317-912-1000

317-912-1000

In today’s unpredictable economic landscape, financial stability requires more than saving money in a traditional bank account. Many families face unexpected challenges that can quickly deplete savings and create financial stress. Let’s explore how participating whole life insurance cash values can provide a powerful tool for overcoming financial obstacles through the real-life story of one family’s experience.

Eric, 33, and Taffy, 29, were a young couple with four children when they began working with McFie Insurance. Like many responsible parents, they initially purchased term life insurance to protect their family by replacing lost income and paying off their mortgage should either of them pass away unexpectedly.

However, after learning about participating whole life insurance, they realized this financial tool could provide death benefit protection and living benefits through accessible cash values. They understood that over time, their participating whole life policies would build enough death benefit to eventually make their term insurance unnecessary.

Three years after purchasing their participating whole life insurance policies, the family faced an unexpected challenge. During Taffy’s fifth pregnancy, she developed preeclampsia, a serious complication that required her to be placed on bed rest. This meant Taffy had to stop working, potentially creating financial hardship for the family.

Fortunately, in those three years, Eric and Taffy had built cash value in their policies – Eric had been paying $10,000 annually for his policy, while Taffy contributed $5,000 per year to hers. Together, they had accumulated over $40,000 in cash value.

Prior to Taffy’s health crisis, the couple had already experienced one benefit of their policies. They had recently purchased a new van to accommodate their growing family, using the cash value from their policies as financing. Instead of getting an auto loan from a bank, they borrowed against their policy values, paid cash to the dealership, and made monthly payments of $660.49 back to the insurance company at a 5% interest rate on a 60-month schedule.

When Taffy’s pregnancy complications arose and her income stopped, this $660.49 monthly payment became difficult to maintain. Here’s where the flexibility of participating whole life insurance proved invaluable:

This flexibility meant Eric and Taffy could temporarily stop making the $660.49 monthly payments until Taffy recovered and returned to work. Had they financed their vehicle through a bank or dealership, they might have faced late fees, credit score damage, or even repossession when they couldn’t make their payments.

Remarkably, their policy cash values continued growing even while they weren’t making loan payments. Although the growth would have been faster had they continued their loan repayments, they weren’t penalized with the loss of the guaranteed annual cash value increases their policies promised.

During Taffy’s recovery period:

Understanding the growth potential, Eric and Taffy prioritized paying their annual policy premiums even when finances were tight during Taffy’s recovery, though they temporarily paused their policy loan repayments.

Once Taffy was able to return to work after the birth of their fifth child, the couple simply resumed their monthly loan repayments according to their original agreement. This restored their ability to leverage their policy values again in the future, along with all the additional cash value that had accumulated during their financial challenge.

The experience demonstrated several advantages of participating whole life insurance:

To understand why participating whole life insurance was so effective for Eric and Taffy, it’s important to recognize how this financial tool differs from more common insurance products and savings vehicles.

The term “participating” means policyholders participate in the profits of the insurance company through dividends. While dividends are not guaranteed, many established mutual insurance companies have paid them consistently for over a century, even through economic downturns.

These dividends can be used in several ways, including purchasing additional paid-up insurance, which increases the death benefit and the cash value of the policy.

The cash value in a participating whole life policy represents your equity in the death benefit – the portion you’ve essentially “paid up.” This is different from the cash value in other types of policies like universal life insurance.

As you pay premiums, you gradually build ownership in the policy’s death benefit. This cash value component has several important characteristics:

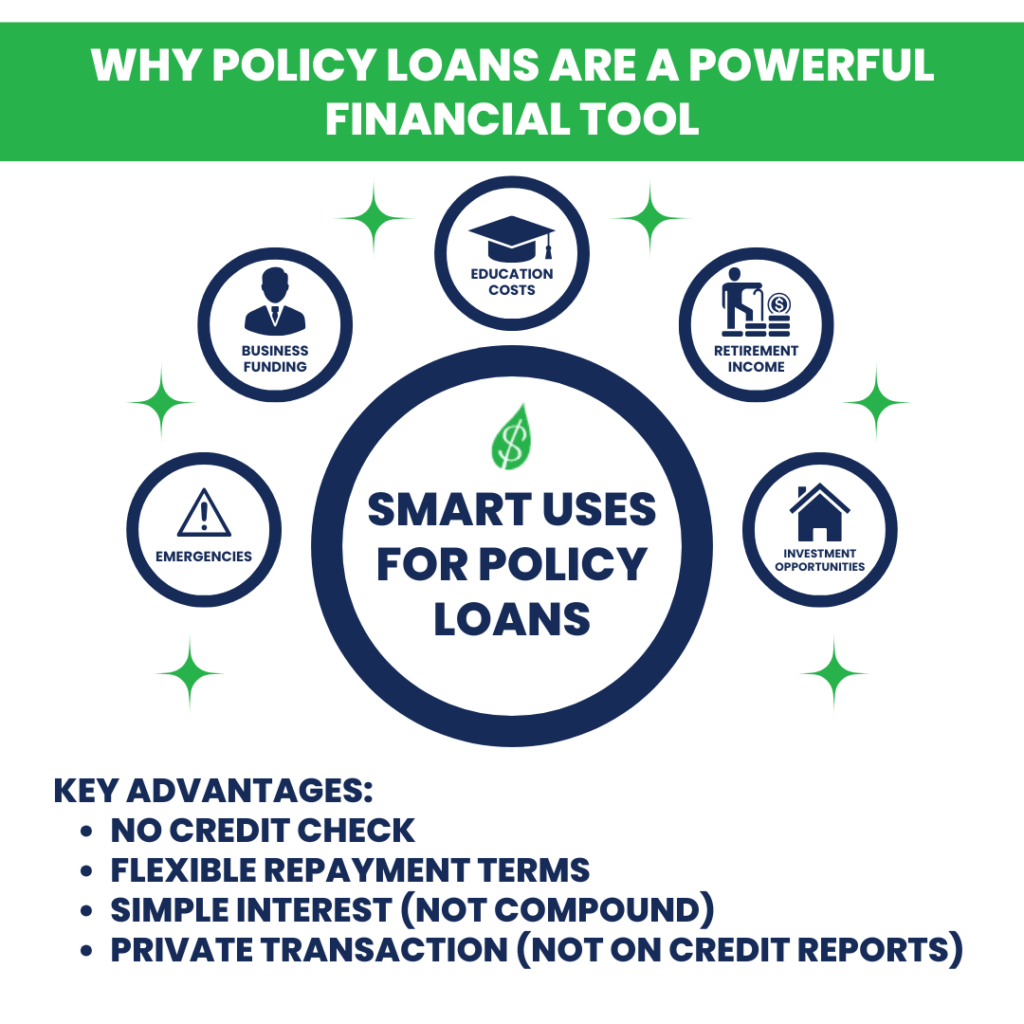

The policy loan feature that benefited Eric and Taffy offers several unique advantages:

While Eric and Taffy’s story highlights how participating whole life insurance helped during a financial emergency, these policies can be leveraged for various financial needs throughout life:

In each case, the policy owner maintains control and flexibility while keeping their money growing even as they use it.

It’s been suggested that approximately 70% of Americans will never build a substantial estate without life insurance. This makes sense considering the median savings account balance for Americans is just $62,410, roughly equivalent to the average annual income. When emergencies or major expenses arise, these savings can quickly disappear, leaving families financially vulnerable.

Eric and Taffy’s experience demonstrates a different approach. Their participating whole life insurance policies provided not only death benefit protection but also financial flexibility during challenging times. Even while leveraging their cash values to purchase their van and navigate Taffy’s temporary income loss, their policies continued to grow in value.

This combination of protection, accessibility, and ongoing growth makes participating whole life insurance a powerful tool for building long-term wealth while maintaining financial resilience against life’s unexpected challenges.

For families seeking protection and financial flexibility, a well-designed participating whole life policy can provide:

Financial obstacles are an inevitable part of life. For Eric and Taffy, a health complication could have created financial strain at an already stressful time. Their participating whole life insurance policies provided the financial resources they needed to navigate this challenge without additional hardship.

In an unpredictable world, financial tools that provide protection and flexibility are invaluable. Participating whole life insurance, when properly structured and understood, can be an important component of a financial strategy that helps families overcome obstacles and build long-term financial security.

For families like Eric and Taffy’s, participating whole life insurance has proven to be not just an insurance policy, but a versatile financial tool that provides protection, builds wealth, and offers peace of mind through life’s unexpected challenges.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.