately be more expensive for consumers because their sustainability over time isn’t guaranteed. Despite some IUL agents downplaying this concern, Nash’s position was clear: IBC was meant to work with Participating Whole Life Insurance (PWLI), not IUL.

One of the reasons behind this stance is that insurance companies profit more from selling IUL policies compared to PWLI. With IUL, the risk of investment tied to the policy’s performance is transferred to the individual holding the policy. This contrasts with PWLI, where the insurance company keeps and manages the risk. As a result, the financial burden placed on IUL policyholders can be greater over time due to this shifted risk.

Secondly, unlike a Participating Whole Life Insurance (PWLI) policy where coverage gradually becomes fully paid for, the cost of maintaining life insurance coverage with an Indexed Universal Life (IUL) policy keeps increasing. This growing financial responsibility often becomes too much for the policyholder to handle. When that happens, not only is the insurance coverage lost, but also all the money that the policyholder has invested in the IUL policy from the start.

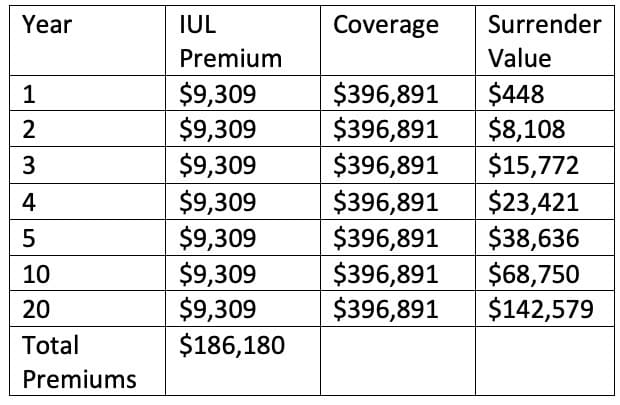

To highlight the risks involved with IUL policies, I created several examples for a healthy 30-year-old man. I aimed to show what a policyholder faces when choosing an IUL policy compared to a PWLI policy, assuming the goal was to maintain at least $396,891 in death benefits. By comparing these with the costs tied to a renewable term policy that also offers $396,891 in coverage, the financial implications of maintaining that level of life insurance become much clearer.

The annual premium for getting $396,891 coverage with an Indexed Universal Life (IUL) policy is set at $9,309. However, this premium amount isn’t fixed and can be adjusted. A common error among IUL policyholders is choosing to pay only a portion of this $9,309, not the full amount.

This decision can lead to financial issues down the line. The part of the premium that goes unpaid is meant to accumulate interest, which would help balance out the rising costs of an IUL policy over time. By not paying the full premium, policyholders miss out on potential interest earnings. Additionally, if they do decide to pay the extra amount later, they’ll incur fees from the insurance company on those extra payments. So, either by paying fees or by forfeiting interest, IUL policyholders end up at a financial disadvantage.

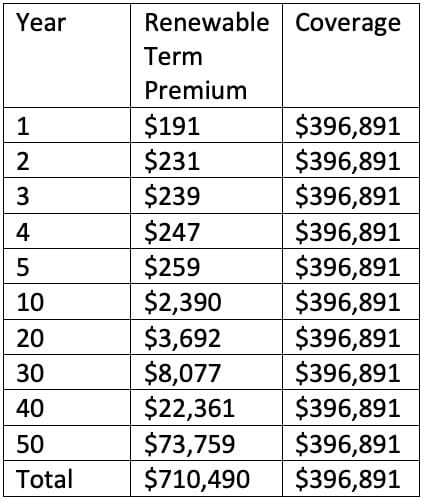

It’s important to note that the $9,309 annual premium isn’t actually required in the initial years of any life insurance policy, including IUL. This is evident when looking at the premiums for renewable term insurance, which offers the same $396,891 coverage but only costs $191 in the first year. However, as shown in the renewable term insurance chart, the cost for this type of insurance skyrockets in the later years.

Without the interest that should have been earned from the additional funds in the Indexed Universal Life (IUL) policy’s scheduled premium, all the rising costs for maintaining coverage will have to be covered by the policyholder themselves. This is because the extra money paid in premiums was supposed to generate interest, which would help reduce or even completely cover these increasing expenses in the future. The idea is to invest more money now to save on costs later on. But does this strategy actually work as intended?

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Looking at the IUL chart provided above, the total amount paid in scheduled premiums up to the 20th year amounts to $186,180. However, it’s important to note that the cash value you could get from surrendering the policy in the 20th year is only $142,579.

When you add up all the premiums paid for the 20-year term insurance, which total $44,964, to the cash surrender value of the Indexed Universal Life (IUL) policy after 20 years, you get a figure that’s almost the same as what the total premiums would have been if the IUL policyholder had paid every scheduled premium up to the 20th year ($187,543 vs. $186,180).

This suggests that the money that could have been used for the policyholder’s benefit in the IUL policy was instead used to cover the costs of the renewable term insurance, rather than growing over time. Over the years, the cost of renewable term insurance goes up, meaning even more of the IUL policy’s cash value will be needed to cover these increasing costs. Eventually, there might not be enough cash value left in the IUL policy to handle these expenses, risking the policy’s lapse if the policyholder can’t afford the extra costs. Looking further, by the 50th year, the cost of maintaining the term insurance exceeds the death benefit by $313,599 ($710,490 – $396,891).

The cash value you can get from an Indexed Universal Life (IUL) policy after 20 years, known as the surrender value, is mainly the result of the excess premiums paid, along with a bit of interest that might have been earned on those extra payments. With the surrender value at $142,579 and the total premiums paid reaching $186,180 by the 20th year, there’s a difference of $43,601. This shortfall is almost the same as the total cost of renewable term insurance over 20 years, which is $44,964, being just $1,363 less. So, earning just around $1,363 in interest on over $142,579 of excess payments over two decades doesn’t exactly showcase a strong investment return.

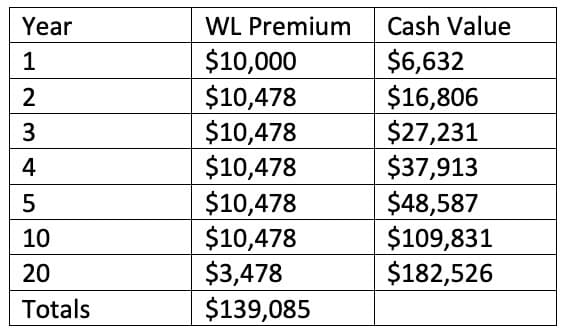

Alternatively, this person could have opted for a whole life insurance policy. By the tenth year, the guaranteed cash values of this policy—which reflect actual ownership equity, not just overpaid premiums—would surpass the total amount paid for the policy by more than $5,000. This means the policyholder owns more in guaranteed cash value than the total payments made on the policy.

By the twentieth year, the total payments made into this whole life policy, known as the cost basis, are guaranteed not to exceed $139,085. To put this in perspective, remember that the Indexed Universal Life (IUL) policy required $186,180 in scheduled payments by the same year.

When you add up the cost of twenty years of renewable term insurance coverage to the whole life policy’s cost basis, the total comes to $184,034 ($44,949 for term insurance plus $139,085 for whole life). This total is very close to the guaranteed cash value of the whole life policy at $182,526 after twenty years. This results in a cash value that is $43,441 higher than the premiums paid over these two decades. Achieving this level of cash value means that the coverage in this whole life policy gradually became equity, or “paid-up” insurance, over time. This approach stands in sharp contrast to the IUL policy, where cash values had to be continually depleted to maintain the set coverage amount.

Getting $43,441 more than what you’ve invested in something is fantastic, especially when the value of your purchase also goes up. That’s exactly what happens with a participating whole life insurance policy.

By the 21st year, the death benefit of this whole life policy has grown to an impressive $587,997 guaranteed! Imagine buying a house and seeing its market value jump by 48.15% over two decades. With this whole life policy, a 48.15% increase in the value of the death benefit is a sure thing.

Get a working knowledge of how each type of life insurance policy works.

After reading this 10-page booklet you'll know more about life insurance than most insurance agents.

Download here>

Nelson Nash really hit the nail on the head when he advocated for using participating whole life insurance with the Infinite Banking Concept (IBC), rather than IUL insurance. As Nash often said, “IBC isn’t about interest rates.” It’s actually not about investing at all; it’s about recouping the cost of your money, leveraging the solid guarantees that come with owning participating whole life insurance.

For further insights, read more on Indexed Universal Life Insurance. When you’re ready to explore your options for life insurance, consider scheduling a strategy session with us. We’re here to assist you in securing the coverage that best suits your requirements.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.