702-660-7000

702-660-7000

It’s that time of year…Summer Vacation!

Vacations are a wonderful way to get recharged, enjoy the wealth of family relationships and create unforgettable memories with the people you love. Because of this, vacations can be one of the best investments that you’ll ever make.

And here’s more good news: Just because a vacation is an investment in yourself and your family doesn’t mean it can’t be a good investment of your $$$ (dollars) too.

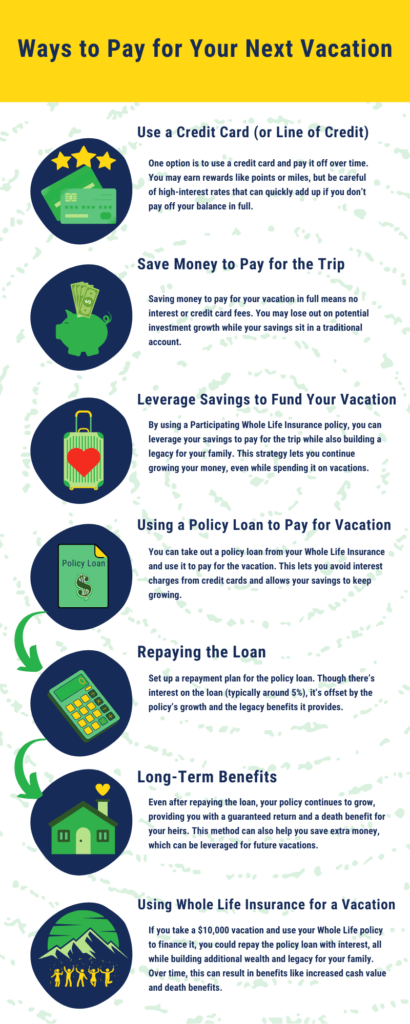

There are 3 ways to pay for your next vacation:

Most people pay for vacations with option 1 or 2. They’ll use a credit card and get the points which is great, but then they’ll either pay interest to the bank (option 1) or lose interest they could have earned on the money used to pay off the credit card (option 2).

Either way these people are back at $0, saving up for the next vacation.

So what about option 3? By saving consistently in a place where you can leverage your savings to pay for your next vacation, you can create a guaranteed foundation that will ensure that you don’t go all the way back to $0 when you pay for that next vacation.

How can this work? If you use a Participating Whole Life Insurance policy, it’s simple.

Won’t there be some interest on the policy loan?

Yes. Right now it’s about 5% with most insurance companies.

Does this interest defeat the purpose of financing your vacation with a policy loan?

No, because you come out ahead (even ahead of just paying cash) in 3 ways:

Here’s an example: Let’s say you start a Participating Whole Life insurance policy and take a $10,000 family vacation. You put the vacation on a credit card to get the points.

When you get home you take a policy loan for $10,000 and pay off the credit card so you don’t have to pay 19.99%.

Now you make a plan to repay the policy loan over 2 years. The insurance company only requires 5% but any extra you choose to pay will be money you can use over again so why not pay the extra % you would have had to pay to the credit card company? The monthly payment comes to $508.91.

At the end of 2 years you’ll have repaid $12,213.84. $529.04 of interest went to the Insurance Company so you saved an extra $1,684.80 which you can leverage and use again along with the original $10,000.

Your policy continues growing during this time GUARANTEED (as long as you pay the premiums and interest). It also provides a death benefit/legacy for your heirs.

The $529.04 of interest paid to the insurance company is offset by growth in the original policy over time. I ran some numbers on a 50 year old male in standard health to compare the results of financing the vacation this way vs. withholding $10,000 from premium in the first year to pay cash for the vacation.[1]

In year 30 (age 80) the cash value difference comes to an extra $10,369 guaranteed ($21,165 with non-guaranteed dividends). This is like getting a guaranteed 10.44% rate of return (13.08% projected ROR) on the $529.04 that you paid in interest.

Taking a vacation every 2 years and repeating this process, these rates go down to about 1.78% (guaranteed) 6.07% (projected). Still a very good return considering you are actively using $10,000 and have purchased an additional death benefit/legacy of ($26,936 to $40,999) during these 30 years and beyond.

Plus remember the “extra” $1,684.80 every 2 years that you would have had to pay to the credit card company but are saving instead? This is like the icing on the cake…you can use these $ to increase your return by lowering the policy loan balance, purchasing additional policy(s) (not quite enough to do that yet) and/or indulging in a nicer vacation next time around.

Doesn’t it just make sense to fund your vacations this way from now on?

Whenever you can leverage your policy values and get both guarantees, and the benefit of using the money with a legacy to boot…that’s a great time to use your policy, a great time to take a vacation! Now we’re talking about getting the profits of two “investments” at the same time instead of only one.

The bottom line is: Never settle for either/or when you can choose both.

Take the steps you need to make your next vacation a great investment for your $$$ as well as your family’s wealth and well-being.

Relaxing on the beach, skiing down the slopes or exploring new places…wherever your next vacation takes you, you’ll feel better knowing that thousands of $ will be coming back to you and your family because you took a little extra effort to utilize the best strategy.

What? You want to fund vacations like this more than once every two years? What will you need to do? You’ll need to save more. You can increase your premium amount so that the amount of cash values available to you allow you to do what you want to do.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.

[1] $10k/yr initial premium + extra $10k in year 1 for comparison example