702-660-7000

702-660-7000

Purchasing high cash value life insurance for the purpose of “Becoming Your Own Banker”, which R. Nelson Nash christened The Infinite Banking Concept (IBC), has been marketed by many agents just to sell more life insurance with little regard to the need of building the high cash values required to implement IBC.

Nash explicitly states in his book that whole life insurance is the product which provides the guarantees for IBC to work. Furthermore, the whole life insurance used needs to be a participating contract so the policyholder will be eligible to earn dividends the life insurance company pays to policyholders. This is critical if the policyholder wants to keep more of the interest lost to the cost of finance. Without dividends, 100% of interest paid will be lost to the insurance company just like with traditional loans. With dividends, much if not all the interest lost or paid when financing can be recovered. Of course, everything purchased is financed. One either gives up interest they could have earned on their money when they pay cash, or they use someone else’s money and end up paying interest to that somebody else.

But beyond these basics, each whole life insurance policy purchased for implementing IBC must have the highest premium possible, with the lowest death benefit possible and the maximum cash value possible! As simple as these guidelines are, many policyholders have been, and continue to be, deceived or misinformed and end up purchasing whole life policy(s) which do NOT match up to Nash’s criteria for use in “Becoming Your Own Bank”.

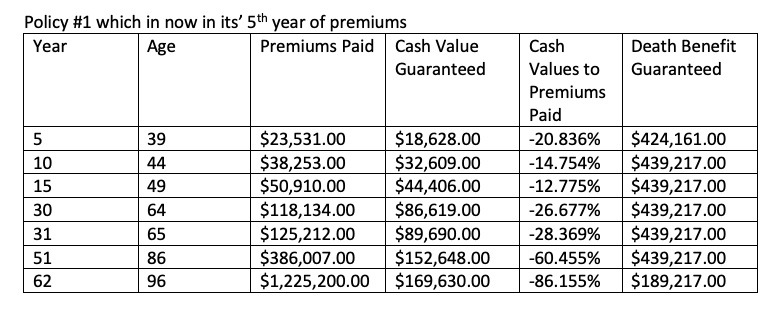

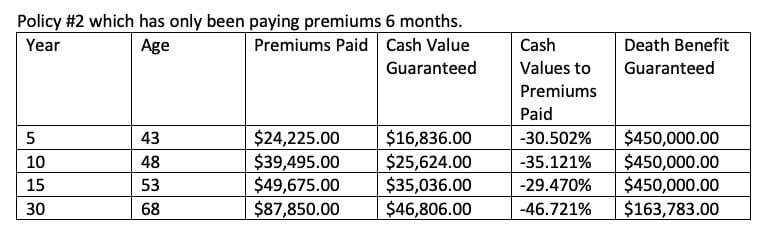

Recently, a policyholder called our office for a policy review on a couple of policies which he had purchased through another agent. Here is a snapshot of what these two policies looked like.

Both of these policies paid large first year premiums, nearly 80% more than needed, compared to the premiums in years 2-121. Yet, the cash values in both policies NEVER exceed the total cost of premiums! Furthermore, in policy #1, premiums paid by age 96 are 84.556% more than what will ever be paid out in a death benefit claim.

It is obvious that neither one of these policies were designed for IBC even though the agent who sold them said they were. The policyholder came to us when he realized he will never have more cash value than what he has been required to pay in premiums. Unfortunately, these policies where both designed for the highest premium to be paid in year one because the agent selling these policies earned a higher commission, as agents earn the majority of their commissions in the first year a policy is sold.

Whole life insurance policies designed for IBC would NEVER have guaranteed cash values which perpetually are LESS than total premiums paid. Instead, there would be a specific date in the contract where the cash values would be guaranteed to exceed the cost of premiums. On top of this, dividends paid by the insurance company to the policyholder would add to these guarantees each and every time dividends were paid.

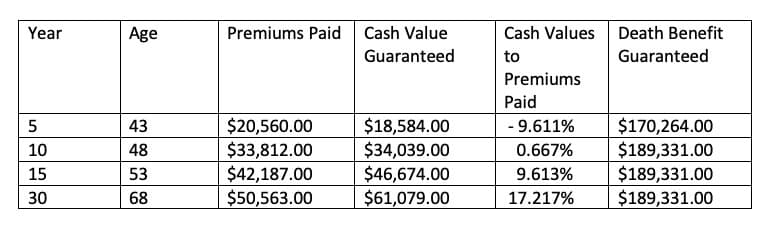

In this case, by lowering the death benefit to comply with Nelson Nash’s IBC guidelines on how to design a whole life policy, we can get something that looks like the following:

In this policy illustration, designed to implement IBC, there is more cash value than what has been paid in premiums by year 10. And by year 30 there is 17.217% more guaranteed cash value than premiums paid and 73.294% more death benefit than what has been paid in premiums.

Just remember, you want the highest premium possible, which you can afford, with the lowest death benefit possible because the death benefit will grow over time, along with the maximum cash value possible in the policy right from the very start of a new policy. If you can combine all three of these things together, while complying with the modified endowment contract stipulations the IRS has outlined, you will be off to a great start. You will indeed have a whole life policy which will serve you well as you begin to finance the things you purchase in life using policy loans, instead of losing the interest you would normally pay to others.

IBC is a way of life. You must use it, or you will lose it. Without using IBC, you will continue to lose interest or pay interest to others for the rest of your life. At McFie Insurance we specialize in helping people keep more of the money they make by designing, selling and servicing whole life insurance policies. But we go beyond this! We mentor our policyholders so they can maximize the use of their policies and build the sustainable wealth they need for their future.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Most Americans depend on Social Security for retirement income. Even when people think they’re saving money, taxes, fees, investment losses and market volatility take most of their money away. Tom McFie is the founder of McFie Insurance which helps people keep more of the money they make, so they can have financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.