702-660-7000

702-660-7000

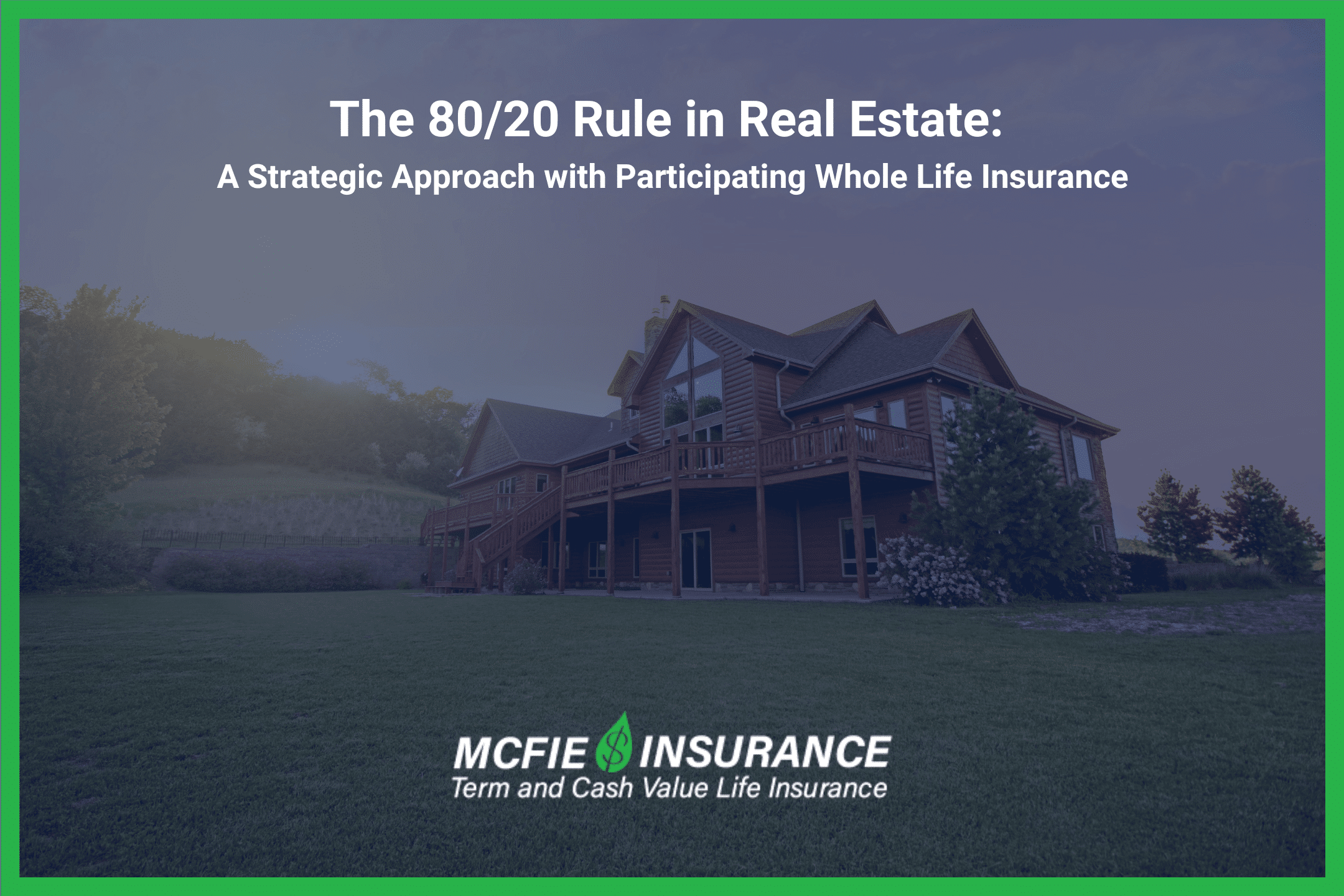

When I first learned about the 80/20 rule, also known as the Pareto Principle, it transformed how I thought about efficiency and productivity in real estate investing. This principle suggests that roughly 80% of your results come from 20% of your efforts. Let me share how understanding this rule, combined with participating whole life insurance, can create a powerful strategy for real estate investors.

The principle manifests in real estate in several ways. For instance, 80% of your rental income might come from 20% of your properties. Or 80% of your tenant problems might come from 20% of your renters. Recognizing these patterns helps you focus your energy and resources where they matter most.

As a real estate investor myself, I’ve observed that about 80% of valuable real estate opportunities come from 20% of market research and networking efforts. This insight led me to develop a more strategic approach to property selection and portfolio management.

Here’s where participating whole life insurance becomes a valuable tool. Many successful real estate investors use participating whole life insurance as a foundational element of their investment strategy. Let me explain why.

First, participating whole life insurance provides guaranteed cash value growth that you can access through policy loans. This creates a reliable source of capital for real estate investments without depending on traditional financing. The cash value grows tax-deferred, and when structured correctly, you can access it through policy loans without triggering tax events.

Here’s a real life example: Barbara and Lee owned their home free and clear but couldn’t qualify for a traditional loan when they needed capital. However, their participating whole life insurance policy provided them the necessary funds through a policy loan, which they could repay on their own schedule.

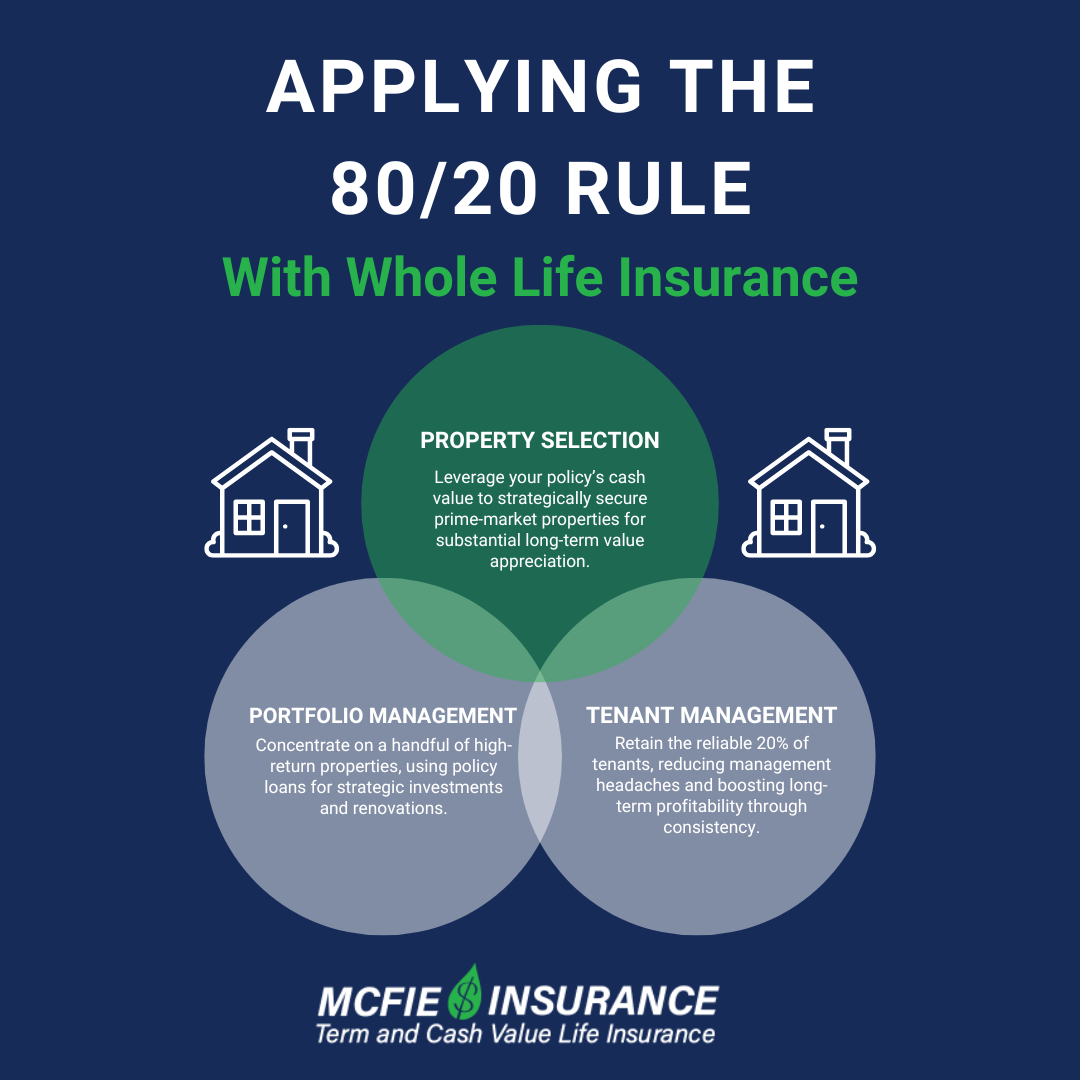

When combining the 80/20 rule with participating whole life insurance, focus on these key areas:

Property Selection: Use your policy’s cash value to acquire properties in the top 20% of your target market. These properties typically generate the majority of long-term value appreciation.

Portfolio Management: Rather than spreading yourself thin across many properties, concentrate on the few that promise the highest returns. Use policy loans strategically for down payments or renovations on these select properties.

Tenant Management: Invest your time and resources in retaining the 20% of tenants who consistently pay on time and take care of your properties. This reduces management headaches and increases long-term profitability.

To implement this strategy effectively:

Let me share a real example. Fred started with a participating whole life policy that allowed him to build substantial cash value. By focusing on the 20% of properties in his market that showed the highest potential, he used policy loans to acquire strategic properties while maintaining control over his capital.

Fred’s approach illustrates how combining the 80/20 rule with participating whole life insurance creates a sustainable investment strategy. He doesn’t need to worry about bank financing or strict repayment schedules, giving him flexibility to focus on the most profitable aspects of his real estate business.

|

Discover The Perpetual Wealth Code™, an easy system to maximize the control of your savings and minimize penalties so you can keep more of the money you make and build wealth every year WITHOUT riding the market roller-coaster. Download here> |

Successfully implementing this strategy requires knowledgeable guidance. At McFie Insurance, we specialize in designing participating whole life insurance policies that complement real estate investment strategies. Our team helps investors understand how to maximize the benefits of both the 80/20 rule and their insurance policies.

Remember, the 80/20 rule is not just about identifying what works best – it’s about taking action on those insights. By combining this principle with the stability and growth potential of participating whole life insurance, you create a powerful framework for real estate investment success.

For real estate investors looking to build sustainable wealth, understanding and applying the 80/20 rule alongside participating whole life insurance opens new possibilities for growth and security. It’s about working smarter, not harder, and using the right tools to support your investment goals.

Ready to learn more about how participating whole life insurance can enhance your real estate investment strategy? Schedule a strategy session with us. We’ll help you understand how to implement these principles in your unique situation and design a policy that supports your real estate investment goals.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.