317-912-1000

317-912-1000

A business exit strategy is a well-thought-out plan for when you decide to leave your business. This plan outlines how the transition will happen and specifically defines the financial benefits of your exit from the business. Just as you create a business plan to guide your company’s operations, it’s important to have one for guiding your departure. No business plan is complete without a financially sound exit strategy in place.

|

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here> |

Having a business exit strategy is smart business. In fact, some business owners start their business with the intention of exiting it after a certain number of years. This doesn’t mean they lack dedication; it means they have a clear plan in mind.

When considering your exit strategy, it is important to think not only about how you’ll leave but also how to make that process smooth and profitable for all involved:

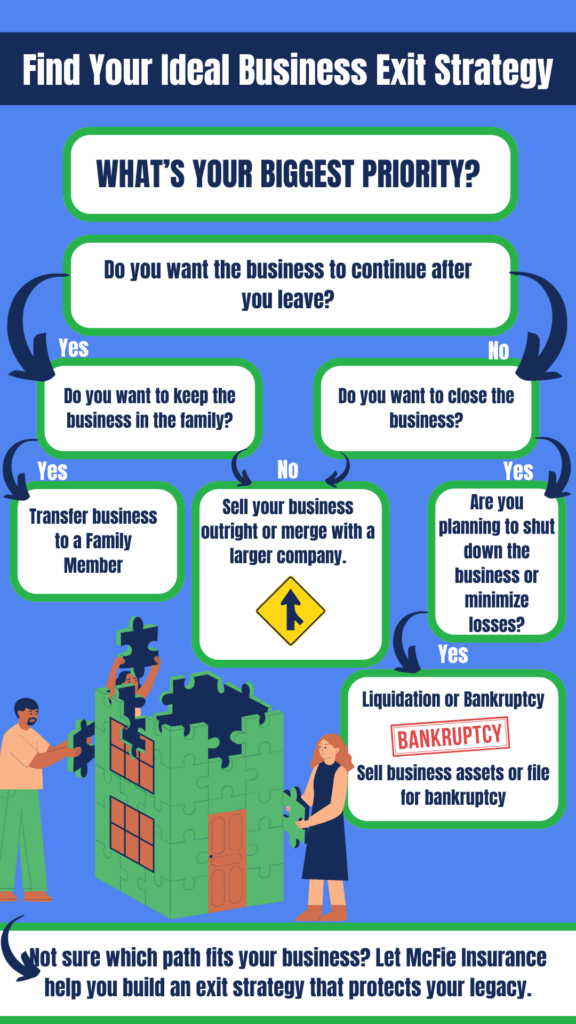

Let’s consider the various options for your business exit strategy.

Many business owners aspire to keep their business within the family. This involves planning to transfer the company to a child or another relative at a certain point. This can be a great exit strategy and will depend on whether your family dynamics can handle the challenges of business ownership. It will also depend on who in the family is the most qualified person to run the business after you make your exit.

Pros:

Cons:

In a merger or acquisition exit strategy, your company is either bought by or combined with another company, preferably one that is similar or has aligned values as you and your business.

One advantage of this exit strategy is the ability to negotiate the selling price. In contrast, going public through an IPO would determine your company’s value relative to the industry.

The risk with this option is that only about 20% of businesses listed for sale actually find a buyer. If merging or being acquired is your preferred route, it’s wise to have a backup plan in case a buyer never materializes.

Pros:

Cons:

Unlike a traditional acquisition, this business exit plan involves another company purchasing your business primarily to gain access to its talented and skilled employees.

While this may mean that your business name won’t carry on, it does provide security for your employees. In this scenario, it’s essential to negotiate terms considering your employees’ specific needs.

Pros:

Cons:

It is important to plan for any of these exit strategies in advance, as there’s a high probability that when you’re ready to leave your business, you may not be able to. Selling your business to management or an existing employee(s) maybe an option that is available for you. Already familiar with the inner workings of your business, they might be able to make a smoother transition and provide continued loyalty to your employees, clients and customers.

Furthermore, since your employees are already familiar with your business, and likely know you, more flexible financial arrangements may be possible during the transition.

Pros:

Cons:

If you’re not the sole owner of your business, it’s possible to sell your portion to a business partner or another investor. This can serve as a relatively straightforward exit strategy, depending on the buyer’s intentions and financial capability.

Pros:

Cons:

Many entrepreneurs dream of eventually offering shares of their business to the public, aiming for substantial profits. In the context of small business exit planning, this option isn’t suitable for everyone as several factors must align for this choice to be viable.

Even if your business is thriving, your industry might not attract public interest, which could negatively impact your company’s value. Moreover, IPOs are relatively rare occurrences. In the late 1990s, there were around 8,000 domestic public companies in the U.S. (out of millions), but in recent years, this number has dwindled to approximately 3,600.

Nevertheless, if the right conditions exist, an IPO can be highly lucrative.

Pros:

Cons:

Among various exit strategies for businesses, liquidation is the most definitive and most disheartening option. Opting for liquidation means closing down your business and selling off its assets. Liquidation would result in the conclusion of your business.

If you choose this path, keep in mind that you’ll need to use the cash generated from selling assets to settle any debts and compensate shareholders. Additionally, consider how this decision may impact employees, as well as clients or customers who rely on your services.

Pros:

Cons:

Regarding small business exit planning, bankruptcy is something nobody necessarily plans for. But, without a planned exit strategy in place the likelihood of bankruptcy becomes significantly more probable.

The necessity for bankruptcy typically arises unexpectedly. The bankruptcy process may legally liquidate your assets while destroying your credit. Your debts might be relieved, but not necessarily, and it will take time to rebuild your credit and reputation.

Regrettably, 9 out of 10 startup businesses fail. Bankruptcy then is one of the risks associated with starting and owning a business. It is crucial to understand the implications of filing for business bankruptcy under Chapter 7, 11, or 13.

Pros:

Cons:

Where should you start when it comes to planning your small business exit strategy? While the specifics of your exit plan will be unique to your business, there are some fundamental questions to consider as you begin crafting your strategy:

When you’re just launching your business, this question may seem premature. However, even in the early stages, it’s essential to think ahead and contemplate your long-term business exit strategy. Even if you anticipate a lifelong commitment to your business, it’s wise to plan for retirement or a future transition. Have you structured your business to allow for this possibility down the road?

Perhaps you realize that your tolerance for business ownership is limited. What is your ideal scenario for when this time arrives? Would you still want a role in the business even if you no longer own it?

Answering these questions is crucial for making the right plans. It may also be beneficial to revisit your thoughts on these matters periodically as your life and aspirations change.

Financial goals vary from person to person. Despite your passion for your business or its positive impact on the world, nearly every entrepreneur has financial needs and objectives intertwined with their business plans (sadly, nearly 70% of entrepreneurs don’t consistently save for retirement). Whatever your financial aspirations may be, they will significantly influence the outcome of your exit strategy.

Planning for your business exit is a crucial process that requires careful consideration. Many business owners seek guidance from professionals such as accountants, business attorneys and life insurance agents to make well-informed decisions. Once you’ve addressed the initial questions, you need to develop an exit strategy for your business plan to be complete.

During this phase, you’ll need to focus on actionable tasks, including tax planning, finances and ensuring the money will be available and liquid when you exercise your exit strategy. Understanding your company’s true value is also essential as this value defines your options.

In essence, the exit strategy planning process revolves around clarifying your personal and business objectives to make the best decision when the time comes to exit your business.

It’s wise to create a framework that allows for a well designed exit strategy to work. There are numerous exit strategies available for you to consider when envisioning the future of your business. Making sure the money necessary to successfully utilize the exit strategy you have planned for yourself from your business is essential.

No universal business exit strategy fits all scenarios. The right exit strategy for you and your business will depend on various factors. The common thread with all exit strategies is, they all involve financing to be profitable.

The most prudent approach to planning a business exit strategy is to be proactive. Even when launching your business, it’s essential to contemplate potential exit scenarios for the future. By actively considering the process, its execution, and its consequences, you will increase your likelihood of success and profitability when the time arrives for you to part ways with your business.

At McFie Insurance, we help people plan for success. We believe you should have control of your own capital and financial future. To achieve this kind of financial success requires planning ahead. Contact McFie Insurance today to get the guidance you need on the best business exit strategy for you and your business.

Ben T. McFie

Ben T. McFie

There's a lot of confusion around finance; there's so much to know and it's frustrating when you don't know enough to make the best financial decisions. I like to bring clarity to financial matters so people can make good financial decisions that will help them live wealthier more fulfilling lives.