317-912-1000

317-912-1000

Liquidity in the context of life insurance relates to the ease with which you can access cash from your policy. Policies that possess a cash value component, such as whole life insurance, offer liquidity because you have the option to take a policy loan, withdraw funds or surrender the policy for the cash value.

While the primary function of life insurance is to deliver financial assistance to your loved ones upon your death, certain life insurance types provide the added benefit of allowing access to cash value during your lifetime.

Term life insurance lacks liquidity since it doesn’t carry a cash value. While many individuals like the straightforward and temporary protection that term policies offer, having a liquid permanent life insurance policy can enlarge emergency or retirement savings, especially for those with intermediate to advanced financial situations.

Life insurance is deemed a liquid asset only under specific circumstances. An asset is considered liquid if it can be swiftly converted to cash, much like a savings or investment account. For beneficiaries, the death benefit becomes a liquid asset once it’s disbursed.

Your life insurance qualifies as a liquid asset if:

In all the instances mentioned above, your life insurance qualifies as a liquid asset due to the ease of obtaining cash from it. Such policies can prove beneficial for accessing cash especially if you’ve exhausted other options. Consulting with a financial advisor or an independent insurance agent can guide you in determining if a liquid life insurance policy aligns with your financial objectives.

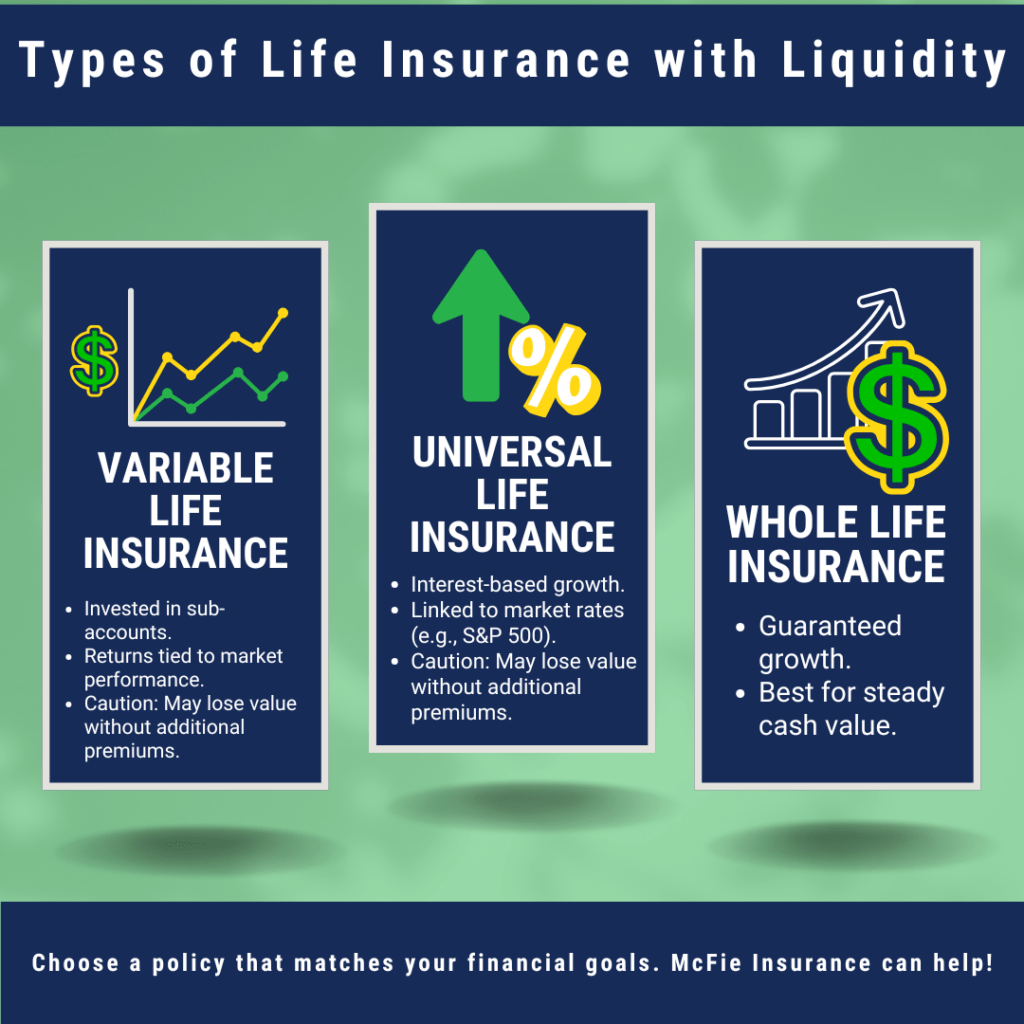

The liquidity attribute in life insurance predominantly pertains to permanent life insurance policies that come with a cash value. This encompasses whole, universal, and variable life insurance.

The price tag on permanent life insurance is notably higher, ranging from five to 15 times more for initial premiums than its term counterpart. In the long run, whole life insurance can end up being a much better price than term insurance. Various permanent insurance modalities foster cash value growth differently, potentially offering a superior return and subsequently, enhanced liquidity.

While term life insurance doesn’t inherently possess liquidity, it may have a conversion option to a permanent policy.

A term conversion can providetax-deferred savings through the cash value just as a typical permanent policy would do, because the coverage actually becomes a permanent policy at the time of conversion. If you’re older in age, a term conversion might not be the most effective asset augmentation strategy because you still “start” the permanent policy at the age you have attained at the time of conversion.

For those without the conversion option on their term life insurance, it’s advisable to talk with your insurance agent about getting coverage that can be convertible in the future.

Procuring a life insurance policy with cash value and liquidity is optimal for those capable of managing the higher initial premiums and who are seeking long-term tax-deferred growth.

Premiums are usually paid with after-tax dollars, but then cash value growth beyond premiums paid is tax-deferred and taxes are not triggered when these funds are accessed via policy loan during one’s lifetime.

Cash value accumulations can be very useful for a wide variety of people who need more savings accessible outside company retirement plans. Future business owners and families who want to ensure access to cash during important parts of their life are often great candidates.

Even people approaching retirement can sometimes use life insurance cash values as a liquid source of funds to counter-balance volatility in the stock and bond markets.

At McFie Insurance we believe most people who are disciplined savers, and who like to think creatively when it comes to their savings and investments, can benefit from permanent whole life insurance that builds healthy cash value with a solid guarantee. Call us today for more info!

What does the term ‘liquidity’ signify in the context of a life insurance policy?

In the realm of life insurance, liquidity is indicative of the ease with which cash can be accessed via policy loan or withdrawn from the policy.

Is life insurance considered a liquid asset?

While the cash value inherent in a permanent life insurance policy can be deemed a liquid asset, its death benefit cannot be categorized as such unless/until the insured person dies. Term life insurance doesn’t qualify as a liquid asset.

Which life insurance variants offer liquidity?

Life insurance policies that are permanent in nature and allow for policy loans and withdrawals embody the essence of liquidity. These would include whole life, universal life, and variable life insurance contracts.

It’s important to note that universal and variable flavors of so-called “permanent” life insurance can lose value and may not be truly permanent without considering the potential of further premium requirements.

Ben T. McFie

Ben T. McFie

There's a lot of confusion around finance; there's so much to know and it's frustrating when you don't know enough to make the best financial decisions. I like to bring clarity to financial matters so people can make good financial decisions that will help them live wealthier more fulfilling lives.