702-660-7000

702-660-7000

There’s no doubt that deferring taxes on the money you earn can allow your wealth to grow more quickly, as it allows you to reinvest those savings and compound them over time. This strategy comes with an inherent risk—the uncertainty of future tax rates. You can’t predict with certainty what tax rates will be when you withdraw that money, which can create a gamble. This uncertainty can make it difficult to plan for your financial future, and it might not always be a sustainable strategy. There’s also the added risk of trying to achieve that higher rate of return, which requires taking on more investment risk.

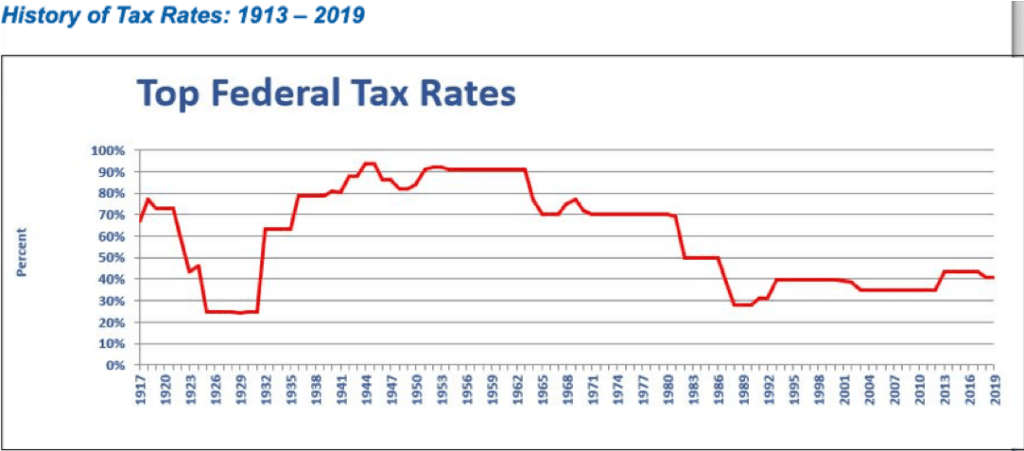

Since the mid-1980s, U.S. tax rates have remained relatively low compared to historical standards, largely due to the policies of presidents Ronald Reagan, both George H.W. Bush and George W. Bush, as well as Donald Trump. These low rates have benefitted many individuals, but the reality is that such rates are unlikely to last forever. With the United States government facing an ever-growing and increasingly unsustainable debt load, it’s difficult to foresee how long these low tax rates can remain in place. Eventually, the government may need to raise taxes to address the national debt, which could lead to higher tax rates in the future that could impact your financial strategy.

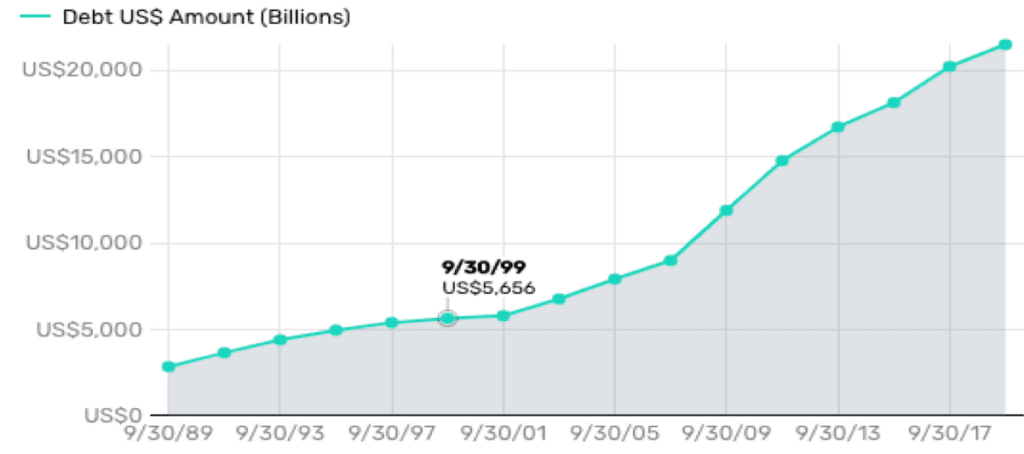

As of February 2019, the U.S. government debt exceeded $22 trillion. Two thirds of that debt is represented in U.S. Treasury bills, notes and bonds. The rest is obligations to intragovernmental departments such as Social Security and other trust funds. In other words, all this debt belongs to U.S. citizens.[i]

As of February 2019, the U.S. government debt exceeded $22 trillion. Two thirds of that debt is represented in U.S. Treasury bills, notes and bonds. The rest is obligations to intragovernmental departments such as Social Security and other trust funds. In other words, all this debt belongs to U.S. citizens.[i]

[ii]On careful examination, you can see how this debt became so large. One  reason is due to the lower tax rates that were implemented in the mid 1980s. Since then the escalation of U.S. debt has soared. Of course, other issues such as funding programs that benefit those who have never contributed to the system are definitely part of the debt problem too, as well as mismanagement by our elected officials and the expansion of government.

reason is due to the lower tax rates that were implemented in the mid 1980s. Since then the escalation of U.S. debt has soared. Of course, other issues such as funding programs that benefit those who have never contributed to the system are definitely part of the debt problem too, as well as mismanagement by our elected officials and the expansion of government.

But the $22 trillion of debt is pennies compared to the $210 trillion of liabilities that the US government has promised to deliver on in the future. Add the states liabilities to this and the debt is well over 115% of our GDP.[iii]

This brings up Social Security which you are paying towards in the form of FICA deductions from your paycheck. FICA stands for Federal Insurance Contributions Act, but it isn’t an insurance contract as the government can and has refused to pay out what it has withheld. In 1960, the Supreme Court ruled, in Flemming vs. Nestor, that Social Security is not insurance or any other kind of personal property. FICA obligates you to make payments, but it doesn’t require that Social Security make payments to you at any time or for any reason. Of course, Congress can change these benefits at any time they wish. So even though under current law your Social Security benefits are guaranteed, Congress can change that law whenever they deem it in their best interest to do so.

Naturally, Congress has been eyeing deferred tax accounts since the Clinton years as another pool of money that they can seize and spend. But can the U.S. government actually do that? Absolutely. France, Ireland, Hungary, Argentina have all renovated their private and public pension plans, and so the precedence has already been set. However, taxing these assets prior to distribution might be the more likely modus operandi, rather than an actual seizure, simply because the U.S. has been subject to more favorable private property laws than those in other countries. Also, a tax could more easily be justified and re-established on savings already benefiting from an exemption of the income tax code, rather than an outright seizure.

This then, is what we have to look forward to: An increase in taxes to offset our national debt. It’s not a matter of if but rather when. Tax may come as a tax on savings which has been built in tax deferred accounts, (i.e., 401(k)s, 403(b)s, 457 plans and IRAs) or it may come as an increase in income taxes, or both. Either way, higher tax rates are in your future. They are a must if the U.S. is to remain solvent.

All of this is necessary to understand and address the major question: “Is tax deferred savings better than never taxed savings?” And the answer is ALWAYS: Never taxed savings are better!

IRA or 401(k) savings held in target-date mutual funds are projected to earn between 6% and 10% through 2050. But if you are looking at an earlier date, then those projections drop to between 2% and 5%.[iv] Of course any such projections are at risk and provide zero guarantees because they are merely projections. Even so, if you contribute $1,000 a month to your 401(k) for the next 30 years, and you can earn the 6%, you will have $1,005,620 before you pay your taxes. But those taxes will take at least 32% of that $1,005,620 leaving you with roughly about $685,000.

A well-engineered and funded Participating Whole Life Policy, using the same amount of money you funded your IRA or 401(k) with, would provide more income and would also provide you with the benefit of accessing your death benefit for chronic, critical or terminal illnesses. And that is because the NEVER TAXED life insurance policy doesn’t have to pay Uncle Sam a dime on the growth you have experienced over the life time of your policy, while the 401(k) or IRA does.

Of course, when you or your spouse dies, the remaining spouse will inherit the unlimited marital deduction. But now there will be only a single person filing the taxes on the same amount of money being distributed from those tax deferred plans. And that means the taxes paid will be greater than when they were paid when you were filing jointly.

Then there’s estate taxes. Money inherited by a non-surviving spouse, that is held in a tax deferred account, will be added to the estate of the deceased. If estate taxes need to be paid with distributions from the tax deferred account, then income tax will be paid by the beneficiary of the 401(k) or IRA, on that distribution. And if this income triggers addition income tax for the beneficiary, then another distribution from the 401(k) or IRA, to pay that additional income tax, might be necessary, and then that money will be taxed as well. This snowball effect can be devastating with 50% to 90% of the inherited qualified plan money going to pay taxes.[v]

Again, the best way to protect your loved ones from this un-necessary taxation is with a Participating Whole Life Insurance Policy. After you turn 59 ½, you can take distributions from your IRA or 401(k) without paying the 10% penalty tax. You can use distributions from these funds to pay premiums on an existing life insurance policy or premiums on a new life insurance policy. The Participating Whole Life Insurance policy builds cash value which you can access and use for the rest of your life, without facing Required Minimal Distributions (RMDs) and the taxes that the IRS collects on those RMDs. This can save you a tremendous amount of money over your life time in taxes while not reducing your cash flow.

As you spend your life insurance cash values, you will continue to experience cash value growth and added face value in your life insurance policy over your entire life. And when you pass there will be a death benefit for your spouse or some other beneficiary. And the money from that death benefit will be absolutely income-tax free!

Positioning yourself to NEVER pay taxes is ALWAYS better than positioning yourself to defer your taxes today and opt to pay later because:

NEVER TAXED money can multiply your legacy without reducing your life style.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.

[i] https://bradfordtaxinstitute.com/Free_Resources/Federal-Income-Tax-Rates.aspx

[ii] https://www.thebalance.com/the-u-s-debt-and-how-it-got-so-big-3305778

[iii] https://www.forbes.com/sites/johnmauldin/2017/10/10/your-pension-is-a-lie-theres-210-trillion-of-liabilities-our-government-cant-fulfill/#2b8616f165b1

[iv] https://money.usnews.com/money/retirement/401ks/articles/what-is-the-average-401-k-return

[v] https://www.thebalance.com/what-happens-to-a-retirement-account-when-the-owner-dies-3505228