702-660-7000

702-660-7000

You’ve heard it over and over again – start saving for retirement as soon as you can. Most people aim to retire by the age of 65, but the truth is the ability to retire isn’t determined by your age. Many strive to create an attainable pathway to a comfortable retirement but being able to retire at even the traditional age can sometimes be easier said than done.

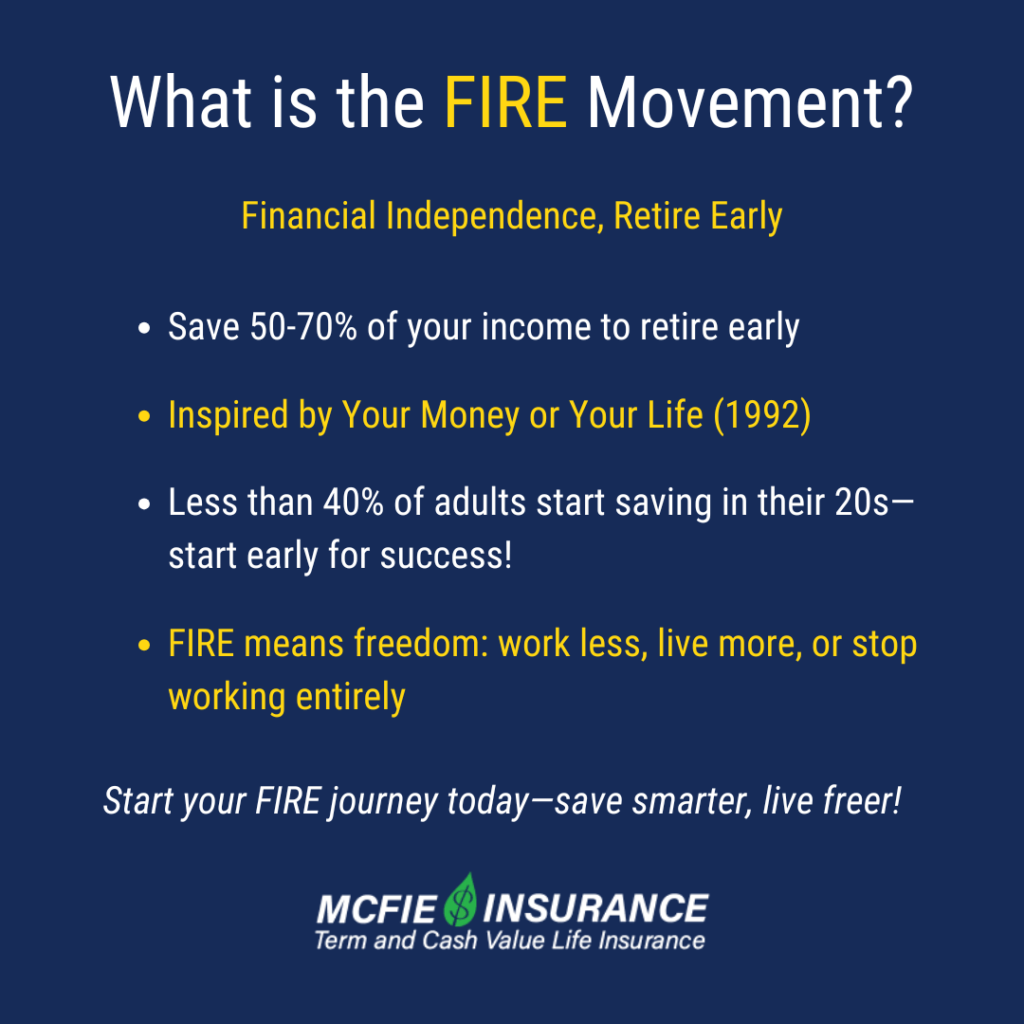

A new approach to early retirement called the FIRE movement has become more and more popular over the past few years. Those who wish to retire in their 50s, 40s, or even their 30s have found the FIRE movement to be a viable plan to gain financial freedom faster. Let’s take a look at what exactly the FIRE movement is, if it’s right for you, and why we might suggest our take on money management and early retirement: The Perpetual Wealth Code™.

So what is the FIRE movement? F.I.R.E. stands for financial independence, retire early. Essentially, it’s an aggressive approach to saving and investing more, keeping your costs low, and raising your income so you can retire well before the traditional age of 65. The movement can be traced back to Vicki Robin and Joe Dominguez and their book “Your Money or Your Life” which was published in 1992. It has since steadily increased in popularity throughout the past decade, particularly amongst millennials.

The FIRE movement not only sparked a trend for early retirement but also in planning early for the future. In past studies, less than 40% of adults who have a retirement plan started saving in their 20s. One of the main and most important lessons to learn from the FIRE movement is that the earlier you start planning for your future, the better.

To truly save for early retirement, the FIRE investing and savings plan requires putting at least 50% of your income into a savings account or investments. People who are “on FIRE” are saving between 50-70% of their income to become more financially independent.

It’s also important to note that the term financial independence, retire early doesn’t necessarily mean that you don’t work for the rest of your life. What “financial independence” really means is that you no longer have to work full time if you don’t want to. FIRE retirement could mean that you have the option to work part-time, try your hand at a freelance job, or that you do actually stop working altogether and retire early. These options all become a possibility because you don’t have to totally rely on a constant incoming paycheck. Rather, you live on the money that you’ve saved or the income from the money you have saved. So how do those who follow this viral movement afford to save so much? Let’s break it down.

Cutting your expenses big-time is the first step toward planning for financial independence with the FIRE method. While it may seem obvious that spending less money on unnecessary expenses can help with your savings plan, it’s not often the easiest task for people to do. However, based on math alone, keeping expenses to a minimum is a powerful tool to have in your arsenal. If you’re able to cut out expenses now and in the future, you’ll be able to save and invest your money while also decreasing how much you would need to accumulate for retirement.

If you’re considering joining the FIRE movement, the first thing you’ll want to do is to make a list of all your expenses and define which ones you can’t get around, which ones you can cut back on, and which ones you deem unnecessary. This isn’t to say that you should necessarily start living on the absolute bare minimum, but instead, looking at how you can lead a comfortable life without spending too much of your hard-earned money.

Reducing your expenses is a great first step toward financial independence and increasing your income on top of that is the second step. Increasing your income will allow you to save or invest an even larger percentage of your income.

Maybe you have a passion project you could turn into a side business or maybe your family has a property that could be turned into a rental. There are many ways to get creative and find additional avenues to increase your income while also keeping in mind potential raises and promotions in your current job. An extra $1,000 a month can always help you on your way to financial freedom.

While there are many different ways to invest, it’s important for FIRE movement followers to invest aggressively. The easiest place to start is maxing out retirement savings plans like a 401k or Roth IRA, but these tools do not always provide the best results. Remember that investing aggressively is not the same as saving money in a safe and secure environment.

Most FIRE movement experts recommend putting at least 15% of your income into investments. These could range from lower-risk investments like bonds, CDs, or mutual funds to higher risk investments like stock market portfolios or emerging market investments. Different investments may yield different returns, so it’s important to estimate how much of a return you’ll need on your investments when choosing them to reach an early retirement savings goal.

So how much money do you need in order to retire early? Let’s take a quick look at what it actually takes to have a comfortable retirement. Some plan to live on 70% of what their income is before retirement. As a simple example, if you’re currently making $100,000 a year, once you retire, you should have enough in savings and investments to live on $70,000 a year. Others rely on the 4% rule or a Monte Carlo simulation, where a software program simulates several possible return/spending combinations, and perhaps even different inflation rates to estimate probabilities of how long a certain amount of money could last in retirement.

While the FIRE method for retirement seems to have many success stories in recent years, people have also seen even more reason to plan ahead and beyond a simple FIRE number estimate for retirement. Between rising inflation, health care, associated living costs, taxes, home maintenance, and unforeseen emergencies, you may be underestimating the actual cost of living once you’re retired. These factors can affect your retirement plan and are critical to take into account when planning for the future.

Inflation is always a killer, so even if you estimate reasonable return and spending rates, there is a high probability that you could come up short unless you consider widely different outcomes. A small change in the inflation rate, for example, can make a huge difference to an early retiree having enough money for the rest of their life or running out of money after all their fancy planning. In our experience, it is not good to focus on one number as a goal to retire early but to rather focus on continuing to be productive and earning money as long as possible and to use the “extra” wealth you accumulate to make the world a better place as you go. Plan to accumulate much more than you ever think you’ll need and manage it wisely.

There’s no doubt that jumping on the FIRE bandwagon is not for the faint of heart. Between the aggressive saving and investing, it can be a lot of work, stress, and extreme frugality. Plus, not everyone even has the means to put 50% or more of their paycheck away in their 20s or at any point in their life. This movement also most likely is going to require at least a six-figure income per year to be achievable. If this doesn’t sound doable for you, but you’re still wanting the options that financial freedom and early retirement can offer, there is another way.

At McFie Insurance, The Perpetual Wealth Code™ is at the heart of everything we do. It’s an advanced and proven strategy that can help you self-finance your lifestyle and save for the future – whatever that may look like for you. This code encompasses some of the good aspects of the FIRE movement but with a more practical and specific approach that works for a wider range of people. Here are a few key points of The Perpetual Wealth Code™:

All of these guide points can help lead you to financial independence and/or early retirement if that is what you wish. A bonus of The Perpetual Wealth Code™ system is that much of your financial life can be enhanced by using strategically designed participating whole life insurance. If you’re interested in learning more about The Perpetual Wealth Code™ and how life insurance, retirement planning, and your specific financial wants and needs go hand-in-hand, start your journey today by scheduling a free strategy session with McFie Insurance.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.