317-912-1000

317-912-1000

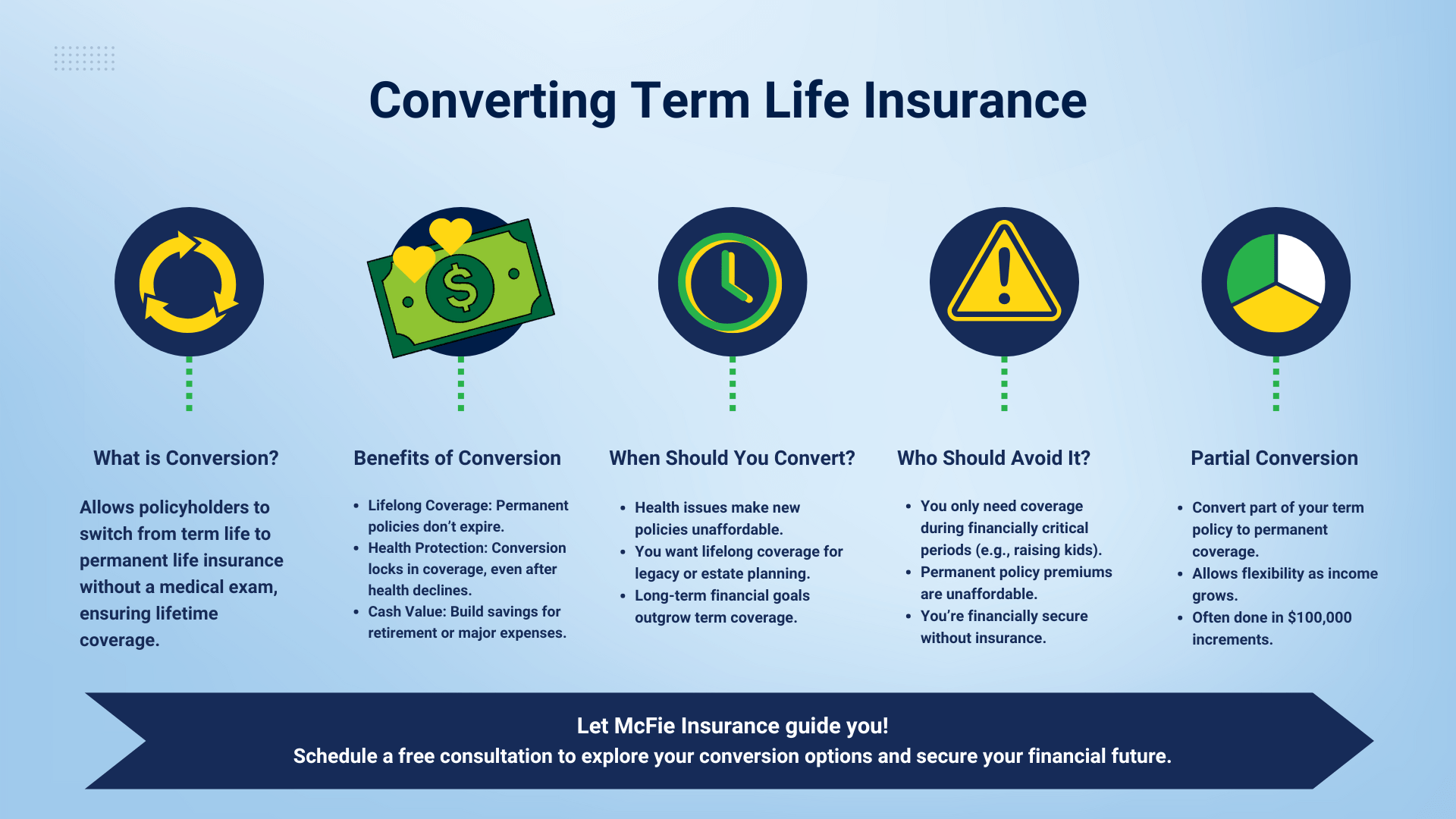

The term life insurance you secured when your children were young plays a pivotal role in your financial protection, offering financial security at a cost-effective rate. But, these policies are intentionally designed for short-term coverage. If you outlive the policy’s duration, your beneficiaries receive no death benefit.

Term insurance might suffice for your family’s needs. But, if there’s been a shift in your earnings, financial goals, or health, you might be able to convert your term insurance into a permanent life insurance (such as whole life or universal life insurance).

A key incentive to switch to permanent coverage is the potential for policyholders to build cash value, which can assist with retirement or other long-term financial objectives.

Permanent life insurance assures a death benefit for your heirs as long as the policy remains active, not just for a predefined period. Many individuals approaching retirement opt for permanent policies. They offer a means to handle final expenses, bolster financial security for a surviving partner, or establish a monetary legacy for their offspring or grandchildren.

While individual financial circumstances vary, permanent life insurance often serves as an effective long-term strategy. Many choose term insurance in their earlier years due to financial constraints. Yet, as their financial situation evolves, converting the policy becomes a viable option.

Converting to a permanent policy, like whole life or universal life, is generally more expensive. Premiums for whole life insurance are commonly 10 times more than those for term life insurance with an identical death benefit, but you can often build some solid cash values in return. This is because permanent insurance offers lifelong coverage with set premiums. The actual premium amount will be contingent on personal factors.

Before converting your term life policy into a whole life policy, you should understand the pros and cons of the conversion.

Relying on insights from a knowledgeable financial professional is important. They can assist in making informed decisions, preventing unsuitable choices.

Considering a term to whole life conversion? Here are the top five questions to ask:

Many term life insurance policies include a conversion feature, which allows policyholders to switch to a permanent life insurance policy during the term of their policy. This option provides flexibility, but it’s important to understand that while it’s often available, it comes with a higher premium. There’s usually the possibility to extend the term of the policy if needed, though this option often leads to an increase in premiums as well.

Insurance companies charge a slightly higher premium for policies that include a conversion option, as it adds value to the policyholder. Some insurers may offer a discount on the premium for the new policy during its first year, which can help offset the initial costs associated with making the conversion.

It’s important to note that conversion clauses in term life policies are not one-size-fits-all. The specifics can vary between different insurance products and companies. Some policies allow for conversions at any time before the term expires, while others limit conversions to a specific period—like within the first 10 years of the policy. There may also be age restrictions that prevent conversions after a certain age, often setting a cap at 75 years old. Longer conversion windows can sometimes result in higher costs due to the added flexibility.

When selecting a term life insurance policy, it’s crucial to carefully review the conversion options and the permanent policies available for conversion. Each insurance company may have different rules, and understanding the costs and benefits of converting to permanent coverage is key.

To fully understand the conditions of your term policy and to determine the best strategy for conversion, it’s always wise to thoroughly review your policy or consult with a financial expert who can provide tailored advice.

Switching from term insurance to permanent insurance isn’t always the best choice, particularly if you desire some extra coverage only during your family’s most financially challenging times.

There’s a belief that certain individuals might not even require life insurance (be it term or permanent) if they possess substantial assets and savings, ensuring their family won’t undergo financial turmoil should the main breadwinner pass away suddenly. such situations aren’t commonplace. It’s hard to truly ascertain your financial readiness without predicting potential future challenges.

If the premium costs of a permanent policy with equivalent death benefit coverage are burdensome, retaining some of your term insurance may be prudent. While term insurance might be more cost-effective for the same coverage amount, it only disburses benefits if the policyholder passes away while the policy is still active..

There are instances where individuals lean towards the long-lasting assurance of a permanent policy but require a heftier death benefit than their budget permits. In these scenarios, term life insurance, providing a larger death benefit at a fraction of the cost, is often a good option in combination with some permanent coverage. Ultimately, it boils down to financial flexibility.

Assessing the pros and cons of conversion also entails factoring in income consistency. If there’s apprehension about maintaining the higher premiums of a permanent policy due to potential income disruptions, keeping more coverage in the form of term insurance, which usually has lesser premiums, might be a safer bet. It’s essential to note, non-payment of premiums leads to policy termination, which eliminates a death benefit.

Permanent insurance is often viewed as a mechanism to afford a base level of coverage for final expenses, assist a remaining partner, or bestow a financial inheritance to heirs. It presents solutions for unforeseen costs, such as those stemming from health emergencies or unexpected home repairs, as well as for sustained financial burdens like university fees or lingering debts. Using cash values by borrowing or making partial withdrawals will decrease the policy’s available cash value and net death benefit..

Switching from term to permanent could be a wise choice if you:

There’s a multitude of benefits to owning permanent life insurance beyond the mere death benefit with tax efficiency being paramount.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

In essence, life insurance boasts a threefold tax boon. The cash value grows on a tax-deferred basis, you can retrieve the cash value without tax implications (up to the cost basis – the cumulative amount spent on policy premiums), and the death benefit is typically disbursed to your beneficiaries devoid of income tax.

Conversion can be an excellent option for individuals whose health has changed, making them ineligible for a new insurance policy. Health changes that might affect insurability include diagnoses of conditions like heart disease, diabetes, cancer, or other serious illnesses.

One of the main benefits of the conversion feature is that policyholders are guaranteed the ability to convert to a permanent life insurance policy without being denied coverage due to health changes, as long as the conversion takes place within the window specified by the term policy. This ensures that individuals who might otherwise struggle to obtain permanent life insurance due to health issues aren’t left without options.

This feature becomes important in certain situations. For example, if someone is diagnosed with a terminal illness like cancer, or if they anticipate a reduced life expectancy, converting to a permanent policy could provide peace of mind. This guarantees a death benefit that will support their loved ones, regardless of their changing health status.

However, it’s essential to remember that the right to convert is often time-sensitive and may not last for the full duration of the term policy. If a serious health condition, like a terminal diagnosis, arises late in the term period, the conversion option might no longer be available. Therefore, understanding the specific terms and timing of the conversion feature is vital to make sure that it can be used when most needed.

For those considering transitioning their term policy into a permanent policy but find the premiums steep, a partial conversion might be an option, if the insurance provider permits it. Here, only a segment of the original term life policy transitions into a permanent policy.

Policyholders could convert a portion, like 20% of their term policy, every couple of years in tandem with their increasing income.

In a decade, they’d hold a fully-fledged permanent policy. There are instances when term life insurance initially emerges as the sole feasible choice due to restricted finances. Yet, with a convertible feature, one can gradually transition it into permanent coverage. Note: Often partial term conversions must be done in $100,000 increments.

For numerous growing families, term life insurance stands as an important safety blanket, granting financial security against the potential loss of life & income at the cheapest rate in the short-term. But as finances change, especially those who face health challenges or have long-term objectives, should contemplate the pros and cons of converting from term insurance to permanent insurance, or at least getting some permanent coverage along with their term insurance sooner than later.

Term policies with conversion opportunities grant more flexibility.

Both term life insurance and whole life insurance have their distinct advantages tailored to specific life circumstances and financial stages. The potential to convert from a term policy to a permanent policy offers policyholders flexibility, acting as a safety net when life throws unexpected curves, particularly concerning health or changing financial needs. While term insurance provides an affordable safety net during vulnerable financial periods, permanent insurance caters to building mid-term liquidity, as well as long-term planning and legacy goals.

Ultimately, the decision to convert rests on individual needs, financial health, and long-term objectives. Seeking guidance from a financial professional and understanding your conversion rights can help you make the best decisions for your financial situation.

Let McFie Insurance help you decide what is the best financial strategy for you. Schedule a free consultation and start you journey toward controlling your financial future.

If you’re considering converting term insurance to whole life, you may want to look beyond just coverage and think strategically about how permanent insurance can support your overall financial goals. That’s where the Infinite Banking Concept comes into play.

The Infinite Banking Concept is a strategy that uses specially designed whole life insurance to create a personal banking system. It allows policyholders to build cash value, access that cash through policy loans, and recycle money through their own life insurance policy—rather than relying on traditional banks or lenders.

Here’s how it works in simple terms:

Unlike traditional savings or investment accounts, whole life policies used in Infinite Banking are contractually guaranteed to grow, regardless of economic downturns. And because the cash value keeps compounding, even when borrowed against, your money works harder over time.

If you’re thinking about converting your term policy, it’s worth asking:

Could your whole life policy do more than just provide a death benefit?

We specialize in designing policies for the Infinite Banking Concept, giving you the power to protect your family, access liquidity, and build long-term wealth—all with one tool.

Ben T. McFie

Ben T. McFie

There's a lot of confusion around finance; there's so much to know and it's frustrating when you don't know enough to make the best financial decisions. I like to bring clarity to financial matters so people can make good financial decisions that will help them live wealthier more fulfilling lives.