702-660-7000

702-660-7000

The Tax Cuts and Job Acts (TCJA) bill was signed in December 2017. The new tax plan came with a myriad of changes. In this article we’ve broken down the tax plan, in an easy-to-understand way.

Certain adjustments benefit some people more than others, and vice versa. Ultimately, one individual or household may see both advantages and pain-points from these changes. Our recent interview with a tax expert is a great resource for tips on how filing might be different for you with these tax reforms. In this article, we’ll go over the three major reforms in more depth, and also give an overview of some of the other reforms that affect fewer people.

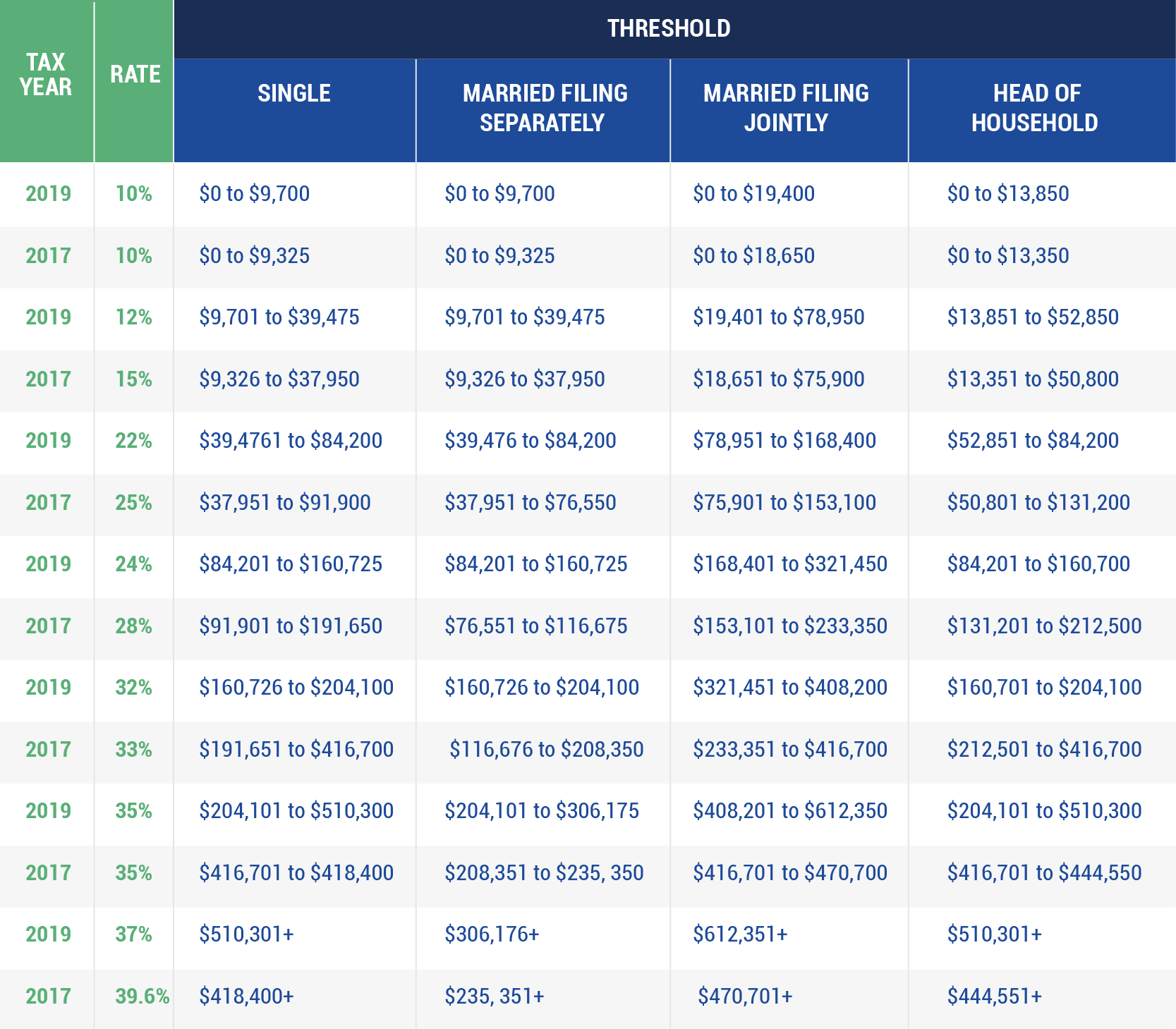

While we’re still working with seven brackets, the rates within the brackets have changed. The thresholds, or income ranges that determine which bracket you belong in, have also changed. Here is a comparison of the rates and thresholds for the 2019 tax year versus the 2017 tax year, those from before the new tax plan. Remember that the taxes you file in 2020 come from the 2019 tax year. Also, keep inflation in mind when comparing these thresholds.

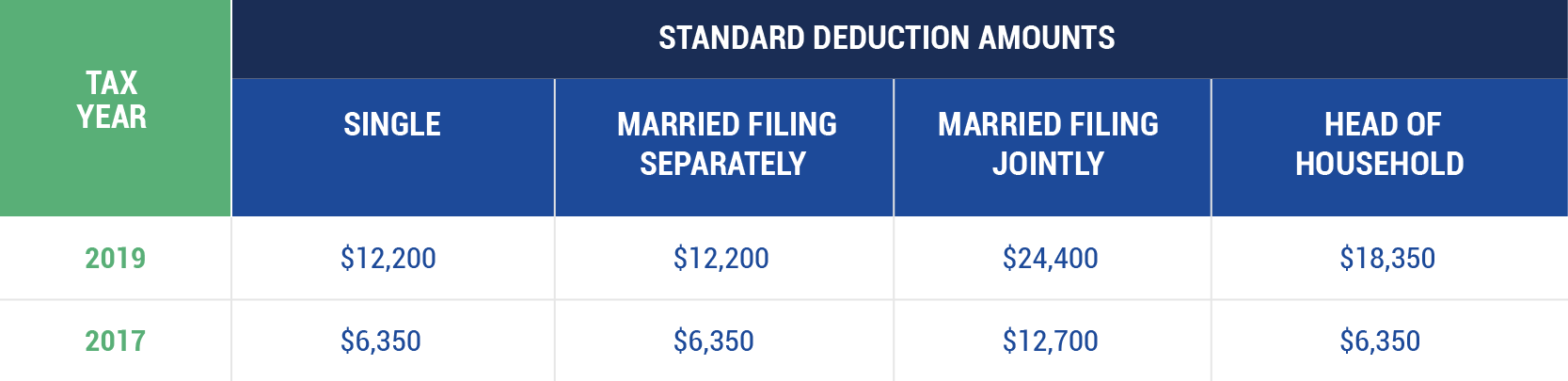

Standard deduction was increased in the new tax plan. This expands the amount of filers who should use the standard deduction and benefits them since they now have less taxable income. It also allows those who qualify for the standard deduction to avoid itemizing, which can be time-consuming. If you were itemizing in previous years and now fall within the standard deduction, your taxes may be less time-consuming now.

The tax reform brought quite a few changes to itemized deductions, including removal of the Pease limitation. Many itemized deductions were capped, removed, or limited through the TCJA. However, a few deductions did improve for filers. Here are a few examples of the most impactful adjustments to itemized deductions.

The Child Tax Credit has changed from $1,000 nonrefundable credit to $2,000, largely refundable credit. This means that as long as you qualify, you could receive a portion (up to $1,400) of the Child Tax Credit in your tax refund.

Those giving their estates to heirs benefit from the increase in the estate tax exemption. Now, the exemption is $11.8 million for individuals and $23.36 million, if you’re married filing jointly.

The corporate tax rate was 35% and is now 21%. Unlike some of the other tax alterations from the TCJA, this is a permanent change and will not expire in 2025.

The Affordable Care Act included the individual mandate provision which penalized individuals who did not comply with the mandate. This is no longer applicable.

Handling your taxes correctly could mean the difference of thousands of dollars for you and your family. Transitioning to the reforms within the TCJA will be smoothest if you become well-informed and use resources at your disposal.

One of the resources we recommend is getting a tax return review by Jack Cohen CPA. With over 33 years of experience with the IRS, and 12 years as a CPA, Jack is very proficient with the tax code. He has saved many McFie Insuranceclients thousands of dollars in taxes. Contact us for a personal introduction to Jack Cohen CPA, if you would like a complimentary tax review.