317-912-1000

317-912-1000

When it comes to estate planning and life insurance, you’ll often hear financial advisors and insurance professionals recommending that you set up a separate trust to own your life insurance policies. On the surface, it sounds like a smart move – after all, who doesn’t want to minimize taxes and protect their assets? But as someone who’s spent years helping people navigate the complex world of finance and insurance, I’m here to tell you that life insurance trusts aren’t always the golden ticket they’re made out to be.

Now, don’t get me wrong. I’m not saying life insurance trusts are inherently bad or that they never make sense. But what I am saying is that you need to be very careful and fully understand what you’re getting into before you jump on the trust bandwagon. There are some hidden dangers that can seriously impact the effectiveness of these trusts, and I’ve seen too many people get burned by not knowing the full story.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

So let’s dive in and take a closer look at life insurance trusts – the good, the bad, and the ugly. By the end of this article, you’ll have a much clearer picture of whether a life insurance trust is really the right move for your situation.

Before diving into the pitfalls, let’s first make sure we understand what a life insurance trust is. At its core, a life insurance trust is a type of legal arrangement designed to own and manage your life insurance policies. Rather than you being the direct owner of the policy, the trust takes over that role. It also becomes the beneficiary, meaning it will receive the death benefit when you pass away.

So why would someone go through the trouble of setting up a trust just for a life insurance policy? The main reason comes down to taxes—specifically, estate taxes. While the payout from a life insurance policy is generally not subject to income tax for your beneficiaries, it can still be counted as part of your taxable estate if you’re the owner of the policy at the time of your death.

This is where the life insurance trust comes into play. By transferring ownership of the policy to the trust, you can potentially remove the proceeds from your estate. The idea is to shield that money from estate taxes, allowing your loved ones to receive the full benefit of the policy without it being reduced by a hefty tax bill.

In short, a life insurance trust offers a way to preserve more of your legacy and ensure it goes directly to the people or causes you care about—without the IRS taking a large portion first.

This can be appealing if you’re worried about your estate exceeding the federal estate tax exemption (which is $13.61 million per person in 2024) or if you live in a state with its own estate tax that kicks in at a lower threshold.

Sounds pretty good so far, right? Well, hold onto your hats, because we’re about to get into why it’s not always as rosy as it seems.

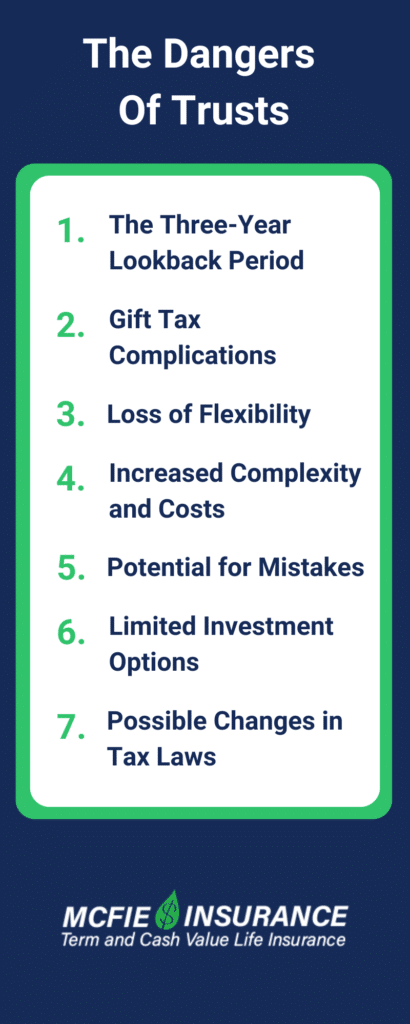

Here’s a major issue that often catches people off guard: if you transfer an existing life insurance policy into a trust, there’s a three-year rule you need to be aware of. You must live for at least three years after the transfer for the policy to be excluded from your taxable estate. If you pass away within that three-year window, the IRS will pull the full value of the death benefit right back into your estate for tax purposes—undermining the main reason for setting up the trust in the first place.

You might be thinking, “No big deal—I’ll just have the trust buy a brand-new policy instead of transferring an old one.” And that’s a valid strategy. If the trust is the original owner and applicant on the new policy, the three-year rule doesn’t apply. This approach comes with its own set of challenges, especially when it comes to structuring the trust and funding premium payments properly. We’ll dive into those details shortly.

Another common pitfall involves gift taxes. Every time you contribute money to the trust to pay life insurance premiums, that contribution is treated as a gift for tax purposes. You can use the annual gift tax exclusion—$18,000 per beneficiary in 2024—to help offset this, but the process isn’t as simple as just handing money over to the trust.

To qualify for the annual exclusion, the gift has to be of “present interest,” meaning the beneficiary must have the immediate ability to use or access the funds. Since most trust arrangements don’t naturally allow this, special provisions—called Crummey powers—are usually added. These provisions give each beneficiary a short window of time, usually 30 days, to withdraw their share of the gifted funds before the money is used to pay the insurance premium.

It’s a bit of a legal dance. If these steps aren’t followed precisely, your contributions may not qualify for the annual exclusion. That could force you to tap into your lifetime gift tax exemption or even trigger a gift tax bill. So while the life insurance trust can be a powerful estate planning tool, it needs to be carefully maintained to avoid unintended tax consequences.

Once you put a policy in an irrevocable trust, you’re largely giving up control. Want to change beneficiaries or borrow against the policy’s cash value? Too bad – those decisions are now in the hands of the trustee. This loss of flexibility can be a real problem if your circumstances or wishes change down the road.

Setting up and maintaining a life insurance trust isn’t a DIY project. You’ll need to work with an experienced estate planning attorney to draft the trust document, and you may need ongoing legal and tax advice to make sure you’re managing it correctly. All of this adds up to higher costs and more paperwork compared to simply owning a policy outright.

With all the moving parts involved in a life insurance trust, there’s a lot of room for error. Forget to send Crummey notices to beneficiaries? Fail to pay premiums on time? Have a trustee who doesn’t understand their duties? Any of these mistakes could potentially invalidate the trust or cause other unintended consequences.

If you’re using a permanent life insurance policy like whole life (which I often recommend for other reasons), having it owned by a trust can limit your ability to fully leverage the policy’s cash value. You might miss out on opportunities to use that cash value for investments or other financial strategies.

Estate tax laws have a habit of changing. What if the estate tax exemption goes up even higher or the estate tax is eliminated altogether? You could find yourself stuck with a complex trust structure that’s no longer necessary.

Now, after all that doom and gloom, you might be wondering if there’s ever a good reason to use a life insurance trust. And the answer is: it depends on your specific situation. There are certainly cases where the benefits can outweigh the drawbacks.

For example, if you have a very large estate that’s well over the federal exemption amount, and you’re buying a new life insurance policy specifically for estate liquidity purposes, a trust might make sense. Or if you’re in a state with a low estate tax threshold and you want to protect a significant life insurance payout from state-level taxes, a trust could be worth considering.

But here’s the key: it needs to be part of a comprehensive estate plan that takes into account all of your assets, goals, and potential tax liabilities. It’s not a one-size-fits-all solution, and it’s definitely not something you should rush into just because someone told you it’s a good idea.

For many folks, I believe there’s a simpler and more effective way to use life insurance as part of your financial strategy: a well-designed participating whole life insurance policy.

Here’s why I often recommend this approach:

Now, I know whole life insurance has gotten a bad rap in some circles. People say it’s expensive or that you’re better off buying term and investing the difference. But the truth is, not every whole life policy is created equal. When properly designed and used as part of a comprehensive financial strategy, it can be an incredibly powerful tool.

The key is working with someone who understands how to structure these policies for maximum benefit and who can show you how to use them effectively. That’s where we come in at McFie Insurance. We specialize in designing high-cash value whole life policies that give you the protection, growth, and flexibility you need.

Life insurance trusts can serve a purpose in certain high-net-worth estate planning situations. But for most people, the complexities, costs, and potential pitfalls outweigh the benefits. Before you go down that road, make sure you fully understand what you’re getting into and consider whether there might be simpler, more effective alternatives.

If you’re trying to figure out the best way to use life insurance as part of your overall financial strategy, I encourage you to look beyond the standard advice and explore all your options. A well-designed whole life policy might be just what you need to protect your family, grow your wealth, and create the financial future you’re dreaming of.

At McFie Insurance, we’re here to help you navigate these decisions and find the solution that’s right for you. We don’t believe in one-size-fits-all approaches or pushing products that don’t make sense for your situation. Instead, we take the time to understand your unique needs and goals, and then we work with you to create a customized strategy.

So if you’re ready to take control of your financial future and want to learn more about how life insurance can play a role, why not schedule a strategy session with us? We’ll answer your questions, walk you through your options, and help you make an informed decision about what’s best for you and your family.

Remember, when it comes to your finances, knowledge is power. Don’t let anyone push you into a complex trust arrangement without fully understanding the implications. Take the time to educate yourself, ask questions, and explore alternatives. Your future self will thank you for it.

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.  Tomas P. McFie DC PhD

Tomas P. McFie DC PhD