702-660-7000

702-660-7000

James Carville, the strategist behind Bill Clinton’s successful 1992 presidential campaign, famously coined the phrase “It’s the economy, stupid” when Clinton was running against incumbent George H. W. Bush. This pithy remark resonated with voters who were feeling the economic consequences of Bush’s tax increases—a stark contrast to his memorable “Read my lips: No new taxes!” campaign promise four years earlier.

This same wisdom can be applied to understanding the Infinite Banking Concept (IBC). At its core, IBC is about your personal economy—whether you choose to take control of your financial future through participating whole life insurance or continue to let others manage your money. Don’t be misled by critics who lack a full understanding of how money works over time or who have incomplete knowledge about participating whole life insurance.

Consider Phil’s experience with participating whole life insurance and the Infinite Banking Concept:

Let’s break down what happened in Phil’s financial journey:

The extraordinary cash value growth Phil experienced wasn’t just luck—it was by design. The structure of his participating whole life insurance contract played a crucial role in his success. These growth rates can vary dramatically between different insurance carriers and products, which is why working with knowledgeable agents is essential.

Phil’s policy was designed by specialists at McFie Insurance who structured it to guarantee maximum cash values while providing the opportunity to earn dividends from the insurance company. These two factors combined to drive the impressive cash value growth in Phil’s policy as he repaid his loan.

Creating this optimized design requires an agent willing to prioritize client benefits over commission. Here’s why: Life insurance agents typically earn their highest commissions selling basic whole life insurance. This approach gradually becomes paid-up over time, similar to how a mortgage is eventually paid off. In Phil’s case, more than 43% of his policy wasn’t basic whole life but rather paid-up insurance from the start. Commissions on paid-up insurance are lower than those on basic whole life insurance.

Paid-up insurance generates cash value in all whole life insurance policies. Due to IRS regulations, a whole life policy that starts with more paid-up insurance than the IRS approves becomes taxable. To avoid this tax scenario, agents have to carefully balance the ratio of basic whole life insurance to paid-up whole life insurance for each individual client. The amount of paid-up insurance allowed in a policy design varies based on factors including age, health, and the total scheduled annual premium payment.

Some agents attempt to circumvent IRS regulations by using term insurance riders in their whole life policy designs, allowing for increased initial paid-up insurance without creating immediate tax liability, but that comes with long-term disadvantages:

a) While the term rider does “fool” IRS requirements and allows more initial paid-up insurance, which increases initial cash values…

b) Unlike basic whole life insurance, the term rider doesn’t automatically convert to paid-up insurance over time

c) The term rider costs more than purchasing a separate convertible term policy

d) The additional death benefit from the term rider may prevent the policyholder from qualifying for additional life insurance while the rider remains active

e) Unlike basic whole life insurance (which maintains level premiums) and paid-up insurance (which requires no further premiums), the cost of the term rider increases over time

f) If the term rider is cancelled or converted before satisfying the IRS’s 7-year pay test, the entire policy’s cash values lose their tax-preferred status

For these reasons, McFie Insurance rarely uses term riders when designing participating whole life policies for Infinite Banking purposes. Term riders can complicate implementation of the Infinite Banking Concept and limit its full benefits for policyholders.

Phil’s case isn’t an exception—it demonstrates the potential available to anyone who implements the Infinite Banking Concept through properly designed participating whole life insurance. The advantage is clear: anytime someone can earn a return on their loan repayments, they come out ahead financially. This is the essence of IBC.

Critics often oversimplify the equation by saying: “Phil invested $200,000 ($20,000 annually for 10 years) and ended up with only $278,551 of cash value after 20 years.” This misses the point entirely because, as Carville would say, “It’s the economy, stupid.”

Phil recouped the cost of his $24,000 loan and gained an additional $47,888 in the process. Without paying an extra penny, his cash values grew by $114,228—from $164,323 when he first took his policy loan to $278,551 at the end of year 20. This represents a tax-free 5.425% return on Phil’s $164,323, with continued death benefit protection.

As Phil’s policy matures, his death benefit will grow as dividends earned on this policy purchase more paid-up insurance. Phil now has several options for his accumulated wealth:

Any of these choices puts Phil in a stronger economic position than he would have been without implementing the Infinite Banking Concept.

This analysis has focused primarily on the cash value aspect of Phil’s participating whole life policy rather than the insurance coverage it provides. There are several reasons for this focus:

a) The insurance coverage provided by participating whole life varies from person to person based on age and health, while cash values remain relatively similar based on premiums paid

b) The Infinite Banking Concept is concerned with cash value generation rather than death benefit size—the death benefit is a beneficial by-product of practicing IBC

c) If the coverage provided by a participating whole life policy used for IBC isn’t sufficient for a client’s needs, supplemental term insurance can often be purchased at reasonable costs

d) A well-designed participating whole life policy for Infinite Banking purposes should have:

Following these guidelines helps policyholders maximize the benefits of the Infinite Banking Concept, allowing them to finance assets, business expenses, equipment, home improvements, real estate, joint ventures, and other cash flow needs—all while recouping their money and experiencing compounding growth similar to Phil’s results.

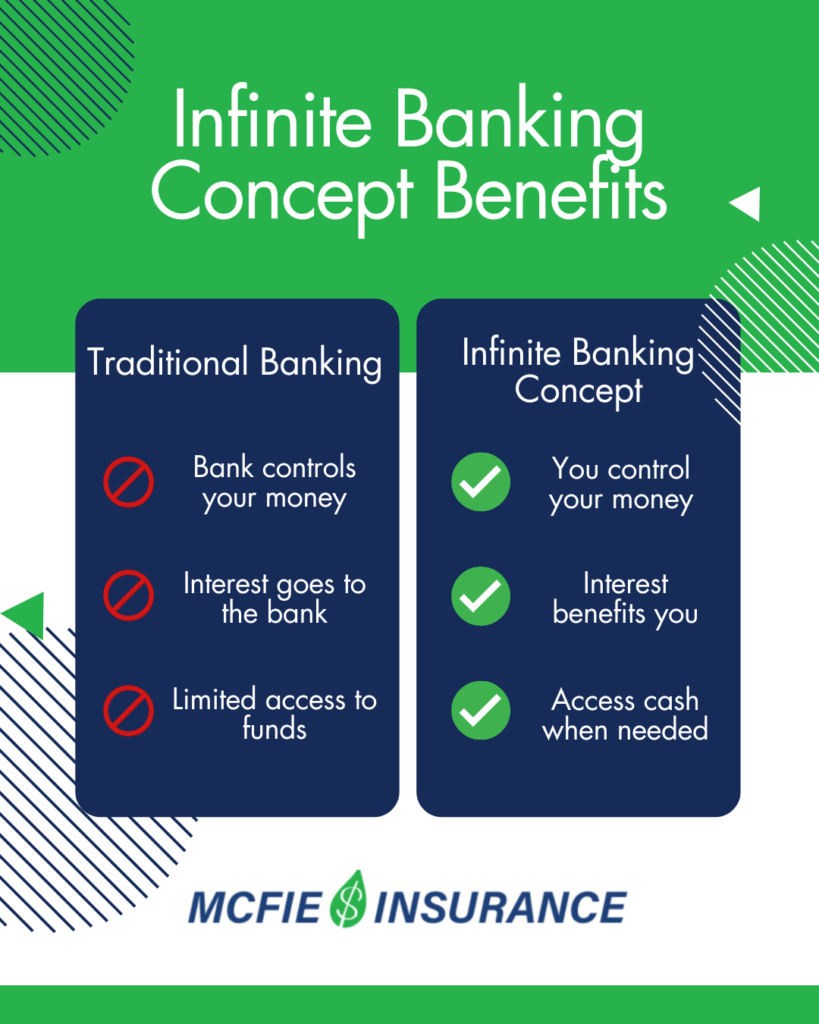

The Infinite Banking Concept shows a shift in financial thinking. Instead of handing your money over to banks and financial institutions that profit from your deposits and loans, you become your own banker. You maintain control over your money, build an asset that grows regardless of market conditions, and create a system where the interest you pay benefits you rather than a third party.

James Carville’s famous quip about the economy remains as relevant today as it was in 1992. The Infinite Banking Concept is about your economy—your ability to build, control, and multiply your wealth over time. It’s about breaking free from conventional financial wisdom that keeps most Americans dependent on institutions that profit from their money.

Critics who dismiss IBC fail to see the bigger economic picture. They focus on simplified rate-of-return comparisons without understanding the combination of benefits that well-designed participating whole life insurance provides: guaranteed growth, tax advantages, accessibility, control, protection from market volatility, and the ability to “become the bank” in your financial transactions.

While the Infinite Banking Concept offers many advantages, it’s not a one-size-fits-all solution. The strategy works best for individuals who:

The power of IBC lies not in the financial product itself but in how it’s used as part of a comprehensive wealth-building strategy. When implemented correctly—with properly designed policies and disciplined banking practices—the Infinite Banking Concept can transform your personal economy.

James Carville’s focus on the economy helped Bill Clinton win the presidency in 1992. Today, that same focus on economic fundamentals can help individuals take control of their financial futures through the Infinite Banking Concept.

Phil’s case study demonstrates how a properly designed participating whole life insurance policy, used as a banking system, can create remarkable financial results. His experience isn’t extraordinary—it’s what’s possible when you understand how to make your money work for you instead of for someone else.

The next time someone tells you that whole life insurance is a poor investment or that the Infinite Banking Concept doesn’t work, remember Carville’s wisdom: “It’s the economy, stupid.” Your personal economy benefits when you recapture the interest you’d otherwise pay to banks, when your money grows tax-deferred, when you maintain control and access to your capital, and when you create a legacy that can benefit generations to come.

The Infinite Banking Concept helps you take charge of your financial destiny and build sustainable wealth that works for you in every economic climate.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.