702-660-7000

702-660-7000

Your twenties are a powerful springboard for building long-term wealth and success. This decade offers a rare combination of freedom, flexibility, and potential that’s difficult to replicate later in life. With fewer financial responsibilities, the support of family still within reach for many, and the kind of mental and physical energy that can fuel long workdays and bold ideas, your twenties are uniquely suited for taking calculated risks—especially when it comes to launching a business.

One of your biggest advantages at this stage is time. The earlier you start, the more time you have to learn, fail forward, recover, and grow. Unlike older entrepreneurs who often juggle family obligations, mortgages, and career limitations, you likely have the bandwidth to go all-in on your ideas. This is why many of the world’s most successful founders got their start young. Innovators like Steve Jobs and Mark Zuckerberg didn’t wait until life settled down to begin—they built their empires in their early twenties because they had the time and freedom to fully dedicate themselves to their visions.

Whether or not you want to be the next tech mogul, the principle still applies: use this season of life to invest in yourself, explore your interests, and lay the groundwork for a future on your own terms.

Today’s technology-driven world has opened the doors wide for young entrepreneurs to step into the business arena with fewer barriers than ever before. With tools like social media, digital advertising, AI-powered content creation, and platforms that enable rapid prototyping and e-commerce setup, launching a startup no longer requires a massive investment of capital or infrastructure. You can reach global audiences from your dorm room, test product ideas quickly, and scale a business with very little overhead.

E-commerce platforms like Shopify, Etsy, and Amazon enable creators and innovators to sell products with minimal upfront investment. And models like drop-shipping or print-on-demand have removed the need for inventory management, making entrepreneurship more accessible to anyone with an idea and the drive to see it through.

A perfect example of this is a college student who recently turned a simple passion project into a profitable venture. While finishing his degree, he launched an online store selling custom miniature sports helmets. By leveraging drop-shipping, he avoided the costs and complexities of managing inventory. The store’s automation allowed him to focus on school while earning a consistent stream of income. It’s proof that with the right tools and mindset, building a successful business is possible—even as a full-time student.

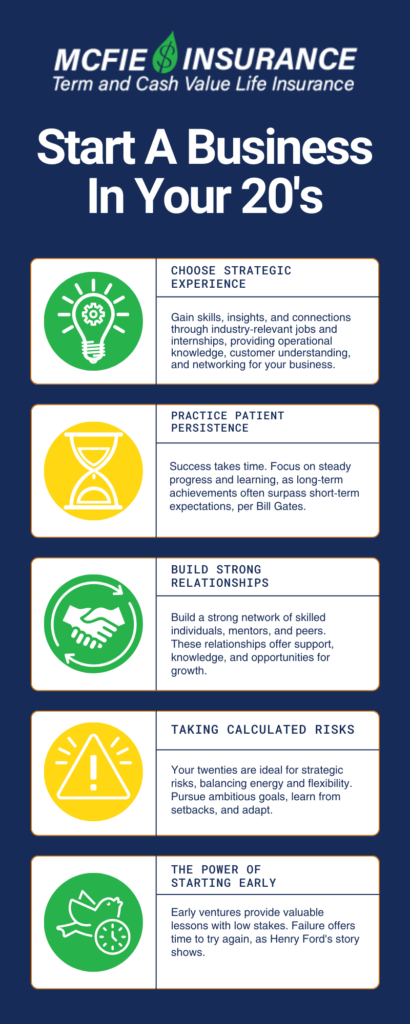

Starting a business at a young age is one of the smartest investments you can make in your future. Early ventures offer hands-on education in a way no classroom can replicate. And the beauty of starting young? The stakes are often lower, the lessons come quicker, and you have the luxury of time to course-correct if things don’t go as planned. Many of today’s most respected business leaders didn’t succeed right out of the gate. Henry Ford, for instance, experienced multiple business failures before launching the automotive empire that changed the world. His story proves that setbacks aren’t the end—they’re often just the beginning.

Early entrepreneurship also gives you a head start on building long-term wealth and independence. When you start young, you can take advantage of compounding growth, develop industry-savvy earlier, and shape a business around your strengths and passions—all before major life responsibilities start to weigh heavily.

Starting young allows you to:

Build long-term financial security through steady business growth

Develop crucial business skills and industry connections

Create multiple revenue streams before taking on major life obligations

Learn from failures while having family support to fall back on

These years offer freedom, flexibility, and the opportunity to turn curiosity into competence. So if you have an idea—or even just the hunger to learn—now is the perfect time to act.

An often-overlooked resource for young entrepreneurs is whole life insurance. Unlike term insurance that simply provides a death benefit, whole life insurance builds cash value over time that you can borrow against to fund your business needs.

By starting a whole life policy in your twenties, you benefit from:

When your business needs capital for equipment, inventory, or expansion, you can borrow against your policy’s cash value without credit checks or collateral requirements. The loan interest feeds back into your policy rather than profiting an outside lender. This creates an efficient funding cycle where your business growth simultaneously builds long-term wealth through your insurance policy.

Whether you’re relying on traditional financing or utilizing innovative tools like insurance policies, there are several core principles that are essential for young entrepreneurs seeking success:

One of the most valuable ways to prepare for entrepreneurship is to gain strategic experience. Seek out jobs, internships, or side projects that equip you with relevant skills and insights for your future business. Working within your target industry is a game-changer. It provides a deeper understanding of how the business operates, the specific needs of customers, and potential market gaps you might be able to fill.

This real-world knowledge will help you avoid common pitfalls and make more informed decisions when you launch your own business. These experiences often provide the opportunity to build a network of mentors, partners, and industry professionals who will play a role in your journey.

Entrepreneurship is a marathon, not a sprint. Building a successful business from the ground up takes time and effort. Most ventures take years to generate significant revenue, and even longer to become truly profitable. Instead of expecting overnight success, focus on making steady progress and committing to learning. Be patient with the process, and embrace small wins that move you closer to your end goals. As Bill Gates wisely observed, “People often overestimate what they can accomplish in a year but underestimate what they can achieve in a decade.” It’s a reminder that success doesn’t happen overnight—often, the best things take time and consistent effort.

No successful entrepreneur achieves their goals in isolation. Surround yourself with talented and driven individuals who complement your skill set. Seek out mentors who have walked the path before you—those who are willing to share their experience, lessons learned, and valuable insights. But beyond mentors, networking with other young entrepreneurs who are facing similar challenges is invaluable. This peer group offers support, guidance, and opportunities to collaborate. A strong network can open doors that would otherwise remain closed, from business partnerships to funding opportunities and beyond. Building and nurturing these relationships will lay the foundation for a thriving business.

One of the greatest advantages of being a young entrepreneur is the ability to take calculated risks. Your twenties provide a balance of energy and flexibility without the weight of major financial obligations that might hinder your decision-making. With fewer responsibilities, you can afford to take on more ambitious projects, try new strategies, and pivot when necessary. But it’s essential that these risks are calculated, meaning you evaluate downsides and adjust your course if things don’t go as planned. Each risk taken—even if it results in failure—provides lessons that will make you more knowledgeable and prepared for the future. It’s through taking these strategic risks that you’ll gain the experience for long-term success.

One of the greatest assets you have as a young entrepreneur is the ability to continuously learn and adapt. The business world is constantly evolving, and staying informed about new technologies, industry trends, and market dynamics is key to staying ahead of the curve. Make learning a regular part of your entrepreneurial routine—whether it’s through books, podcasts, workshops, or networking events. Adaptability will be one of your strongest tools in facing challenges and seizing opportunities.

By embracing these principles, you’ll develop the critical skills necessary to succeed as an entrepreneur and create a solid foundation for long-term growth. Your twenties are the perfect time to lay the groundwork for a thriving business and to build a future filled with financial independence, personal growth, and professional success. With time, persistence, and the right support, you can turn your entrepreneurial dreams into reality.

Starting a business in your twenties creates compound benefits that extend far beyond immediate profits. The skills, connections, and experiences you gain become invaluable assets regardless of your ultimate path. Even if your first venture fails, the knowledge gained positions you for future opportunities.

The technological tools and resources available today make this an unprecedented time for young entrepreneurs. By combining these advantages with the natural benefits of youth – time, energy, and limited obligations – your twenties become the ideal launch pad for building lasting success.

Remember that success rarely follows a straight line. Expect challenges and setbacks along the way. But by starting early, leveraging available resources like whole life insurance, and maintaining steady progress toward your goals, you position yourself for long-term prosperity. The choices you make during this pivotal decade truly shape the opportunities available for the rest of your life.

Take action now to begin building your future. Research your market, develop your skills, and explore funding options like whole life insurance policies. While your peers focus on short-term pleasures, you can lay the groundwork for lasting financial independence. Start now!

by Gracine McFie

by Gracine McFie

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable.