702-660-7000

702-660-7000

“If I was counseling an individual, and my purpose was to help that individual, the most important thing would be that you should save more.” Says Robert J. Shiller, an American economist, Nobel Peace prize winner, academic professor at Yale University, and best-selling author.

Taking note from Professor Shiller, saving money is one of the most helpful pieces of financial advice for people at any age and any stage of life. Save. Save. Save. You might often hear people say you can never have enough money in savings. With retirement, emergency funds, future big purchases (like buying a home or car, education, and more) it can be hard to measure how much saved money you’ll need for all of life’s needs and wants.

In this article, we’ll talk about the “savings by age” philosophy, common life events you’ll want to save for, and explain the best way to accrue these savings while making your money work for you.

First, it’s important to note that there is no “one size fits all” plan when it comes to saving money. Saving money and savings goals are subjective to an individual’s lifestyle – things like income, renting vs. owning, spending costs, family size, etc all have a play in the age-old question “how much money should I have saved”. However, there are some guidelines you can follow for saving money throughout the course of your lifetime.

The most common life event people tend to save for is retirement. There are many different calculations and estimations out there that claim they can tell you how much you should save before retiring. But in reality, this is practically impossible, due to inflation which is constantly changing, unpredictable life events, and different growth rates on savings plans.

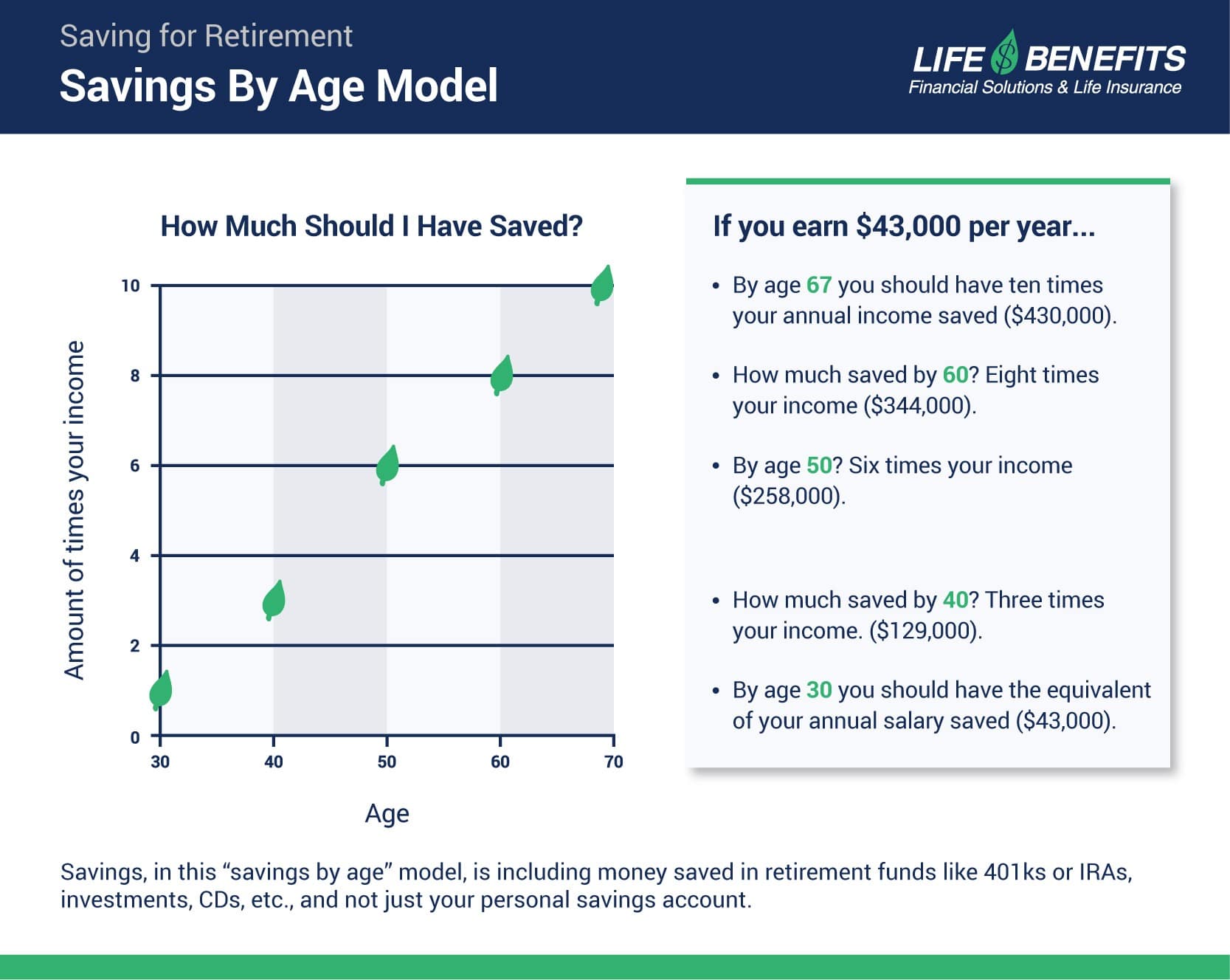

Planning for retirement can be a tricky game. Many financial institutions like to use the “savings by age” benchmark as an easy way to project a savings amount for people asking “how much money should I have saved”. The “savings by age” benchmark multiplies your income amount by a certain number, depending on your age to suggest how much you should have in savings. Here is an example of some recommended numbers using the “savings by age” benchmark:

Savings, in this “savings by age” model, is including money saved in retirement funds like 401ks or IRAs, investments, CDs, etc., and not just your personal savings account. Keep in mind, depending on where your money is saved, you may have to pay taxes on your money and there may be certain limitations and regulations you must follow in order to access your savings.

As with anything, you should ask yourself “does this make sense”? In this example of “savings by age”, your annual income if you retired at age 67, and lived for another 20 years, would be $21,500 per year or $1,791 per month. This is half the annual income you earned during your working career. When you take into consideration the average cost of assisted living which is about $4,000 per month, the realisticness of this savings benchmark plan is highly questionable.

For more on saving money for retirement, view our articles on Roth IRA vs. 401k and 5 Critical Things to Include in your Retirement Planning.

As mentioned earlier, saving for retirement isn’t the only thing you should be saving for. As the saying goes, “life happens.” It’s important to have a part of your savings set aside for all those instances when unexpected life events or emergencies happen because they most likely will at some point.

Ideally, your emergency savings account should have three to six months worth of expenses in a place that is easy to access. You can use a bank account, a can in your freezer or, if you want the money you keep to grow, you can use participating whole life insurance (more on this later). This number may fluctuate based on your age and the average expenses you incur. For example, given the average millennial spends approximately $4,800 per month, the ideal savings amount for someone in that age range would be three to six times this amount, or $14,400 to $28,800 per year.

To calculate the ideal amount you should have in emergency savings, create a budget that shows your average monthly expenses and multiply that monthly average by at least three to get your recommended emergency savings amount.

In addition to saving for retirement and emergencies, it’s also important to consider your life goals and make sure you incorporate them into your savings plan. Do you want to own a house in the future? Are you planning on having kids and sending them to college? Maybe you’re wanting to go on periodic vacations? All these goals are important to keep in mind when asking yourself “how much money should I save?”

While it’s hard to blanket estimate savings needed for these goals, doing your own research, prioritizing your goals, and considering your age and the timeline in which you plan to accomplish your goals, will help you get a better idea of additional savings you’ll need to have for the future. To get an idea of what some common future savings could look like, check out the chart below.

Have you ever heard people talk about how they are avid savers? Often these people will put the money they save into plans where they can’t access it. They do this because they want their savings to grow and the only alternative they know is to keep it in a place where they can access it. But their money hardly grows at all, or worse, it doesn’t grow at all! Most people don’t know that you can save your money, earn growth on your savings and still have access to that money? This is where The Perpetual Wealth Code comes into play.

Many people think of savings as investments. But saving in investments like a 401k or IRAs, often leaves your money tied up in accounts where it’s inaccessible or you are heavily penalized if you do access it for most of your lifetime. The Perpetual Wealth Code eliminates these issues and helps you become a wise money manager and grow your wealth while you continue to save.

There are three key points to the Perpetual Wealth Code:

Something else that is important to consider when saving is where to save. As mentioned earlier you want your savings to be in a place where you have access to them and where they grow tax-deferred.

That’s why using participating whole life insurance as a place to keep your savings makes a lot of sense. Here’s why:

With this method of savings, your money is working for you allowing you more freedom and flexibility to live your life and meet your savings goals, take care of emergencies that may happen, and eventually fund your retirement. Additionally, participating whole life insurance offers another bonus…a legacy by means of the death benefit which can provide more freedom and flexibility for your children as they live their lives and raise your grandchildren.

If you’re interested in learning more about growing your savings in a wise and profitable way, schedule a free strategy session with a member of the McFie Insuranceteam. During this time we’ll design a policy for you that aligns with your savings plan of how much money you want to keep and how much money you can afford to save.