702-660-7000

702-660-7000

As a small business owner, you constantly balancing the need to grow with the challenge of financing that growth. Traditional financing methods like bank loans, lines of credit, or using your savings each come with drawbacks. But there’s another option that many successful business owners leverage: participating whole life insurance.

This approach, often associated with the Infinite Banking Concept, allows business owners to access capital on their own terms while building wealth at once. Let’s explore how this works through the story of Sandra, a salon owner who used this strategy to double her business profits.

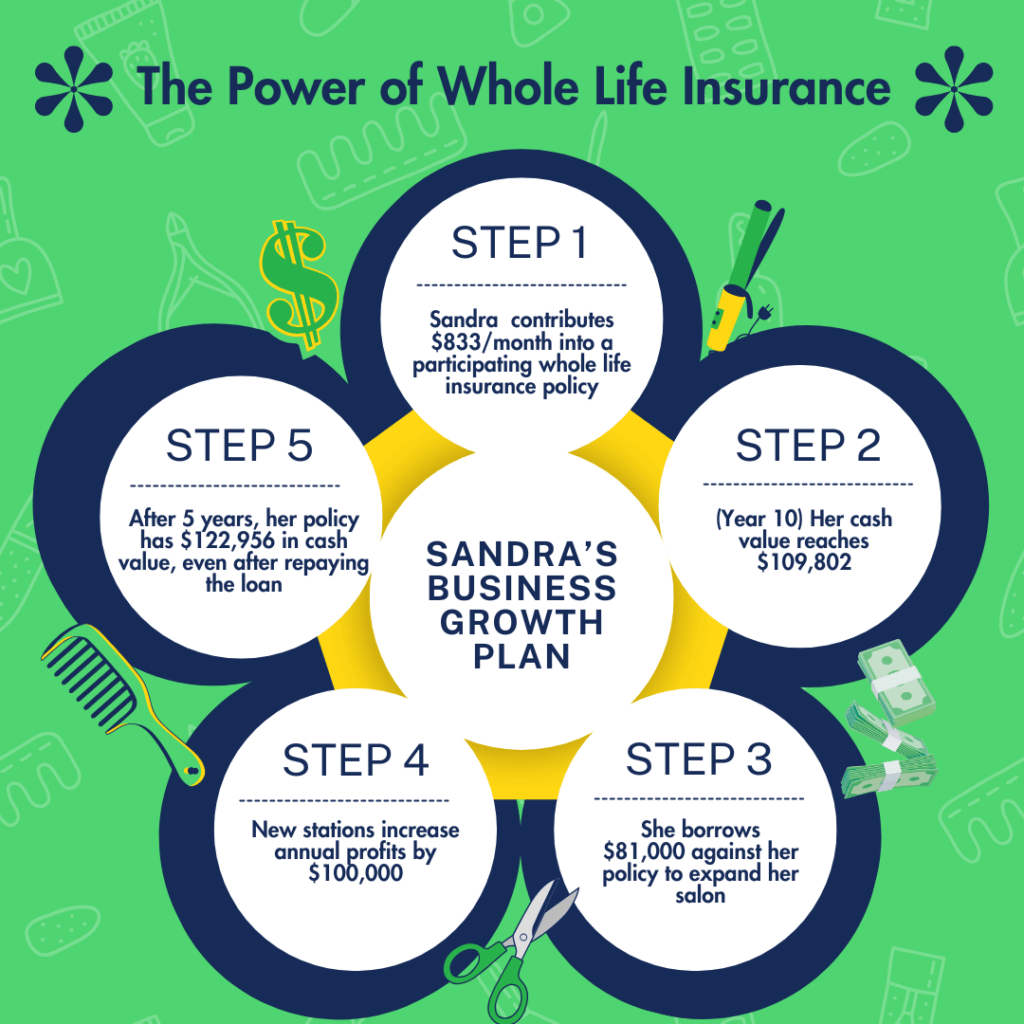

Sandra opened her hair salon when she was thirty-one with a clear vision for her business and for how she’d finance its future growth. From day one, she committed to setting aside $833 monthly to fund future expansions without taking on traditional debt.

Many business owners might default to storing these funds in a 401(k), IRA, or standard investment account. Sandra recognized the limitations of these approaches:

Instead, Sandra chose to channel her monthly $833 into a participating whole life insurance policy.

What Sandra implemented is referred to as the “Infinite Banking Concept” (IBC), popularized by R. Nelson Nash in his book “Becoming Your Own Banker.” The core idea is simple yet powerful: use properly structured participating whole life insurance as your own personal banking system.

With this approach, you:

Ten years into her business, Sandra’s salon was thriving, but she saw an opportunity for growth. By adding six more stations, she calculated she could increase annual profits by $100,000— doubling her current earnings.

Thanks to her consistent $833 monthly contributions, her participating whole life policy had accumulated $109,802 in cash value. This became her expansion fund.

When the time came to expand, Sandra contacted her insurance agents at McFie Insurance (as hundreds of their clients do regularly) to help her structure a policy loan. Here’s how the process worked:

While this might seem similar to a traditional business loan, there are crucial differences that make this approach superior:

When you take a policy loan, you’re not withdrawing your money from the policy. Instead, the insurance company lends you money using your cash value as collateral. This means your policy continues growing as if you hadn’t borrowed a dime. The insurance company’s general account funds the loan, not your cash value.

After completing her repayment schedule over 60 months, Sandra’s results were impressive:

Let’s examine how Sandra’s approach compares to other common financing methods:

Had Sandra obtained a business loan from a bank:

If Sandra had simply saved her business profits until she reached $81,000:

Sandra’s in-laws suggested she should have invested her monthly savings instead. Let’s analyze this option:

While the pure numbers might appear favorable to the investment approach, this comparison overlooks important factors:

Sandra’s strategy provided multiple layers of benefit beyond financing her expansion:

Throughout the entire process, Sandra maintained life insurance coverage for her family, starting at $300,426 when she first took the loan and growing to $428,568 by the time she repaid it. Had she passed away during this period:

Many participating whole life policies include riders that allow access to the death benefit while still living if faced with terminal, chronic, or critical illness. This provided Sandra with additional security as a business owner.

Sandra also recognized the long-term value of her policy for eventual business succession. When ready to sell her salon:

Sandra’s approach demonstrates the core principles of the Infinite Banking Concept:

By using participating whole life insurance, Sandra became her own source of financing. She recaptured the “banking function” in her financial life—the ability to finance her own purchases and recapture the interest typically lost to financial institutions.

Unlike traditional savings or investments where withdrawals interrupt compound growth, Sandra’s policy continued growing even while she used the money elsewhere. This creates an advantage that compounds over time.

Sandra maintained complete control over her financing terms. There was no bank application, no credit check, and no external approval process. She determined her own repayment schedule based on what worked for her business cash flow.

The cash value in her policy grew tax-deferred, and she accessed it tax-free through policy loans. Additionally, she claimed tax deductions on the interest portion of her repayments.

While participating whole life insurance offers many advantages for business financing, it’s not a one-size-fits-all solution. Consider these factors:

Sandra’s strategy worked because she started ten years before needing the capital. This approach requires patience and discipline, making it better suited for planned expansions rather than immediate needs.

You need to be able to consistently fund the policy with premiums that fit your current budget. While premiums are typically flexible, the strategy works best with regular contributions.

Not all whole life insurance policies are created equal. For this strategy to work effectively, you need a properly structured participating whole life policy designed to maximize cash value growth while minimizing insurance costs.

This approach works best as part of a comprehensive financial strategy that may include other investment vehicles, business entities, and tax planning.

If you’re considering using participating whole life insurance to finance your business growth, here are the steps to get started:

Begin by understanding the fundamentals of the Infinite Banking Concept and participating whole life insurance. There are numerous books, “Prescription for Wealth,” available to downloas from resources like McFieInsurance.com.

Work with an advisor who specializes in this strategy and understands business applications specifically. They should be able to design a policy optimized for cash value growth rather than just selling you insurance.

A properly designed policy for business financing should:

Begin funding your policy, understanding that the first few years will show slower cash value growth as the policy establishes itself.

Like Sandra, recognize that this is a long-term strategy that improves with time. The longer you use it, the more powerful the results become.

Sandra’s story illustrates how participating whole life insurance, when properly structured and utilized according to Infinite Banking Concept principles, can become a powerful tool for business growth and succession planning.

By creating her own banking system through her policy, Sandra:

While traditional financing focuses on acquiring capital for immediate needs, Sandra’s approach built multiple forms of value simultaneously. She financed her business growth while creating a parallel financial asset that continues growing regardless of her business’s performance.

Every business owner faces the challenge of financing growth. By considering participating whole life insurance as part of your financial strategy, you may discover, as Sandra did, that the right financing approach doesn’t just fund your growth—it becomes an integral part of creating lasting wealth.

Every life insurance policy is unique, designed for different purposes with different premiums based on the product, your age, health, net worth, and other factors. To determine if a participating whole life policy could benefit your business growth strategy, consult with a financial professional who specializes in this approach.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.