317-912-1000

317-912-1000

Whether you’re exploring life insurance for the very first time or taking a closer look at your current coverage, preparing for a consultation with a financial professional is a smart move. Life insurance isn’t just about securing a death benefit—it’s about building a strategy that supports your long-term financial goals, protects your loved ones, and complements your overall plan.

But with so many different types of policies and options available, it can be easy to feel overwhelmed or unsure about where to begin. That’s why meeting with an experienced advisor can make all the difference. They can help you understand what kind of coverage fits your needs, explain the nuances of different policy structures, and make sure you’re not paying more than necessary for the protection you want.

Before you sit down with a financial expert, it’s helpful to come prepared with an understanding of your goals, current financial picture, and the questions that matter most to you. Doing so will make your consultation more productive and empower you to make informed decisions about your future.

In this guide, we’ll share some practical tips to help you get ready for your life insurance consultation—so you can walk in with clarity and walk out with a plan that works for you.

Consider your current life stage – it’s vital for everyone, but especially for those transitioning into a new phase of life. Such transitions can include:

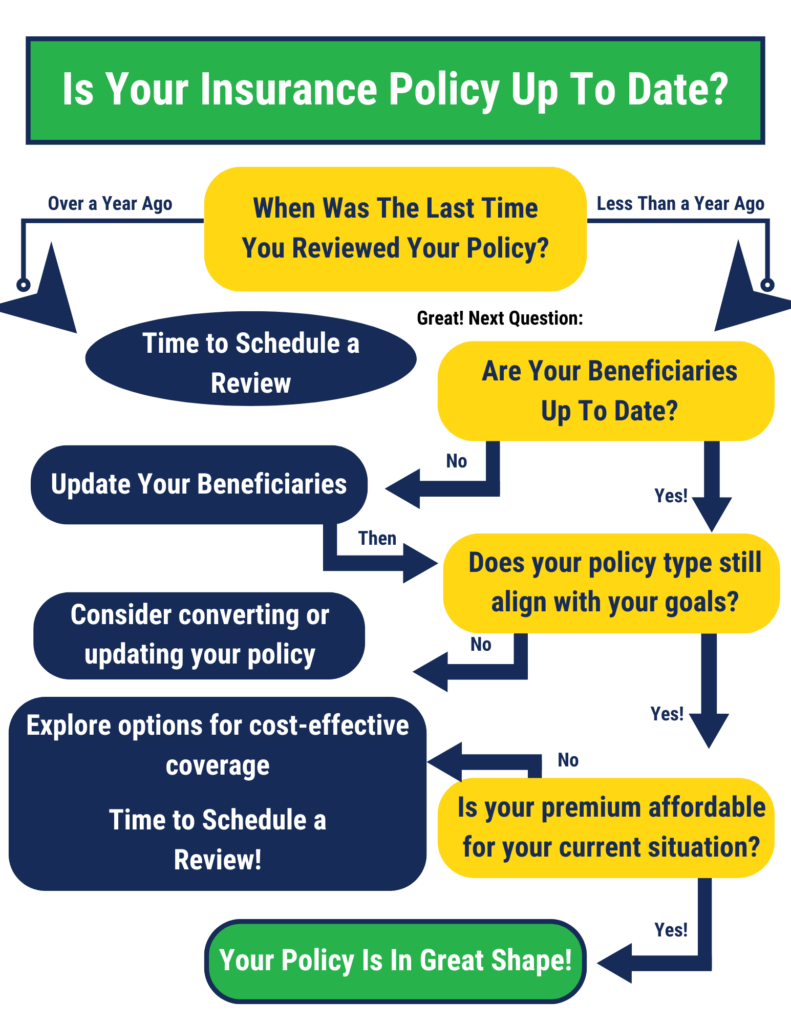

Life changes often bring new financial responsibilities, and your life insurance policy should evolve alongside your needs. Before you meet with a financial advisor, it’s recommended that you go through the following checklist. Doing so will help you identify gaps, ensure your beneficiaries are up to date, and give your advisor a clear picture of your current situation—ultimately allowing them to provide more tailored and effective guidance during your consultation.

For income protection, evaluate whether the death benefit from your existing policy suffices to sustain your family’s lifestyle or to support the ongoing success of your business. In terms of estate protection, consider if your death benefit can adequately handle estate taxes or needs related to wealth transfer. An LIMRA report stated that approximately 44% of American families would face substantial financial challenges within six months if the family’s main income earner were to pass away.

The underwriting process is how life insurance companies evaluate the level of risk they’re taking on when offering coverage to an individual. Factors like age, health history, lifestyle, and medical conditions all play a role in determining your eligibility and the cost of your policy. In general, the younger and healthier you are at the time of application, the lower your premiums are likely to be—making early enrollment a strategic financial decision.

As you prepare to meet with a financial advisor or insurance professional, take a moment to reflect on the following: What are you currently paying for life insurance coverage? Is there an opportunity to secure the protection you need at a lower cost? Given your current health and age, could now be the right time to undergo underwriting again to lock in more favorable rates? Evaluating these questions can help guarantee you’re not overpaying for coverage or missing out on more better options that align with your long-term financial goals.

Consider whether the ownership of your policy aligns with your estate planning or business objectives. Are the beneficiaries listed in your policy current? Have you adequately addressed all your plans regarding succession, your employees, or heirs? If you have doubts or considerations about these aspects, it’s beneficial to prepare a list of potential modifications to discuss during your meeting.

Reflect on whether the kind of life insurance policy you hold, be it term, whole life, or universal life, continues to fulfill your goals. Consider any employer-provided group life insurance or other policies you have. If you possess term insurance, what are your plans after the term concludes? Determine if your policy can be converted to permanent insurance and the timeframe for such a conversion.

Assess whether the optional riders and additional coverage you have are still necessary. Are there any new features that might be beneficial? Riders are designed to tailor your insurance policy to your specific requirements. For instance, you might think about including a Children’s Insurance Rider, allowing your child to convert their term insurance to permanent insurance upon reaching 25 years of age.

Take time to assess whether your permanent life insurance policy is performing in line with your expectations. Has the policy’s cash value grown at the pace you anticipated? Is it on track to meet your long-term financial goals? It’s important to regularly evaluate whether the policy’s projected performance still supports your needs—whether that’s providing lifelong coverage, supplementing retirement income, or serving as a funding source for future opportunities.

Look closely at your most recent annual statement or in-force illustration. Does the accumulated cash value provide enough support to sustain the policy without requiring higher premium payments later on? Could adjustments be made to optimize the policy’s benefits or align it more closely with your evolving goals? These are important questions to review with an advisor who can help you interpret the data, explore alternatives, and see that your policy remains a valuable component of your financial strategy.

Reviewing your life insurance policy can either confirm that your coverage aligns with your objectives or reveal that you have excessive or inadequate coverage. Such a review may uncover opportunities for more cost-efficient coverage or expose mismatches between your existing coverage and your current goals. A financial expert, with their expertise and knowledge, plays a crucial role in guiding you through this essential process.

Policy reviews are also instrumental in integrating the cash value of your life insurance into your overall financial portfolio. They help in setting new legacy goals and assessing how your business interests intertwine with your personal insurance needs.

This process is key to safeguarding your loved ones. Ensuring they are well-provided for and not burdened financially in your absence is a fundamental aspect of life insurance planning.

Choosing insurance doesn’t need to be as complicated as insurance agents make it seem. Give McFie insurance a call or schedule a consultation and we can help you decide what type of insurance is right for you. Or check out our Life Insurance checklist!

by Gracine McFie

by Gracine McFie

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable.