702-660-7000

702-660-7000

You get an email from a big fancy resort offering you a 4-night stay in their best condo for only $200 if you listen to their timeshare pitch. You’re thinking, “Woo hoo an extra cheap vacation for the family!” knowing you won’t buy into the timeshare option. But somehow they rope you in during the presentation and now, here you are with a timeshare. Many Americans have been in this situation.

Whether you’ve been dreading your timeshare from the moment you signed the papers or you used to enjoy it but no longer do, we’ll explain some options on how to get out of a timeshare and discuss another strategy for managing your money which will give you more control of your financial future.

Timeshares involve a variety of contracts and types of ownership, which affect how each timeshare operates. Essentially, a timeshare is a shared ownership model for vacation properties, allowing multiple people to bear the costs and ensuring you have access to the property annually. At first glance, timeshares seem appealing. However, they often come with undisclosed maintenance fees and additional annual expenses, which can turn ownership into a burdensome ordeal and complicate the process of exiting a timeshare agreement. If you’re considering how to get out of a timeshare, here are five potential strategies to explore.

If you’ve recently purchased a timeshare and are having second thoughts, there might be a way out. Known as the rescission period, this is a brief timeframe during which you can reverse your purchase and cancel the contract. According to the Federal Trade Commission, the minimum duration for this period is three days, but this can vary as each state in the U.S. has the authority to establish its own rescission timeline. Consequently, the period might extend anywhere from three to 15 days, depending on the state where the timeshare is situated—not necessarily where you reside. For timeshares located abroad, it’s crucial to investigate the rescission policies of the specific country. Additionally, it’s important to understand what initiates this period. Is it from the date of purchase, or when you receive specific documentation about the timeshare? Typically, this detail is mentioned in the general information provided about the timeshare or within the disclosure statement.

If you’re still within the cancellation window for your timeshare, the key to exiting your agreement is to craft a cancellation letter and send it directly to the resort’s designated cancellation address. Finding this address can be tricky; it’s often buried in the fine print or not provided at all. However, you have the right to contact the resort and request this information. Since the rules vary by state, it’s crucial to understand the specific requirements for where your timeshare is situated. In some states, your cancellation period doesn’t even start until you’ve received the necessary cancellation details, which can work in your favor. When sending your letter, choose a delivery method that requires the resort to acknowledge receipt, such as certified mail. This prevents the resort from denying they received your cancellation request. Be wary of any additional “cancellation fees” the resort might try to impose, and don’t hesitate to challenge any charges that seem unjustified.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Once the rescission period has ended, your next step could be to negotiate with the resort to reclaim the timeshare. It’s possible your timeshare agreement includes a “deed-back” clause, which is essentially an option for you to return the timeshare to the resort. Check your contract and any related documents to see if you have this clause. If your contract lacks a deed-back clause, consider discussing with the resort’s sales manager to see if they might be open to taking the timeshare back, potentially with some added incentive from your side. However, this approach requires careful consideration and strategy, as it may not always be the most effective way to exit your timeshare commitment.

If renegotiating with the resort or a deed-back aren’t viable options, selling your timeshare could be another route, though it might require additional investment on your part to facilitate the sale. It’s crucial to understand that if you’re still paying off a loan for your timeshare, selling it might not be feasible until the loan is fully settled. Once you’re free from any loan obligations, the next step is to determine the market value of your timeshare. Consulting with real estate professionals, exploring timeshare resale platforms, or using other online listing services can provide insight into your timeshare’s worth. After establishing a selling price, you have several avenues for listing your timeshare, such as hiring a real estate agent or utilizing online marketplaces. Keep in mind, the resale market may not allow you to recover all the expenses incurred from owning your timeshare, but selling it can ultimately save you from future costs associated with the property.

When you’ve tried everything else without success, it might be time to think about getting professional help, either from an attorney or a timeshare exit company. Although this route can be more expensive, choosing the right professionals could lead to a successful exit from your timeshare commitment. If you decide on an attorney, look for one with expertise in contract law who also offers some form of service guarantee. When it comes to timeshare exit companies, prioritize those with a solid reputation and specific experience in handling timeshare cases. A company known for effectively assisting others in exiting their timeshares could be a reliable choice.

While many people might offer tips on exiting a timeshare, not all suggestions are advisable. Here are some strategies you might want to avoid:

Renting Out Your Timeshare: It might appear to be a smart move, but most resorts have policies against this. Besides, rental income is unlikely to cover the full extent of your timeshare expenses.

Handing Over Your Timeshare: Transferring your timeshare to someone else means passing on the burden of fees and payments. If you’re dissatisfied with your timeshare, it’s unlikely a friend would feel differently. This approach could strain your friendships.

Ceasing Payments: This is arguably the least advisable route. Not keeping up with your timeshare payments can lead to late fees, increased debt, and possible legal action. Avoid stopping payments as a means to escape your timeshare obligations.

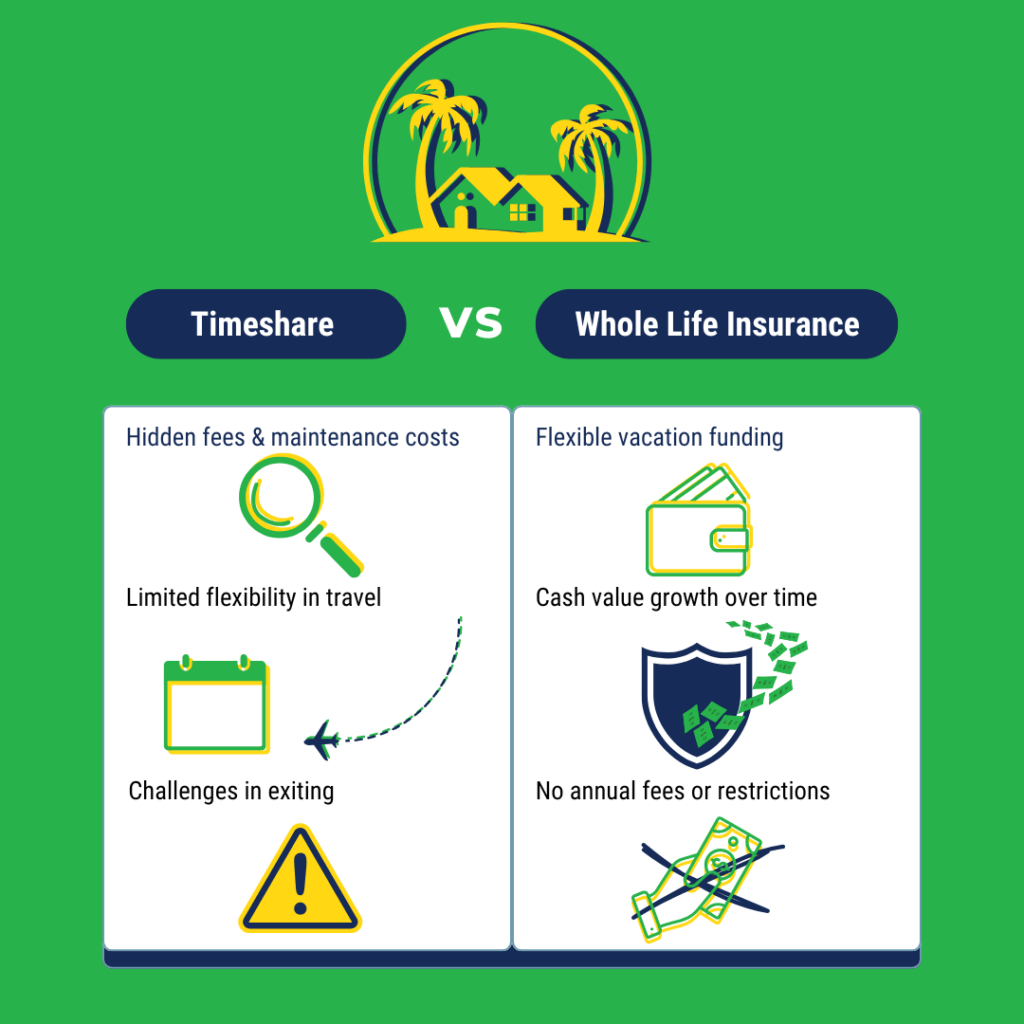

Instead of committing to a timeshare, consider a more flexible approach to vacation planning that keeps your finances in your hands.

At McFie Insurance, many of our clients opt to allocate their “vacation funds” towards premiums for a participating whole life insurance policy. This way, when it’s time for a vacation, they can take out a policy loan to cover their expenses and repay it at their own pace over the following year or beyond. This method allows for spreading out vacation costs, making it easier to manage within your budget.

The cash value of the life insurance policy is designed to increase over time, exceeding the total amount paid in premiums. This growth offers a savvy way to both save for future vacations and fund them, yielding a return that’s generally more favorable than what a standard bank savings account might offer.

Choosing this route over a timeshare means you won’t be confined to specific vacation spots and obligated to use them to justify the expense. You’ll enjoy the liberty to pick your holiday destinations freely, without the burden of continuous maintenance fees tied to timeshare agreements.

This strategy can also be more cost-effective in the long run, even for those who prefer visiting the same places, providing greater financial flexibility compared to the commitments of a timeshare.

At McFie Insurance, we specialize in crafting participating whole life insurance policies tailored to cover you for your entire life, typically with annual premium payments.

This type of insurance not only assures a payout to your beneficiaries upon your passing but also offers the opportunity to accumulate cash value within the policy over time. Additionally, you might receive dividends based on the insurance company’s surplus profits, though these dividends aren’t guaranteed.

If timeshare commitments are weighing you down, or if you’re seeking a smarter way to fund future vacations, consider a well-structured life insurance plan. Book a consultation with McFie Insurance. We’re here to guide you through:

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.