317-912-1000

317-912-1000

Investors have several options for purchasing real estate to earn a profit. If you’re interested in acquiring rental properties, commercial buildings, or fix-and-flip real estate, there’s a suitable investment strategy for you. Today, we will explore fix-and-flip real estate and explain how investors can rapidly generate profits through this approach.

You’ve probably heard the term “fixer-upper” to describe homes that are outdated, damaged, or simply in need of some TLC. The fix and flip real estate strategy centers around purchasing these types of properties at a discounted price, investing in renovations, and then reselling them for a profit—ideally within a relatively short timeframe.

For most investors and the lenders who finance these projects, the target is to complete the renovation and sale within 12 months. That said, many lenders understand that real estate doesn’t always move according to plan, and they are often willing to extend loan terms if more time is needed to finish the project or close a sale.

The success of a fix and flip venture depends on several elements. First and foremost, setting a realistic budget—and sticking to it—is essential. Equally important is selecting the right property: one that has the potential to be sold at or above market value after improvements are made. A thorough and well-thought-out renovation plan is also key, not only for staying on budget but for keeping the project timeline on track.

If you’re intrigued by the fix and flip model but unsure how to get started, it’s important to understand that success begins with preparation. From researching your local market to securing financing and building a reliable team, there are a series of strategic steps you’ll need to take to give your investment the best chance of delivering a solid return.

|

An easy read and a perfect introduction to whole life insurance and The Perpetual Wealth Code™ Available in eBook or Audiobook format. Download here> |

Like any investment strategy, fixing and flipping real estate comes with its own set of advantages and disadvantages. If you’re interested in exploring the pros and cons of fixer-uppers, continue reading as we delve into them below.

Pros of Fix and Flips

Fixing and flipping properties remains one of the most accessible ways to break into the real estate market, even though it comes with its own set of challenges. While there is a learning curve, this strategy gives aspiring investors the chance to dive in and gain hands-on experience from the very beginning. It requires in-depth research, investment of time, and a willingness to put in real work—but the rewards can be well worth the effort.

One of the most appealing aspects of fix and flip investing is the opportunity for relatively quick profits. Unlike buy-and-hold strategies that often take years to produce meaningful returns, flipping homes can generate substantial income in a much shorter timeframe—sometimes within just a few months. This makes it an attractive option for those who want to see faster results from their real estate investments.

Another benefit is the high level of flexibility that fix and flip projects offer. These deals can be shaped around your personal budget, investment goals, timeline, and level of experience. Whether you’re a seasoned contractor who wants to take on every detail yourself or a beginner who prefers to outsource the renovation work, there’s room to tailor the approach to match your preferences and capabilities. This adaptability makes the fix and flip strategy a valuable and versatile entry point into real estate investing.

Cons of Fix and Flips

Going over your budget can significantly affect your success with a fix and flip property. Exceeding the budget cuts directly into your profits, making strict financial control crucial.

Fix and flip properties generally offer fewer tax advantages compared to other real estate investments. These benefits typically become available only if you convert the property into a rental.

Additionally, fix and flip investments are extremely time-consuming. Even if you employ independent contractors, you still need to oversee the project and ensure that it stays within budget. This involvement demands a significant time commitment.

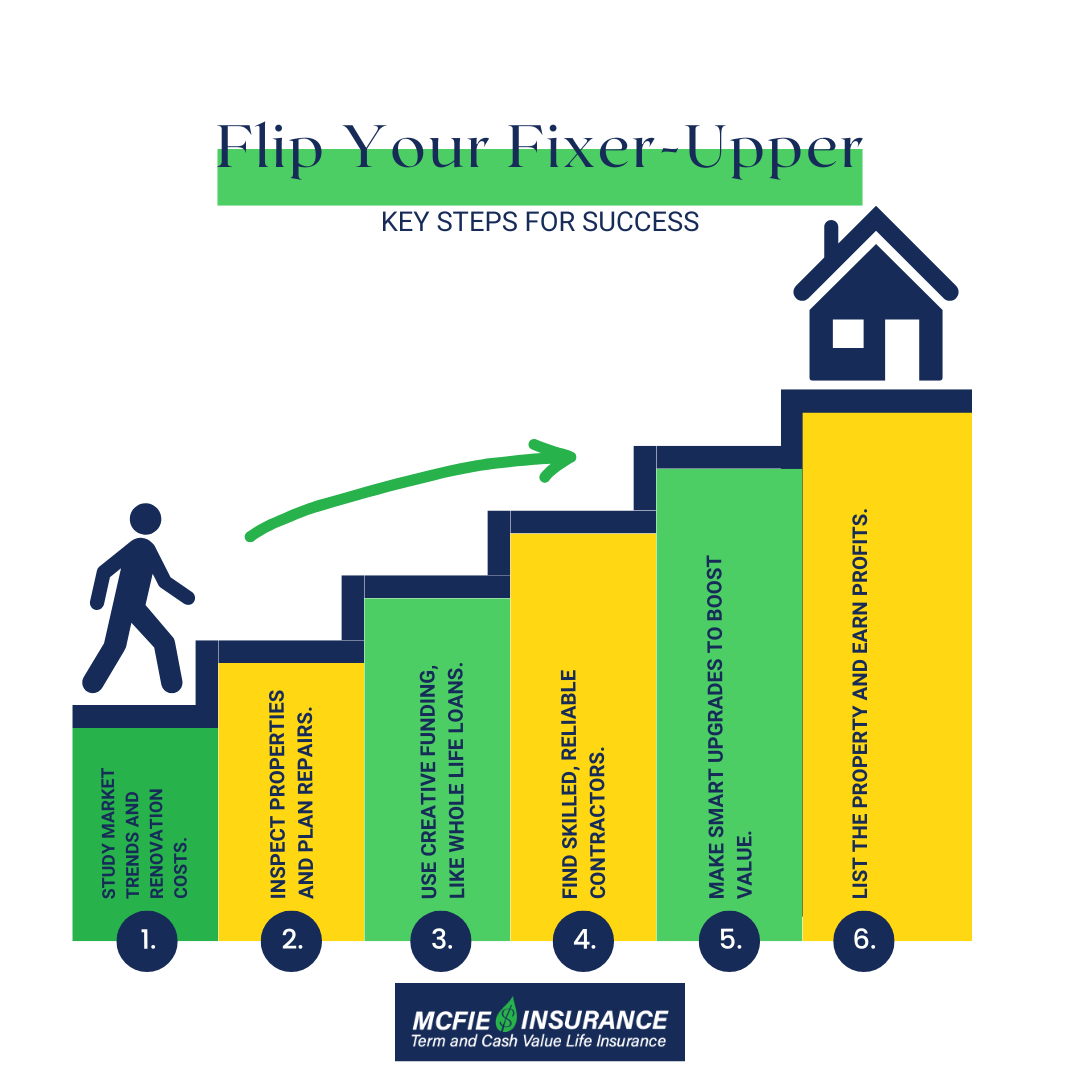

Repairing damaged real estate demands substantial time, effort, and financial investment. Therefore, it’s crucial for investors to undertake the following steps before committing to a fix and flip real estate purchase.

1. Research the Market You Intend To Buy

The first step in any real estate investment is market research. Before selecting a fix and flip property, you need to analyze the market in the community where you plan to invest. Initially, you must assess the profitability of a fixer-upper and learn how to identify a favorable property deal.

Investors also need to understand the typical duration required to fix and flip a property and fully grasp the associated renovation costs. With this information, you may want to create a comprehensive business plan to document your expectations and budget timelines.

2. Find The Best Suited Property

Next, with a solid business plan in place, it’s time to select a suitable property to purchase. You can find a property through a real estate agent or by searching on your own. Regardless of the method, it’s crucial to thoroughly inspect every aspect of the property.

Consider the potential risks, benefits, profitability, location, and local competition. Additionally, before purchasing the real estate, ensure that you walk through the property to identify the types of repairs it will require.

3. Figure Out Financing And Consider Whole Life Insurance

Once you’ve identified a property to purchase, the next step is to secure financing. You don’t need a large sum of cash on hand to acquire real estate. There are several financing options available. For instance, you could approach private money lenders or use equity from other properties to secure a home equity loan.

However, it’s important to note that most fix and flip properties do not qualify for traditional mortgage loans. Because they are considered riskier than conventional properties, financing fix and flip real estate can be more challenging.

This is where leveraging money from a Whole Life insurance policy can be extremely beneficial. Unlike traditional mortgage loans, where the property would need to qualify before the mortgage company will lend, there is no qualification process for loans against Whole Life insurance. You can borrow for anything at any time and…it’s an interest only loan!

4. Hire Contractors to Help If You Don’t Have The Time Or Skills

Once you’ve acquired your property, the next step is to determine the necessary repairs. Start by listing the repairs that are essential, cost-effective, and will add value to the property. Then, proceed to hire contractors to execute these repairs.

Finding a high-quality contractor is vital for a successful fix and flip project. Rather than choosing contractors based solely on the lowest bids, consider their references, testimonials, and qualifications. If you’re uncertain about how to find a reliable contractor, ask for referrals from other investors. Craigslist and Angie’s List can also be helpful tools.

5. Make The Necessary Renovations to the Property

The most challenging part of property renovation is staying within your allocated budget. During the renovation phase, investors have the flexibility to be as hands-on or hands-off as they prefer. If you opt for a more hands-on approach, you can assist contractors with the renovations.

If you prefer to let your independent contractors handle the repairs and renovations, that is entirely acceptable. The key priority in the renovation process is to ensure that you do not exceed your budget.

6. Stage and Sell (or Rent) Your Property

Once your contractors have completed all the necessary repairs and renovations, it’s time to decide whether to stage, sell, or rent the property. To maximize its appeal, it’s crucial to clean and stage the property effectively. If you are an established landlord and require assistance managing your properties, contacting a local property management company might be beneficial.

If your goal is to sell the property and realize a profit quickly, it is important to take professional photos and list it at a fair market price. Alternatively, if you prefer to become a landlord and rent out your property, you should list it at a reasonable price and emphasize the benefits of renting to potential tenants.

Leveraging whole life insurance to invest in fix-and-flip properties can be a strategic way to utilize minimize the cost of capital when investing. Here’s a step-by-step guide on how to use this method effectively:

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

Step 1: Understand Your Policy

First, familiarize yourself with the terms of your whole life insurance policy. Determine how much cash value your policy has accumulated. Cash value is the equity of your policy. It builds up over time and it can be used as collateral for you to use the insurance company’s money or even a third-party lender’s money.

Step 2: Review Borrowing Terms

Contact your insurance agent or carrier or agent to inquire about the terms for borrowing against your policy’s cash value. Find out what the interest rate is, when the interest on the loan is due, and how long it will take to receive the funds requested.

Step 3: Calculate Available Funds

Determine how much money you can borrow from your policy. This will help you know how much capital you have available for investing.

Step 4: Borrow from Your Policy

Once you have all the information and have identified a promising property, proceed to borrow the necessary funds from your life insurance policy. Ensure that you manage these funds carefully to cover both the purchase and renovation costs.

Step 5: Repay the Loan

Once the property is sold and the profit is realized, prioritize repaying the loan you took against your life insurance policy. Timely repayments are essential to restore your policy’s full cash value and coverage.

By using this structured approach, you can leverage your whole life insurance to fund, fix and flip real estate investments effectively while managing risks associated with borrowing against a life insurance policy.

Loans from whole life insurance have no IRS restrictions on how the funds are used. Unlike funds in a Roth, 401K, or IRA, which have restricted usage and allow no sweat equity, personal use or personal benefit, whole life policy loans don’t come with restricted usage rules or regulations. This is an added benefit of using whole life policy loans versus a Roth, 401K, or IRA to fund fix and flips.

At McFie Insurance, our mission is to help individuals and families build stronger financial futures through the power of whole life insurance. We believe that the right policy can do more than just offer protection—it can open the door to greater financial flexibility and opportunity. When structured properly, whole life insurance allows you to access and leverage your policy’s cash value for a wide range of investments and personal goals. Whether you’re planning for retirement, funding a business, or simply looking for more control over your financial life, we’re here to guide you every step of the way. Reach out to us today to schedule a consultation and discover how whole life insurance can work for you.