702-660-7000

702-660-7000

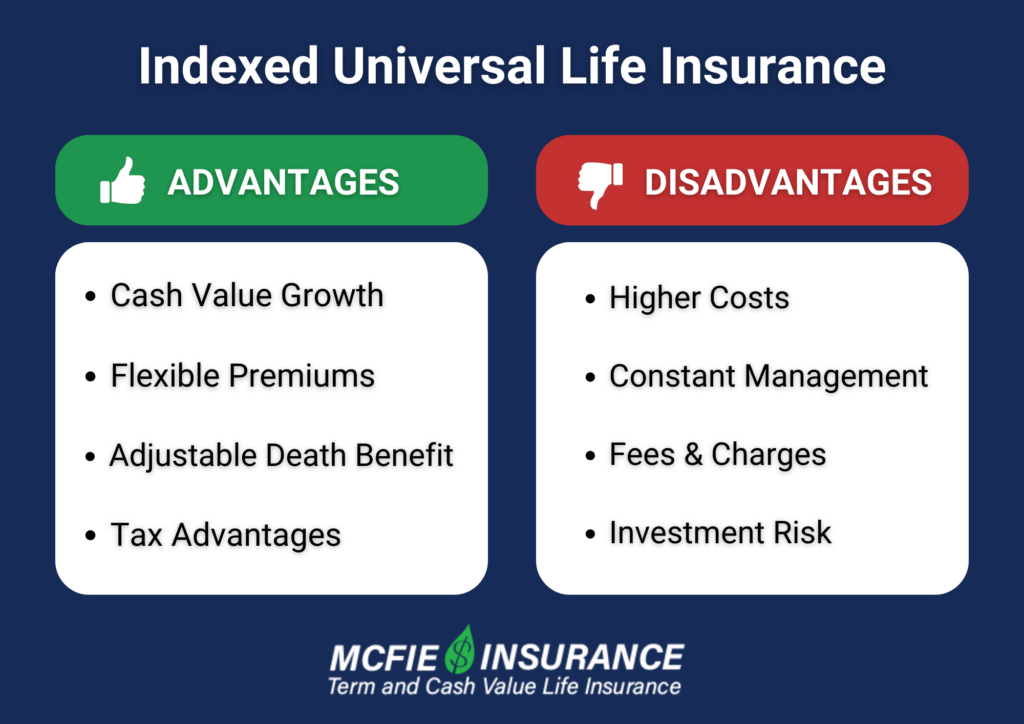

Are you considering Indexed Universal Life Insurance (IUL) but unsure if it’s a smart financial move? IUL policies blend the flexibility of universal life with the growth potential of stock market indexes.

However, this unique combination also comes with significant complexity and risks. We’ll explain how IUL works and weigh the pros and cons to help you determine if it’s right for you.

IUL policies consist of two core components:

The death benefit is supplied through annually Renewable Term insurance. This is the most expensive type of life insurance because the cost increases each year as you age and become riskier to insure.

Level Term Insurance is very similar to Renewable Term, but with a key difference. With Level Term, the insurance company guarantees your premium to be fixed or level for a set period. 10, 15 and 20-year terms are common periods for a Level Term policy. Once this level period has expired you may be able to renew, but the premiums will be much higher than they were for the previous period because your age has increased making you a higher risk for the insurance company.

Renewable Term is the most expensive way to buy life insurance. The Insurance Company looks at your age and health and offers to give you a certain amount of death benefit in return for X amount of premium. This premium will provide you with coverage for one term. The length of the term will be specified in the policy’s contract. Many renewable policies have a one-year term, but some are longer.

If you would still like coverage once your term has expired, your policy may be renewed. Your new premium will be higher as your age has increased and you represent a greater risk to the Insurance Company.

The premiums on Renewable Term policies rise quickly.

The premiums on IUL policies are flexible. You can pay less or more in premium as you please. When you pay a premium on an Indexed Universal Life Policy, your money:

The death benefit is the amount of money the Insurance Company agrees to pay to your beneficiaries if you should die while the policy is inforce. Since IUL is based on Renewable Term insurance, the cost of buying a death benefit will rise over time. As the cost rises, more of your premium dollars will be used to pay the increasing cost of your death benefit and less of your premiums will make it into your cash account.

IUL policies allow flexible premiums, but it’s critical to understand how your payments are allocated. Each premium is divided three ways:

There are numerous fees beyond the standard IUL policy charges, including:

The remaining premium after covering insurance costs and fees is deposited into the cash account. This is where IUL gets interesting.

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

The Cash Account is where Indexed Universal Life (IUL) policies are meant to shine. After covering insurance costs and fees, the remaining premium goes into your cash account, which represents your policy’s cash value. While some see this as equity, it’s actually the result of overpaying for coverage.

Your cash account mirrors an index like the Dow Jones or Nasdaq, though your ability to choose depends on the insurer. A key selling point is that you can’t lose money—returns are typically guaranteed to be no less than zero, with some policies offering a small positive return. However, there’s a cap on how much you can earn, and insurers can adjust this annually. Plus, these policies exclude index dividends, which can significantly impact growth.

Can you lose money? Yes. Even if market losses don’t affect your balance, rising insurance costs can drain your cash value over time. Many IUL policies struggle to keep up, making this a common issue rather than an exception.

Importantly, most IUL policies put a cap on the maximum interest you can earn, even if the index performs exceptionally well. For example, if your cap is 10% and the index gains 15%, you would only get credited 10%.

Insurers can also limit your cash value growth through participation rates. If your participation rate is 80%, you would receive just 80% of the index gains. So if the index rose 10% and your participation rate is 80%, your cash value would be credited only 8%.

Flexible premiums in an Indexed Universal Life (IUL) policy let you pay more, less, or even skip payments. If you overfund the policy—paying more than required—extra funds go into your cash account after covering insurance costs and fees.

However, IULs are subject to the IRS seven-pay test, which limits how much you can overfund before the policy becomes a Modified Endowment Contract (MEC). If a policy becomes a MEC, it loses its tax advantages, and any growth becomes taxable. Once a policy is classified as a MEC, it stays that way, so staying under the seven-pay limit is crucial.

On the flip side, if you pay less than illustrated or skip a payment, the insurance company will cover the shortfall by withdrawing from your cash account. If there aren’t enough funds, the policy lapses, meaning you lose both the cash value and the death benefit.

Since IULs use Renewable Term insurance, premiums rise over time. Unless your cash account grows fast enough to cover increasing costs, it’s only a matter of time before premiums consume the cash value, causing the policy to lapse—often when the insured is older and could have left an inheritance.

Indexed Universal Life policies are often depicted as a part of retirement income strategies. Most times these strategies involve overfunding the policy to boost the cash value (money in the cash account) so that the retiree can draw on the cash value for income in later years.

This is a poor strategy because almost invariably the premiums on IUL products become so exorbitant it is impossible or impractical to pay them. When the policy lapses there will be nothing to draw income from.

|

Tools of the Trade - How to Use the Cash Value in Your Life Insurance A quick reference guide on how policy loans work, how to make loan repayments and how to track your loans. |

Now that you grasp the mechanics of how IUL works, let’s examine the pros and cons.

One of the most common questions about Indexed Universal Life Insurance is “What does it cost?” As with most insurance products, the answer is: It depends.

Premiums for IUL policies tend to be higher than term life insurance but lower (in the early policy years) than whole life insurance. The exact premiums will depend on factors like your age, health, smoking status, and coverage amount.

According to SmartAsset, here’s some average monthly premium rates for a $250,000 IUL policy, based on a non-smoking individual in excellent health.

|

Age (years) |

Male

($ per month |

Female

($ per month) |

|

25-35 |

$96 – $122 | $71 – $96 |

|

35-45 |

$122 – $171 |

$96 – $148 |

| 45-55 | $171 – $303 |

$148 – $238 |

| 55-65 | $303 – $491 |

$238 – $445 |

Keep in mind these are just averages. Your specific quote could be higher or lower.

It’s also important to note that IUL policies have a myriad of fees beyond the base premium that can add to the total cost. These may include:

All of these charges eat into your cash value growth, so it’s crucial to get a full picture of a policy’s costs before signing on. Scrutinize the illustration and ask the agent to break down all fees.

Also, remember that because the insurance component of IUL is an annually Renewable Term, the cost of insurance will increase every year as you age. Budget for the likelihood of premiums rising over time to keep the IUL policy in force.

The allure of IUL’s cash value growth potential can blind buyers to the reality of the product’s costs. But those expenses are unavoidable and can make or break the long-term viability of the policy.

Understand them upfront so you can make an eyes-wide-open decision about whether Indexed Universal Life Insurance is worth the cost for your needs and budget. Don’t let sticker shock down the road derail your financial plans.

Indexed Universal Life Insurance is a niche product. It’s best suited for individuals seeking a combination of life insurance and cash value accumulation who are willing to shoulder high risks and complexity.

IUL tends to be most advantageous for those purchasing larger face amounts. Small policies are unlikely to deliver sufficient cash value growth to justify the product.

One specific use case where IUL can make sense is for high income earners who have maxed out other tax-advantaged savings vehicles and have a high risk tolerance. The tax-deferred growth potential can be attractive in this scenario.

On the other hand, those seeking simplicity, guarantees, and pure insurance protection should steer clear of IUL. The product’s risks and complexities are overkill for those needs.

IUL is also not recommended as a primary vehicle for generating retirement income. The possibility of the policy lapsing if the cash value is drained is too great a risk for those depending on lifetime income.

IUL is not recommended for those desiring lifelong insurance coverage, as most IUL policies are guaranteed to lapse.

If you’ve determined IUL isn’t the right fit for your needs, here are some alternatives worth considering:

For those seeking a straightforward, risk-averse permanent life insurance solution, it’s hard to beat whole life. Premiums and death benefit are guaranteed for life. Cash value grows at a fixed rate. Whole life removes the guesswork.

If your primary need is affordable insurance protection, term life is the most cost-effective option. It provides coverage for a specific number of years with fixed premiums. There’s no cash value component.

IUL policies can be very profitable for insurance companies, but they are extremely risky for individuals to own. An IUL could possibly benefit you if the stock market is trending down resulting in your cash value growing faster than the rest of the market, the insurance company has appropriately capped your cash account, and your premiums stay reasonable. IUL policies are complex in nature and have many moving parts and pieces.

The complexity and multiple variables in an IUL contract can become a huge financial risk and liability to the owner of the IUL policy. It is important to understand all these details thoroughly. We always recommend you consult with someone who has knowledge and experience with IUL policies if you are considering purchasing, or already have one in your financial portfolio.

When in doubt, lean towards the tried and true. There’s no shame in simplicity, especially when it comes to your family’s financial security.

At McFie Insurance we provide financial expertise on Life Insurance. If you want to:

Call our office 702-660-7000. We help people understand life insurance so they can get the right life insurance policy, and have financial peace of mind.

by Steven McFie

by Steven McFie

Many people make bad financial decisions, not because they want to, but because they don’t understand enough to make good financial decisions. I like to make things as simple as possible. Simple things are easier to understand. And when you understand something, it’s easier to make good financial decisions. (Yes this is an old picture - need to get an updated one.)