702-660-7000

702-660-7000

Money is more than currency in our pockets or numbers in a bank account. It represents a profound aspect of human civilization that reveals much about our nature and the ways we interact. Understanding what money is and its deeper purpose can transform our relationship with this element of modern life.

The concept of money has ancient roots. Before formal currency, societies relied on bartering—the direct exchange of goods and services. This system, while functional in small communities, became cumbersome as civilization expanded. The inefficiencies of finding someone who both had what you wanted and wanted what you had (known as the “double coincidence of wants”) led to the development of intermediary exchange items.

Early forms of money varied widely across cultures. Some societies used glass beads, others wampum (shells), tally sticks, precious metals, or stones. These proto-currencies shared common characteristics: they were relatively scarce, durable, portable, divisible, and widely accepted within their communities.

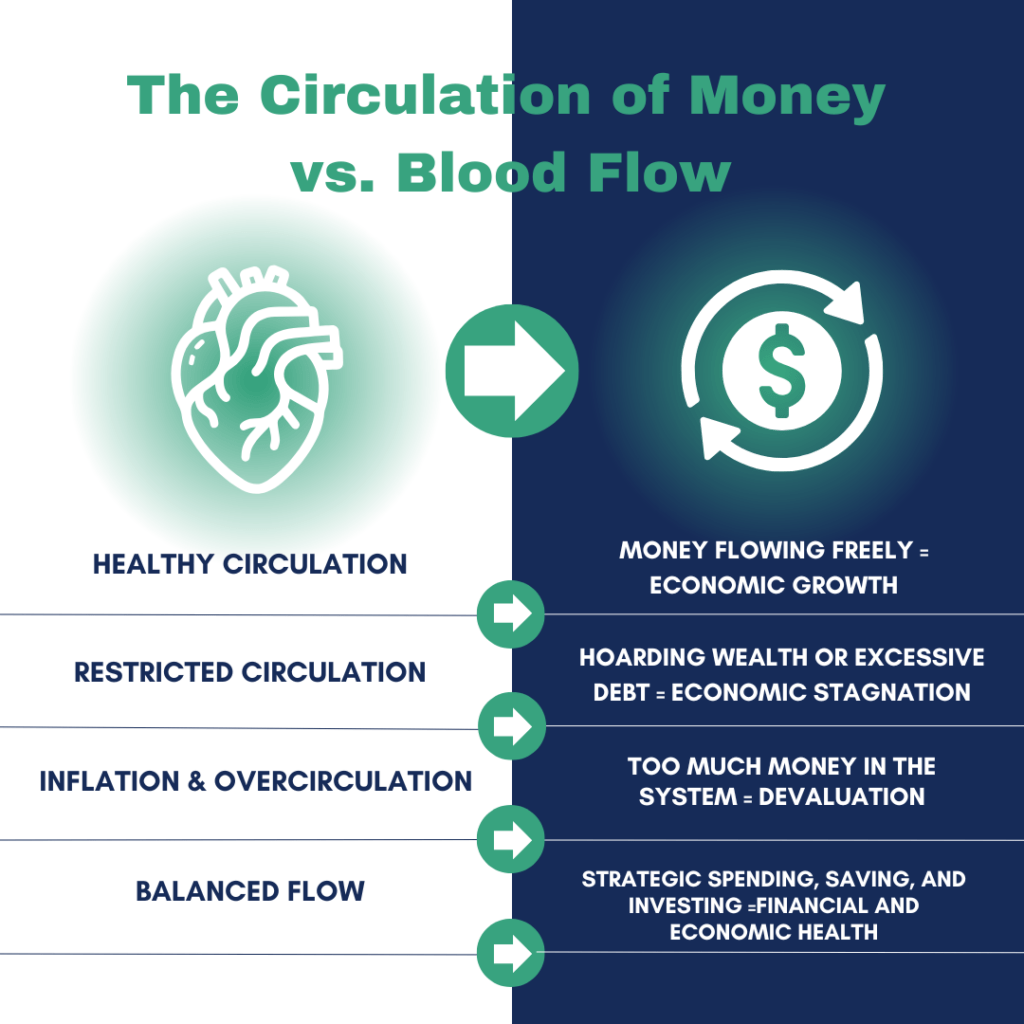

The Hebrew language offers fascinating insights into the connection between money and humanity. The word ‘dam’ means blood, and its plural form ‘damin’ refers to money, payment, and retribution. This linguistic connection isn’t coincidental. Just as blood circulates through our bodies sustaining life, money circulates through the economy sustaining commerce and interaction.

Those who have never read Eleanor H. Porter’s classic “Oh, Money! Money!” are missing a timeless epoch. Porter captures not only why we need money but also what money can and cannot accomplish. She understood it isn’t what money is, but what we do with money that matters most.

Money serves as a medium of exchange, a unit of account, a store of value, and a standard for deferred payment. But beyond these functions, money represents something fundamental—it’s a social technology that facilitates human cooperation on a massive scale.

For mankind, money, like blood circulation, is prerequisite if value is to be produced. When circulation becomes restrictive or inhibited, the value any individual or group can produce is severely diminished or destroyed. Mankind was designed to interact and socialize with others to fully become everything we were created to be. As blood that stops flowing develops clots creating a life-threatening condition, so money that stops flowing becomes a threat to greater production.

When blood flows irregularly or out of control, blood pressure issues and hemorrhagic conditions develop. Likewise, money which is hoarded rather than remaining in circulation is easily destroyed by inflation, while interest paid for the use of someone else’s money can quickly bleed us dry if not carefully managed.

Money is a rudimentary part of who we are as human beings. Understanding this truth helps us avoid falling into the trap of believing that “money is the root of all evil”—a common misquotation. The actual statement is that “the love of money is the root of all evil.” This distinction is crucial. Money itself is morally neutral; it’s our relationship with it that determines whether it becomes a force for good or ill in our lives.

When we fail to grasp this truth, we find ourselves in a war against ourselves, which consumes and makes us incapable of fulfilling our purpose. Money is meant to serve as a tool that allows us to fulfill our mission of being fruitful, multiplying, replenishing the earth, and subduing it.

The Greeks called human interaction ‘ecclesia,’ the gathering together of citizens from out of their homes into the public for the purposes of deliberating together. This pulling together in ‘ecclesia’ fashion permits mankind to be fruitful, multiply, and replenish the earth by subduing it, and generate abundance out of scarcity, which is the first law of economics.

At its core, money is a system of trust. Paper currency has value because we collectively agree it does. This shared belief allows us to exchange pieces of paper or digital entries for goods and services of real value. Without this trust, money as we know it would cease to function.

This trust extends beyond government-issued currency. Whatever form of money is honored amongst the human parties involved in economic interaction is what makes it possible to subdue and replenish the earth while generating greater prosperity for all mankind.

Today’s money has evolved beyond physical currency. Digital transactions, cryptocurrencies, and complex financial instruments have expanded our concept of money, yet its purpose remains unchanged—to facilitate the exchange of value between people and create cooperation on a scale otherwise impossible.

Just as the circulation of blood is essential to physical life, the circulation of money is vital to economic life. When money flows freely through an economy, it nourishes all parts of the system, enabling growth and prosperity. When it becomes concentrated or stagnant, economic health suffers.

Understanding the circulatory nature of money helps us see why hoarding wealth and excessive debt can be problematic. The former reduces the money available for use in the economy, while the latter creates unsustainable obligations that eventually restrict circulation.

Americans personally spend billions of dollars annually on interest costs. The U.S. Government spends hundreds of billions of dollars on interest. We have become a nation of debtors, and only when we grasp the sobering fact that debtors are always enslaved to their lenders will we be capable of loosening the shackles of economic slavery and become truly prosperous again.

Money serves multiple purposes in our individual lives:

Money’s purpose is not to be accumulated for its own sake. As Porter understood, it’s what we do with money that matters most. Money that sits idle fails to fulfill its purpose, just as blood that doesn’t circulate fails to sustain life.

The purpose of money goes past individual benefit to societal good. When we understand money as a means of facilitating human cooperation and productivity, we begin to see wealth creation not as a zero-sum game but as an activity that can benefit many.

Money is far more than currency—it’s a profound social technology that enables human flourishing through exchange and cooperation. Its purpose is not merely to be accumulated but to circulate, facilitating the creation of value and the fulfillment of human potential.

By understanding money’s true nature and purpose, we can develop a healthier relationship with it. Rather than seeing money as an end in itself, we can recognize it as a tool that, when properly used, enables us to live more fully, contribute more meaningfully, and build a more prosperous society for all.

As we navigate our financial lives, may we remember that money works best when it flows like blood through the economic body, nourishing all parts of the system and enabling the whole to thrive. And may we use this powerful tool not merely for personal gain, but for the greater purpose of creating value and improving life for ourselves and others.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.