702-660-7000

702-660-7000

As young adults venturing into the world of personal finance, it’s essential to grasp the ins and outs of one of the most common financial tools at our disposal: the debit card. This small piece of plastic carries significant weight in our daily transactions, acting as a bridge between our bank accounts and the goods and services we desire. Let’s explore how debit cards work and why they matter to you.

A debit card is a payment card that allows you to access the money in your checking account directly. Think of it as an electronic version of your checkbook, but far more convenient and widely accepted. When you use a debit card, you’re essentially telling the merchant, “Hey, take this amount from my bank account right now.”

When you swipe, insert, or tap your debit card at a point of sale, you’re initiating a complex but lightning-fast process:

This entire process typically takes just seconds, allowing for quick and seamless purchases.

Debit cards offer two main types of transactions:

Both methods are secure, but PIN-based transactions are generally considered more secure as they require a code only you should know.

One handy feature of debit cards is the ability to get cash back during a purchase at many retailers. This means you can make a purchase and withdraw cash from your account in one transaction, saving you a trip to the ATM. For example, if you’re buying groceries for $50 and need $20 in cash, you can ask for cash back, and the total transaction will be $70, with $50 going to the store and $20 in cash handed to you.

Some banks require a minimum balance or a certain number of debit card transactions per month to waive account maintenance fees. This is where understanding your bank’s policies becomes important. For instance, your bank might waive a $12 monthly fee if you maintain a $1,500 minimum daily balance or make at least 10 debit card purchases per month.

It’s worth noting that these requirements can sometimes influence your spending habits. You might find yourself making small, unnecessary purchases just to meet the transaction quota. Always be aware of your bank’s policies and how they align with your financial habits.

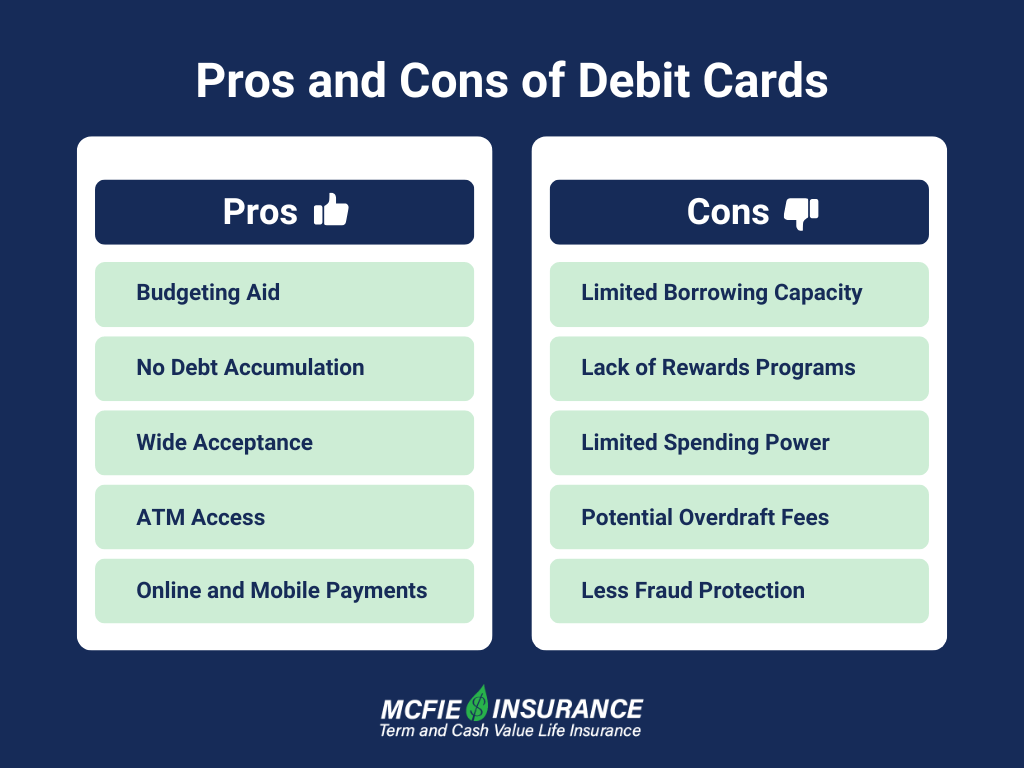

While debit cards offer convenience and direct access to your funds, they do come with some limitations:

Unlike credit cards, debit cards don’t allow you to borrow money. You’re restricted to the funds available in your linked checking account. This can be a double-edged sword. On one hand, it prevents you from accumulating debt. On the other, it might limit your purchasing power in emergencies or when making large purchases.

For example, imagine you’re buying textbooks for the semester, and the total comes to $500. If you only have $400 in your checking account, your debit card transaction will be declined, even if you have the remaining $100 in a savings account.

Most debit cards don’t offer the enticing rewards programs that many credit cards do. You won’t earn points, miles, or cashback on your purchases. This means you’re missing out on potential benefits for money you’re spending anyway.

Your spending is restricted to the balance in your checking account. This can be problematic if your funds are split between different accounts. Let’s say you have $1,000 total, but it’s divided between your checking ($600) and savings ($400) accounts. If you need to make an $800 purchase, your debit card (linked to checking) would be declined, even though you have enough money overall.

If you accidentally spend more than you have in your account, you might incur overdraft fees. These can be substantial, often around $35 per transaction. Some banks offer overdraft protection, but this usually comes with its own fees or requires linking to a savings account or credit line.

While debit cards do offer some fraud protection, it’s generally not as robust as what credit cards provide. If someone fraudulently uses your debit card, the money is taken directly from your account. Even if you report it quickly, it can take time for your bank to investigate and refund the money, potentially leaving you short on funds in the meantime.

Despite these drawbacks, debit cards offer several advantages that make them a valuable financial tool:

Debit cards can help you stick to a budget because you can only spend money you actually have. This can prevent overspending and help you develop good financial habits.

Unlike credit cards, debit cards don’t allow you to spend money you don’t have. This eliminates the risk of accumulating high-interest debt.

Debit cards are accepted at most places that take credit cards, giving you the convenience of plastic without the risk of debt.

Your debit card doubles as an ATM card, allowing you to withdraw cash when needed.

Many debit cards can be used for online purchases and mobile payments, adding to their convenience.

To maximize the benefits of your debit card while minimizing potential drawbacks, consider these tips:

As you navigate the world of personal finance, remember that tools like debit cards are just that – tools. They’re not inherently good or bad; their value depends on how you use them. By understanding how debit cards work and their place in your financial toolkit, you’re taking an important step toward financial literacy and independence.

Each decision, no matter how small, contributes to the larger picture of your financial well-being.

As you continue on your financial journey, keep learning, stay curious, and don’t be afraid to ask questions. Remember, everyone starts somewhere, and with desire, determination, and discipline, you can master the art of personal finance. Your debit card is just one chapter in the story of your financial life – make it a good one!

by Gracine McFie

by Gracine McFie

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable.