317-912-1000

317-912-1000

The Infinite Banking Concept (IBC) has gained attention as a financial strategy that transforms how people think about borrowing, saving, and building wealth. At its core, this approach uses specially designed whole life insurance policies as a personal banking system, offering an alternative to traditional lending institutions.

The Infinite Banking Concept was pioneered by R. Nelson Nash in the 1980s during a period of high interest rates. Facing real estate investments leveraged at rates as high as 23%, Nash discovered he could access capital through his whole life insurance policies at much more favorable rates of 5-8%. This revelation led him to develop a systematic approach to using whole life insurance as a personal banking system.

The concept is built around a simple but powerful idea: fund specially designed whole life insurance policies to create cash value that you can borrow against for any purpose, whether it’s paying off debt, financing business ventures, purchasing investments, or covering major expenses.

The term “infinite” doesn’t refer to unlimited funds, but rather to the unlimited ways you can utilize your policy’s financial mechanisms. Much like how traditional banks use depositors’ money for various purposes, IBC allows policyholders to use their cash value repeatedly for different needs:

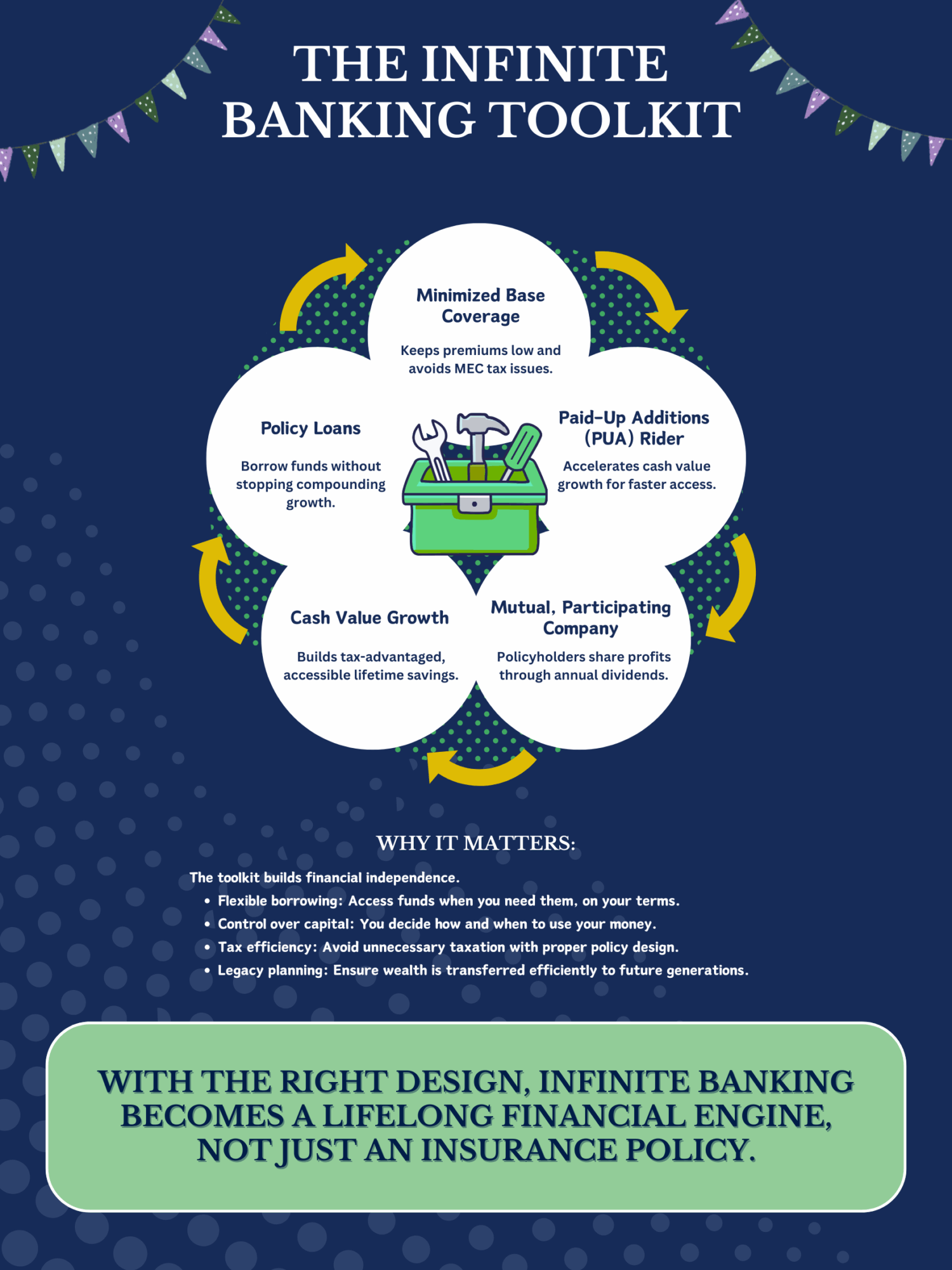

Not all life insurance policies work for infinite banking. The strategy requires dividend-paying whole life insurance policies with specific design characteristics:

The foundation of a successful infinite banking policy lies in its specific design characteristics. Minimized Base Coverage is crucial because the policy should maintain only the minimum death benefit required by law to preserve its life insurance status. This approach avoids the policy becoming a Modified Endowment Contract (MEC), which would eliminate the favorable tax treatment that makes infinite banking attractive. When a policy becomes a MEC, withdrawals are taxed on a last-in-first-out basis, and early withdrawal penalties may apply.

The Maximized Paid-Up Additions (PUA) Rider serves as the engine of cash value growth. This rider allows you to pay additional premiums beyond the base policy cost, which immediately purchase paid-up life insurance and create instant cash value. Unlike the base premium, which must cover insurance costs and company expenses, PUA riders convert almost dollar-for-dollar into accessible cash value. This feature accelerates the accumulation of funds available for borrowing.

Understanding Mutual and Participating vs. Stock-held companies is essential for maximizing returns. Mutual insurance companies are owned by their policyholders, who participate in the company’s profits through dividend distributions based on the insurer’s actual performance. These participating policies allow you to share in the company’s success, with many mutual companies maintaining dividend payment histories spanning over 100 consecutive years.

Stock-held insurance companies are owned by shareholders whose main interest is maximizing stock value rather than policyholder benefits. While some stock-held companies may pay dividends, they lack the consistent track record and policyholder-focused structure of mutual companies. With mutual companies, policyholders are both customers and partial owners, ensuring that company profits are returned to those who made them possible rather than being distributed to external shareholders seeking maximum returns on their investment.

A well-designed infinite banking policy should demonstrate strong early cash value accumulation, which sets it apart from traditional whole life insurance policies focused on death benefits. In quality policies with maximized PUA riders, you can expect approximately 50-70% of first-year premiums to translate into immediate cash value. This accumulation occurs because the PUA rider complies with the IRS’ requirements to keep the policy growing tax free.

The timeline for full premium recovery falls between years 8-15, depending on the policy design, your age, and health rating. This break-even point is crucial for infinite banking success, as it represents when your accessible cash value equals or exceeds total premiums paid.

When evaluating policy performance, internal rates of return range from 2-4% on projected values, including dividends. While these returns might seem modest compared to stock market projections, once the dividend is paid they represent guaranteed, after-tax equivalent returns with no market risk. These rates don’t account for the leverage benefits of using policy loans to fund other investments or keep the opportunity cost which are lost when paying with cash or using traditional financing. Neither do these internal rates of return (IRR) reflect the complete picture as the death benefit hasn’t even been considered in these IRR projections.

The accessibility factor distinguishes infinite banking policies from other savings vehicles. Policy loans are available within days of application through a simple request process. There are no credit checks, income verification requirements, or restrictions on how you use the funds. This liquidity, combined with competitive interest rates, creates the flexibility that makes the infinite banking concept viable for various financial strategies.

Understanding how policy loans work is important for implementing infinite banking successfully. When you take a policy loan, you’re not actually withdrawing your cash value from the policy. Instead, the insurance company lends you money from its general fund, using your policy as collateral. This distinction is crucial because it means your cash value continues to grow uninterrupted while you have access to funds for other purposes.

This mechanism allows your money to work in two places at once, which is often called “the miracle of infinite banking.” Your cash value continues earning dividends and guaranteed interest within the policy, while the borrowed funds can be deployed for investments, business opportunities, or personal expenses. The insurance company views policy loans as one of its safest investments, as it can recover any unpaid balance from the policy’s cash value or death benefit.

Interest rates on policy loans are competitive with traditional lending sources, ranging from 5-8% annually. The interest calculation uses simple interest rather than compound interest, meaning you only pay interest on the outstanding principal balance. Many policies also offer flexible repayment options, meaning you can make interest-only payments, repay principal and interest, or even allow interest to compound annually and be added to the loan balance.

The tax advantages of policy loans provide additional benefits. Loan proceeds are generally considered tax-free since they show a return of your basis (premiums paid) or borrowed funds secured by your policy. This tax treatment allows you to access your cash value without creating taxable events, unlike withdrawals from traditional retirement accounts or investment sales that might trigger capital gains taxes.

One important consideration is that unpaid policy loans will reduce the death benefit dollar-for-dollar. This reduction doesn’t significantly impact the overall strategy since the borrowed funds are usually deployed productively elsewhere. The key is maintaining discipline in loan repayment to preserve the policy’s long-term performance and death benefit protection.

Contrary to popular belief, infinite banking isn’t exclusively for the wealthy. Starting premiums can be relatively modest:

The key is consistency and proper policy design rather than massive premium payments.

The growing popularity of infinite banking has unfortunately led to confusion and misrepresentation in the marketplace, resulting in disappointed policyholders and criticism of the concept itself. Understanding these common issues can help you avoid costly mistakes.

One of the most prevalent problems involves improperly designed policies that prioritize agent commissions over cash value growth. Since agent commissions are calculated based on the base death benefit amount, some agents design policies with excessive death benefits and minimal PUA riders. These policies may look like infinite banking tools but perform poorly because too much of your premium goes toward insurance costs rather than cash accumulation. A properly designed policy should minimize the death benefit to the legal minimum and maximize the PUA rider to optimize cash value growth.

Another issue is the marketing of universal life policies as infinite banking tools. Universal life insurance, whether variable or indexed, operates differently from whole life insurance. These policies lack the guarantees and dividend-paying structure essential to infinite banking success. Variable universal life policies expose your cash value to market risk, while indexed universal life policies have caps, participation rates, and fees that can impact performance. Neither provides the predictable, guaranteed growth that makes infinite banking viable.

The problem of excessive premiums occurs when agents convince clients to purchase more insurance than they can reasonably afford long-term. Infinite banking policies are built around consistent premium payments. Policies that strain your budget may lead to lapses or early reduced paid-up insurance options, both of which can destroy the strategy’s effectiveness. The premium amount should align with your long-term financial capacity rather than maximum possible coverage.

Perhaps most dangerous are promises of unrealistic returns or guarantees that misrepresent how infinite banking works. Some promoters describe the strategy as a way to “beat the market” or guarantee specific returns, which is inaccurate and misleading. Infinite banking provides steady, predictable growth with tax advantages and liquidity, but it’s not a high-return investment strategy. Setting appropriate expectations is crucial for long-term satisfaction with the approach.

The reality is that infinite banking works best when viewed as a long-term financial tool that provides liquidity, tax advantages, and growth rather than a get-rich-quick scheme. Success requires patience, proper implementation, and realistic expectations about returns and timeframes. When properly executed, it offers unique benefits, but it’s not appropriate for everyone or every financial situation.

The versatility of infinite banking makes it valuable for various financial strategies:

Debt Elimination: Use policy loans to pay off high-interest debt, then repay the policy at more favorable rates.

Business Financing: Access capital for equipment purchases, inventory, or expansion without traditional business loan requirements.

Real Estate Investment: Use policy loans for down payments or property improvements while maintaining liquidity.

Retirement Planning: Create tax-free retirement income through policy loans while preserving the death benefit.

Education Funding: Finance children’s education without affecting financial aid eligibility.

Infinite banking works best for individuals who:

The success of an infinite banking strategy depends on proper policy design and ongoing management, making the selection of the right professional is crucial to your success. Unfortunately, not all insurance agents understand the requirements for infinite banking, and some may prioritize their commission over your policy design.

Look for professionals who demonstrate a deep understanding of the design requirements for infinite banking. They should be able to explain why minimizing the base death benefit and maximizing paid-up additions is essential, and they should be willing to show you illustrations comparing traditional whole life designs with infinite banking optimized policies. A knowledgeable practitioner will understand the tax implications and be able to explain how to avoid MEC limits while maximizing cash value growth.

The willingness to minimize base coverage to maximize cash value growth is an indicator of agent integrity. Since agent commissions are based on the base death benefit amount, agents focused on infinite banking should be willing to sacrifice commission income to design policies that serve your interests. If an agent pushes for higher death benefits or discourages maximizing PUA riders, they may not be the right fit for infinite banking implementation.

Ongoing education and support distinguish excellent practitioners from those who simply sell policies. Infinite banking requires understanding how to effectively use policy loans, manage repayment schedules, and integrate the strategy with your overall financial plan. Look for professionals who provide educational resources, regular policy reviews, and guidance on implementing the strategy effectively rather than just delivering policies and disappearing.

Whole life insurance designed for infinite banking offers a unique approach to personal finance management. When properly implemented, it provides financial flexibility, tax advantages, and steady growth while maintaining the protection benefits of life insurance.

It’s not a magic solution or appropriate for everyone. Success requires proper policy design, consistent funding, disciplined repayment of loans, and a long-term perspective. Like any financial strategy, it should be evaluated within the context of your overall financial goals and circumstances.

The infinite banking concept is a time-tested approach to building wealth and maintaining financial control, but it requires commitment, proper implementation, and realistic expectations to achieve its full potential.

Before implementing any infinite banking strategy, consult with qualified professionals who can assess your situation and design policies that align with your financial goals.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.