702-660-7000

702-660-7000

by John McFie – originally written in June 2018

It’s no secret that America’s retirement system is broken. The problem has been compounding for a few decades and it’s getting worse.

It’s no secret that America’s retirement system is broken. The problem has been compounding for a few decades and it’s getting worse.

It started with Company pension plans also known as defined benefit plans. These plans have always had mismanagement and underfunding headaches, and the problems accelerated on a large scale during the 1980’s.

The Pension Benefit Guaranty Corporation – a public company formed by the Employee Retirement Income Security Act (ERISA) of 1974 to insure benefits from pension plans – has picked up paying benefits to retirees whose pensions have gone bankrupt, but the PBGC’s plan is now on track to become insolvent by 2025.

State and local public pensions have been able to avoid the definition of insolvency longer because of different rules, less oversight and taxpayer funding, but now their unfunded liabilities exceed $6 trillion.

Starting in the 1980’s and accelerating through the 90’s, underfunded pension plans have prompted a massive shift toward defined contribution plans where employees directly take the risk for the performance of their own retirement investments through accounts like the common 401(k).

On the surface it seems like a logical thing to do, and it probably was better than some options, but 401(k)s, IRAs, 403(b)s, SEPs etc. (I’ll call them tax qualified plans collectively) were never intended to replace traditional pension plans.

Today’s tax qualified plans are designed for the accumulation phase and not the distribution phase – they really aren’t the best financial tools for converting a pile of assets into a sustainable income stream.

And even if they were, matters have gone horribly wrong for most people during the accumulation phase. At the end of the day the facts show that:

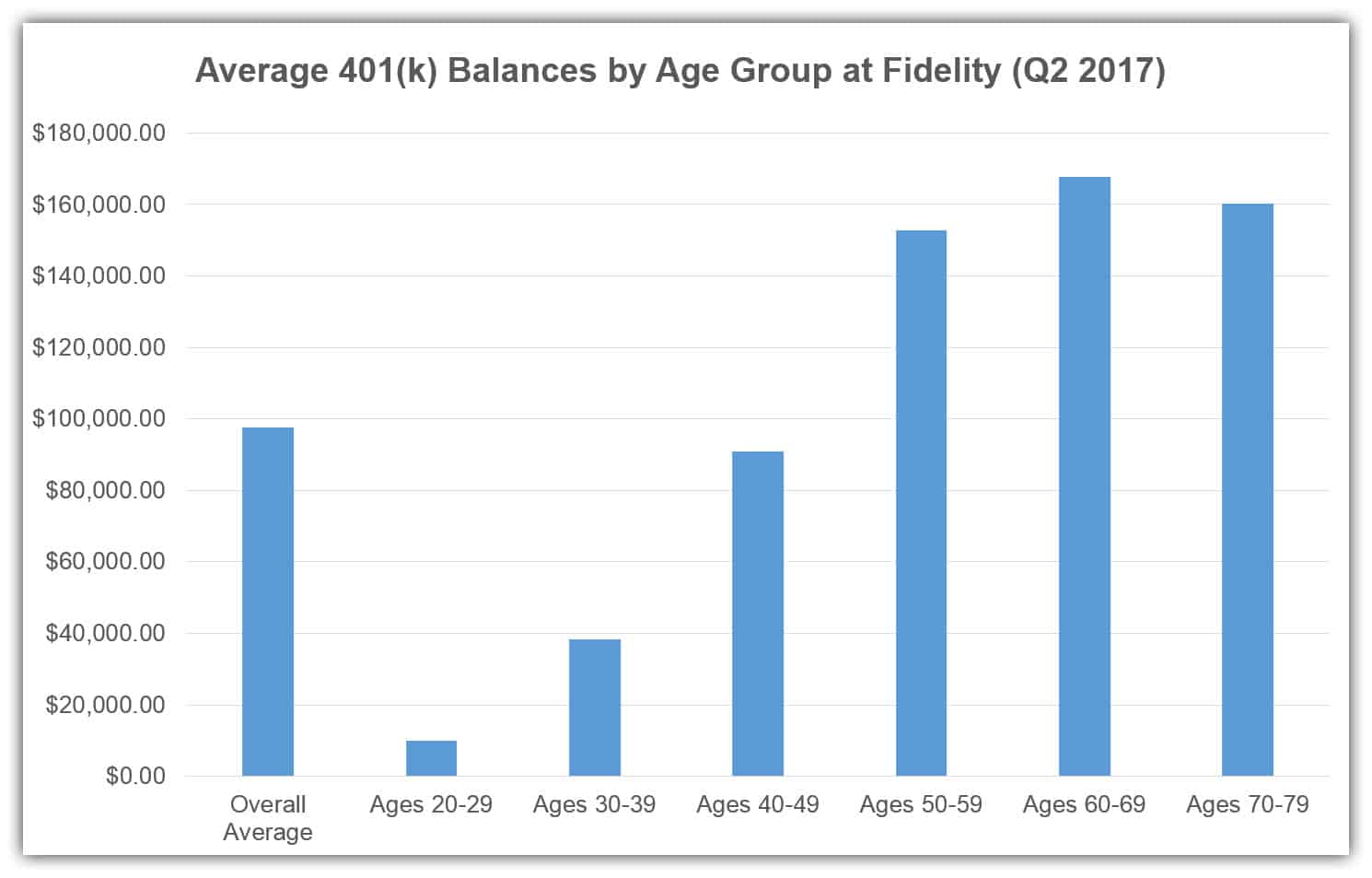

Fidelity reports that the average 401(k) balance as of the second quarter of 2017 is only $97,700. And it’s not much better for people age 60-69 who check-in with an average 401(k) balance of only $167,700 – not even close to enough to retire comfortably.

Fortune reported in 2015 that of the roughly 13 million 401(k) accounts managed by Fidelity, a total of 72,379 or just 0.6% had a balance more than $1 million. Only 1,100 of these accounts were owned by people who made less than $150,000/yr.

“The rest made a lot more, over $350,000 a year, making the fact that they were able to save $1 million over 34 years sound a lot less impressive, and probably not even enough for someone making $350,000 to retire on.”

Altogether many factors have contributed to the current situation where people are running short of funds as they approach retirement.

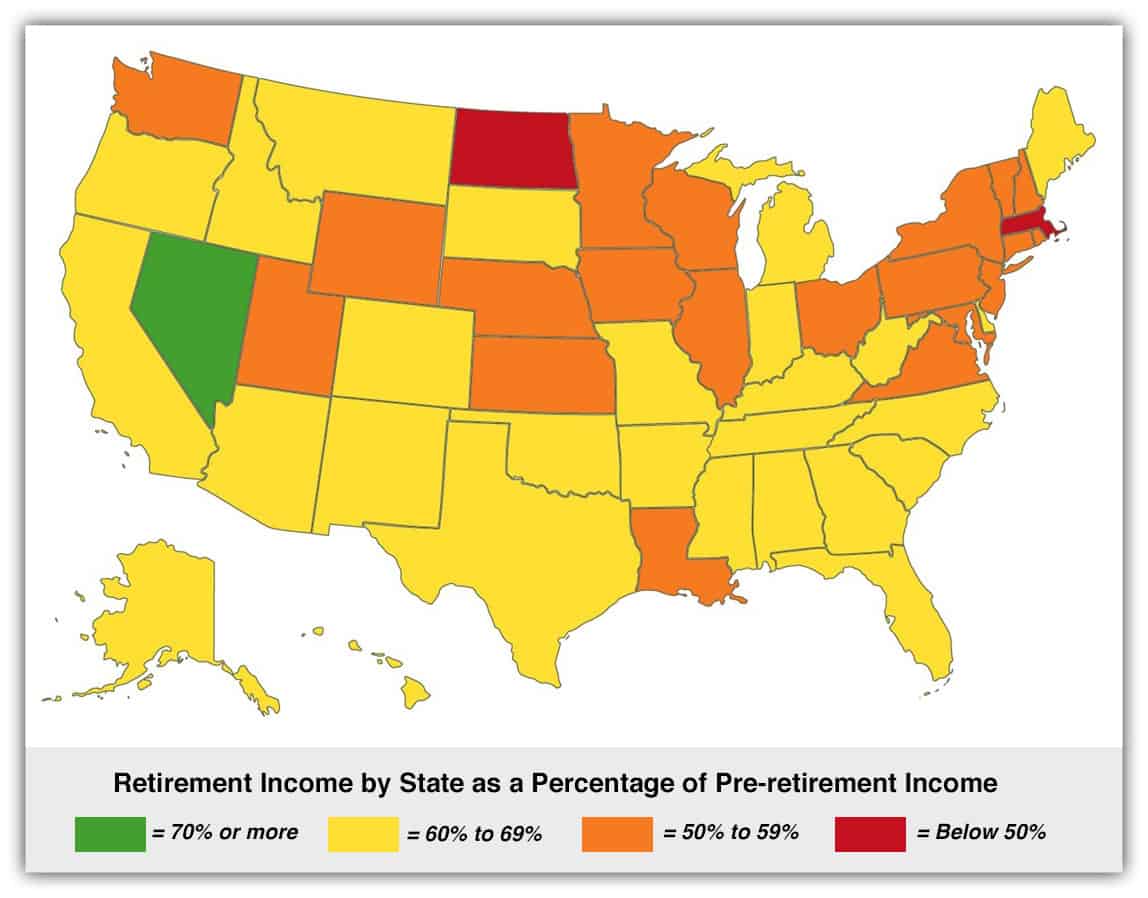

Across the United States retirees are now living on significantly less income than they had during their working years. Taking 10% or even 30% less income because of lower living expenses in retirement might make sense, but not 30-50% less which is closer to reality across the country.[i]

The American Institute of CPAs reports that more than 55% of Americans say, “Running out of money in retirement is their greatest fear.”

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

This map shows average retirement income as a percentage of pre-retirement income for retirees across the United States.

Source: Interest.com

It’s not a pretty picture. An article on Forbes.com suggests many Late Baby Boomers (born 1956-1965) and Generation X (born 1966-1975) should consider a combination of cutting back lifestyle, maximizing income and making the most of their money management opportunities to obtain a more solid financial security for the future.

This is the problem facing many great Americans today and this is the reason to consider remastering your own retirement now before it’s too late.

Experts generally agree on the “broken system” diagnosis:

“At first, the 401(k) was designed to be a thrift plan, an extra savings plan. It was never designed to be a retirement plan. You can see it in its very structure.” ~ John Bogle

“The 401(k) plan was never meant to be a mainstream pension plan and is a poor substitute for one.” ~ John Wasik

“Novel advice on how to save for retirement: Don’t put any more money in your tax-deferred retirement savings.

This is heresy in a world where people hate taxes and it is taken as gospel that you should defer them if you can. FORBES has helped spread the gospel. For two decades we have been advising you to maximize your tax-deferred 401(k) accounts and IRA, and, at the other end, to minimize withdrawals. Let your earnings compound tax free, went the thinking. Deferral is magic.

That’s not necessarily true anymore. After a year of turmoil in Washington, D.C. and on Wall Street, it’s time to rethink savings. You might be better off skipping the 401(k).” ~ William Baldwin in 2009

“…401(k) plans are a crummy deal for millions of workers. That goes doubly for young and low-wage earners.” ~ David Randall

Experts also agree that people need to save more money to offset the rising costs of healthcare, assisted living and longevity.

But when it comes to possible solutions, the experts don’t always agree.

Many gurus and Wall Street firms favor a new “Guaranteed Retirement Account” (GRA) or some variation of this type of system to replace the current 401(k) system. This proposal would be an “add-on account to Social Security” and advocates higher contribution requirements (really another tax), no access to the money until retirement and more government oversight.

Wall Street firms would manage the money and benefit by obtaining investment dollars on more certain and long-term horizons; thus it comes as no surprise that many are in favor of the proposal including Tony James the president of Blackstone investment group. James has co-authored articles and even a book (Rescuing Retirement) in support of the GRA system with economist Teresa Ghilarducci who first made the GRA proposal in 2007.

Many experts have pointed out flaws in the GRA proposal, some even as simple as the numerical values assumed in projection models. See: A Plan That Needs More Money as one example.

None of the financial strategies in the GRA system are new, revolutionary or anything that people cannot do on their own without a government mandate. Whether the government should be involved or not really becomes a values question – not a math question.

Overall, the idea behind the GRA system is to sell Retirement Security to the American public at the expense of giving up control over more of their money. Control of the money is the BIG issue here, as it always is – follow the money trail.

Opponents of the GRA system also point out that the US government cannot be trusted to properly oversee a GRA system any better than the Social Security Trust fund which was raided and replaced with IOUs years ago.

Social Security was originally supposed to be an insurance system for old age but has morphed into an entitlement program for re-distributing the wealth from a younger working generation to an older retired generation.

Picture: Old Social Security Insurance promotional materials

Picture: Old Social Security Insurance promotional materials

Any thinking person in their right mind today will realize it is not ideal to rely on Social Security income for a major part of their financial future. Financial projections are showing the Social Security trust fund will be depleted by year 2034.

Yes, the Social Security system is supposed to be backed by the “good faith” (aka taxing power) of the US government and politicians from both sides of the aisle will probably try to bail it out to keep voters happy; but politicians are people too, they have limitations and of course many of them are liars.

Simple question, but there’s no one easy answer.

It used to be that financial planners would use 4% as a rule of thumb to calculate the assets you would need to obtain a certain passive income level. In fact, this was so common it was referred to as the “4% Rule”.

This meant that if you could accumulate $1 million for retirement you could take 4% or $40,000 as passive income every year in retirement with no worry of running out of money. For $70,000 of income you would need $1,750,000 (70,000/4%).

Today with lower investment returns most people will need more assets than they used to need to obtain a solid and sustainable passive income stream. Projected market returns over the next 10 years aren’t looking any better.

“BlackRock expects long-term (10 years plus) annualized gains of 5.9% for U.S. and 3.1% for U.S. bonds. Vanguard also recently published an economic and market outlook in which the fund giant had a median forecast for the next 10 years of 6.6% for stocks and 3.1% for bonds.”

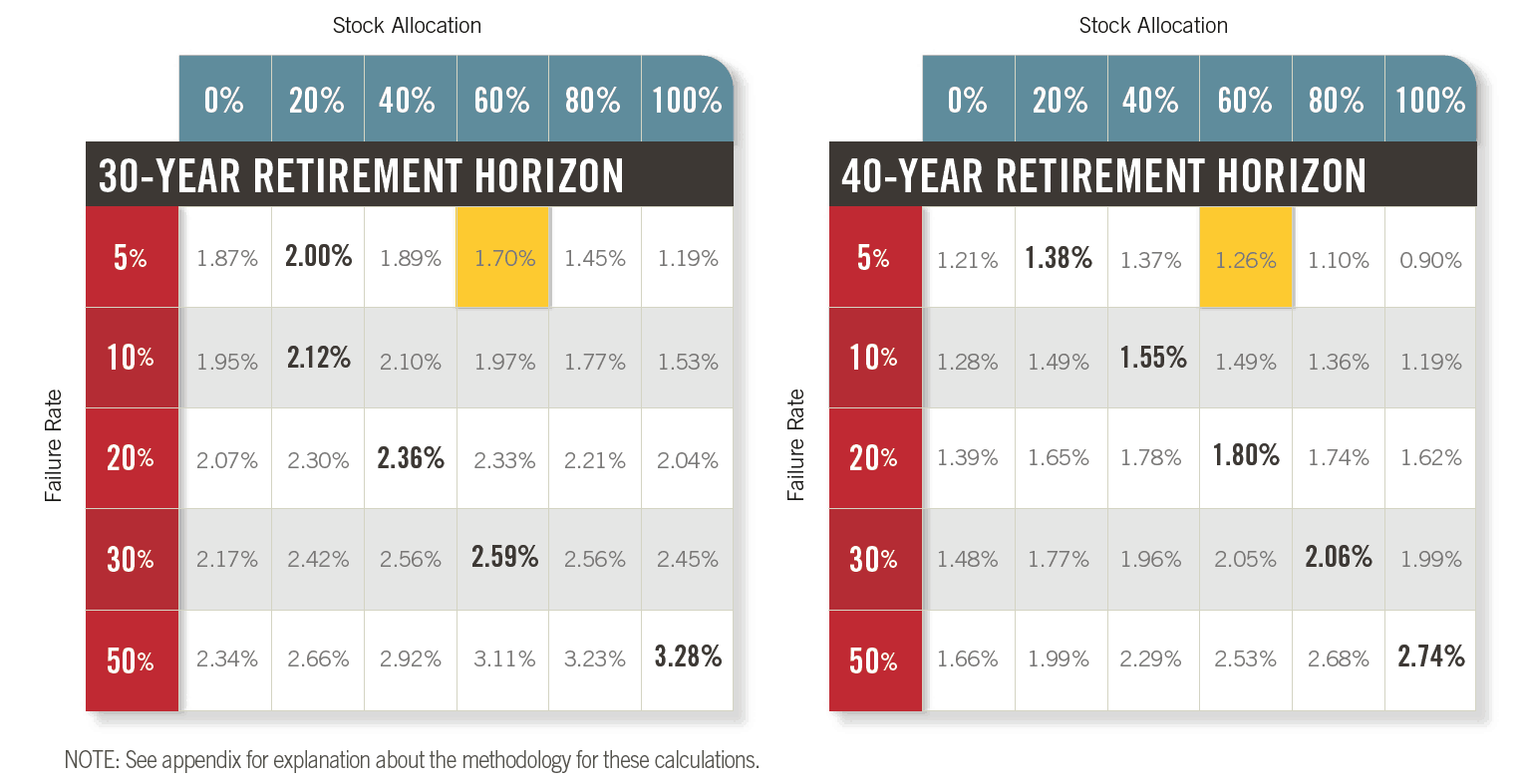

Research by Dr. Wade Pfau on Sustainable Withdrawal Rates shows that retirees today should really only expect to take an annual income of 1.55 – 2.12% of their account value if they want an “acceptable” 10% probability of running out of money.[ii] For the techies reading this article, you can find Dr. Pfau’s complete report here.

Chart Source: Rethinking Retirement by Dr. Wade Pfau and Wade Dokken

Chart Source: Rethinking Retirement by Dr. Wade Pfau and Wade Dokken

Here’s a link to an Excel calculator if you want to work with your own numbers and different risk rates:

Retirement Withdrawal Projection Worksheet for Excel – Direct Link

Using a sustainable withdrawal rate of 2.12% with a 10% chance of running out of money, here’s a table mapping different passive income levels to asset values:

| 2.12% Withdrawal Rate – Income to Assets | ||||

|---|---|---|---|---|

| Income | Assets | Income | Assets | |

| $30,000 | $1,415,094 | $100,000 | $4,716,981 | |

| $45,000 | $2,122,642 | $200,000 | $9,433,962 | |

| $60,000 | $2,830,189 | $300,000 | $14,150,943 | |

| $75,000 | $3,537,736 | $400,000 | $18,867,925 | |

| $90,000 | $4,245,283 | $500,000 | $23,584,906 | |

As you can see from the table, an income of $60,000 per year ought to be backed up by traditional assets of at least $2.8 million dollars. To be on the safe side, that number is over $3.8 million with a 1.55% withdrawal rate.

| 1.55% Withdrawal Rate – Income to Assets | ||||

|---|---|---|---|---|

| Income | Assets | Income | Assets | |

| $30,000 | $1,935,484 | $100,000 | $6,451,613 | |

| $45,000 | $2,903,226 | $200,000 | $12,903,226 | |

| $60,000 | $3,870,968 | $300,000 | $19,354,839 | |

| $75,000 | $4,838,710 | $400,000 | $25,806,452 | |

| $90,000 | $5,806,452 | $500,000 | $32,258,065 | |

Who wants to be a financial slave to accumulate this kind of money? Let’s look at some other options.

There is no “magic bullet” financial solution that will provide total security in this world, but obviously the best way to approach your golden years, is to become abundantly wealthy.

Picture a healthy reserve of savings and investments from which you can pull more than enough passive income to last the rest of your life, do the great things you want to do to, make the world a better place, and leave a huge financial legacy. That’s a great ideal! Go ahead and shoot for the stars…people have done it before, you might do it too.

Statistically, you’re better off NOT to try the Las Vegas route, or the latest penny stock newsletter tips. But if you’re someone with great opportunities, a great work ethic and lots of drive to stay on course when the going is rough, you could strike a gold-mine as a business owner.

Whatever your venture, be sure not to tie your happiness to the outcome. As Dale Carnegie wisely observed:

“The person who seeks all their applause from outside has their happiness in another’s keeping.”

Maybe you can strike it lucky, but make sure you always have a financial backup plan too.

The first ingredient is pretty obvious – a Good Savings Plan. Nothing comes from nothing, so if you don’t have much in savings, this is the place to start.

Working with clients who need a better savings plan we often refer to the 10-20-70 Budget System. Here’s a video demo:

We also have some free worksheets you can download to check your own budget with the 10-20-70 model:

10-20-70 Worksheets – Free Download

If you’ve been wondering what percentage of your income to save for retirement, the 10-20-70 system may be the answer you’ve been looking for.

Realize that when you have no debt the ideal savings rate is 30% of your income (the 10% + the 20%). And if you’re starting late, already short of funds, you may need to save more than 30%. 10% is a minimum.

Other aspects of a solid retirement strategy include:

So you have a Savings plan now – GOOD. Where are you saving the money?

The gurus tell you to send the maximum amount to tax qualified plans. But remember tax qualified plans are designed to accumulate money – they don’t do so well when you go to take money out.

My Dad, Dr. Tomas P. McFie wrote:

Any pilot, can assure you that taking off and flying an airplane is a fairly simple task. In fact, it is so simple that most people, even young children, can take off and fly an airplane with relatively simple instruction. But when it comes time to descend and land that aircraft, without diligent training and practice, your chances of success and survival are severely limited.

The same is true about saving for retirement. It’s a fairly simple task. But just because it’s simple doesn’t mean everyone is doing it because as Einstein said, “Simple doesn’t make it easy.” Diligent and habitual savings today includes the know-how to land your airplane (i.e. a plan for spending money in retirement as well as just saving it).

This is one point pension plans have in their favor – an efficient distribution system that includes an actuarial element which factors life expectancy into the benefit payouts. Tax qualified plans simply don’t have this.

Actuaries are mathematicians who can predict how many people in a given group will die and when, they just don’t know who. So when actuaries are working with a lot of people’s money they can guarantee higher incomes for everyone in the group than any of those individual people could safely draw from their own assets.

You see, if private pensions would have been properly funded and managed, they might still be good vehicles for passive income. Even today, there are ways to cash-in on actuarial models and apply them to maximize passive income for your retirement.

Actuaries work for pension administrators and also at life insurance companies where they design life insurance and annuity products.

On the back end, annuities work in much the same way as a pension payout model. It’s not unusual to see 4-6% plus annual payout rates from guaranteed fixed annuities depending on age, and health factors.

You still need to consider whether your retirement is underfunded, but one way to greatly increase the amount of money you can draw from a tax-deferred retirement plan, without the risk of running out of money would be to roll the account to a tax-deferred annuity at retirement.

This alone could be a game changer for your retirement income strategy! But annuities have problems too.

In recent years variable and indexed annuities have been touted as the “latest greatest” annuity products by many insurance companies, but they expose clients to market risk and often big surrender fees. Not good.

I suggest avoiding most variable and indexed annuities like the plague. There are simply too many moving variables to make them dependable financial tools. Remember that any type of variable or indexed annuity or life insurance product is about shifting risk to the customer away from the insurance company.

Even if you get a good annuity with rock-solid guarantees – they still can have downsides. For example, what if you roll 401(k) assets to an immediate annuity and die the next day? Oops! All the money you worked so hard to accumulate would go to the insurance company. Yes, you could plan for some payments to continue to a beneficiary and recover some of the principal that way, but this would reduce the income stream while you’re alive – we’re looking for strategies to increase income.

Also, the amount of income in a fixed annuity is fixed – you can’t easily pull from the principal for extra expenses such as health care and assisted living without seriously affecting future income.

A high cash value Whole Life insurance policy can solve both of these problems:

Life insurance uses actuarial models in a different way than annuities, providing a death benefit when an insured person dies. Depending on the type of life insurance there is sometimes access to Cash Value during one’s lifetime as well.

As with annuities, not all life insurance is created equal. There is a plethora of products which you can read more about here. Just like you want to avoid variable and indexed annuities, you want to avoid variable and indexed life insurance products which are tied to the stock market in some way.

If you really want to ride the market rollercoaster you can do better investing directly in the market or a low cost index fund, rather than through a hybrid life insurance product which adds a layer of administration and possible contract changes.

Term insurance is really good for young people, but it gets more expensive over time and doesn’t build any Cash Value; thus term insurance cannot solve the problems with annuities as outlined above.

You also want to avoid Universal/Flexible life insurance products in all shapes and forms. Universal life insurance is built on a base of term insurance. The cost of this term insurance is paid from the “Cash Value” (really a Cash Side Fund) of the universal product which usually gets depleted with age. Sometimes additional premiums are required to keep the policy in force – not something you want to be facing in your golden years.

This leaves Whole Life insurance. Cash value in whole life insurance is different than cash value in Universal life insurance – it represents your equity in the death benefit. The insurance company will lend you money against this cash value or you can take a withdrawal.

It’s best if you own established whole life policy(s) with lots of cash value before you need to use them to complement your passive income strategy, but even people in their 60’s can get reasonable rates on whole life insurance to make some income strategies worthwhile.

Depending on age and health a whole life policy designed to maximize cash value and minimize commission for the insurance agent can create a long-term internal rate of return of 3-4% (premiums to cash value). Usually the breakeven point, when cash value is greater than total premiums paid, comes between years 7-15.

Many financial professionals tell clients they won’t need life insurance when they get to retirement. You’re about to see how that’s not always true. I’d go as far as saying it’s only true in a few cases because life insurance provides more options for passive income in many diverse scenarios.

Here’s a video example on using life insurance and annuities to optimize your passive income in retirement:

A whole life insurance policy can also be used as a buffer account for extending passive income from an investment account during retirement.

For example let’s say Joe had a $1 million investment account in 2008 and had to pull an annual income of $70,000 that year after facing a 38.49% loss.

The market bounced back to some degree over the following year, but the money Joe withdrew that year didn’t see the benefit of this “bounce”. If Joe could have found his $70,000 income somewhere else in 2008 the money in his 401(k) could have lasted almost 3 years longer.

The lesson here is that you don’t get to choose when market fluctuations occur, but when you retire you will need money to live on every year and it has to come from somewhere.

If you have cash values in life insurance you can withdraw or borrow money against the cash values in the years your investment and retirement accounts are down. It’s like a private bail-out for your retirement plan.

Here’s a video example of how Life Insurance can work as a buffer account.

As this example shows, a good life insurance policy can make a better “buffer account” than bond investments.

Life insurance cash values also make great reserves for unexpected health care expenses and assisted living. And when you access this money, you don’t have to worry about getting into a higher tax bracket if you do it right. Access to tax-free income like this can even help you avoid unnecessary taxes on social security income.

If push comes to shove and your retirement was seriously underfunded, you can always roll remaining life insurance cash values to an annuity creating a guaranteed annual income for life. Usually the longer you can wait to do this the better, but it’s always an option.

If you want the best benefits using life insurance to maximize your passive income, you will want to capitalize the policies so they’re established long before you get to retirement. The more established they are, the better.

So, let’s see how this works with your Savings plan right now – short-term.

Technically the question would be: How does whole life insurance do during the accumulation phase? The answer is: Great – and it’s looking even better compared to the sluggish market returns experts are predicting over the next decade plus.

People often ask, “What is the annual rate of return (ROR) on a whole life policy?” There is no annual ROR but we can figure an Internal Rate of Return (IRR) based on premiums and projected policy values. Here’s a graph of the internal rate of return calculations for a well-designed policy on a 30 year old male in average health.

As you can see, a well-designed whole life insurance policy can create an annual internal rate of return of 3-4% long-term. That’s really nice when you consider this is after administration and the cost of insurance. Also, you don’t pay taxes on the growth inside the policy[iii] and there’s virtually no risk.[iv]

This return is quite comparable to what an average investor is getting on at least part of their portfolio – especially considering the average investor is usually not invested 100% in stocks. Some bonds are often returning less than 3%.

But money in life insurance, is money that a financial advisor can’t invest for you. Many investment advisors have a personal interest in downplaying life insurance, as much as insurance agents have an interest in promoting it. The sign of true character is when people from either side can step beyond personal interests and have a real, fact-based discussion.

Depending on your goals, it might make sense to plan your retirement assets to include a combination of life insurance and other investments. There is certainly more upside potential in the stock market – of course the downside potential is there too.

We’ll have people call our office from time to time and report that they bought whole life insurance years ago and the growth in cash value has done better, overall, than their other investments.

My point is, that the internal rate of return in whole life insurance is fairly comparable to long-term market returns especially for the “safe and steady” portion of an investor’s portfolio. Whole life insurance does have an important place in retirement planning.

Even if you’re age 60-70 reading this article for the first time, there still may be some good options available to maximize or extend your retirement income using whole life insurance. Be sure to talk with a wise and caring agent, who will really consider your personal situation and your best interests rather than simply pushing for the sale.

Part of America’s retirement crisis lies in the fact that people raid their retirement savings for other purposes and destroy the compounding power. With easy access to cash values, this possibility is wide open when using whole life as a savings vehicle. Could it be a problem?

Tax qualified plans, by contrast, limit access to your money through a 10% penalty that holds on until age 59 ½. But even this penalty hasn’t precluded people who really needed access to their retirement savings. It can even be argued that the penalty slaps people when they’re already down and have run out of other options.

The whole attitude behind the 10% penalty is built on the assumption that people are stupid and would spend their retirement money, so we have to protect people from themselves or they’ll become a burden on society. That’s not the American way! What’s wrong with responsibility?

In 2017, Americans were actually saving more money in their 401(k)s as reported by Bankrate, but then they had to access the money or load up on credit card debt to finance “emergencies”. This prompted a Yahoo Finance Headline: Americans are Saving More for Retirement. Are They Saving Too Much?

The problem isn’t that Americans are saving too much, but maybe they need at least some penalty-free access to their savings. I believe most Americans know they need to save more and they’re trying, but then they’re getting penalized for doing “the right thing”. This makes it really hard to do more of the right thing and save more.

We’ll always have to help people who didn’t discipline themselves to do the right thing, or maybe who couldn’t cope with overwhelming circumstances – there are real cases of need. This is a fact of life and always will be in an imperfect world.

But as a wise money manager you have nothing to fear from taking responsibility of your finances. Using whole life insurance as a savings vehicle opens financial opportunities that aren’t available for those who choose to lock their money into tax qualified plans.

When you take a policy loan from a whole life policy, this doesn’t kill the compounding growth – instead you pay interest on the outstanding loan until it is paid off. The insurance company is lending you money from the general account which is fully collateralized by your Cash Value, thus your policy continues operating the way it normally does.[v]

Of course you can borrow from tax-qualified plans for emergency circumstances too, but you have to meet the qualifications (no opportunities, just emergency access) and the interest must be paid with after tax dollars, so you’ll pay taxes for a second time when you withdraw that money.[vi]

Among the key factors for building a solid retirement strategy, is to maximize the options you have for passive income and keep those options open as long as possible.

Including life insurance in your planning certainly opens more options – even during the accumulation phase. Annuities do offer an option for higher passive income, but also limit your options going forward. As a general rule you will want to wait as long as possible to lock-in any part of your passive income plan involving annuities.

Multiple life insurance policies can create more options because assets in one policy can be rolled to an annuity creating a guaranteed income stream while keeping another policy intact. Just remember to balance this option with the fact that insurance coverage split across multiple policies does usually carry a higher cost than the same amount of coverage in one policy.

Considering the total premium cash flow is also important to maximize your options. I’ve seen plans for disaster where insurance agents have sold multiple policies with total premiums at a high percentage of the client’s income – up to 96% in one case! Those poor clients were “taken to the cleaners.” The same problem can happen on a smaller scale too, eliminating options that you could keep by making premiums comfortable and affordable.

Being a wise money manager includes wisdom in planning for life insurance premiums. You want to be reasonably sure that you’ll be able to afford premiums on any new whole life insurance policy for at least the first 5 years – longer in most cases.

A good rule of thumb is to start with premiums about 10% of your income up to a maximum of around 30% when you have no debt and are comfortable saving that much or more. This is a rule of thumb so don’t take it too literally, but at least you’ll have a general idea of where you want to see total premiums. Based on our research, and working with many clients, these are the ideal levels that we have seen to be most effective to maximize options for passive income planning.

All through this article we’ve been focusing on passive income for retirement, but retirement is really not the best life goal. Here’s another important perspective on planning your financial future.

In the Bible (Luke 12: 15-21) Jesus tells a parable of the greedy farmer whose harvest was abundant. The farmer decides to tear down his barns and build bigger ones. Then in his heart, he tells himself “Soul, you have many goods laid up for many years to come; take your ease, eat, drink and be merry.”

But God says to him, “You fool! This very night your soul is required of you; and now who will own what you have prepared?”

The lesson from this parable points eerily at the modern idea of retirement. Oftentimes when people retire, they die shortly afterward, unless they have a purpose to fill the void created when they stopped working and contributing to society.

This purpose should ideally be more than simple volunteer work where your presence would not be seriously missed if you were absent. In fact, earning money is one way to prove that your contribution is valued by someone in the world.

It’s no surprise that the key to longevity is caring for others, and this should always be a goal. Also consider how effective your life or career can really be if you’re aiming for retirement most of the time?

Rabbi Daniel Lapin deals with this subject in his book Thou Shall Prosper where the 10th Commandment for Making Money is: Never Retire!

Rabbi Daniel Lapin deals with this subject in his book Thou Shall Prosper where the 10th Commandment for Making Money is: Never Retire!

He gives a great analogy of golf and the importance of the follow-through. “Like most people, you may wonder why the follow-through is important because you have already hit the ball.” But, you see, “if retirement is your goal, your entire career drive will be deeply flawed. You will never create all you could have.”

Rabbi Lapin points out that belief in retirement as a life goal is a sort of “spiritual virus that infects all your thinking.” You subconsciously start slowing down and when you reach your retirement age (whatever it is) “your wealth will be far less than it would have been if you had reached that age with no thoughts of retirement in mind.”

Lapin goes on to say:

“The traditional Jewish contempt for retirement is an important factor in Jewish economic success. Do some Jews retire? Of course they do, but seldom as part of a life plan that mandated retirement at some predetermined date. In many cases, they sold a business or came into a large sum of money and found themselves out of work. Some wisely reentered business, whereas others became idle and deteriorated. If you are working now, I say plan on never retiring. If you are currently retired, I say put down this book until you found a job for yourself or created one.”

Reading this section, maybe you’ll find yourself rethinking retirement. At least you can be thankful for the experience of learning sooner than later that retirement isn’t all it’s cracked up to be.

Who knows, but perhaps the American retirement crisis is one way God’s trying to get the attention of his children saying, “No, you really don’t want that.”

There’s nothing wrong with creating passive income now or for the future, in fact, planning your financial future wisely is just as important as being a wise financial steward from day to day. But you might not want retirement to be your goal.

Eli Cohen once said:

“…hell starts when the person you are meets the person you could have been.”

Anonymous says:

“Plan wisely, live well and be content but never sated.”

America’s retirement system is broken – it started with pension plans and now defined contribution plans such as 401(k)s are seriously underfunded as well. Sustainable withdrawal rates are much lower than suggested by the old “4% rule” – probably closer to 2% in today’s environment.

Looking at history and current proposals, it is doubtful that any government-backed plan for American retirement will ever gain popular support and if it did, would likely face the same problems affecting pensions systems, 401(k) plans, and even Social Security.

An actuarial element applied to passive income distributions can efficiently convert assets to a sustainable income stream at a higher rate than from the assets alone. With proper planning whole life insurance and guaranteed fixed annuities can be used privately, to create a better and more efficient retirement income strategy.

And if you don’t plan to retire, whole life insurance can make a great ongoing accumulation vehicle with the options for passive income ever-present during your golden years.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.

Footnotes:

[i] Analysis of Census Bureau data by Interest.com

[ii] Based on Monte-Carlo simulations. The Monte-Carlo analyses model is the gold-standard for financial planning simulations involving market projections.

[iii] Cash Value growth in a life insurance policy is tax-deferred. Cash Values can be accessed via policy loan with no tax and withdrawals are taken on a First-In First-Out (FIFO) basis which means premiums come out first tax free. Withdrawals beyond total premiums paid (the cost basis) would be taxable as ordinary income.

[iv] Dividends are not guaranteed but once paid they can never be taken away.

[v] Direct-recognition policies do “recognize” an outstanding loan when dividends are calculated – an exception to this rule.

[vi] With the exception of Roth type plans. Distributions from Roth plans are not taxed because the original contributions were already taxed.