317-912-1000

317-912-1000

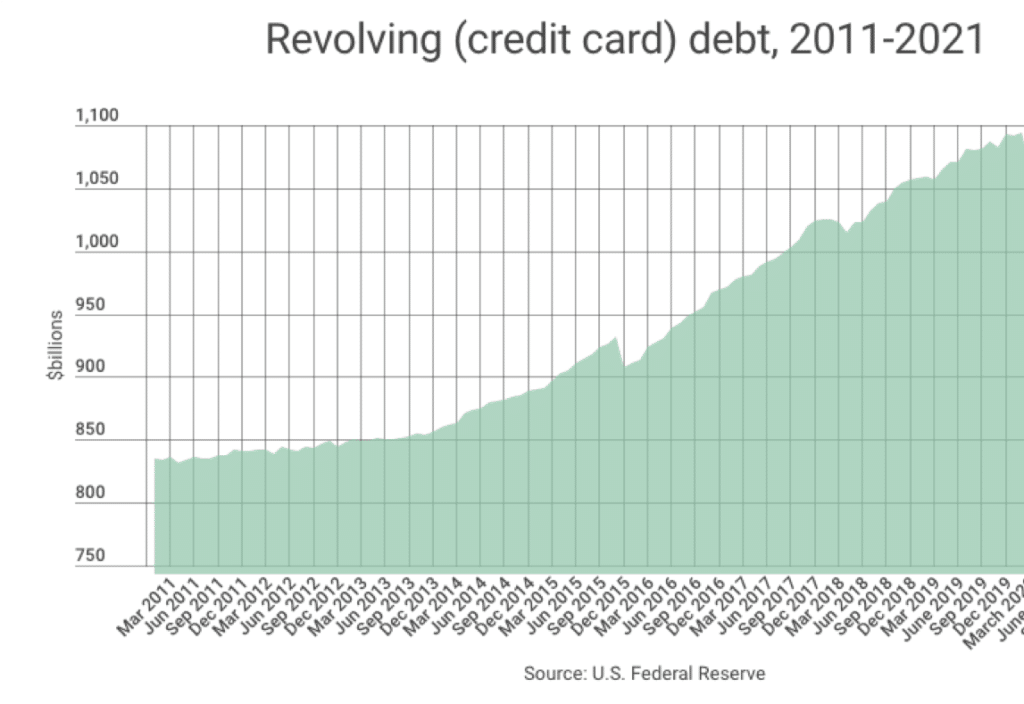

Finally, after 8 years, credit card debt decreased in 2020 by an average of 14% nationwide. Even so, in 2019 Americans spent $122 Billion on credit card debt interest, an evil which had drastically increased by 50% over the previous 5 years. Millennials, Gen X and Baby Boomers are the generations which are driving up this debt with Gen X (those who are 40 to 56 years old) carrying nearly double the average national credit card balance from month to month. Yet only 33.75% of all Americans pay their credit cards off every month and avoid paying interest.

Finally, after 8 years, credit card debt decreased in 2020 by an average of 14% nationwide. Even so, in 2019 Americans spent $122 Billion on credit card debt interest, an evil which had drastically increased by 50% over the previous 5 years. Millennials, Gen X and Baby Boomers are the generations which are driving up this debt with Gen X (those who are 40 to 56 years old) carrying nearly double the average national credit card balance from month to month. Yet only 33.75% of all Americans pay their credit cards off every month and avoid paying interest.

Besides paying interest, paying your credit card off every month can help you build and maintain a high credit score, according to the American Bankers Association. But with only slightly over 33% of credit card holders paying their credit card balance off every month, there is still a lot of interest being transferred to banks and credit card companies every year that could be used to build sustainable wealth for those who are losing this money to the cost of interest.

Credit cards are an amazing financial tool which can help you keep more of the money you make, if you use them wisely. A credit card which pays points or cash back on purchases is like receiving a cash discount every time you make a purchase. But it takes discipline to only spend what your budget can afford to benefit from such rewards offered by certain credit card companies and banks. And then you must pay the balance off every month, or the cost of interest will out weight the benefits.

To understand how quickly the interest can add up, consider this. A $5,000 credit card balance with a minimum monthly payment of $111.22 will end up costing you $1,673.33 in interest, which is nearly 34 cents more than every dollar you spent for your original purchase(s) of $5,000. What the credit card company allowed is for you to comfortably and affordably spend over 1/3rd more than what you would have spent had you paid cash for your purchase.

Using this same methodology, R. Nelson Nash suggested using whole life insurance to keep your money growing safely and securely while leveraging your policy to comfortably and affordably make specific purchase(s). Doing so would allow you to keep a large portion of that cost of interest, instead of willingly paying it to the credit card companies and bankers.

This is such a simple concept that many still struggle to see the financial wisdom and benefits. So, we continue to see Americans willingly paying credit card companies $122 billion every year when they could be keeping that $122 billion for themselves.

Here is something else to reflect upon. It is better to:

You will end up with more money in your pocket, earning compound interest at 2.1% on your savings, while paying 4% interest on a decreasing principal.

This is what credit card companies and banks know and use to their advantage. Participating whole life insurance allows you to earn a low guaranteed growth on your money while you have the guaranteed right to borrow the insurance company’s money up to the value of what you have in your policy. This guarantee allows you to leverage your policy’s cash values and keep the cost of interest which you would normally spend and send to the credit card company and/or bank when using their credit card(s) and in doing so outperform the cost of the loan.

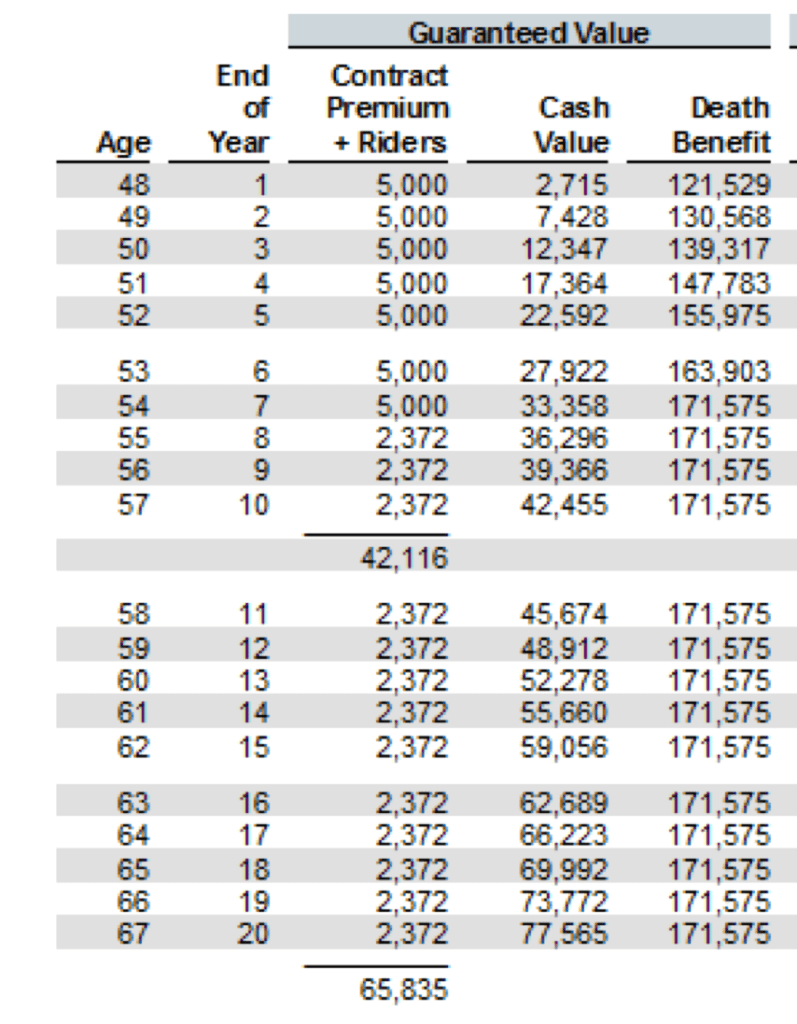

For example, a policyholder who has paid premiums for 10 years has more cash value guaranteed in the policy than what has been paid in premiums. Canceling the policy would put more money in the policyholder’s pocket than what was paid by the policyholder from this time forward. Yet, if the policyholder doesn’t cancel the policy, but uses it to collateralize a policy loan, the policyholder could borrow the $42,000 plus and keep his policy growing.

For example, a policyholder who has paid premiums for 10 years has more cash value guaranteed in the policy than what has been paid in premiums. Canceling the policy would put more money in the policyholder’s pocket than what was paid by the policyholder from this time forward. Yet, if the policyholder doesn’t cancel the policy, but uses it to collateralize a policy loan, the policyholder could borrow the $42,000 plus and keep his policy growing.

Over the next 5 years the policy is guaranteed to grow by $16,601 ($59,056 – $42,455). And the cost for these 5 years of growth has been $2,372 a year for 5 years, or $11,860. Policy growth then, above and beyond premium costs, has been $4,741 between years 10 and through year 15 of this policy.

If the policyholder had taken a policy loan in year 10 for $40,000 and repaid that policy loan at 5% interest, then the policyholder would have re-paid $11,280.47 each year for 4 years or a total of $45,121.89. The sum of the interest would be $5,121.89.

But recall the $4,741 of guaranteed growth, above and beyond the cost of premiums paid for this policy in years 11-15. Doing so makes the actual interest cost for this $40,000 loan only $380.89 instead of $5,121.89 which makes the cost of interest only 0.237% instead of 5%.

Waiting a few years later to make this same loan of $40,000 would guarantee the cost of the loan being reduced to zero or even a gain. For example, a $40,000 loan in year 15 repaid at 5% over the next 5 years would see policy growth of $18,509. Subtracting the premium costs of $11,860 provides a guaranteed policy growth of $6,649 over those five years, instead of $4,741. Yet the cost of interest on the policy loan will remain the same, 5% or $5,121.89. Taking the policy gain of $6,649 and subtracting the interest ($5,121.89) represents a gain of $1,527.11. This turns a loss into a gain.

We are instructed to overcome evil with good. Furthermore, we should never let our good be evil spoken of. The basic principles surrounding the cost of interest and how to recover that cost are simple but profound. God tells us that he has chosen the simple things of this world to confound those who think they are clever, the little things in life to overcome much larger things. With slow and steady growth provided by participating whole life insurance, you too can overcome the high price which is being paid for interest and turn that evil into something good for you and your loved ones. It only takes desire, determination and discipline on your part to get interest to work for you, instead of against you.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.