317-912-1000

317-912-1000

With permanent life insurance, you have options to access the surrender value (commonly called cash value) that builds in your policy. You can withdraw funds directly, take a policy loan, or use your cash value as collateral to borrow from the insurance company.

57-page slide deck

57-page slide deckMany people are losing money with typical financial planning. Even people who were "set for life" are running out of money in retirement. Here's an easy guide with 3 things you can do to become wealthier.

Download here>

Each option affects your policy differently, so understanding the implications is crucial for making good financial decisions.

A withdrawal permanently reduces both your cash values and death benefit. With universal life insurance, this reduction could force you to pay more premiums out-of-pocket or even cause your policy to lapse. For whole life insurance, withdrawals reduce your coverage amount and future dividend potential.

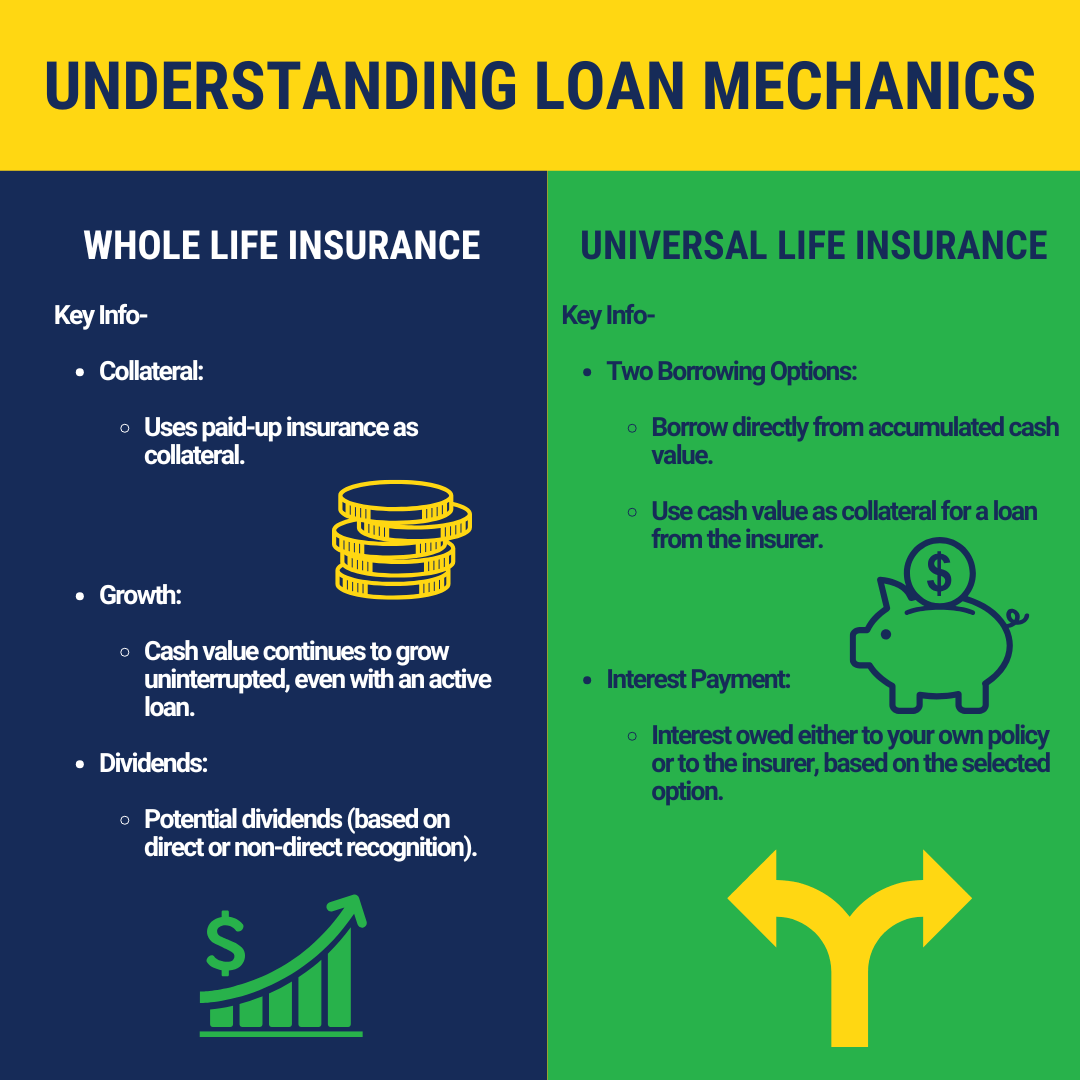

Whole life insurance policy loans offer a unique advantage that sets them apart from traditional withdrawals. When you take a loan against your policy, you’re not actually removing money from your cash value. Instead, the insurance company lends you money from their general fund and uses your cash value as collateral. This means your policy continues to grow, earning guaranteed interest and potential dividends—even while you’re using the loaned funds.

One mistake policyholders often make is withdrawing money rather than borrowing against the policy. Once your withdrawals exceed your cost basis (the total premiums you’ve paid), the excess is treated as taxable income. That tax bill is not only unexpected for many, but completely avoidable.

By understanding how whole life insurance loans work, you can access capital when you need it while keeping your policy intact and avoiding unnecessary tax burdens. Don’t let a lack of understanding cost you. At McFie Insurance, we help you build smart strategies to access your wealth—tax-efficiently and sustainably.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Universal Life Insurance policy loans give you two options:

With option one, you repay yourself with interest according to your contract. With option two, you pay the insurance company interest on their loan to you. Either way, your continued policy growth depends on your specific contract terms.

Whole life insurance policy loans are more straightforward – you never actually borrow your own money. Instead, your paid-up insurance serves as collateral for a loan from the insurance company. This preserves your guaranteed growth rate and dividend potential (though dividends may be affected differently by direct vs non-direct recognition companies).

The process is simple – just submit a loan request form to the insurance company. They’ll transfer funds to your bank account or mail a check.

For whole life insurance, your policy continues growing according to the guaranteed contract while securing the loan. With universal life, you’ll need to specify whether you’re borrowing your own money or using it as collateral.

While getting a loan is straightforward, you must carefully evaluate whether it makes financial sense.

A policy loan makes sense when you can either make more money or keep more money than without the loan. Let’s look at some examples:

If you have $10,000 in credit card debt at 12% interest and can get a 5% policy loan, you’ll save 7% – a clear win. But what if your existing debt is at 3% and the policy loan is 5%? You need to consider:

Let’s analyze a scenario with a $10,000 cash value growing at 2.75% annually:

Over 5 years:

The policy loan lets you keep about 55.35% more money overall. This demonstrates why calculating the total financial impact is critical.

This depends entirely on your specific situation. Life insurance costs vary based on age, gender, lifestyle and policy details. Work with a knowledgeable agent to find the right fit.

Premiums depend on individual factors like age and health. Consult a licensed agent for accurate quotes based on your situation.

This varies by policy type and cash value accumulation. Building sufficient cash value typically takes several years, often a decade or more.

Most companies allow loans up to 90% of cash value, though some permit 100%. Check your specific policy details and consult your agent.

Policy loans can be valuable tools for managing money and building sustainable wealth when used appropriately. They’re not magic solutions as some agents claim when promoting concepts like Infinite Banking or Bank On Yourself. However, when the math works in your favor, policy loans offer a way to maintain control of your money instead of paying others to manage it.

The key is understanding that policy loans are simply tools – neither magical nor dangerous when used wisely. Focus on the actual numbers and only use policy loans when they truly help you keep more of what you make.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.