317-912-1000

317-912-1000

While banks create money through credit expansion and drive economic instability, participating whole life insurance offers individuals a way to become their own bank, providing guaranteed growth, protection from inflation, and freedom from the boom-bust cycles that have plagued our economy for over a century.

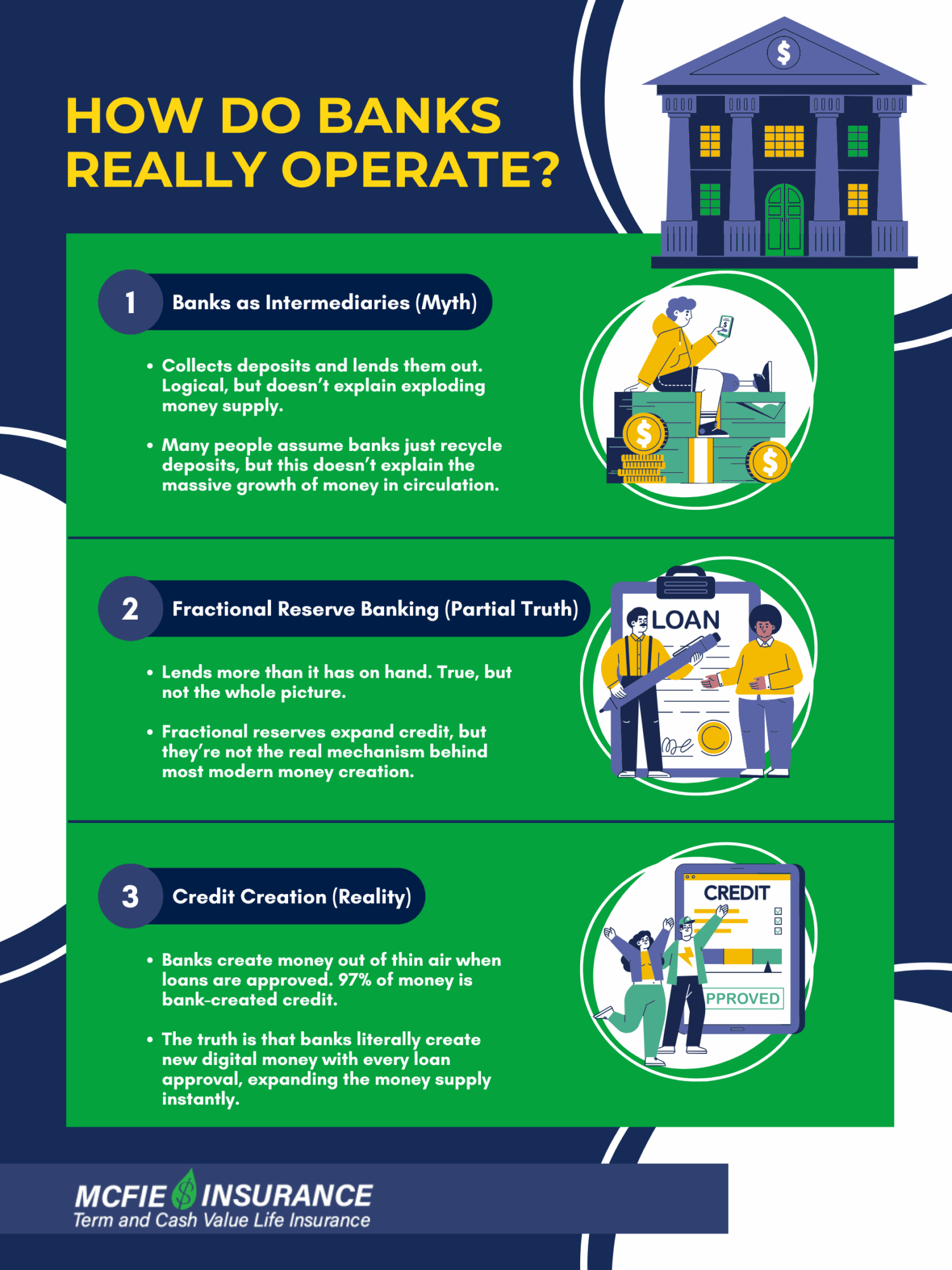

Most people hold one of three beliefs about how banks operate, but only one tells the complete story that affects your financial future.

Theory 1: Banks as Simple Intermediaries

Many believe banks simply collect deposits and lend them out to borrowers, making profit on the interest rate spread. This sounds logical but doesn’t explain how the money supply has exploded over the past century.

Theory 2: Fractional Reserve Banking

Others understand that banks lend out more money than they actually hold in deposits, knowing that not all depositors will withdraw their funds at once. This allows banks to “leverage” their deposits and create additional lending capacity.

Theory 3: Credit Creation (The Reality)

The truth that few understand is that banks actually create new money when they approve loans. This isn’t theory—it’s documented fact. When a bank approves your mortgage, they don’t transfer existing deposits to the seller. They create new digital money with keystrokes, expanding the money supply instantly.

Today’s sobering reality: 97% of our money supply consists of credit created by banks, while only 3% is actual paper currency.

This power to create money out of thin air has consequences for every American family. The direction of newly created credit determines whether we experience inflation, asset bubbles, or economic growth:

Consumer Credit = Price Inflation

When banks flood the economy with credit for consumption and everyday purchases, prices soar across the board. We witnessed this during the COVID-19 pandemic when money creation reached unprecedented levels, leading to the highest inflation rates in decades.

Asset Credit = Dangerous Bubbles

When credit flows mainly into real estate, stocks, and other assets, it inflates bubble markets that eventually crash. The 2008-2009 financial crisis perfectly illustrates this pattern, when banks extended credit almost indiscriminately for home purchases.

Productive Credit = Economic Growth

Only when credit finances construction, manufacturing, farming, and other production does the economy grow sustainably without creating inflation or bubbles.

Unfortunately, banks haven’t been discriminating about where they direct credit, leading to a century of boom-bust cycles.

Since the Federal Reserve System began operations in 1913—supposedly to provide monetary stability—the United States has experienced:

Perhaps most telling of all: In 1913, the lower and middle classes owned 60% of America’s wealth. Today, they own just 8%.

This dramatic wealth transfer is the predictable result of a monetary system that benefits those with first access to newly created credit while eroding the purchasing power of everyone else’s savings and wages.

While we can’t control the banking system, we can opt out of its wealth-transfer mechanism through participating whole life insurance designed for the Infinite Banking Concept.

Unlike banks, life insurance companies can’t create money from thin air. When they make policy loans, they can only lend money they actually possess. This difference means:

When you take a loan against your participating whole life policy, you’re accessing the insurance company’s money while your own money continues to grow at guaranteed rates. This creates several powerful advantages:

Inflation Protection: Your policy’s guaranteed growth plus dividends typically outpaces inflation over time, protecting your purchasing power even when banks are debasing the currency.

Recession Resilience: While bank credit tightens during economic downturns, your policy loans remain available at contractual rates, providing financial flexibility when others face restricted access to capital.

Wealth Recovery: Unlike traditional loans that transfer your wealth to banks, policy loans allow you to recover the cost of major purchases while retaining the growth your policy provides.

Interest Rate Independence: You can access capital for investments or major purchases even when banks raise rates to combat their own inflation-creating policies.

Participating whole life insurance has been used as a personal banking system for over 100 years. Consider these applications:

Business Financing: Fund equipment purchases, inventory, or expansion without depending on bank credit approval or economic cycles.

Real Estate Investment: Access down payment funds even when banks tighten lending standards during market uncertainty.

Education Funding: Finance children’s education without subjecting your family to variable interest rates or changing loan programs.

Retirement Income: Create a reliable income stream that doesn’t depend on volatile markets or government policy changes.

Emergency Capital: Maintain liquidity for unexpected opportunities or challenges without liquidating other investments.

The Infinite Banking Concept, pioneered by R. Nelson Nash in the 1980s, transforms participating whole life insurance into a comprehensive financial strategy. The “infinite” nature comes from the unlimited ways you can use your policy’s financial mechanisms:

Not all life insurance policies work effectively for the Infinite Banking Concept. The key is working with specialists who understand how to:

The banking system’s primary function appears to be transferring wealth from working families to financial elites. While this system operates beyond individual control, you can protect your family’s financial future through participating whole life insurance.

The choice is clear: Continue participating in a monetary system designed to erode your wealth, or create your own family banking system that protects and grows your capital regardless of economic conditions.

If you haven’t already established participating whole life insurance designed for the Infinite Banking Concept, now is the time to explore this proven wealth-building strategy. In an environment of monetary uncertainty and systematic wealth transfer, becoming your own bank is smart financial planning that’s essential for preserving your family’s economic independence.

The banking system will continue creating money, driving inflation, and generating boom-bust cycles. The question isn’t whether these patterns will continue, but whether you’ll be protected when they do.

Ready to learn how participating whole life insurance can protect your family from banking system instability? Contact us today to discover how the Infinite Banking Concept can work for your situation.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.