702-660-7000

702-660-7000

More people are questioning their reliance on the stock market for building wealth. While stocks have historically delivered strong long-term returns, they come with downsides that have many investors seeking alternatives. If you’ve ever watched your portfolio value plummet during market corrections or worried about having enough money for retirement, you’re not alone. The search for alternatives to the stock market is about finding financial tools that provide greater certainty, control, and sustainability across different economic environments.

Market volatility has become more pronounced in recent years. The swings we’ve witnessed—from the pandemic-driven crash of 2020 to inflation concerns and interest rate hikes—have left many investors questioning whether traditional market investing aligns with their financial goals and risk tolerance.

Beyond volatility, there’s growing awareness that the typical financial advice of “just invest in index funds and wait it out” isn’t the solution many were led to believe. Even when following conventional wisdom, investors face challenges:

These concerns are driving a re-evaluation of how we build and preserve wealth.

The current economic environment adds another layer of complexity. Inflation has reached levels not seen in decades, interest rates have risen, and geopolitical tensions impact markets globally. Many economists and market analysts warn that we may be facing a period of below-average returns in traditional markets after the extended bull run of the 2010s.

For investors nearing retirement or those with shorter time horizons, the prospect of a “lost decade” in market returns isn’t something that can simply be waited out. Younger investors are questioning whether the same wealth-building strategies that worked for previous generations will deliver similar results in a changing economic landscape.

Most people understand diversification to mean spreading investments across different stocks or adding bonds to their portfolio. True diversification goes deeper—it means having assets that respond differently to the same economic conditions.

During market downturns, traditional diversification often fails as correlations between different asset classes increase. Stocks, real estate securities, and many bonds may all decline, as we witnessed during the 2008 financial crisis.

Diversification means incorporating financial vehicles and assets that:

By broadening your financial strategy beyond conventional market investments, you can create a more durable recipe to wealth building—and your financial future doesn’t have to be tied so directly to stock market performance.

Despite being promoted as the cornerstone of wealth-building for decades, the stock market comes with limitations that can impact your financial future. These limitations have affected millions of investors throughout history. Before exploring alternatives, it’s important to understand the problems we’re trying to solve.

Stock market volatility is often dismissed with advice like “just don’t look at your portfolio” or “stay the course.” While this perspective has merit for long-term investors, it oversimplifies the impact of volatility on financial outcomes.

The reality is that market volatility creates tangible financial consequences:

Disrupted Financial Planning: Market drops can derail even the most carefully constructed financial plans. A 30-40% market decline can suddenly transform a seemingly secure retirement plan into one plagued by uncertainty.

Liquidity Constraints: When you need access to your money during market downturns, you face the unpleasant choice of either selling investments at depressed values or finding alternative sources of funds. This dilemma can force difficult compromises at the wrong time.

Risk Management Trade-offs: To reduce volatility, most stock market investors increase their allocation to bonds as they age. This approach comes at the cost of lower returns when interest rates are low, creating a difficult balancing act between stability and growth.

Recent history offers examples of volatility’s impact. During the 2008 financial crisis, the S&P 500 lost approximately 55% of its value from peak to trough. The COVID-19 pandemic caused a 34% drop in just over a month in early 2020. Even in “normal” times, corrections of 10% or more occur regularly.

For those relying on their investment portfolio for income or near-term financial goals, these swings represent real constraints on financial security.

Modern portfolio theory suggests that diversifying across different asset classes reduces risk. This seems to work alright during normal market conditions but can fail during economic downturns.

Asset Correlation in Crisis: During major market stress periods, correlations between diverse assets often spike. This means your diversified portfolio may not provide the protection you expected:

Limited True Diversification: Within publicly traded securities, it’s difficult to find non-correlated assets. Global markets have become more interconnected, and algorithmic trading can amplify correlation during volatility.

Index Concentration Risk: As index investing has grown in popularity, market indices have become concentrated in a few large companies. For example, by early 2023, just seven technology companies represented over 25% of the S&P 500 index, creating hidden concentration risk for many “diversified” investors.

Diversification requires looking beyond conventional market-based investments to assets and financial strategies that operate on different principles and respond to different economic drivers.

One of the most underappreciated limitations of stock market investing is the impact of timing and sequence of returns—especially for those approaching or in retirement.

The Retirement Red Zone: The 5-10 years before and after retirement are a vulnerable period. Market declines during this window can have a disproportionate negative effect on long-term financial outcomes, even if long-term average returns remain positive.

The Mathematics of Loss: Market losses require larger gains to break even. A 20% loss requires a 25% gain to recover, while a 50% loss requires a 100% gain. This reality can compound the impact of a poor sequence of returns.

Practical Implications: Two investors with identical average returns but different sequences can have dramatically different outcomes. Consider this simplified example:

Investor A retires just before a market downturn and experiences negative returns in the first three years of retirement, followed by positive returns.

Investor B retires at the beginning of a bull market, experiencing the same returns as Investor A but in reverse order.

Even with identical average returns over time, Investor A may run out of money decades earlier than Investor B because withdrawals during down markets create permanent losses that cannot be recovered.

Studies show that sequence risk can cause a portfolio to run out of money over 10 years earlier, even with identical average returns.

These limitations don’t mean the stock market shouldn’t play a role in your financial plan. Rather, they highlight why relying exclusively on market-based investments creates vulnerability.

The key is that financial security requires more than just maximizing average returns—it requires:

When most people hear “life insurance,” they think of a death benefit—money paid to beneficiaries when the insured person passes away. But participating whole life insurance offers something more dynamic: a multi-purpose financial tool that can serve as a cornerstone of your wealth-building strategy while you’re alive.

Whole life insurance is different from term insurance, which only provides a death benefit for a specific period. Instead, whole life provides permanent coverage with a unique structure that creates living benefits through its cash value.

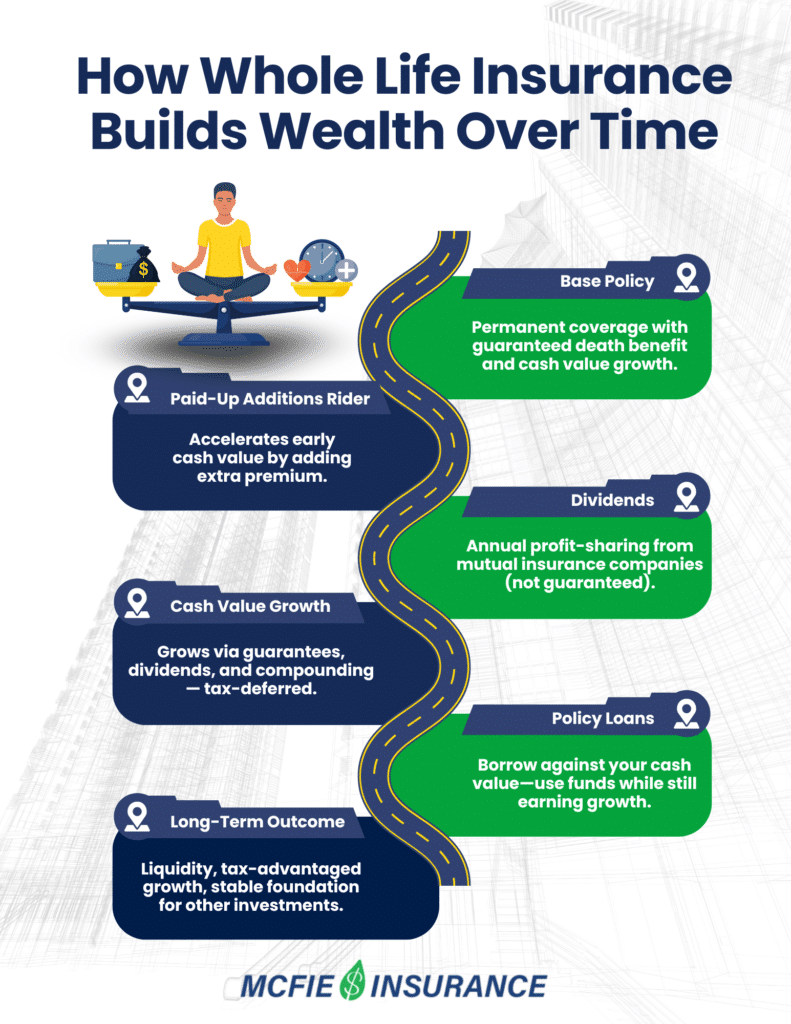

A well-designed participating whole life policy consists of several components. First, there’s the base policy, which provides the guaranteed death benefit and cash value growth. Then there’s the Paid-Up Additions Rider, a rider that allows you to inject additional premium dollars, maximizing early cash value growth. Finally, there’s the dividend system—the “participating” aspect, where the insurance company shares profits with policyholders.

Unlike stock-based investments, participating whole life insurance is built on contractual guarantees. The insurance company is legally obligated to deliver on the promises outlined in your policy.

Most participating whole life policies are issued by mutual insurance companies, which are owned by policyholders rather than shareholders. This ownership structure creates an alignment of interests. The company exists to benefit policyholders, not outside investors. Profits are shared with policyholders through dividends. Management decisions tend to focus on long-term stability rather than quarterly profits. Some mutual insurance companies have histories spanning 150+ years, having successfully navigated depressions, world wars, and every economic crisis in between.

The cash value component of whole life insurance is what transforms it from simple death protection into a powerful financial tool. Unlike the volatility of stock investments, cash value in a whole life policy grows in a pattern that increases over time.

How Cash Value Grows

Cash value accumulates through:

In a well-designed policy, the cash value exceeds the total premiums paid, typically between years 7-15, depending on the policy design as well as your age and health when you start.

Cash value growth enjoys tax benefits. Growth accumulates tax-deferred, and access to cash value through policy loans can be tax-free. The death benefit also passes to beneficiaries income tax-free. These tax advantages become especially valuable in a high-tax environment and for those in higher tax brackets.

Accessing your policy’s cash value through policy loans is an often misunderstood feature of whole life insurance. Here’s what makes policy loans unique.

When you take a policy loan, the insurance company lends you money from their general account (not directly from your cash value). Your policy’s cash value serves as collateral for the loan. Your policy typically grows as if you hadn’t borrowed anything. You can repay the policy loan on your own schedule—or choose not to repay the loan during your lifetime as long as you cover the interest on the policy loan.

This creates a unique situation where you can use money for other opportunities while your money grows in your policy.

Savvy policyholders use this capability in many ways. You can create your own financing system by using policy loans to pay for major purchases like vehicles, then repay yourself instead of a bank, keeping the interest within your financial ecosystem. Business owners use policy loans to manage cash flow fluctuations, fund expansion, or seize time-sensitive opportunities without disrupting operations. You can also use policy cash value to fund investments with higher returns, creating a spread between your policy loan interest rate and your investment return.

The process of creating your own financing system using whole life insurance and keeping the interest within your own financial ecosystem is called “Infinite Banking.” You can read more about Infinite Banking here.

While the stock market can offer higher returns in some periods, participating whole life insurance provides something the market can’t: stability regardless of economic conditions.

The cash value in a participating whole life policy grows according to a schedule guaranteed in your contract. This growth occurs regardless of market performance, without the risk of losing principal, and with predictable increases over time.

Perhaps most valuable is that whole life insurance’s performance is uncorrelated with stock market returns. During the 2000-2002 and 2008 market crashes, when many investors saw their portfolios cut in half, whole life policyholders experienced continued guaranteed growth, dividend payments (though some companies modestly reduced their dividend scales), and full access to their cash value without having to sell depreciated assets.

More recently in 2020, and 2025 as stock markets dropped, the same facts hold true.

Designing Your Policy for Maximum Effectiveness

Not all whole life policies are created equal. To function as a good financial tool, a policy must be properly designed with an emphasis on cash value accumulation rather than maximum death benefit.

Due to the complexity of proper policy design and the fact that most agents are trained to maximize commissions rather than cash value efficiency, it’s essential to work with a specialist. Look for someone who understands and prioritizes policy design for banking/financing purposes, is willing to reduce commissions to improve policy performance, and has personal experience utilizing this strategy.

Participating whole life insurance isn’t right for everyone, but it can play a valuable role in many financial plans. It’s an asset for those who want predictability in part of their portfolio. Many seek this option when they desire tax advantages and protection from creditors. If you’re looking for financial tools that provide multiple functions (protection, growth, liquidity), whole life insurance deserves consideration.

Those who want to create a personal financing system for major purchases often find whole life insurance to be an effective foundation. The same is true for people who need reliable access to capital regardless of market conditions. Whole life insurance isn’t an “investment” in the traditional sense—it’s a tool that creates a stable foundation from which other wealth-building activities can operate with greater efficiency and reduced risk.

Most financial strategies work best as part of an integrated approach rather than in isolation. Participating whole life insurance functions best when it forms the safe foundation of your financial portfolio. It provides the liquidity needed to capitalize on opportunities in other asset classes. It creates tax diversification alongside your other retirement accounts. It can serve as a counterbalance to your market-based investments.

By using whole life insurance as a complementary tool rather than your only financial strategy, you may gain the ability to be more aggressive with your other investments, knowing you have a solid foundation of guaranteed growth.

It’s been said that real estate has created more millionaires than any other asset class. While stocks fluctuate wildly with the market, real estate provides something tangible—physical property that can generate income, appreciates over time, and serves human needs. As an alternative to stock market investing, real estate offers advantages that have made it a cornerstone of wealth building for centuries.

One of the downsides of real estate investing can be a lack of liquidity. Building liquidity in whole life insurance cash values can compliment a real estate investing strategy.

Direct ownership—purchasing and managing physical properties yourself—remains the most straightforward way to invest in real estate. This approach gives you control and allows you to capture multiple profit sources at once.

When you own investment property directly, you can benefit from several value streams:

Cash flow from rental income provides immediate returns that exceed traditional fixed-income investments. A well-selected property may generate 5-10% cash-on-cash return annually, providing steady income that can complement or eventually replace your primary income source.

Long-term appreciation builds equity over time. While real estate doesn’t always move in a straight line upward, high-quality properties in growing areas have historically appreciated at rates that outpace inflation by 1-3% annually over long holding periods.

Mortgage paydown creates forced savings as your tenants pay down your loan balance each month. This equity building occurs regardless of market conditions—even in a flat market, your equity position improves monthly as principal reduction continues.

The combination of these profit centers—cash flow, appreciation, loan paydown, and tax benefits—creates a wealth-building engine that’s difficult to replicate in other asset classes.

If the responsibilities of direct ownership seem daunting, publicly traded Real Estate Investment Trusts (REITs) offer a way to invest in real estate portfolios with the convenience of buying and selling shares through your brokerage account.

REITs are companies that own, operate, or finance income-producing real estate across nearly every property sector—from apartment buildings and shopping centers to data centers and cellular towers. By law, REITs must distribute at least 90% of their taxable income to shareholders as dividends, making them popular among income-focused investors.

The REIT structure creates several advantages:

Professional management handles all aspects of property selection and management. Each REIT typically specializes in specific property types or geographic regions, employing teams with expertise in their focus areas.

Diversification across multiple properties reduces the risk associated with any single asset. Even a modest investment in a REIT can give you fractional ownership in dozens or hundreds of properties.

High dividend yields typically range from 3-6%, higher than the average S&P 500 dividend yield, making REITs attractive for income-seeking investors.

While REITs offer convenience and professional management, they also come with limitations and risk. Their performance may correlate more closely with the broader stock market than direct real estate ownership, diminishing some diversification benefits. During the 2008 financial crisis, many REITs saw their values drop precipitously along with the stock market, despite the properties maintaining much of their value and cash flow.

REIT investors sacrifice control over property selection and management decisions. The tax benefits are also more limited than direct ownership, with dividends typically taxed as ordinary income rather than qualifying for lower dividend tax rates.

Despite these drawbacks, REITs remain an option for investors seeking real estate exposure without the responsibilities of direct ownership. They can be well-suited for retirement accounts where the tax inefficiency of REIT dividends is neutralized.

Each real estate investment approach offers distinct advantages and considerations, making them suitable for different investor profiles and financial goals.

Direct property ownership often makes the most sense for those who want maximum control over their investments, have the time and interest to develop real estate expertise, and can commit at least 20-25% for down payments along with reserves for unexpected costs.

REITs are likely to be a better fit for investors who prioritize liquidity and the ability to quickly adjust their real estate allocation, prefer passive management with minimal time commitment, and are investing primarily through retirement accounts where tax efficiency is less critical.

Many sophisticated investors incorporate multiple approaches, creating a layered real estate strategy. For example, they might own a few rental properties directly in their local market and invest in specialized REITs for sectors like data centers or healthcare facilities.

While stocks tend to dominate investment discussions, fixed-income alternatives also deserve consideration —especially for people who need predictable income and capital preservation.

Bonds represent loans to governments, municipalities, or corporations that pay fixed interest over a set period. But today’s bond landscape offers more options than buying individual bonds and holding them until maturity.

Bond ETFs and mutual funds can provide instant diversification across hundreds of bonds with minimal investment. They allow you to target specific durations, credit qualities, or sectors without the complexity of managing individual bond portfolios.

For those seeking higher yields without stock market exposure, corporate bonds and preferred securities may offer compelling alternatives. Investment-grade corporate bonds typically yield 1-3% more than treasuries of similar duration, while preferred securities—hybrid instruments with characteristics of both stocks and bonds—may yield higher rates.

Private credit investments have also emerged as accessible alternatives. These investments finance businesses through direct lending arrangements, providing higher yields in exchange for reduced liquidity compared to publicly traded bonds.

Annuities are contracts issued by insurance companies that can provide guaranteed income streams—something important for retirement planning.

Fixed annuities offer predictable rates of return for specific periods, serving as higher-yielding alternatives to CDs without the market risk of bonds. Today’s rates on multi-year guaranteed annuities frequently exceed those of comparable CDs by 0.5-1.5%.

Income annuities convert a lump sum into guaranteed lifetime income, creating a “personal pension.” This can provide valuable peace of mind for retirees concerned about outliving their assets.

While annuities offer unique benefits, they require careful evaluation of contract terms, surrender periods, fees, and issuer strength. Working with an advisor who understands these nuances is important.

For funds you might need in the short term or as a safety net, certificates of deposit and high-yield savings accounts provide government-backed security with modest returns.

Online banks often offer yields higher than traditional brick-and-mortar institutions—sometimes 10-15 times the national average on savings accounts. The best high-yield savings accounts currently offer rates between 4-5% with full FDIC insurance and complete liquidity.

CD laddering—spreading investments across CDs with staggered maturity dates—can provide higher yields of longer-term commitments while maintaining regular access to portions of your capital.

While these vehicles may not build substantial wealth, they can serve roles in financial planning: providing liquid emergency funds, holding money for near-term goals, and serving as a stable foundation for more growth-oriented investments.

Treasury securities represent loans to the U.S. government and are considered the closest thing to risk-free investments, backed by the “full faith and credit” of the federal government.

Treasury bills mature in one year or less, while Treasury notes range from 2-10 years and Treasury bonds extend to 30 years. Each offers different yield and interest rate risk profiles to match varying time horizons.

Series I Savings Bonds deserve special attention for inflation protection. These bonds adjust their interest rates semi-annually based on inflation, making them unique among fixed-income options. The current rate combines a fixed rate that lasts for the bond’s 30-year life with an inflation adjustment that changes every six months.

Treasury securities can be purchased directly through TreasuryDirect.gov, eliminating middleman costs and complexities.

Fixed-income options can serve many purposes in a well-designed financial strategy:

Bonds can provide stability when stock markets decline, generally moving in the opposite direction of equities during crisis periods. However this did not occur in 2022 when stocks and bonds both came down over 10% in the same year.

Fixed income investments generate reliable income regardless of market conditions— important for retirement.

They help preserve capital for short and medium-term goals where market volatility can create unacceptable risk.

The key is selecting the right fixed-income vehicles for your specific objectives, time horizon, and liquidity needs rather than chasing the highest yields.

In a world dominated by digital assets and paper securities, physical and tangible investments offer unique advantages. These real assets provide portfolio diversification and potential inflation protection that can be difficult to achieve through financial securities alone.

Gold, silver, platinum, and palladium have served as stores of value for thousands of years. Unlike government currencies, precious metals cannot be created through monetary policy decisions.

Gold tends to maintain purchasing power over extremely long time periods. While it may not generate income like dividend-paying stocks or interest-bearing bonds, it often shines brightest during periods of economic uncertainty or geopolitical instability.

Investors can access precious metals through physical ownership (coins and bars), allocated storage programs, exchange-traded funds (ETFs), or mining company stocks. Each approach offers different trade-offs between security, liquidity, cost, and exposure to mining operations versus the underlying metal itself.

Physical ownership provides maximum control but requires secure storage solutions, while ETFs offer convenience but introduce counterparty risk and ongoing expense ratios.

Art, rare coins, vintage automobiles, fine wine, and other collectibles represent an intersection of personal passion and investment potential. Unlike some financial assets, collectibles may provide enjoyment beyond their investment return.

The investment case for collectibles relies on scarcity, cultural significance, and growing global wealth creating demand for limited-supply items. Certain segments have demonstrated impressive long-term appreciation—blue-chip art has outperformed the S&P 500 over some periods, while select vintage cars have appreciated at double-digit annual rates.

However, collectibles come with considerations: high transaction costs (often 10-20%), subjective valuation, storage requirements, insurance costs, and authenticity concerns. These investments require specialized knowledge and should usually represent a modest portion of most portfolios.

Farmland has produced reliable returns with low volatility for decades. Unlike gold or art, agricultural land generates ongoing income through crop production or leasing arrangements while also appreciating in value over time.

The investment thesis is straightforward: global population growth and rising incomes increase food demand, while the supply of arable land remains essentially fixed. This supply-demand imbalance supports long-term appreciation.

Timberland investments offer biological growth regardless of financial market conditions. Trees continue growing even during recessions, effectively “storing value on the stump” until market conditions become favorable for harvesting.

Both farmland and timber have historically provided inflation-adjusted returns of 6-8% annually with less volatility than stocks. Previously accessible primarily to institutional investors, new platforms now allow individual investors to participate with more modest amounts through crowdfunding models and specialized REITs.

Physical and commodity investments require different approaches than traditional financial assets:

Time horizon needs to be longer, typically 5-10 years at minimum, to offset higher acquisition and disposition costs.

Liquidity constraints are high, as selling physical assets can take months and involve substantial transaction costs.

Expertise requirements are higher, as valuation requires specialized knowledge not widely available.

Storage and maintenance costs must be factored into return calculations.

For most investors, physical assets work best as portfolio complements rather than core holdings—perhaps 5-15% of total assets for diversification, inflation protection, and reduced correlation to financial markets.

When properly selected and structured, tangible assets can provide a level of portfolio resilience difficult to achieve through stocks and bonds alone. They represent real value in a world where financial assets sometimes seem detached from economic fundamentals.

After exploring multiple alternatives to stock market investing, the question becomes how to integrate these options into a cohesive strategy. The goal isn’t to avoid stocks entirely—it’s to build a more resilient portfolio that can thrive across different economic environments while supporting your specific financial objectives.

Effective portfolio construction goes beyond spreading investments across different asset classes. It requires thoughtful integration based on how each component responds to economic conditions and complements other holdings.

Consider each alternative through multiple lenses:

Cash flow characteristics—some alternatives generate steady income (rental properties, REITs), while others store value without current income (precious metals, some collectibles).

Tax treatment varies between alternatives. Whole life insurance offers tax-free access to cash value via policy loans, while real estate provides depreciation benefits, and some bond interest may be tax-exempt.

Liquidity profiles differ. Publicly traded REITs may offer some liquidity, but direct real estate might require months to sell, and some collectibles could take years to convert to cash at optimal values.

By understanding these characteristics, you can strategically position each alternative to serve specific roles in your financial picture rather than simply chasing returns.

Building a balanced portfolio with alternatives doesn’t happen overnight. For most investors, the journey begins with strategic additions to existing holdings.

If you’re heavily invested in stocks, think about adding some whole life insurance. Real estate may also have a place in your portfolio.

If your portfolio is predominantly in retirement accounts with limited investment options, you may want to explore opportunities for alternative allocations in accounts where you have more flexibility.

Remember that most alternatives work best with long-term commitment. Start with allocations you can maintain through market cycles rather than making dramatic shifts you might later want to reverse.

Throughout this exploration of alternatives to stock market investing, we’ve covered substantial ground—from the unique advantages of whole life insurance to the wealth-building potential of real estate, the stability of fixed-income alternatives, and the inflation protection of tangible assets. Each option offers benefits that traditional stock market investing alone doesn’t provide.

But knowing your options is just the beginning. Implementing these strategies requires knowledge, and integration into your broader financial picture.

At McFie Insurance, we’ve spent over 17 years helping clients build financial strategies that incorporate whole life insurance. Our approach goes beyond selling insurance products—we want to help you develop a financial strategy that creates sustainability and control.

Whether you’re just beginning to explore alternatives to the stock market or looking to optimize strategies you’ve already implemented, we invite you to schedule a strategy session with our team. During this complimentary consultation, we can help you see how to integrate life insurance as a good financial tool.

Don’t leave your financial future to chance or limit yourself to conventional investment options that may not serve your best interests. Take your next step toward financial freedom by contacting McFie Insurance today.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.