317-912-1000

317-912-1000

Operating a small business often means juggling various responsibilities, with tax optimization sometimes slipping through the cracks. Yet, many tax deductions can benefit you as a small business owner. Here’s a list of seven ways to trim your tax bill.

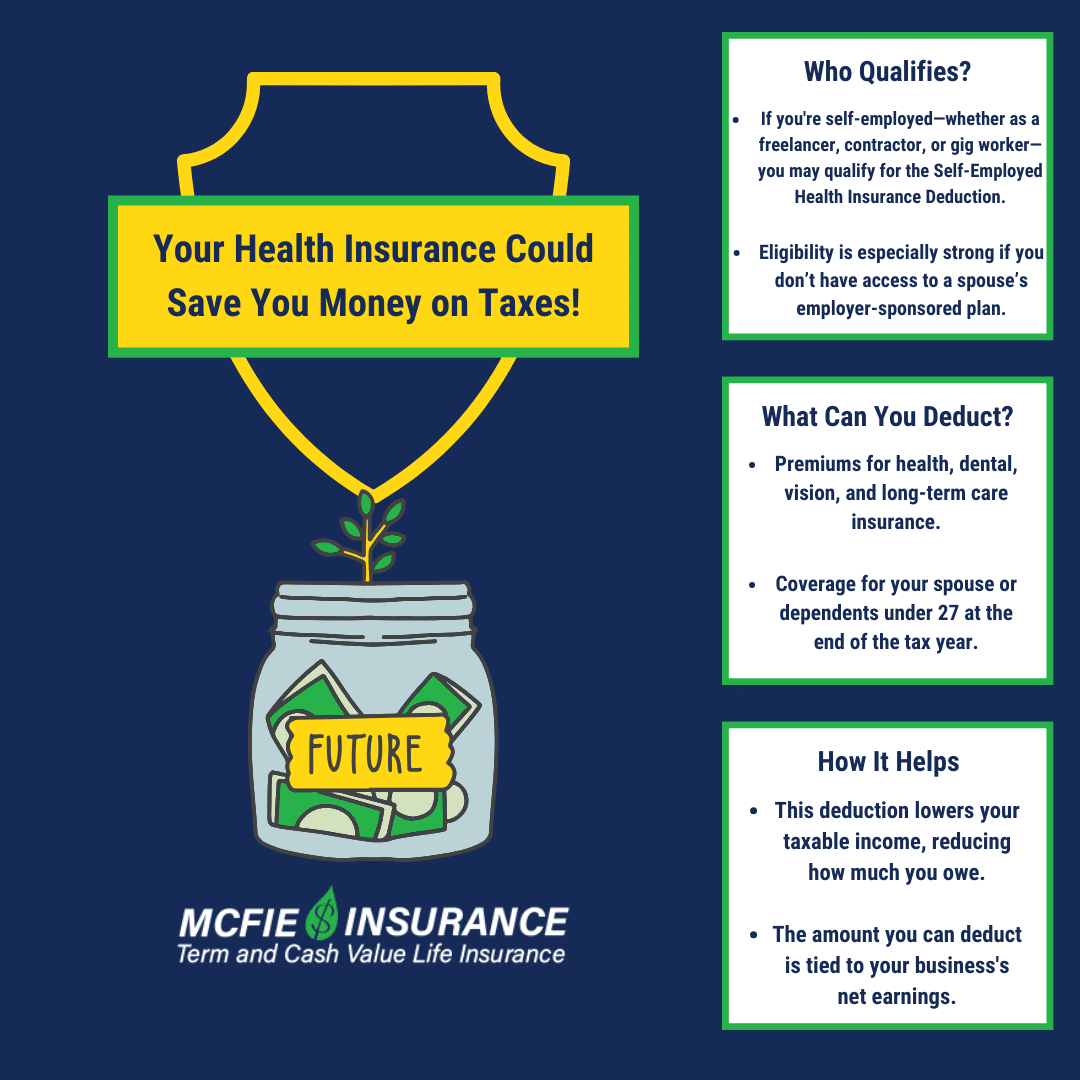

Purchasing health insurance can often be a large expense, especially for those who are self-employed and responsible for covering their own costs. There are valuable tax benefits available that can help ease this financial burden. If you are self-employed—whether as a freelancer, contractor, gig worker, or engaged in any other non-traditional employment—you may qualify to claim the self-employed health insurance deduction. This is beneficial if you don’t have access to health coverage through a spouse’s plan.

This deduction allows you to offset a portion of your health insurance premiums by reducing your taxable income. The amount you can deduct is generally linked to your net earnings from your business, which in turn lowers your overall tax liability. This tax break can make a meaningful difference in managing the high costs associated with healthcare coverage.

The deduction isn’t limited to just basic health insurance premiums. It also extends to dental and vision insurance, as well as long-term care coverage. Coverage premiums paid for your spouse and any dependents under the age of 27 at the end of the tax year may also qualify. This broad scope provides a valuable opportunity for self-employed individuals to safeguard their health while enjoying meaningful tax relief.

For the forward-thinking small business owner, retirement savings plans offer both long-term potential and immediate tax relief.

Individual or Solo 401(k): If you’re a self-employed individual without other employees, an Individual orSolo 401(k) might be a good option. It allows you to contribute a significant portion of your income. For 2023, the limit is $66,000, with an additional catch-up contribution of $7,500 for those 50 and above.

SEP IRA: Another choice for the self-employed is the SEP IRA, allowing savings of up to 25% of your income. The contribution limits mirror the Solo 401(k) at $66,000, plus the catch-up amount for older individuals.

Traditional and Roth IRAs: Beyond the specialized accounts, traditional and Roth IRAs can further cut your tax liability.

Moreover, you might be eligible for the Saver’s Credit, which rewards you with up to $1,000 (or $2,000 if married and filing jointly) for contributing to various retirement accounts including 401k, 403(b), 457 plan, SIMPLE IRA, SEP IRA, Traditional IRA, and Roth IRA.

Defined Benefits Plans: For business owners with high income, there is also the option to put away big dollars for retirement through a defined benefit plan and save a lot of taxes. There are different types of defined benefit plans including cash balance plans and 412(e)3 plans. In general these plans tend to work best for older owners with younger employees, and for business owners with 10 employees or less.

Cash balance plans may be invested, whereas 412(e)3 plans are fully funded with annuities and/or life insurance and not subjected to market volatility. There are higher administration costs for defined benefit plans but there is also a tax credit for new plans in 2023 and the significant tax deferral can often offset administration costs for the right candidates.

Ensuring that you leverage all available small business tax deductions does require planning and potentially, consultation with a tax professional. A basic understanding of the tax world can significantly enhance your financial management, fortifying your business against unforeseen challenges and facilitating sustainable growth.

For those declaring business income on their individual tax returns, the qualified business income deduction, or Section 199A deduction, is a potential bonus. The entities that can tap into this deduction encompass:

This deduction enables eligible entrepreneurs and small businesses to deduct a maximum of 20% of their qualified business income. If your taxable income falls below $182,100 (single) or $364,200 (joint) in 2023, you might qualify. Surpass these limits, and a prorated deduction could be available.

“Qualified business income” generally translates to the net amount of income, gains, losses, and business-related deductions. Exclusions to this definition are:

Note: For businesses tagged as “specified service trade or business” (like doctors, lawyers, financial planners, and more), the deduction phases out sooner than other professions.

If your business requires you to drive, purchasing a company vehicle can fetch you tax-saving deductions provided by the IRS.

Here are two popular deduction methods:

Standard Mileage Rate: For every business mile driven, the IRS permits a deduction. In 2022, this was set at 62.5 cents per mile, while in 2023, it’s 65.5 cents. To take a deduction under this option, maintain a log distinguishing business miles from personal miles, excluding standard commuting distances.

Actual Expenses: Instead of the per-mile deduction, you might opt to sum up all auto-related business expenses, which encompasses costs like gas, maintenance, tires, licenses, insurance, and more. Calculate the business vs. personal use percentage, and based on this, you can claim the relevant portions of your vehicle expenses. This method might be more advantageous than the standard mileage rate in certain situations.

Staying organized and maintaining accurate records are crucial to ensure that you claim the appropriate deductions and maximize your tax savings.

Business investments can sometimes be deducted immediately as an expense or over time, which can aid in diminishing your taxable income and consequently your tax liability.

Business equipment usually depreciates over time due to routine use and aging. Recognizing this, the IRS offers ways to match your income deduction to this value drop across the asset’s operational life.

There are different avenues to claim depreciation:

Section 179 Deduction: This lets you deduct a substantial amount when the asset starts its service. For 2023, the cap is $1,060,000.

Bonus Depreciation: Unlike the fixed maximum of Section 179, here you can deduct a sizable percentage from the asset’s purchasing price. The Tax Cuts and Jobs Act of 2017 enhanced this from 50% to a full 100%, enabling deductions for the entire price of new or previously-owned equipment. This deduction will be phased out between 2023 and 2026. For 2023 the deduction dropped from 100% to 80% which is still significant

MACRS Depreciation: Using the Modified Accelerated Cost Recovery System, firms can avail larger tax deductions in the asset’s earlier years and decrease them as years go by, when compared to straight-line depreciation.

A Note on Vehicles: For business-related vehicles, depreciation can be a viable deduction. However, there are IRS rules concerning high-end vehicles. In 2022, first-year depreciation for business-exclusive vehicles is capped at $11,200, plus an extra $8,000 in bonus depreciation. The 2023 values are $12,200 with the same bonus. For SUVs between 6,000 and 14,000 pounds, a majority of cost can be expensed in the acquisition year via bonus depreciation.

For entrepreneurs working from home, this deduction is gold. To qualify, two conditions need fulfillment:

Exclusive & Frequent Use: An area in your dwelling (house, condo, mobile home, boat, etc.) should be exclusively and routinely set apart for your business. This can even include detached structures like studios or garages but not spaces used as hotels or similar establishments.

Core Business Spot: This space should be the chief location of your operations or where you consistently engage with customers.

The term ‘exclusive’ implies that the space is primarily for business. While personal interruptions are inevitable, the key is to ensure they’re minimal, mirroring what would happen in a traditional office setup.

For eligibility, it’s vital that the home office area is distinct from personal spaces and is primarily used for business activities.

The IRS allows businesses to deduct a wide range of financing costs associated with operating their enterprise, including interest paid on loans, credit cards, and various other sources of credit. Certain specific rules apply when it comes to interest expenses related to loans used to acquire capital assets for the business. In addition, interest on loans taken out for expenses that are not deductible as business costs will also be disallowed for deduction.

In general, if no special restrictions apply, the interest you pay on business-related financing typically qualifies as a deductible expense, helping to lower your taxable income. This makes financing costs a valuable area to consider when managing your business’s tax obligations.

Examples of deductible financing expenses include the interest on a mortgage used to purchase or improve business property, fees embedded within leasing agreements, or charges incurred for extended payment terms on invoices. Understanding these nuances ensures you can take full advantage of the deductions available to you and optimize your business’s financial strategy.

For small enterprises, every dime is valuable. Lowering tax obligations can equate to added profits to either keep or plough back into the business. The good news is the IRS offers multiple avenues for small business owners to decrease their tax dues.

Several of these strategies require proactive tax planning, like picking the appropriate business vehicle, making timely retirement contributions, among others. To fully leverage the deductions accessible, it’s advisable to collaborate with a tax expert who can pinpoint and cater to your distinct requirements.

At McFie Insurance, we help families, individuals, professionals and business owners plan for their finances by offering smart financial solutions and strategies. To learn more about how you can grow wealth and save money, call us today at 702-660-7000

Ben T. McFie

Ben T. McFie

There's a lot of confusion around finance; there's so much to know and it's frustrating when you don't know enough to make the best financial decisions. I like to bring clarity to financial matters so people can make good financial decisions that will help them live wealthier more fulfilling lives.