702-660-7000

702-660-7000

Building cash values as quickly as possible is one of the main keys to making the Infinite Banking Concept (IBC) work efficiently. Without cash value in your whole life insurance policies, there’s limited collateral to leverage, making it difficult to implement the IBC strategy. But what many practitioners don’t realize is that strategically using multiple whole life policies can significantly enhance your results.

At its core, the Infinite Banking Concept is about leverage. The collateral leveraged within this strategy is the cash value that accumulates in whole life insurance policies. This cash value represents the equity you’ve built in your policy – essentially the portion of the death benefit that is completely paid for. When we talk about “paid-up insurance,” we’re referring to insurance that requires no additional premium payments to maintain.

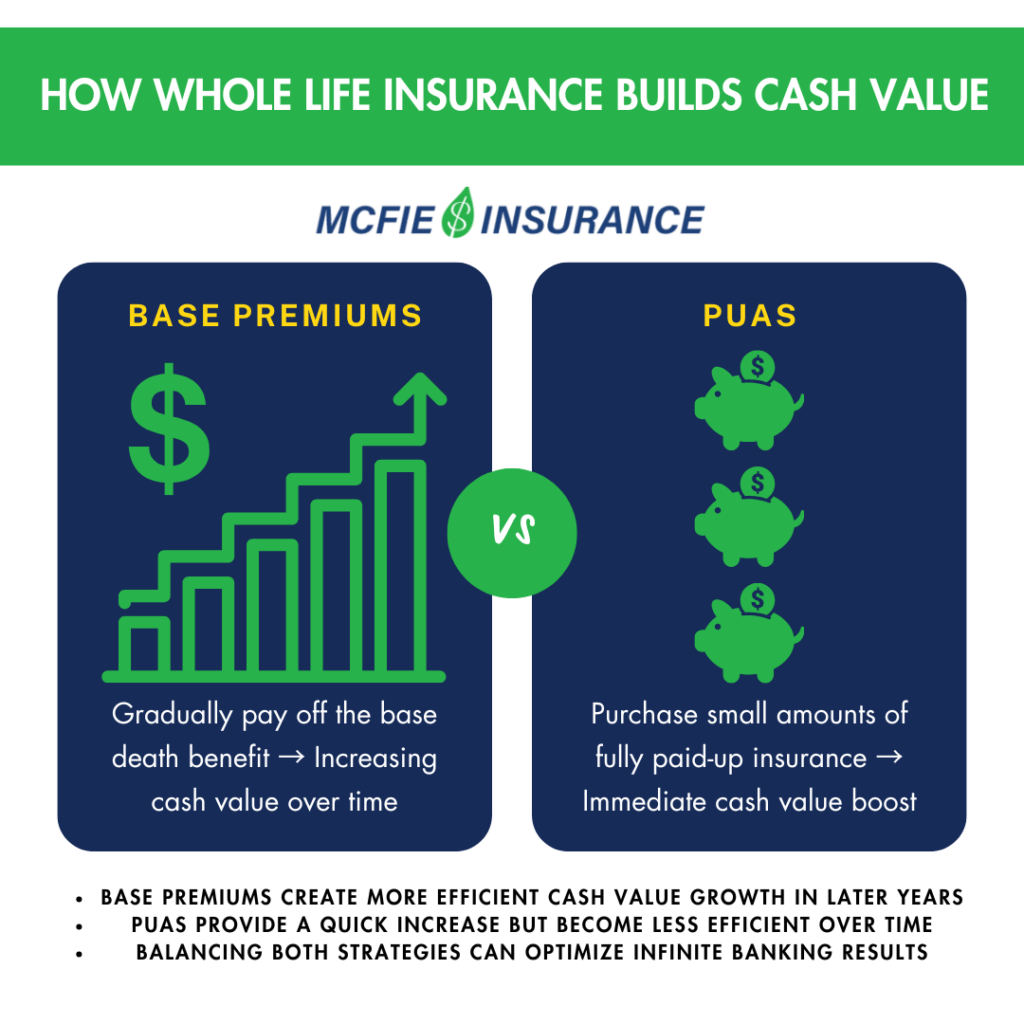

Cash value growth in whole life insurance occurs in two ways:

To maximize the effectiveness of IBC, understanding how these elements work together is crucial.

Before diving into multiple policy strategies, it’s important to understand the framework that influences policy design. The IRS classifies certain life insurance policies as Modified Endowment Contracts (MECs) if they fail what’s known as the “7-pay test.” MECs lose many tax advantages that make whole life insurance attractive for IBC.

A single premium whole life insurance policy – where 100% of the death benefit is paid for with a one-time premium – is automatically classified as a MEC. To avoid this classification, a whole life policy has to contain a certain amount of base death benefit relative to the premium paid. This ratio is calculated based on:

Understanding these requirements is essential when implementing a multiple policy strategy, as improper structuring could trigger MEC status and undermine IBC implementation.

To understand why multiple policies can be advantageous, we need to explore how base death benefit and paid-up additions work differently:

Base Death Benefit functions similarly to a mortgage. Each premium payment “pays off” a portion of this base death benefit, which becomes paid-up insurance. As a policy matures, this base coverage gets paid off faster and faster, creating greater cash value per dollar than what would be produced by the same dollar used to purchase additional paid-up insurance.

Paid-Up Additions (PUAs) allow you to purchase small amounts of fully paid-up insurance with a single premium. While PUAs create immediate cash value, their efficiency differs from base premium payments in the later years of a policy.

Let’s examine a case study to illustrate the benefits of a multiple policy approach:

A 32-year-old male purchases a whole life policy with:

The same 32-year-old male uses the identical $8,000 annual premium, but splits it:

The multiple policy approach produced $51,270 more in cash value (a 22% increase) while the death benefit was only $45,787 less (about a 7% decrease). This highlights that to build cash value more efficiently, it is beneficial to stop purchasing paid-up additions after a certain point and allow the base insurance to be paid off quicker in the later years.

A logical question arises when considering multiple policies: “How do I know I can purchase another whole life policy in the future?” This is where convertible term insurance comes into play.

If our 32-year-old male understands the benefits of adding additional whole life policies over time, he can purchase convertible term insurance that guarantees the option to convert to whole life insurance later. For about $235 per year, he could add $500,000 of death benefit with the guarantee of conversion to whole life insurance when he’s ready to start his second policy.

Over 20 years, the term insurance would cost about $4,700 – less than the $51,270 gain from implementing the multiple policy strategy. This makes purchasing convertible term insurance an excellent strategy for the multiple policy approach.

There are several reasons why multiple policies can create better results in an Infinite Banking strategy:

When implementing a multiple policy strategy, consider these approaches:

Start a new policy every few years while funding existing policies. This creates a cascade of policies at different stages of efficiency.

Purchase policies on family members of different ages to take advantage of better rates for younger insureds while maintaining control as the policy owner.

Design policies with different emphases – some maximized for early cash value, others optimized for long-term growth.

Purchase convertible term insurance to systematically convert portions to whole life policies over time.

Let’s consider how this might work for someone implementing the Infinite Banking Concept:

Maria, a 35-year-old business owner, begins with a $12,000 annual premium policy with the maximum PUAs allowed without triggering MEC status. She also purchases a $500,000 convertible term policy.

After funding her initial policy for five years, Maria decides to maintain the base premium on her first policy but redirect her PUA payments to start a second policy. Three years later, she converts a portion of her term insurance to create a third policy.

By age 50, Maria has three policies generating cash value at different rates of efficiency. When she needs capital for her business, she can borrow from the policy that makes the most sense based on loan rates, cash value growth, and other factors. This gives her more flexibility than she would have with a single policy.

While multiple policies offer advantages, there are some considerations:

To maximize the benefits of a multiple policy approach, consider these tips:

Building cash values in whole life insurance to leverage for financing assets, refinancing debt, making investments, recovering the cost of capital, or improving cash flow is the cornerstone of the Infinite Banking Concept. While anyone can implement IBC with a single policy, utilizing multiple policies can enhance your results when done strategically.

The key to success with multiple policies, as with any IBC implementation, is proper education and planning. It requires:

When implemented correctly, a multiple policy approach to Infinite Banking can create greater cash value accumulation, more flexibility, and better overall control of your financial resources. This strategy exemplifies the essence of the Infinite Banking Concept: becoming your own banker by maximizing the financial tools at your disposal.

Remember that each person’s situation is unique, and while multiple policies can offer advantages, the implementation should be tailored to your individual goals, cash flow, and long-term plans. At McFie Insurance we specialized in the Infinite Banking Concept and can help you determine if a multiple policy strategy is right for you and how best to structure it for your situation.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.