702-660-7000

702-660-7000

Have you ever wondered why banks are some of the wealthiest institutions in the world? It’s because they’ve mastered a simple yet powerful concept: they use other people’s money to generate wealth for themselves. What if you could apply the same principles to your finances? That’s exactly what the “be your own bank” strategy allows you to do.

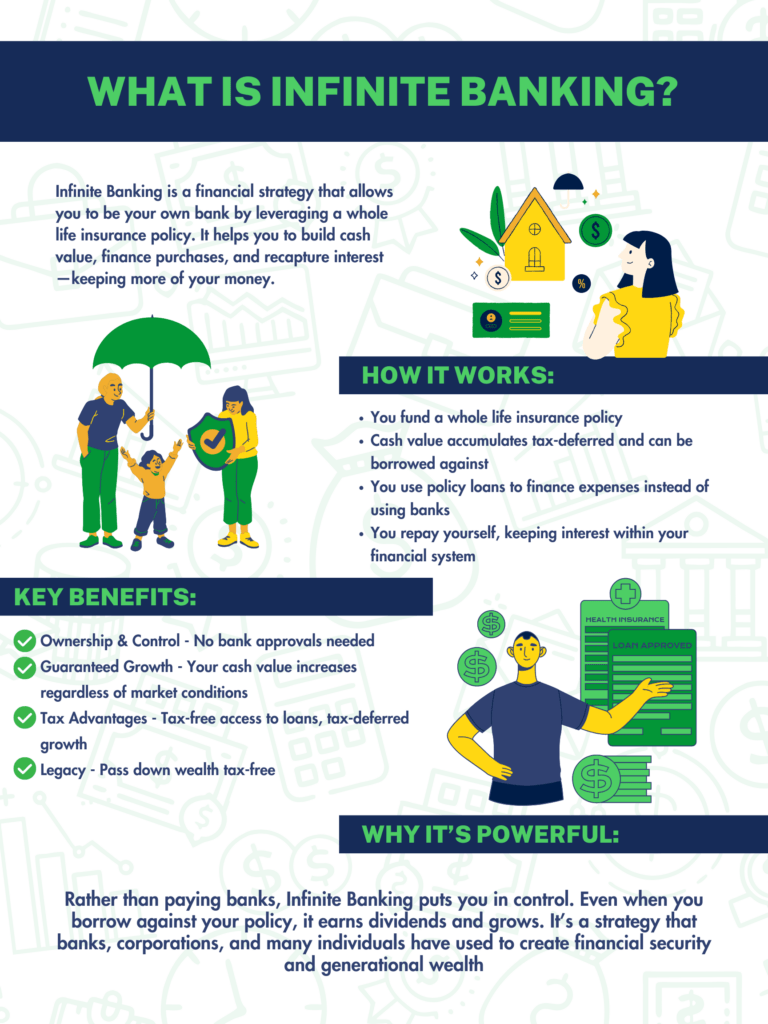

Being your own bank isn’t about opening a financial institution or storing cash under your mattress. Rather, it’s a financial strategy that puts you in the position traditionally held by banks—allowing you to recapture the interest you would pay to financial institutions while building wealth in a tax-advantaged environment.

At its core, this concept involves using specially designed whole life insurance policies as a financial tool that provides protection and a growing pool of capital you can access throughout your life. Instead of borrowing from banks and financial institutions, you borrow from your policy and repay yourself—keeping the interest and growth within your own financial system.

When you save money in a traditional bank, you earn minimal interest—often less than 1% annually—while the bank uses your deposits to make loans at much higher rates, sometimes 10-20% or more (especially with credit cards). This spread between what they pay you and what they charge others creates their profit margin.

When you borrow money from a bank:

Traditional banking exposes your money to market volatility, inflation erosion, and complex fees that quietly diminish your wealth over time.

When you establish your own banking system, you determine:

This eliminates the approval process, credit checks, and application fees associated with traditional lending. You’re essentially giving yourself permission to use your own money.

Unlike market-based investments, dividend-paying whole life insurance provides a stable foundation for personal banking. It guarantees annual growth, protects against market downturns, and ensures consistent, predictable increases in cash value. Potential dividend payments enhance growth over time, offering a reliable alternative to the volatility of traditional investment portfolios.

The personal banking concept provides exceptional tax benefits, allowing for tax-deferred cash value growth, tax-free access through policy loans, and a tax-free death benefit for beneficiaries. With no capital gains taxes on growth and no income taxes on properly structured withdrawals, it also offers protection from potential future tax increases. These advantages create an environment where your money can grow more efficiently than in many traditional investment accounts.

When I first heard about the Infinite Banking Concept, I was skeptical. It sounded too good to be true—a way to grow wealth, finance purchases, and create a legacy without relying on traditional banks? After diving into the mechanics and seeing real-world results, I’ve come to appreciate this powerful financial strategy that’s been hiding in plain sight for decades.

The Infinite Banking Concept (IBC), also known as “Becoming Your Own Banker”, is an approach that puts you in the banker’s seat. Rather than being the customer who deposits money at low interest rates and borrows at high rates, you become the institution that profits from the flow of your money.

At its foundation, this concept uses dividend-paying whole life insurance as a financial vehicle—not mainly for the death benefit (though that’s a valuable component), but as a cash accumulation tool that creates a pool of money you can access, control, and direct throughout your lifetime.

The real magic happens when you utilize policy loans from your cash value to finance major purchases, investments, or expenses. When you repay these loans (to yourself), you’re recapturing the interest you would have otherwise paid to a bank or credit card company. This recaptured interest builds value within your policy, creating a positive compounding effect over time.

Think of it this way: Instead of making your monthly car payment to a finance company, you make a similar payment back to your own policy. The interest goes toward increasing your cash value and creating more capital for future use.

The Infinite Banking Concept was formalized and popularized by R. Nelson Nash, an economist and former forestry consultant who faced financial challenges during the high interest rate environment of the 1980s. During this period, when interest rates soared above 20%, Nash found himself with substantial real estate investments financed at painfully high rates.

While looking for solutions, Nash had an epiphany. He realized that the dividend-paying whole life insurance policies he owned could provide liquidity at rates significantly lower than what banks were charging. He could access cash through policy loans at 5-8% while banks were charging 18-23% on conventional loans.

This realization led Nash to develop and refine what would become the Infinite Banking Concept. In 1983, he began teaching these principles to others, publishing his seminal book, “Becoming Your Own Banker,” in 2000. The book uses illustrations to demonstrate how individuals could create and manage their banking systems.

Nash continued to teach and spread his financial philosophy until his passing in 2019, leaving behind an organization called the Nelson Nash Institute to continue his educational work. His approach has gained traction over the past two decades, with countless individuals implementing these principles to transform their financial lives.

What’s fascinating is that while Nash formalized this strategy, the underlying concept—utilizing specially designed life insurance policies as financial tools—had been employed by wealthy families, banks, and corporations for over a century. Nash simply brought this institutional knowledge to the everyday person.

When comparing personal banking using the Infinite Banking Concept to traditional banking methods, several differences emerge:

Traditional Banking: Your money is owned and controlled by the financial institution. They decide loan approval, terms, and interest rates. Your deposits become their assets to leverage.

Personal Banking: You maintain ownership and control.. You decide when to access money, how much to borrow, and your repayment terms. There’s no application process, credit check, or possibility of denial.

Traditional Banking: Interest flows away from you. You earn minimal interest on deposits while paying substantial interest on loans, with the difference creating bank profits.

Personal Banking: Interest flows toward you. When you pay “interest” on policy loans, it increases the profitability of the insurance company. If your policy is a participating whole life insurance policy with a mutual company, a portion of these profits will be shared with you in the form of a dividend. This enhances your wealth rather than depleting it.

Traditional Banking: Savings accounts offer minimal guaranteed growth, while many investment options expose your capital to market risk and potential loss.

Personal Banking: Properly structured whole life insurance provides guaranteed growth regardless of market conditions, with additional growth from dividends (though dividends aren’t guaranteed).

Traditional Banking: Interest earned on savings is taxable, and there are usually no tax advantages to the interest paid on loans (except in limited cases like mortgage interest).

Personal Banking: Growth within your policy is tax-deferred, and access to money through policy loans is tax-free. The death benefit also transfers income-tax-free to your beneficiaries.

Traditional Banking: Your banking relationship ends at your death, with your estate settling outstanding debts.

Personal Banking: Your “banking system” doesn’t end with your passing—it transforms into a tax-free legacy for your beneficiaries that could continue for generations.

Traditional Banking: Money in savings accounts rarely keeps pace with inflation, meaning your purchasing power decreases over time.

Personal Banking: The growth rate in properly structured policies often exceeds inflation, helping preserve and increase your purchasing power long-term.

Understanding these differences helps explain why advocates of the Infinite Banking Concept are so passionate about its potential. It transforms your relationship with money and creates a system that builds wealth rather than slowly eroding it.

Now that we understand the concept and history, let’s dive into the mechanics of how personal banking functions. This is where theory transforms into strategy.

At the heart of the personal banking system is a dividend-paying whole life insurance policy—but not just any policy. For this strategy to work, you need a policy with a mutual life insurance company, where policyholders are essentially part-owners who share in the company’s profits through dividends.

Unlike term insurance that expires after a set period, whole life insurance provides permanent coverage with premiums that remain level for life. These premiums fund the death benefit and cash value that grows tax-deferred over time.

Why dividend-paying whole life specifically? Several reasons:

A standard whole life policy won’t optimize the banking function—the policy has to be designed to maximize cash value growth while minimizing the initial death benefit. This custom design is vital and requires working with an agent who understands the banking concept.

Elements of a properly structured policy include:

The goal is to create a policy where approximately 60-70% of your first-year premium becomes available as cash value, with this percentage increasing each year. By year 5-7, your cash value should approach or exceed your total premium paid.

The cash value within your policy is what powers your personal banking system. This grows in three ways:

This cash value is accessible through policy loans, which don’t remove money from your policy—instead, the insurance company lends you money using your cash value as collateral. Your cash value grows as if you never took the loan.

The most powerful aspect of this system is that it creates a pool of capital. Unlike traditional financing where your payments disappear, your repayments in this system increase your capacity to borrow again while building your legacy.

Moving from theory to practice, let’s explore how to implement your personal banking system. This approach will show you how to transform financial theory into a working system that can revolutionize your approach to money management.

The capitalization phase is critical to your success with personal banking. Here’s how to approach it:

Consistent Premium Payments Your banking system requires regular capital infusions through premium payments. View these not as expenses but as transfers of assets from one pocket (your checking account) to another (your policy’s cash value).

Sources of Funding Consider these sources to fund your policy:

Timing Considerations Many people choose to make a larger initial premium payment followed by smaller ongoing premiums. Others prefer equal payments throughout the year. Work with your advisor to determine the best funding schedule for your situation.

The Capitalization Phase The first 4-7 years represent your capitalization period when you’re building the foundation of your banking system. During this time, discipline and consistency are essential—avoid the temptation to underfund your policy or skip premium payments.

Once your policy is properly capitalized, you’re ready to begin the borrowing and repayment cycle that makes personal banking so powerful.

The Borrowing Process

Creating Your Repayment Schedule Unlike traditional loans with mandatory payment schedules, you determine your own repayment terms:

The most transformative aspect of personal banking is the ability to recapture interest that would normally flow to financial institutions.

How Interest Recapture Works When you borrow from a bank for a $30,000 car at 6% interest for 5 years, you’ll pay approximately $4,800 in interest. That money is gone forever—it becomes the bank’s profit.

With your personal banking system, you borrow $30,000 from your policy and repay it at the same rate. The key difference? That $4,800 now flows back to you, creating a larger pool for future borrowing.

The Compound Effect This recaptured interest creates a compounding effect that accelerates your wealth building. Think of a family that finances multiple cars, a home renovation, education expenses, and business investments over 30 years:

Beyond Interest The power of recaptured interest goes beyond the dollars paid. Because this money continues working for you, earning guaranteed returns and dividends, the impact is magnified over time.

By implementing this process of funding, borrowing, and repayment, you create a financial ecosystem that grows more powerful with each transaction. Rather than seeing your financial life as a series of isolated events (saving, borrowing, investing), the personal banking strategy integrates these activities into a system where each dollar serves multiple purposes at once.

While the mechanics of personal banking are compelling on their own, the strategy offers several advantages that make it even more powerful. These “hidden benefits” often become the most cherished aspects of the system for long-term practitioners.

In today’s uncertain tax environment, the tax benefits of properly structured whole life policies are more valuable:

This creates a flexible tax shelter that can be valuable in retirement when you want to control your taxable income levels.

In many states, life insurance enjoys special legal protections:

These protections have made whole life insurance a favored asset among physicians, business owners, and others in high-liability professions who need to protect their wealth.

While most financial vehicles offer either security OR growth potential, properly structured whole life policies provide:

This reliability creates a stable foundation that can weather economic storms while other investments may falter.

While the living benefits are substantial, the death benefit shouldn’t be overlooked:

Many practitioners view the death benefit as the system’s crowning feature—providing peace of mind that their financial strategy will benefit their loved ones regardless of when they pass away.

These benefits transform personal banking from an alternative financing method into a comprehensive financial strategy that addresses protection, growth, tax efficiency, and legacy in one cohesive system.

When discussing the personal banking strategy, several misconceptions emerge. Addressing these concerns can help clarify whether this approach might be right for your situation.

A common objection to whole life insurance comes from advocates of the “buy term and invest the difference” strategy. This approach suggests purchasing inexpensive term life insurance and investing the premium savings you’d have spent on whole life insurance.

In theory, this sounds compelling. Term insurance is initially less expensive, and market investments could outperform whole life returns. However, this argument overlooks several factors.

First, term insurance expires or becomes prohibitively expensive to maintain. If you outlive your term policy, you’ve paid premiums for decades with nothing to show for it. Whole life insurance becomes fully paid up eventually, providing coverage for your entire life with no additional premiums.

Second, the “invest the difference” portion frequently fails in practice. Studies show that average investors underperform the market due to emotional decision-making, poor timing, and inconsistent contributions. The disciplined structure of whole life premium payments creates forced savings that many people struggle to maintain in self-directed investment accounts.

Third, this argument typically compares apples to oranges by focusing solely on rate of return without accounting for the unique tax advantages, liquidity, and control aspects of properly structured whole life insurance. When all features are considered, the comparison becomes much more nuanced than return percentages.

Finally, the “buy term and invest the difference” approach treats insurance and investments as separate components rather than integrating them into a unified strategy. The personal banking approach creates efficiency by allowing the same dollars to serve multiple purposes.

Another common objection focuses on the initial cash value growth in whole life policies. Critics often point to the first few years when cash values may be less than premiums paid, suggesting this represents a poor “return on investment.”

This perspective misunderstands the nature of whole life insurance. The early policy years involve necessary costs, including underwriting expenses and agent compensation. These costs create a temporary efficiency gap that rapidly closes as the policy matures.

A properly structured banking policy minimizes this gap through the use of paid-up additions riders and other design elements that accelerate early cash value growth. While traditional whole life policies might show cash values of only 10-20% of first-year premiums, well-designed banking policies often show 60-70% or more.

Focusing exclusively on early cash values overlooks the long-term efficiency of the system. By years 7-12, cash values in properly designed policies typically exceed total premiums paid, and the growth curve steepens from that point forward.

The situation resembles building a house. The foundation and framing stages progress slowly relative to the resources invested, but they create the structure that makes everything else possible. Similarly, the early years of premium payments establish the foundation for your banking system that will serve you for decades to come.

The most common misconception is that personal banking using whole life insurance is only viable for the wealthy. This misunderstanding stems from historical perceptions of whole life insurance as a luxury product and from examples that feature large premium amounts.

In reality, this strategy scales effectively to various income levels. While wealthy individuals might fund policies with substantial premiums, the core mechanics work equally well with more modest funding. Many families successfully implement this approach with annual premiums in the $3,000-$10,000 range, well within reach of middle-income households that prioritize efficient financial management.

The key isn’t the absolute dollar amount but rather the consistent commitment to funding your policy over time. Starting with whatever premium fits your budget and gradually increasing it as your financial situation improves can build a robust banking system over time.

The benefits of this approach can be more meaningful for middle-income families than for the wealthy. Recapturing interest on routine purchases like vehicles, education expenses, and home improvements can improve a middle-class family’s financial trajectory, while the tax advantages provide efficiencies that help stretch limited resources further.

When examined without preconceptions, personal banking emerges as a flexible financial approach that can be tailored to diverse financial situations and objectives.

Is personal banking right for you? It’s a question we hear often, and the answer isn’t one-size-fits-all.

This strategy works beautifully for those who value financial independence, appreciate predictable growth, and have the patience to let their banking system develop over time. If you’re looking for overnight success or trying to beat the market with aggressive investments, this probably isn’t your path. But if you’re tired of enriching banks and want a financial approach that builds generational wealth, it deserves your consideration.

At McFie Insurance, we’ve watched countless clients experience that “lightbulb moment” when they grasp how becoming their own banker could transform their financial future. Our team spends time with prospective clients before any policy discussion begins, because we know that understanding precedes implementation.

Ready to explore further? Your first step should be scheduling a strategy session. During this conversation, we’ll discuss your financial goals, examine your current cash flow situation, and offer personalized insights about how personal banking might fit into your financial strategy.

When selecting a professional to guide you, look for someone who practices what they preach. At McFie Insurance, we have implemented these strategies in our own lives – we wouldn’t recommend anything to clients that we haven’t personally tested and benefited from over our 17 years in the field.

The right advisor will review your entire financial picture, design a custom policy that optimizes cash value growth for your situation, and provide ongoing support as you implement your banking system. They’ll help you navigate the complexities of policy design, ensure you avoid tax pitfalls, and teach you how to maximize the efficiency of your banking system over time.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.