317-912-1000

317-912-1000

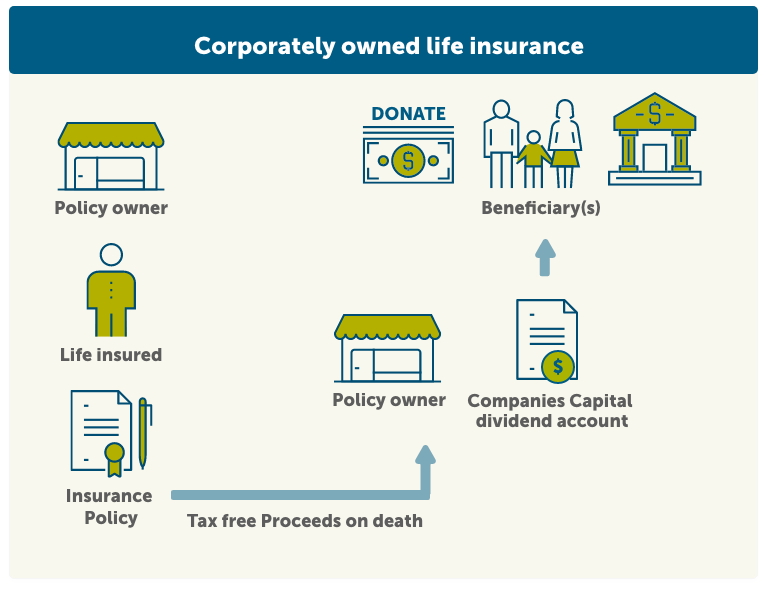

Corporate-Owned Life Insurance (COLI) is a life insurance policy acquired by a business covering the life of its employee, owner, or a debtor. The company retains ownership of the policy, controls access to cash value, bears the premium costs, and becomes the beneficiary upon the insured’s death.

Unlike conventional life insurance where the insured’s family or heirs receive the death benefit, with COLI, the company benefits.

Several alternative names for COLI are:

A distinction of COLI from regular life insurance is that a corporation purchases it, holds the policy rights, settles the premiums, and gets the death benefit following the insured individual’s death. This is not like group life insurance where either the employee or their heirs get the benefits. Still, there are cases where the corporation might split the death benefit with the family of the insured.

Companies leverage COLIs for several reasons, such as offsetting expenses for employee benefit programs, addressing financial implications post the death of the insured (like lost income or recruitment expenses), and to obtain notable tax advantages. Key person insurance is an example of COLI designed for essential personnel, such as leaders, proprietors, and others with specific roles which may be hard to replace.

When procuring COLIs, most business owners opt for cash value life insurance policies instead of term insurance. The corporation is responsible for paying the premium, and a part of these payments build cash value which may be invested, accrue interest at a predetermined rate or build according to a schedule of guaranteed policy values. Provided the policy isn’t terminated before the insured’s passing, cash value growth above premiums paid are typically exempt from taxes.

For a company to establish a corporate-owned life insurance (COLI) policy, it must demonstrate a significant financial stake, which is called an insurable interest, in the life of the key person. This means the company should substantiate that the death of the insured would lead to financial setbacks or hardship to the corporation.

Prior to activating a COLI, the targeted insured must:

Moreover, each year the COLI remains in force, the company is mandated to include Form 8925 in their tax filings. Comprehensive records backing the data on Form 8925 should be maintained by the company.

The allure of tax advantages can be a motivating factor for companies to opt for COLI. If the insured dies, the company is entitled to an income tax-exempt death benefit. While the insured lives, the company can leverage the tax-sheltered cash values via a policy loan.

Differing from regular investment vehicles that incur taxes, the cash value in COLI is taxable only if the policy is relinquished with a gain beyond premiums paid, prior to the insured’s death. Companies can also borrow against the policy’s cash value and potentially take a tax deduction for loan interest on policy loans used for tax deductible business expenses.

Given the potential misuse of COLIs, there are stringent IRS regulations on how COLI can be purchased and utilized. As an illustration, companies are barred from leveraging cash value loans for premium payments and then claiming a tax deduction on the related loan interest.

To ensure the policy’s death benefit remains untaxed, the company must have secured the necessary written notices and approvals from the insured and have adhered to at least one of the following:

The Infinite Banking Concept is a powerful strategy that utilizes the cash value of a whole life insurance policy to create a personal source of financing. While commonly employed by individuals, the principles behind this concept can also intersect with corporate-owned life insurance (COLI) policies, especially those that build cash value over time.

At its core, the Infinite Banking Concept involves borrowing against the cash value of a participating whole life insurance policy to fund expenses, investments, or business opportunities, effectively “becoming your own bank.” This approach leverages the policy’s guaranteed cash value growth and dividend potential, offering liquidity and financial control without relying on traditional lenders.

In the context of COLI, corporations that hold participating whole life insurance policies with cash value can similarly access funds through policy loans. These loans provide tax-advantaged liquidity to cover business expenses, manage cash flow, or invest in growth initiatives. The interest paid on these loans typically goes back into the policy, enhancing its value rather than benefiting an external lender. This self-contained cycle exemplifies the principles of the Infinite Banking Concept at an organizational level.

Implementing the Infinite Banking Concept with COLI requires careful structuring to ensure compliance with IRS regulations and maximize tax advantages. McFie Family Insurance offers expert guidance to help businesses design and manage whole life policies that support these strategies effectively. Our experience enables clients to harness the full potential of cash value life insurance, ensuring that their corporate-owned policies not only provide death benefits but also serve as flexible financial tools.

By understanding and applying the Infinite Banking Concept, companies can enhance their financial resilience, reduce reliance on external financing, and take full advantage of the unique benefits life insurance offers. McFie Insurance is committed to educating and assisting businesses in navigating these sophisticated strategies, providing clarity and confidence in managing their corporate insurance assets.

Understanding the different types of insurance can often be confusing and overwhelming. McFie Family Insurance is here to answer any questions you may have. Give us a call at 702-660-7000 or schedule an intro call here to discover what type of insurance policy is best for your needs.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.