317-912-1000

317-912-1000

Imposter syndrome is remarkably common, affecting up to 70 percent of adults at least temporarily. Even more concerning, as many as 30 percent of high achievers experience it long-term. But what exactly is imposter syndrome, and how does it impact your financial decisions throughout life?

At its core, imposter syndrome could also be called “fear of success.” It emerges when someone achieves success but feels guilty about it, or when a string of successes is interrupted by a setback, leading to the belief that they weren’t truly deserving of that success in the first place.

Pseudo-guilt and self-pity are powerful emotions with far-reaching consequences. They can drive some people to commit crimes, push others into despondency or indecisiveness, foster laziness, and in extreme cases, even lead to suicide. In contrast, authentic guilt paired with an honest recognition of our limitations and worth always comes with the possibility of forgiveness and complete acceptance. Those who have never experienced forgiveness and full acceptance remain trapped in despair, while those who have received it discover a renewed sense of purpose that goes far beyond themselves.

For those with this renewed perspective, success isn’t measured by how much you earn or accumulate, but by how effectively you serve and help others. As Zig Ziglar wisely noted, “You can have everything in life you want, if you will just help other people get what they want.” Genuine success, therefore, centers on how much you can help others rather than how much you can acquire for yourself.

Luke, a physician and historian, recorded a powerful story Jesus told about three servants who were each entrusted with ten minas by their master. For context, one mina was equivalent to about three months’ wages, making ten minas worth approximately two and a half years of income.

When the time came for these servants to account for their management of their master’s money, their outcomes varied dramatically. The first servant had doubled the money, now having twenty minas. The second had increased his portion by 50%, showing fifteen minas. The third servant, however, was paralyzed by fear – a classic case of imposter syndrome. He had done nothing with the funds entrusted to him.

In returning the unchanged sum, this third servant blamed his master for his failure. His master condemned him as unscrupulous, stating that at minimum, he should have deposited the money to earn interest. As a result, the master took the money from him and gave it to the first servant who had demonstrated exceptional stewardship. This reinforces a fundamental principle: those who manage money well are entrusted with more.

The story concludes with the first servant being placed in charge of ten cities in the master’s kingdom, the second overseeing five cities, while the third was banished from the kingdom, losing all influence and standing.

This parable clearly illustrates that imposter syndrome is essentially a self-centered excuse to avoid managing what has been entrusted to us. Fear of success constrains our potential for achievement. Our lack of success diminishes our ability to help and influence others by eroding our standing in our communities.

Authentic success is never about personal gain. True success elevates ourselves and others. When we fall into the trap of defining success merely by financial metrics – how much we earn or accumulate – we embrace what has been called the root of all evil: the love of money.

Ironically, Solomon, historically one of the wealthiest individuals ever, observed that “Those who love money will never be satisfied with money, nor will those who love abundance be content with increase.” Many who have amassed vast fortunes through various means often suffer from imposter syndrome. We see this when the world’s wealthiest attempt to “give back” through endowments, trusts, and foundations. While these efforts may appear noble, they often represent attempts to alleviate their imposter syndrome while cultivating a philanthropic public image. In doing so, they sidestep the cure for imposter syndrome while reinforcing problematic social dynamics.

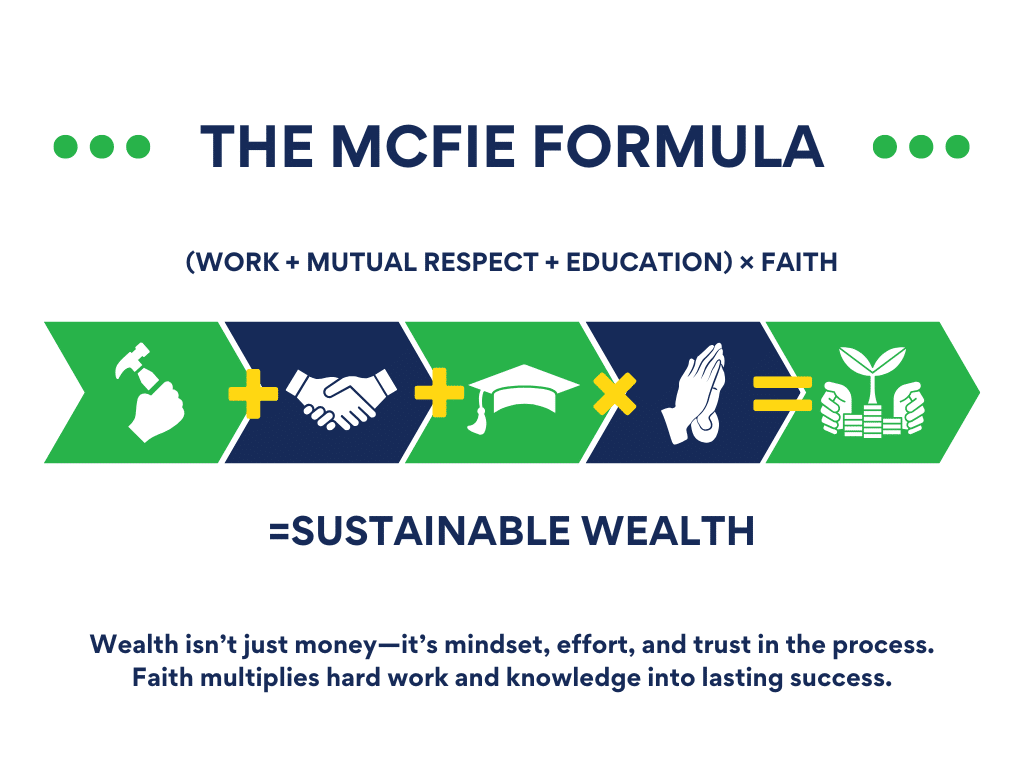

The solution for overcoming imposter syndrome lies in honestly generating, managing, and building wealth according to one’s abilities. Fortunately, there exists a formula for this approach:

(Work + Mutual Respect + Education) × Faith = Sustainable Wealth

This formula provides a framework for addressing imposter syndrome and building authentic success, but understanding its components requires deeper exploration.

Work forms the foundation of wealth creation. Without effort, there can be no value generation. Work isn’t only about employment; it encompasses all value-creating activities. The quality, consistency, and creativity of your work directly impact your ability to generate wealth.

Many suffering from imposter syndrome discount the value of their work, believing they aren’t deserving of compensation or recognition. Overcoming this mindset requires acknowledging the value you create through your efforts.

The concept of mutual respect in wealth building encompasses ethical conduct, fair dealings, and recognizing the dignity of all involved in economic exchanges. Wealth built at others’ expense creates the very guilt that feeds imposter syndrome.

Mutual respect means:

When wealth is built on mutual respect, the guilt associated with imposter syndrome has no foothold.

Continuous learning and skill development are essential for sustainable wealth creation. Education in this context isn’t limited to formal schooling but includes:

Those suffering from imposter syndrome often feel they don’t know enough or aren’t qualified enough despite evidence to the contrary. Ongoing education helps address these knowledge gaps, real and perceived.

Faith in the Formula represents belief in principles larger than oneself. This includes:

Faith is the multiplier in the formula because without it, the other elements may not be fully activated. Those with imposter syndrome often lack faith in themselves and the principles of wealth creation, limiting their potential for success.

Understanding how to apply this Formula can help overcome imposter syndrome and build sustainable wealth.

Many with imposter syndrome undervalue their contributions. Take inventory of your skills, experiences, and the value you create. Document positive feedback, successful outcomes, and personal growth. This approach helps counter the false narratives of imposter syndrome.

Creating systems that automate good financial decisions reduces the impact of imposter syndrome on your finances. Consider:

Good systems function even when imposter syndrome flares up.

Not all financial advice is created equal, making it important to seek education that prioritizes principles over quick fixes, acknowledges risks and rewards, and aligns with ethical wealth creation. The best financial guidance emphasizes long-term sustainability rather than short-term gains, building a solid foundation for lasting success. Quality education builds confidence and helps bridge knowledge gaps that contribute to imposter syndrome, empowering individuals to make informed decisions.

Building wealth ethically creates a foundation free from guilt, making sure financial success is fulfilling. This means providing genuine value in all business dealings, avoiding deceptive practices, and honoring commitments. Ethical wealth creation also involves contributing to your community, reinforcing a sense of purpose beyond financial gain. When you know your success is built on integrity, imposter syndrome loses its grip, allowing you to move forward with confidence.

Remember Ziglar’s principle that success comes from helping others get what they want. Approach wealth building as service by:

This shifts focus from self-centered concerns to the value you create for others.

One practical application of our Formula involves the use of participating whole life insurance. Unlike term insurance, which only provides a payout if you die during the coverage period, properly designed whole life insurance builds cash value over time while still offering a death benefit. This feature makes it a powerful financial tool beyond protection.

This approach provides several advantages for those combating imposter syndrome. The guaranteed growth, regardless of market conditions, offers certainty that helps counter anxiety. Access to cash value through policy loans provides flexibility when opportunities arise, while dividend participation allows policyholders to share in the insurance company’s success. Its long-term focus encourages sustainable financial thinking rather than short-term speculation. When properly structured, whole life insurance becomes an asset that grows steadily, offering valuable options for personal and business purposes.

Imposter syndrome often leads to fear-based financial decisions that undermine long-term wealth creation. Common fear-based financial behaviors include:

Our Formula addresses these fears by emphasizing sustainable principles rather than emotional reactions. By focusing on work, mutual respect, education, and faith, financial decisions become more balanced and rational.

Sustainable wealth extends beyond financial assets to encompass the values and principles passed down to future generations, the systems and structures that continue generating value, and the knowledge and wisdom shared with others. It also includes the positive impact made on communities and institutions, shaping a legacy that goes beyond monetary success. Those who overcome imposter syndrome understand that true wealth is not measured by financial metrics but by the lasting influence they leave behind, guaranteeing that their impact endures well beyond their lifetime.

Imposter syndrome affects many, undermining their potential for success and wealth creation. By understanding and applying the Formula of (Work + Mutual Respect + Education) × Faith = Sustainable Wealth, anyone can overcome this syndrome and build sustainable prosperity.

Unlike approaches that try to alleviate the symptoms of imposter syndrome, our Formula addresses its root causes by promoting ethical wealth creation that benefits the individual and their community. This foundation eliminates the fertile ground where imposter syndrome flourishes.

If you or someone you know struggles with imposter syndrome that’s affecting your financial decisions, reaching out for professional guidance can be transformative. Experts in implementing this Formula can help you recognize your true value, develop effective financial systems, and build wealth that aligns with your deepest values.

By embracing these principles, you can move beyond the limitations of imposter syndrome to create lasting financial success that positively impacts your life and the lives of those around you.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.