317-912-1000

317-912-1000

Standard life insurance and long-term care insurance often have what is called a nonforfeiture clause. This is an insurance policy clause stipulating that an insured party can receive full benefits or partial benefits when the premium can no longer be paid, also known as nonforfeiture benefits. The word nonforfeiture refers to the state or condition of not being subject to forfeiture. A nonforfeiture clause can take the form of various options to help you receive certain nonforfeiture benefits.

Nonforfeiture benefits give you additional choices besides surrendering a policy if you need flexibility in regard to paying the premium. Here’s how nonforfeiture benefits help a policyholder who is surrendering their policy.

In most cases, the insured will have had to make premium payments for at least three years before they can benefit from a nonforfeiture clause. Once the three-year marker has been hit, a nonforfeiture clause can be activated in two ways: 1) the insurance company automatically applies the nonforfeiture clause because the policyholder failed to make premium payments or 2) when a policyholder requests the nonforfeiture to be invoked on his or her policy.

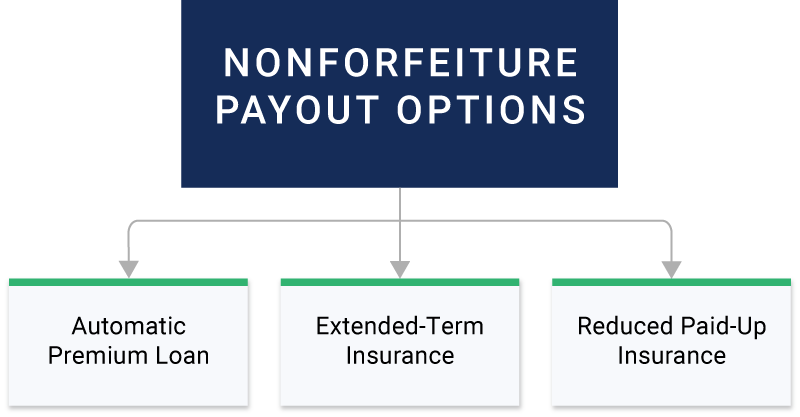

With permanent life insurance policies like whole life insurance, your accumulated cash value can come to the rescue in these situations so you don’t lose all the money you put into the policy. There are three common ways to access this accumulated cash value using a non-forfeiture option.

Important: The option to exercise a nonforfeiture benefit only exists if the life insurance policy has accumulated cash value. Additionally, because nonpermanent life insurance options (like term life insurance) don’t have cash value, nonforfeiture options won’t apply to those policies.

If you are wondering which nonforfeiture clause has the highest amount of insurance protection, that depends on what specifics you want or need. All of these nonforfeiture options will help the policyholder retain some or all of the value built in the original policy while providing a way to get coverage that better suits his or her budget and needs. If the policyholder doesn’t choose one of the above options, the insurance company will apply whatever option was chosen at the time of application.

One of the main goals of a well-designed life insurance policy is to provide for your surviving beneficiaries once you pass away, through the death benefit. If a policyholder surrenders his or her policy, the original death benefit will cease to exist. The good news is those who have permanent life insurance with cash value, are still entitled to that cash value and won’t forfeit previous payments made on it. The bad news is that you’ll no longer have the same death benefit and may be charged a surrender fee depending on the type of life insurance policy that you purchased. Additionally, any outstanding loan amounts from the policy will be settled with the accumulated cash value before it’s surrendered.

Let’s take a more detailed look into the three main ways to access your policy’s cash value from nonforfeiture including automatic premium loan, extended-term insurance, or reduced paid-up options.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

An automatic premium loan is a nonforfeiture benefit that directs the insurance company to access the accumulated cash value in a permanent life insurance product to pay the premium on the policy that is at risk of lapsing from unpaid premiums.

An automatic premium loan is similar to a regular loan where the policyholder accesses the cash values of the policy, but instead of personally receiving the funds, the loan funds are earmarked internally by the insurance company and utilized to pay the outstanding premium on the policy.

If you are wondering which nonforfeiture benefit is the automatic option, you should ask your insurance agent. The extended term is usually the default, but it may have been designated differently at the time of application. A policy owner can change their nonforfeiture benefits option at any time. At McFie Insurance, we have our clients contact our office and we do the paperwork for policy changes they desire.

The extended-term nonforfeiture benefit allows you to purchase a term insurance policy with the same death benefit you originally had from the cash value accumulated in the original policy. This is often the default nonforfeiture benefit that insurance companies apply when a policy lapses.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

From a glance, extended-term insurance might look like the best option if you’re looking to retain your original death benefit amount without paying additional premiums. However, term insurance benefits are only given to your beneficiaries if you die within the coverage period. The length of time for the new term insurance policy will depend on how much cash value you’ve accumulated in your original policy as well as your attained age. Unlike your original permanent life insurance policy that covers you for your whole life, this term policy will end after the coverage period expires and will no longer accumulate cash value.

Going with one of the first two nonforfeiture benefits will forgo your ability to continue to accumulate cash value. Reduced paid-up insurance is the only option that allows the policyholder to keep a portion of his or her original death benefit while continuing to benefit from the original policy attributes like guaranteed cash value and dividends (if available through the insurance company or specific product). When this option is selected, the insurance company cancels contract premiums for all future years of the policy. This change in the contract will also cause a change to the death benefit. Since the insurance company will no longer be receiving premiums, they adjust the death benefit down to match the value of the paid-up insurance in the policy. This is calculated based on the insured’s attained age, cash surrender value, and the number of premiums paid by the policyholder. The new death benefit value will then remain constant without requiring additional premiums. Future policy growth will be substantially slower with this option, but with applicable dividends or earnings, the death benefit may continue to grow over time.

For example, let’s say you have a $500,000 death benefit and $175,000 in accumulated cash value in your whole life insurance policy. If you were to use a reduced paid-up nonforfeiture benefit, you would still have the $175,000 in cash value, but your death benefit might now only be $300,000. You would lose some of the original death benefits, but you’ll no longer have to pay premiums on the policy, and you’ll continue to earn cash value with the ability to use it during your lifetime.

If you’re wondering which of the nonforfeiture benefits provides coverage for the longest period of time, this is the one.

Note: Most insurance companies require policyholders to have paid at least three years of premiums before they would be eligible for reduced paid-up insurance.

In the event you’re looking at nonforfeiture benefits because your policy premiums keep increasing year over year, you likely have a term or universal life insurance policy. If you wanted to switch your term insurance policy for a better premium rate, you could exchange it for a term insurance policy with a level premium period or a permanent life insurance policy with a level premium. This option is available as long as you’re in good health and under the age of 80. If you wanted to exchange your universal life insurance policy for a whole life insurance policy with a level premium, this would be called a 1035 exchange (exchanging a permanent life insurance policy for another permanent life insurance policy). This process of transferring an existing policy to a different policy is similar to a 1031 in real estate where you can exchange one property for another. A 1035 would allow you to get a different policy better suited for you while keeping the values of your current policy. One stipulation for a 1035 to be aware of is that the insured of the old policy has to be the insured on the new policy. Here’s how it would work:

Note: Loan balances can be transferred with a 1035 exchange in some cases or may be settled with the original insurance company before moving your policy over to the new insurance company. Sometimes a 1035 happens within the same insurance company between different products offered. The process looks the same and is called an internal 1035.

Another option is to use the dividends to pay the premium. If you own a participating whole life insurance policy, you can have your dividends applied toward your premium. Dividends are not guaranteed until they’re paid, and in the early years of a policy contract, the dividends might be quite small. Because of this, purchasing a policy with the intent to have the dividends pay for the premiums isn’t a good strategy, but it can be used to pay for the premiums or at least reduce the amount of premium you have to pay each year in the case that you need them to.

Whether it’s a rise in premiums, loss of income, surprise expenses, or something else, there are always ways to reduce or eliminate the premiums on your life insurance policy without losing the coverage and benefits it provides. A nonforfeiture benefits clause is a clause that no policy owner hopes to need but it’s an emergency feature that gives financial peace of mind. We can help you with all of your life insurance needs. Schedule an appointment with McFie Insurance here.

Nonforfeiture clauses are designed to provide protection for policyholders who cease premium payments. In cases where a policy might lapse after a specified grace period, these clauses become significant. If there’s accumulated cash in the policy, state laws generally prohibit insurance companies from simply retaining this amount and cancelling the policy. This ensures that policyholders retain some value from their investment.

The extended term option in life insurance policies, particularly whole life insurance, allows policyholders to utilize the accrued cash value to obtain term insurance. This conversion facilitates the cessation of premium payments while maintaining a death benefit equivalent to that of the original whole life insurance policy. It’s a way to continue coverage without ongoing premium costs.

Cash surrender value is a feature primarily associated with whole life insurance policies, specifically pertaining to their savings component. This value, which can be accessed before the death of the policyholder, represents the available portion of a life insurance policy’s accumulated cash value upon the policy’s surrender. It’s important to note that depending on the policy’s tenure, the cash surrender value might be less than the total accumulated cash value.

by Jesse McFie

by Jesse McFie

I have worked hard and saved from an early age. In 2018, my brother and I started our own welding and fabrication business and grew it to a full-time company. As taxes, fees and inflation ate away at my hard-earned income and savings, I quickly realized that the financial system in America is not designed to help you get ahead. Using participating whole life insurance and the principles we teach at McFie Insurance has helped me get ahead financially. I’ve used my life insurance policies to expand our business, debt free, to purchase equipment, and save for a piece of property. I love sharing with others how they can do the same.