317-912-1000

317-912-1000

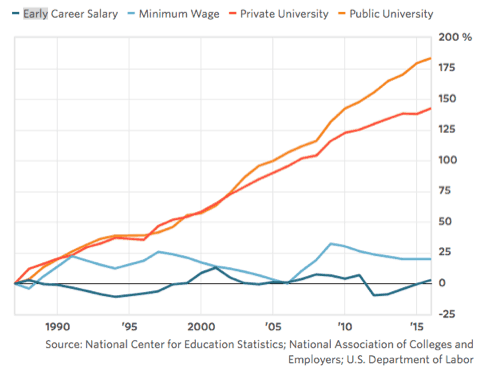

Attending a university or college used to provide a path to a better income. But “In 1987-1988 the average four-year universities and colleges were charging $3,190 a year for tuition. Today, with prices adjusted to reflect 2017 dollars, that average cost has risen to $9,970 a year. Which is a 212.5 percent increase.”[i]

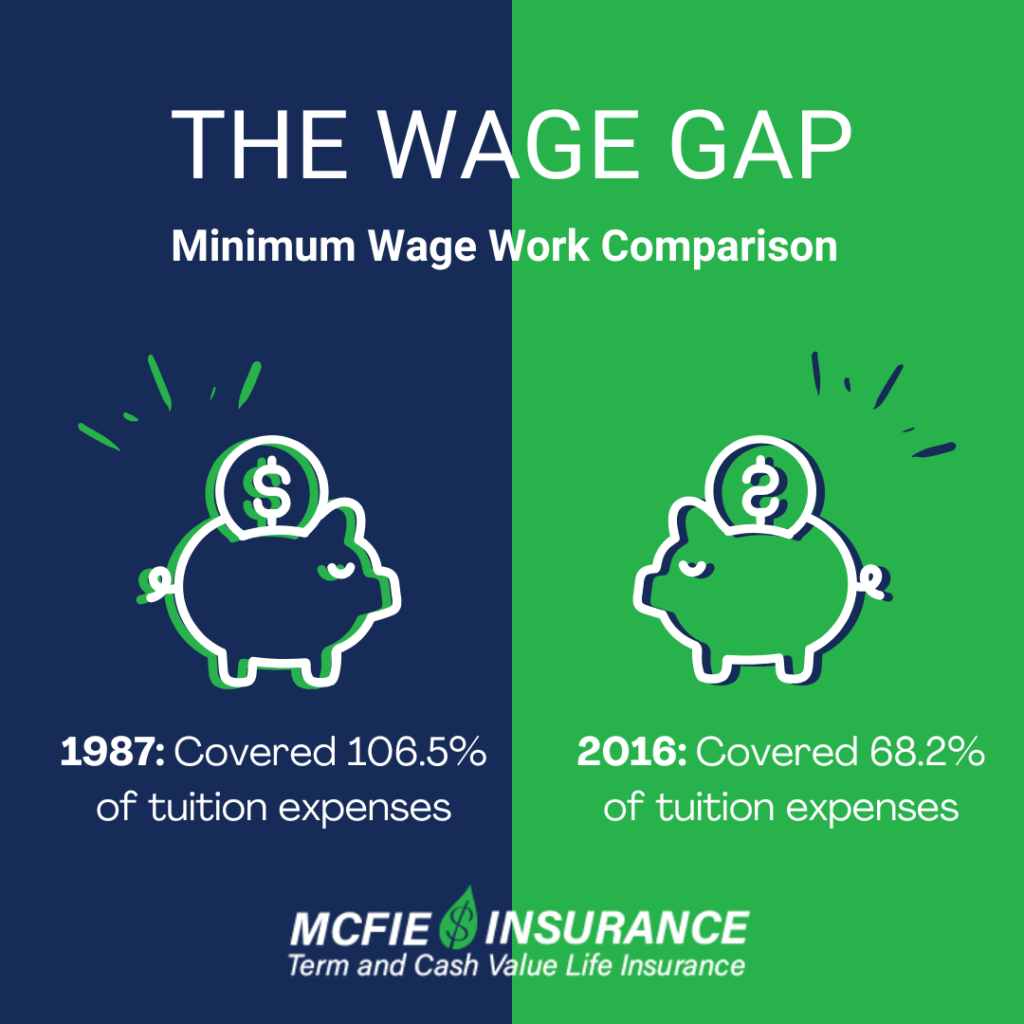

But the killer is, wages have not increased by 212.5 percent. For example, a student working a part-time job earning minimum wage could pay for 106.5% of their college expenses in 1987 while a student working a part-time job earning minimum wage in 2016 would only have been able to pay for 68.2% of their college expenses.”[ii]

Back in 1987–1988, it was still possible for a college student to graduate without a mountain of debt. Tuition was relatively affordable, and many students could cover the cost of their education through part-time jobs, summer work, or modest family support. As a result, graduates were often able to transition directly into the workforce with a clean financial slate. More importantly, they had the ability to begin saving for retirement immediately—giving them a head start in building long-term financial security.

Fast forward to today, and the picture looks very different. While many students still work during their college years, the cost of higher education has far outpaced wage growth. This means that despite their efforts, a significant number of graduates finish school saddled with student loan debt. That debt can be a heavy burden, especially during the early stages of a career when income is at its lowest.

So even if today’s graduate lands a job right after college, their ability to save is often severely compromised. A large portion of their income has to go toward loan repayment, rent, and other living expenses. This delays their ability to invest, save for retirement, or build financial resilience. In contrast to previous generations, the path to financial independence has become longer and steeper for many young adults—largely due to the debt incurred just to gain the education that’s now considered a basic requirement for entry into the professional workforce.

It’s clear that the cost of college tuition has risen over the past few decades, outpacing the growth of wages. While incomes for most working Americans have remained relatively stagnant, the price of higher education has skyrocketed. This growing imbalance has created a widening gap between what students can realistically earn and what they are expected to pay for a college degree.

Before 1987, it was more feasible for students to cover educational expenses through part-time work, modest loans, or family assistance. Today, even those working multiple jobs during school often find themselves graduating with debt. This financial strain is not just a short-term hurdle—it can have long-lasting implications.

The harsh reality is that these soaring costs have eroded the saving power of many college graduates. Instead of using their early earnings to build a safety net, invest, or buy a home, they’re often forced to direct much of their income toward repaying student loans. As a result, they’re delayed—or in some cases, completely blocked—from pursuing the traditional milestones of financial success.

Without the ability to save and invest early, many young adults are finding the American Dream increasingly out of reach. The promise of a bright financial future, once considered the reward for higher education, is now harder to realize than ever before.

Furthermore, as baby boomers retire at the rate of over 10,000 per day, these lower wages and lack of savings becomes a greater and greater liability to college graduates. That is because the taxes required to pay for the ever-increasing cost of the Boomer’s retirement, will have to come out of their pocket. In fact, it has been shown that the cost of Medicare and Medicaid alone will nearly double for a Boomer over what it is today.[iii] According to the US Census Bureau, there are 74 million baby boomers in America. So, who will provide the money needed for these 74 million Boomers Millennials as “it will take until 2028 before Millennials outnumber the Boomer population?”[iv] Especially since Millennials are not earning or saving the money necessary for these future expenses.

Of course, the answer lies not in new government regulation but in deregulation, much like President Trump is delivering. Deregulation will allow a path for full employment to occur once again in America. Once full employment is attained, then wages will naturally rise as workers will again have the leverage necessary to demand higher wages for their skills. These higher wages will increase taxes collected and those taxes will help supply the need required for the Boomers.

Naturally, skilled workers will be the ones who will fill the demand for those higher paying jobs and occupations more readily than mere college graduates. That is because college and universities are not necessarily equipped to teach these skills but have become indulgent by offering degrees and studies which neither develop new skills nor sharpen old ones.

Which brings up another point and that is, 529 college savings plans. Under these circumstance, these government sanctioned savings plans may not be the best method of saving for your child’s future education. Not all education takes place in a classroom and 529 plans are limited, without taxation, to be used for college tuition. Thus, your 529 savings plan may or may not benefit your child who is desirous of developing greater or new skills and not necessarily a college degree. Perhaps a better option would be to park your money in a participating whole life insurance policy so that the cash values will be available for any pursuit your child may have, not limited to merely college or university tuition.

That is because, until wages begin to rise, time spent in college or universities may be more of a hazard to your child’s overall financial well-being. Humbly learning and sharpening the skills that will give your child ready access to those higher wages may be the better opportunity.

College and a university degree can be beneficial for certain professional occupations but always consider the cost versus the risk. Realize that a degree can be earned anytime in the future, but the cost of lost wages and debt incurred are difficult obstacles to overcome once they have begun to compound against you.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.

[i] CNBC Money, Here’s how much more expensive it is for you to go to college than it was for you parents. November, 29, 2017

[ii] https://www.marketwatch.com/graphics/college-debt-now-and-then/

[iii]https://www.google.com/search?q=cost+of+baby+boomers+retirment&oq=cost+of+baby+boomers+retirment&aqs=chrome..69i57.6726j0j7&sourceid=chrome&ie=UTF-8

[iv]https://www.google.com/search?q=cost+of+baby+boomers+retirment&oq=cost+of+baby+boomers+retirment&aqs=chrome..69i57.6726j0j7&sourceid=chrome&ie=UTF-8