317-912-1000

317-912-1000

The purpose of Whole Life Insurance is to provide coverage for the insured during their entire lifetime. Whole Life Insurance is a consumer demanded product that offers more than just a death benefit by letting the policyholder build equity in the policy.

Apply For Whole Life Insurance»

Participating whole life insurance is a proven, reliable place to store wealth that provides consistent protection and guaranteed growth for your entire lifetime when properly designed. Unlike other types of life insurance, it offers real financial security through:

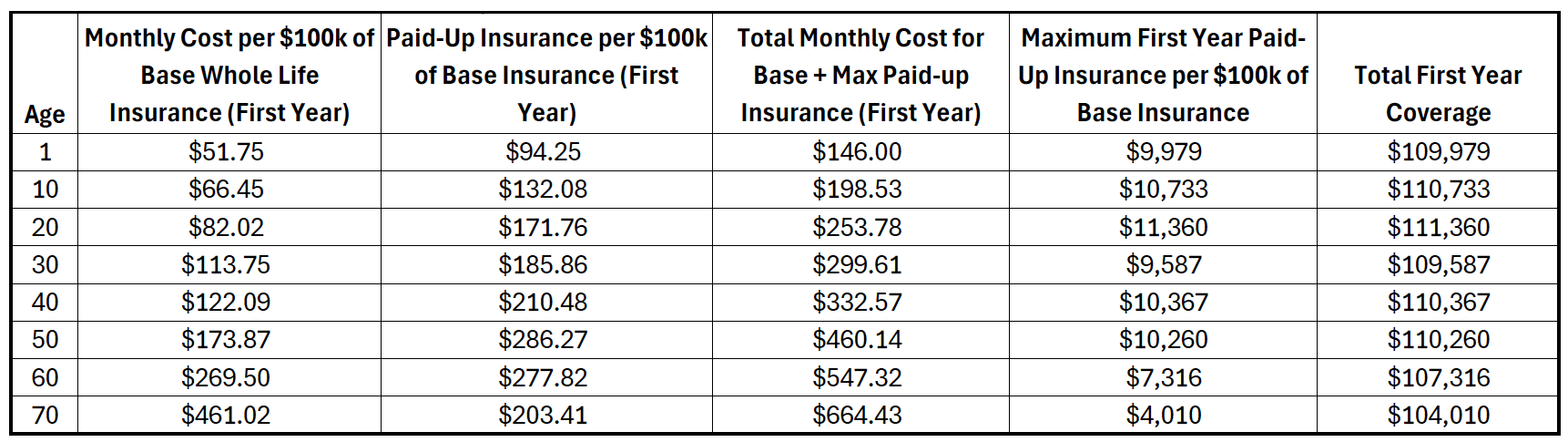

These rate examples are for educational information and are not meant to be used as a quote for any specific individual or on behalf of any specific insurance company. The table above assumes a Standard Non-Tobacco health rate. The multi-colored tables below assume a Preferred Non-Tobacco health rate. Insurance products are backed by the claims paying ability of the issuing insurance company and are not FDIC insured. McFie Insurance LLC its agents, and representatives are not authorized to give investment, legal or tax advice.

These rate examples are for educational information and are not meant to be used as a quote for any specific individual or on behalf of any specific insurance company. The table above assumes a Standard Non-Tobacco health rate. The multi-colored tables below assume a Preferred Non-Tobacco health rate. Insurance products are backed by the claims paying ability of the issuing insurance company and are not FDIC insured. McFie Insurance LLC its agents, and representatives are not authorized to give investment, legal or tax advice.

Equity implies ownership. Equity is the value of an asset minus the liabilities associated with that asset. A Whole Life Insurance policyholder builds equity in the policy as premiums are paid until the contract matures. At maturity, the policyholder will own 100% of the death benefit and will have no obligation to pay premiums. At this point, the policy is a “paid-up” policy.

Other insurance products provide for a death benefit to be paid if the insured dies while the policy contract is still in force. But the unique feature of Whole Life Insurance is that in addition to the death benefit provided, there is a provision made for the policy owner to actually own the death benefit. This provision, which is guaranteed by a legally binding contract, prevents the value of the Whole Life Insurance policy from being eroded by low interest rates and the ever-increasing cost of insurance to which typical Term and Universal Life Insurance contracts are subject.

Understand How Different Types of Life Insurance Work – Use link for Video Playlist (first video featured below)

The portion of the death benefit which becomes the personal property of the policyholder is called paid-up insurance. As paid-up insurance is a legal asset, belonging to the policyholder, it is no longer merely a number promised by the insurance company, and can be used as cash equivalent by withdrawing that value from the policy or using that value as collateral for a loan.

Whole Life Insurance policies were developed because life insurance policyholders were not satisfied with purchasing life insurance on a month by month, or year by year basis, and never accruing equity. Policy owners wanted to have an option to purchase life insurance with the opportunity to develop ownership because with ownership comes control. When Whole Life is paid up, the policyholder owns the death benefit and has no further obligation to pay premiums.

<

The cash value of a Whole Life Insurance policy represents the value of the paid-up insurance in the policy. The cash value can be withdrawn from the policy at any time.

When a withdrawal is made from a Whole Life Insurance policy, the paid-up insurance, which the withdrawn cash value represents, is surrendered. This reduces the total death benefit by the amount of paid-up insurance that was surrendered. Surrendered paid-up insurance reduces the death benefit, it also inhibits the future growth of a Whole Life Insurance policy because a withdrawal from a Whole Life Insurance policy can never be returned to the policy. The inability to return withdrawn money to a whole life policy decreases the value of the policy immediately but also limits long term compounding growth.

In contrast to a withdrawal, a policy loan leveraged against the cash value of a Whole Life Insurance policy can be repaid to the insurance company. Because a policy loan is not a withdrawal it does not affect the compounding growth of the policy like a withdrawal does.

A policy loan is a collateral assignment of a portion of the paid-up insurance, owned by the policyholder, to the insurance company. The insurance company holds the paid-up insurance as surety for the money it lends to the policyholder from the general fund of the insurance company. This collateral prevents any value from being surrendered from the policy and allows compounding growth to continue based on the entire value of the policy.

|

Tools of the Trade - How to Use the Cash Value in Your Life Insurance A quick reference guide on how policy loans work, how to make loan repayments and how to track your loans. |

Policy loans taken against the paid-up insurance portion of the death benefit in a Whole Life Insurance policy can be used for any purpose the policy owner desires as these loans are not regulated by any governmental regulations. However, if a policy loan is outstanding against a Whole Life Insurance policy at the time the policy is surrendered or lapses, the loan will be treated as a withdrawal, which could result in a tax liability if the withdrawal is greater than the total premiums paid for the Whole Life Insurance policy (i.e., cost basis).

As a general rule Whole Life Insurance policy loans are not considered income and do not trigger a taxable event. This allows the owner of a Whole Life Insurance policy to leverage the cash values of their policy(s) to finance investments, transfer debt, or manage to create more value. Here is an article with more in depth information about Life Insurance Policy Loans and Withdrawals and how and when to use them.

Whole Life Insurance can be more than just protection and savings—it can also serve as a private financing tool, giving policyholders the ability to recapture interest they would otherwise pay to banks, credit cards, or finance companies.

This strategy is often referred to as the Infinite Banking Concept, and it relies on one foundational principle: using policy loans to finance major expenses or opportunities, while allowing your policy’s cash value to continue growing uninterrupted.

Unlike a withdrawal, a policy loan keeps your full cash value intact and compounding, even while you use the loan proceeds for things like:

Because the policyholder owns the paid-up insurance used as collateral, they control the loan terms—not a bank or lender. As long as the policy remains in force and loan interest is paid, there are no credit checks, repayment schedules, or restrictions on how funds are used.

Many of our clients use Whole Life Insurance this way to build their own personal banking system, reducing reliance on external financing and keeping more money working within their own household or business.

In the sale of Universal Life Insurance policies, a marketing pattern has developed which focuses on the fact that the beneficiary will receive both the cash value accumulation in the Universal Life Insurance policy as well as the death benefit. This is possible because the cash value accumulation in a Universal Life Insurance policy merely reflects the money that the policy has accumulated based on extra premiums that were paid for that policy as well as any interest that has been earned on those extra premiums.

With Whole Life Insurance, the cash value represents the paid-up insurance (equity) that the policyholder has established in their policy. The death benefit in a Whole Life Insurance policy already reflects the cash values whereas in Universal Life Insurance policies, the cash value accumulation is not a reflection of death benefit. it is merely a reflection of premiums that were overpaid and any interest that was earned on those overpaid premiums after expenses have been paid.

So, when a death benefit is paid from a Whole Life Insurance policy, if there is no loan against the paid-up insurance, the beneficiary receives 100% of the death benefit. If there is an outstanding loan against the paid-up insurance of the policy, the beneficiary will receive the net amount of the total death benefit minus the outstanding loan balance.

When a death claim is filed against a Whole Life Insurance policy that has an outstanding loan the loan is repaid from the face value of the policy and the remaining portion of the face value becomes the death benefit that is paid to the beneficiary.

Either way, with or without a policy loan, 100% of the total death benefit is paid when a death claim is made against a Whole Life Policy.

Whole Life Insurance works because the insurance company assumes the risk of managing the premium dollars collected from the policyholder in exchange for providing a legally binding contract that provides a death benefit for the beneficiary of the policy. That binding contract lasts for the lifetime of the insured if the the terms of the contract are met by the policy owner. It is called Whole Life Insurance because it provides life insurance coverage for the insured’s whole life.

Instead of an ever-increasing premium like those found in Term and Universal Life Insurance contracts, Whole Life Insurance premiums are fixed level premiums that do not increase during the lifetime of the insured. Premiums can be reduced, or even stopped, in the future but the premiums cannot be increased.

The coverage provided in Whole Life Insurance is slowly converted to paid-up insurance which is fully owned by the policyholder. Paid up insurance provides greater liquidity and control over the cash values of a policy.

The sooner paid up insurance is established in a policy, the faster the cash value in a Whole Life Insurance policy will accrue. Keeping the growth of paid-up insurance within the guidelines of the Internal Revenue Code’s seven pay period will keep the policy from becoming a Modified Endowment Contract, and keep the policy’s growth from becoming a tax liability for the policyholder if the policy is ever surrendered, lapses or is borrowed against. Understanding how Whole Life works allows you to avoid tax liabilities.

The death benefit’s value is usually outlined in the insurance agreement, though there can be situations where it’s adjusted. Some policies qualify for dividend distributions, and the insured might decide to employ these dividends to procure additional paid-up coverage, augmenting the eventual payout upon death.

The payout received by beneficiaries isn’t taxed. However, various policy clauses or specific events can influence the death benefit. For instance, unsettled policy loans, along with accumulated interest, deduct from the death benefit on a one-to-one basis.

Several insurance companies provide optional add-ons, available for an additional charge, which ensure or solidify the coverage, encompassing the declared death benefit. Accidental death benefit and waiver of premium are two prevalent add-ons. They safeguard the death benefit, particularly if the policyholder faces severe illnesses or becomes incapacitated and fails to cover the premiums.

When it comes to receiving the death benefit, beneficiaries have options. The standard method is a one-time bulk payment. However, certain policies permit beneficiaries to opt for staggered payments or even transform the death benefit into an annuity. This annuity might provide payments for a predetermined duration or could last the beneficiary’s lifetime. The death benefit accrues interest until disbursed, and this interest might be subject to taxes.

Life insurance proceeds are tax free for the beneficiary up to the gift tax limitations. In addition to this, cash values grow tax-deferred in Whole Life Insurance policies. In a survey taken by Limra (formerly Life Insurance and Marketing Research Association), 11% of people who purchase cash value life insurance do so not merely for the death benefit but also for the tax advantages. Twenty-two percent of people purchase cash value life insurance for the ability to transfer wealth tax-free. The Tax Foundation estimates that $1.68 billion was transferred by clients in 2010, tax-free, and nearly 40% of all such policies were sold with premiums of $20,000 or more annually.[i]

Many Whole Life Insurance policies offer dividends to policy holders. Dividends are paid to policy holders based on the profits the insurance company has earned over the past year. Dividend rates are determined by the insurance company’s board and are paid annually to policy holders on the policy anniversary date of each participating policy.

Dividends are classified as a “return of premium paid” by the Internal Revenue Code and are not taxable if they are used to purchase more paid-up insurance. If they are paid to the policyholder directly, they will be non-taxable but only as they remain less than the cost basis of the policy (the cost basis of a policy is the sum of total premiums paid). Dividends will only be considered income when total cumulative dividends exceed the cost basis of the policy.

Dividends are not guaranteed. However, once a dividend is paid it becomes guaranteed and cannot be removed from the policy without the policy holder’s specific authorization.

Dividends may be used, at the policy holder’s discretion, to:

Whole life insurance, like other life insurance types, offers individuals and families a financial safety net in the event of a primary earner’s demise. If a family is dependent on one individual’s income, whole life insurance ensures monetary stability in the face of an unexpected loss.

However, a unique feature of whole life insurance compared to term life is its potential for investment. After amassing a substantial cash value, policyholders have the option to either withdraw from it or take a loan, facilitating significant expenses such as property acquisition. Many individuals even utilize the cash value from whole life insurance to bolster their retirement funds during unfavorable market conditions.

“It’s a lot more secure than just going the route of the stock market.”

Read more of Dr. Randy’s story and how he is using life insurance for retirement.

For businesses, whole life insurance serves as a protective measure in case a pivotal employee or associate passes away. Such a policy can counterbalance the financial impact resulting from the absence of their expertise. In situations where the deceased held ownership stakes, the insurance proceeds can equip surviving partners with the necessary funds to purchase the deceased’s share in the business.

Whole life insurance comes in diverse forms, distinguished primarily by their premium payment structures:

Furthermore, whole life insurance policies can be classified into participating and non-participating models. In the non-participating format, any surplus from premiums compared to claims becomes profit for the insurance company.

There are important distinctions between the approval methods that can significantly impact your policy’s performance and cost:

For most people looking to use life insurance as a financial tool, a fully underwritten participating whole life policy will provide the best value and strongest guarantees. Even if you have some health issues, going through proper underwriting often results in better premiums than trying to avoid medical evaluation.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

Not all life insurance companies that sell Whole Life Insurance pay dividends to policy owners. If a company does not pay dividends to Whole Life Insurance policy owners, the policy is considered a non-participating Whole Life Insurance policy.

Participating Whole Life Insurance policies, offer dividends to their policyholders. Participation in the dividends of a life insurance company can significantly increase the cash values and the total death benefit in a Whole Life Insurance policy over time. Most Life Insurance Companies that offer participating policies are mutually held Life Insurance Companies instead of stock held Life Insurance Companies.

All insurance policies have fees associated with them. When it comes to how Whole Life insurance works, the fees associated with the policies are fixed and flat; they are already included in the price of the premium for the policy. This is different from Universal Life Insurance policies which have a premium fee that is based on a percentage of the premium paid (This is called a front load). Because of the flat fee in a Whole Life Policy the larger the premium the smaller the fee will be as a percentage of premiums paid. In Universal Life Insurance, the higher the premium paid, the greater the fee will become since the fee is based on a percentage of total premiums paid.

For example, compare the fee of a Whole Life Policy vs. a Universal Policy on a $10,000 annual premium:

If the premiums are increased to $20,000 annual premiums here’s how the fees are affected:

Whole Life: A flat fixed fee of $75, this is 0.4% of the total premium

Universal Life: A 6% fee is $1200 of the total premium

Read more about participating whole life insurance here.

Whole Life Insurance is an asset purchase that builds equity and provides a guaranteed death benefit. Whole Life Insurance is a financial tool that can be used to build wealth, provide liquidity and legally avoid certain income and estate taxes. Whole Life Insurance is a solid and secure financial tool with high consumer demand and is used by individuals, families, business owners and companies to keep more of the money they make, grow their wealth and have financial peace of mind.

When it comes to protecting your family and building sustainable wealth, don’t be fooled by common financial advice suggesting term insurance is “good enough” or that universal life provides meaningful flexibility.

Term insurance is marketed as an affordable solution, but this temporary coverage becomes a liability as you age. You’ll face skyrocketing premiums if you try to maintain coverage after the initial term ends. Even worse, you’ve paid years of premiums with absolutely nothing to show for it – no cash value, no living benefits, just money gone forever.

Universal life insurance might sound appealing with its “flexible” premiums and death benefits. But this flexibility is actually dangerous – it’s built on one-year renewable term insurance with an ever-increasing cost that can drain your cash values and force you to pay much higher premiums later just to keep the policy in force. The guarantees are weak or non-existent.

Here’s what you need to know to make an informed decision:

You must understand exactly what you’re purchasing. A well-designed participating whole life policy will maximize cash value while minimizing the death benefit – providing both the protection your family needs and a powerful financial tool you can use during your lifetime. Many agents won’t design policies this way since it reduces their commission, but we prioritize your financial success.

Your policy should include key features that enhance its value. The accelerated death benefit rider allows access to funds if you become chronically or terminally ill. The waiver of premium rider protects your policy if you become disabled. We’ll help you understand which riders provide real value versus unnecessary costs.

Unlike universal life or other products with weak guarantees, participating whole life insurance provides contractually guaranteed cash values that grow predictably over time. This represents your equity in the death benefit – money you can access through policy loans while your policy continues growing.

When you work with a mutual insurance company, you may also receive dividends – though these aren’t guaranteed. What matters more are the guaranteed values built into your contract.

Too many people purchase life insurance without fully grasping how it works. Schedule a strategy session with us to learn how we can help design a participating whole life policy that will truly serve your financial goals. We’ll explain exactly how the policy works, what’s guaranteed, and how to use it as a powerful financial tool.

The pricing of whole life insurance is influenced by numerous considerations, including one’s age, profession, and medical background. Rates tend to be higher for older individuals compared to the younger ones. Those with an impeccable health record often get more favorable rates compared to those with past health issues.

The sum insured or coverage value also plays a role in determining the premium; a higher coverage value translates to a higher premium. Moreover, some insurers charge more than others, irrespective of the individual and their associated risks. It’s pivotal to highlight that, for identical coverage amounts, whole life insurance usually costs more than term life insurance.

To buy life insurance with McFie Insurance, call the office at: 702-660-7000 or email: [email protected]

[i] https://www.marketwatch.com/story/10-things-life-insurers-wont-tell-you-1308333194735

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.