702-660-7000

702-660-7000

According to Fidelity Investments, in order for your 401K to sustain you in your retirement you will need to have 8x your annual income saved by the time you reach age 67. To keep on track with your savings, you will need to have at least your annual income tucked away by age 35. By age 45 you should have tripled that figure and by age 55 you should have 5x your income saved up in your 401k, so that you will be able to reach that magical number of 8x your annual income by age 67.[i]

According to the Required Minimal Distributions (RMDs) mandated by law, building a 401k like this will become quite a tax liability for you in your retirement. If you can earn 8% on your 401K, then starting when you are 71 your RMD will be $70,424 and by age 89 your RMD will have risen to $244,000 annually.[ii]

The Tax Consequences of Deferring Taxes for Retirement Savings:

By age 89, when your RMDs have reached $244,000, along with your $42,648 annual Social Security Check, you’ll have a $286,648 annual income. But you will be paying $69,810 to Uncle Sam in income taxes because the 2017 tax rates are scheduled to return after 5 short years from the date of this writing.

In fact, deferring taxes to fund a 401k or IRA will increase your tax liability once you reach the age when RMDs are assigned to your account. And if you don’t pay those RMDs, then the government takes 50% of what your RMD was supposed to be as an excise tax.

So, if you max out your 401k beginning at age 35, as outlined in the chart above, realize that after you have lived 10 years paying your RMDs, you will have paid Uncle Sam more in taxes than you ever deferred in your entire working career by contributing to your 401k or IRA.

By the way, earning a higher rate of return in your 401k or IRA merely compounds the taxes you will be forced to pay with you start taking your RMDs. This means higher rates of return, higher yields and higher dividends are not the best way to save taxes or create a sustainable retirement.

How to save taxes on 401k and IRA savings:

Avoiding these taxes on your 401k or IRA savings plans can be a game changer for you. Here are some things to evaluate, if you want to save taxes on your retirement savings:

In answer to the first question, you must analyze the long-term results of saving in your IRA versus a 401K. In your 401k your employer should be matching at least part of your contributions. In your IRA you are the only one contributing to that tax differed savings plan.

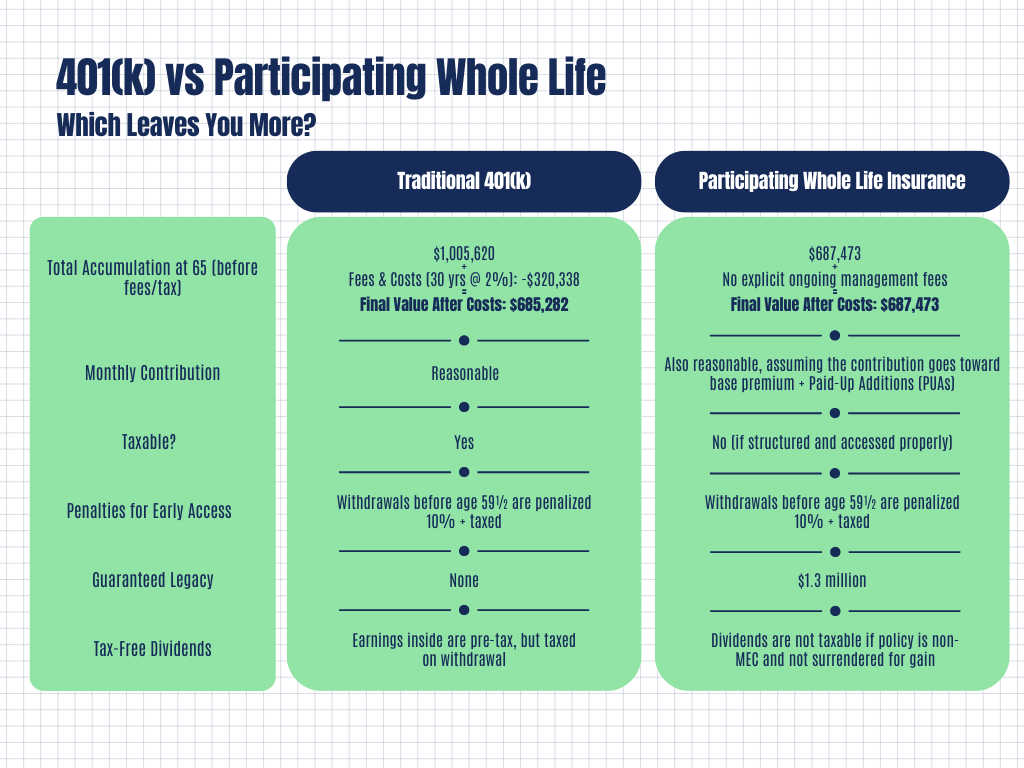

If you can earn 6% in your IRA, and you begin to fund it at $1,000 a month when you are 35 years old, then by age 65 you will have accumulated $1,005,620 without any fees or taxes. But all that money is not yours. With fees, penalties, management costs and trading transactions over those 30 years averaging out to be only 2%, you will merely have $685,282. And you will still face the taxes mentioned above on your RMDs from this tax differed savings plan.

Using the same $1,000 per month to purchase Participating Whole Life Insurance when you are 35 will produce $687,473 by age 65. But this money will never be subject to fees, management costs, trading transactions or taxes. And you can access the money, using it without penalties or restrictions along the way, and in your retirement have access to it all, tax free. In addition to that, you will also have a $1.3 million legacy to leave to your loved ones, or cherished cause, when you pass. (Read more about this type of retirement strategy for passive income here)

So, in answer to question number one and two above, yes, there is an alternative way and place where you can save for your retirement instead of using a tax deferred plan. However, if you are contributing to a 401k where your employer matches your contributions, then using the 401k plan might produce more money for you as the employer’s match can help you overcome some of the taxes and fees associated with contributing and taking distributions from a tax deferred savings account.

In answer to question number three, an example is in order.

For this example, assume you will end up paying $18,000 in taxes if you take distributions of $12,000 a year over the next 10 years from your 401k or IRA. If you are 60 years of age and can access the money in your IRA or 401k without paying the early access penalty, take distributions of $12,000 a year and purchase a Participating Whole Life Insurance Policy. By the end of year ten you will have guaranteed cash value of $125,567, and will never have to pay another premium on this policy for the rest of your life.

What Participating Whole Life Insurance Accomplishes for You:

So How Much Money Should You Have in Your 401k and IRA:

The answer to that depends. It depends on:

Your goal should always be to pay less in taxes. That way you get to keep more of what you make. Ed Slott puts it like this: “The less you pay, the more you keep—but to keep more and pay less, you have to plan, which almost nobody does. But regardless, tax free is always better.”[iii]

Once your money moves from being taxed, to being taxed later and finally to never being taxed again, you have won the tax game. It takes planning to move your tax differed money into a never taxed again account, but once you have accomplished this, all the compounding growth and tax-free accumulation is yours and will never face taxation again.

If you leave your money in your tax-differed account(s) like your 401k and IRA, you may still earn compounding growing, but you will always have to share whatever you save or earn in those accounts with Uncle Sam. As you have seen earlier on, that can be a huge portion of what you thought was yours to keep and use. Even more important though is, the faster and larger your compounding growth occurs after you retire, the more you will have to share with Uncle Sam once you start taking your RMDs. And that is what you need to plan for today, if you want to avoid giving Uncle Sam more than you give yourself or your loved ones.

Your taxes today (2019) are on sale until 2026. After 2026 your taxes will go up. How much they will increase, nobody knows for sure. But on December 31, 2025 the lower tax rates that are in effect today will expire, and tax rates will rise to at least the 2017 tax rate levels. So, paying your taxes earlier makes sense because, basically, taxes are on sale until January 1, 2026. If you pay the taxes today, you will pay less than if you pay them later, after the tax sale expires.

Is a Switch from Tax Deferred to Tax Free Right for You?

That would be a yes, only if you want to keep more money, and not pay so much in taxes. It would also be yes, if you desire to leave a greater tax-free legacy for your loved ones and/or a cherished cause, while still having the same amount, or more to spend while you are still living. These are the primary two reasons why switching from “taxed later to never taxed” would be the right choice for you.

But if you want to pay more money to Uncle Sam, switching from “taxed later to never taxed” is not something you need to take the time to plan for…it will just happen. And you will lose the money you could have saved for yourself.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.

[i] https://www.forbes.com/sites/baldwin/2013/11/27/nine-formulas-for-wealth-building/#58eaad4a28a0

[ii] https://www.schwab.com/ira/understand-iras/ira-calculators/rmd

[iii] https://www.thestreet.com/retirement/ira/roth-ira/how-to-pay-less-in-taxes-especially-in-retirement-14925761