702-660-7000

702-660-7000

When considering whole life insurance policies, understanding how dividends work is crucial. Unfortunately, many life insurance agents use dividends as a selling point by making misleading claims or exaggerating potential returns. This lack of transparency has contributed to the poor reputation that insurance agents have developed over the years.

Dividend-paying whole life insurance can be a valuable financial tool when understood, but marketing around these policies often includes half-truths and misleading assertions. To protect yourself from purchasing a policy that doesn’t serve your needs, it’s important to understand what whole life insurance dividends are and how they actually benefit policyholders.

Dividends in whole life insurance are not guaranteed. They are, in fact, a distribution of a portion of the insurance company’s profits to participating policyholders. The insurance company’s board of directors determines whether dividends will be paid each year based on the company’s financial performance. If the company doesn’t perform well, dividends may be reduced or even eliminated.

When a policyholder receives dividends, they can be used in several ways:

Before purchasing a policy, ask yourself these questions:

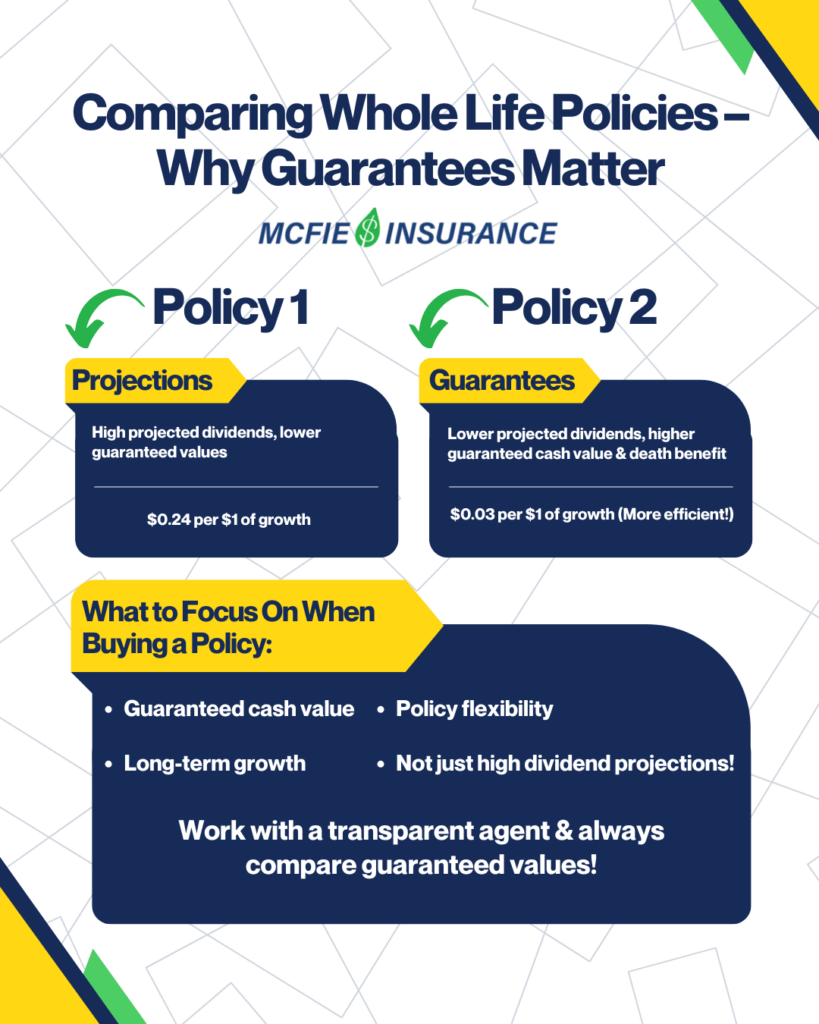

Let’s examine a real-world example to illustrate how dividend projections can be misleading. Recently, a prospect approached McFie Insurance having been shown a policy with impressively high dividend projections. Let’s compare that policy (Policy 1) with an alternative recommendation (Policy 2).

This policy required $100,000 per year in premiums for 10 years. After 10 years:

The agent heavily emphasized these impressive dividend projections to make the sale.

This alternative policy also required $100,000 per year for 10 years, but with different guarantees:

At first glance, Policy 1 seems better because of the higher dividend projections. This is where the deception often occurs.

Let’s analyze how efficiently these dividends translate into actual cash value growth:

Policy 1:

Policy 2:

This means Policy 1’s dividends are over 7 times less efficient at generating cash value! For every dollar of cash value growth in Policy 1, it costs the policyholder nearly 24 cents of their dividend, compared to just about 3 cents in Policy 2.

When evaluating whole life insurance policies, it’s crucial to focus on the guaranteed values rather than non-guaranteed projections. Guarantees are contractual obligations that the insurance company must fulfill, while projections (including dividend projections) are possibilities that may or may not materialize.

In our example:

Whole life insurance is a lifetime contract, so it’s essential to consider the long-term performance, not just the initial years. Policies designed to maximize early values often do so at the expense of long-term growth.

By year 15:

This means Policy 2 requires less premium while guaranteeing more cash value and death benefit in the long run. The policy with lower dividend projections provides better guaranteed value to the policyholder!

Truth: Dividends aren’t technically investment returns. According to the IRS, life insurance dividends are considered a “return of premium” rather than investment income. While this classification is beneficial for tax purposes (dividends usually aren’t taxable), it’s misleading to present them as investment returns.

Truth: While some insurance companies have impressive dividend payment histories, past performance doesn’t guarantee future results. Economic conditions change, and even companies with long dividend-paying traditions can reduce or suspend dividend payments if financial conditions warrant it.

Truth: Dividend rates between companies aren’t directly comparable because:

Truth: As our example demonstrated, a policy with lower dividend projections can provide better guaranteed values and more efficient cash value growth. Higher dividend projections mask less favorable guaranteed values or other policy features.

Truth: Dividend projections are just that—projections. They are neither guarantees nor promises. Market conditions, company performance, and board decisions all influence actual dividends paid. Many policies never achieve their illustrated dividend projections.

A well-designed whole life policy balances early cash value growth with long-term performance. Short-sighted policy design that prioritizes early values often sacrifices long-term growth potential, which is problematic since whole life insurance is intended to be a lifetime financial tool.

Agents emphasize early policy performance because:

A reputable agent will help you design a policy that balances your short-term needs with optimal long-term performance. This balance occurs long after the agent has earned their commission, which is why working with a trustworthy, client-focused agent is crucial.

Understanding the truth about dividend projections matters because whole life insurance is a significant financial commitment. These policies often involve premiums of tens of thousands of dollars over many years. Making a decision based on misleading dividend projections can result in:

To avoid falling prey to misleading dividend projections, follow these steps:

Dividend-paying whole life insurance can be a valuable component of your financial plan when properly understood and implemented. It’s essential to look beyond flashy dividend projections and focus on guaranteed values, long-term performance, and overall policy efficiency.

Don’t be swayed by high dividend projections alone. Instead, assess how efficiently those dividends translate to actual policy benefits and consider the guaranteed values that the insurance company is contractually obligated to provide. A policy with modest dividend projections but stronger guarantees and more efficient cash value growth often provides better long-term value.

Education is your best defense against misleading sales tactics. Take the time to understand how whole life insurance works, mainly how dividends function within these policies. By doing so, you’ll be better equipped to select a policy that truly meets your financial goals, rather than one that looks impressive on a sales illustration.

Remember, whole life insurance is a long-term financial commitment. The policy you choose should provide value throughout your lifetime, not just in the early years when the agent is earning their commission. A properly designed policy balances early cash value with long-term growth, providing living benefits and a death benefit that serve your financial strategy.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.