317-912-1000

317-912-1000

Business owners and investors want clear answers about company performance. Economic Value Added (EVA) cuts through accounting complexity to reveal if a business is really creating wealth. Let’s explore how EVA works and why it matters for your financial decisions.

At its core, Economic Value Added (EVA) is a metric that reveals whether a company is truly building wealth or quietly destroying it. Unlike traditional accounting profits that simply show the bottom line, EVA digs deeper by measuring whether a business is generating returns that exceed the expectations of its investors — those who have put their capital at risk.

To put it simply, a company isn’t just doing well if it’s profitable on paper. It must earn enough to cover not only its operating costs and taxes but also the cost of the capital invested in the business. Investors expect a certain minimum return for the risks they take, and EVA measures whether the company is delivering on that expectation.

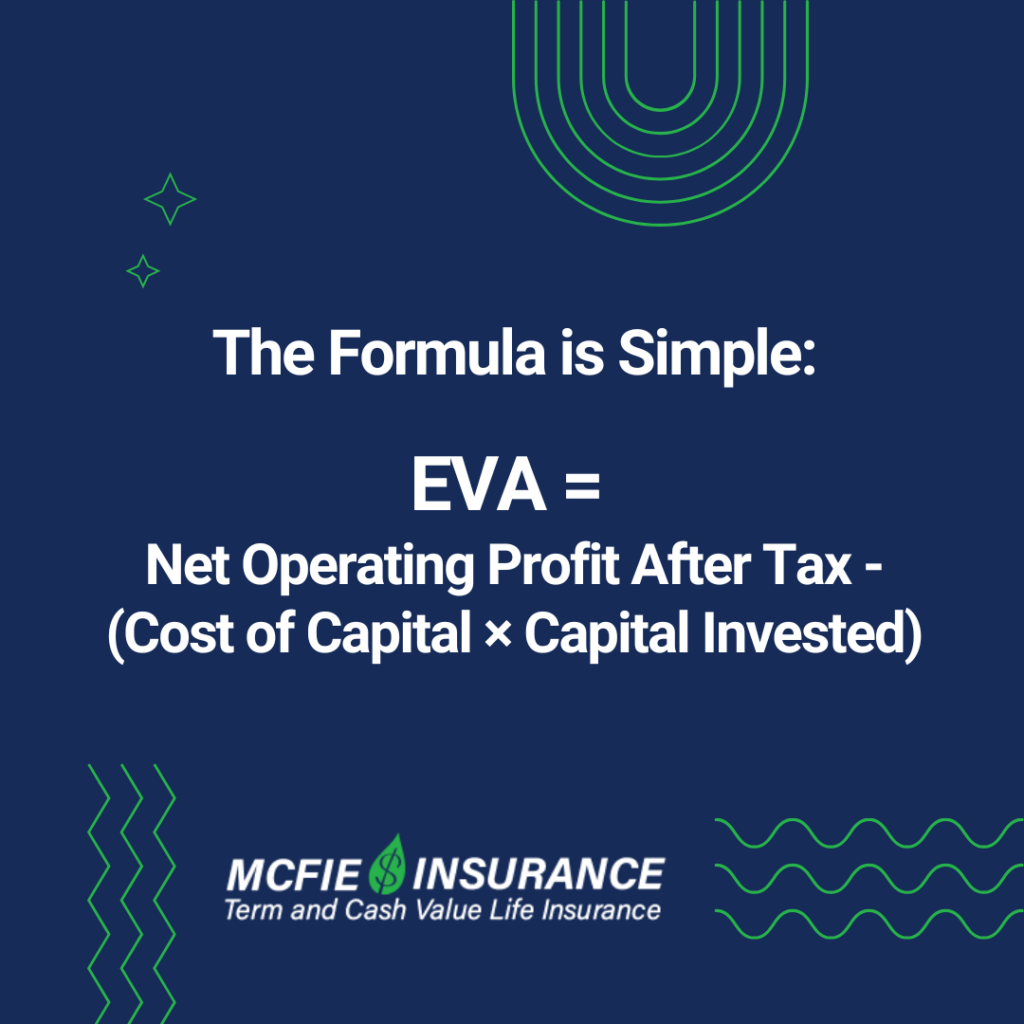

The formula is straightforward:

EVA = Net Operating Profit After Tax (NOPAT) – (Cost of Capital × Capital Invested)

Here’s what that means: NOPAT shows the profits generated from the company’s core operations after accounting for taxes, while the second part, (Cost of Capital × Capital Invested), reflects the minimum return investors require on the money they’ve put into the business.

If the result is positive, it means the company is creating real economic value — profits are exceeding the cost of capital, signaling strong wealth creation for shareholders. On the other hand, a negative EVA indicates that the company is not earning enough to justify the capital employed, effectively eroding investor wealth over time.

Understanding EVA gives investors, managers, and stakeholders a clear picture of true financial performance — beyond the surface of reported earnings — and highlights whether the business is generating sustainable value that justifies continued investment.

Let’s look at the key pieces:

Net Operating Profit After Tax (NOPAT): This is the company’s operating profit adjusted for taxes, but excluding interest expenses. We remove interest since the cost of debt factors into the overall capital cost.

Cost of Capital: This reflects what investors demand as a minimum return, combining both debt and equity costs. It’s calculated using the Weighted Average Cost of Capital (WACC).

Capital Invested: This represents the total funding provided by investors through debt and equity at the start of the measurement period.

Making the Numbers Real

Here’s a concrete example using actual figures:

A company has:

– Capital invested: $54,236

– WACC: 8.22%

– NOPAT: $7,265

The EVA calculation shows:

EVA = $7,265 – (8.22% × $54,236) = $2,805

This positive EVA means the company created $2,805 in real economic value above investor requirements.

Raw accounting figures need adjustments to show economic reality:

Research and development costs should be treated as investments rather than expenses. This reflects their long-term value creation potential.

Real asset value decline (economic depreciation) should replace accounting depreciation, which often distorts true asset worth.

Non-cash charges like provisions and allowances need reversal since they don’t reflect actual capital use.

Operating lease costs should be treated as capital investments to show true resource commitment.

EVA guides strategic choices by showing which business units create the most value. This helps companies direct resources to high-performing areas while fixing or divesting underperforming segments.

For instance, a manufacturing company might discover its specialty products division generates positive EVA while its commodity products show negative EVA. This could prompt shifting investment toward specialty manufacturing.

Many companies have begun to link management compensation directly to Economic Value Added (EVA) performance. This strategic alignment guarantees that executives and decision-makers are rewarded based on the creation of genuine economic value, rather than chasing topline revenue growth or short-term profit increases. By tying compensation to EVA, organizations motivate their leaders to focus on sustainable value creation that truly benefits shareholders over the long haul.

A well-designed EVA-based bonus system typically incorporates several important features to drive the right behaviors:

Base EVA Targets: These are usually benchmarked against industry peers or historical company performance to set a realistic yet challenging baseline for value creation.

Improvement Goals: Beyond just hitting a target, management is incentivized to continuously improve EVA over time, encouraging innovation, efficiency, and long-term strategic growth.

Long-Term Components: To discourage short-termism, a portion of bonuses is often deferred or linked to multi-year EVA performance, ensuring executives remain focused on sustainable success rather than quick wins.

EVA also plays a role in decision-making, especially in mergers and acquisitions (M&A). Evaluating potential deals through the lens of EVA helps companies assess whether the transaction will generate real value above and beyond the cost of capital. This approach goes deeper than just looking at projected revenue or earnings growth, by emphasizing the quality and sustainability of the combined entity’s value creation.

When using EVA in M&A analysis, several key factors should be carefully considered:

Current EVA of Both Companies: Understanding the baseline value each company is generating independently helps set expectations for the combined entity.

Expected Synergy Benefits: EVA can quantify the financial benefits expected from combining operations, such as cost savings, revenue enhancements, or capital efficiency improvements.

Integration Costs: The short- and medium-term costs of integrating two businesses can temporarily reduce EVA, so these must be factored into projections.

Sustainability of EVA: It’s critical to assess whether the merged company will be able to maintain positive EVA over the long term, confirming that the deal isn’t just a short-lived boost but a genuine source of ongoing value.

By leveraging EVA in compensation structures and M&A decisions, companies create a framework that encourages prudent management and strategic growth. This dual application helps ensure that value creation remains at the heart of business performance and corporate strategy.

Companies use EVA to screen potential investments. This ensures capital spending focuses on value-creating opportunities.

Key considerations include:

While EVA offers clear benefits, companies often face hurdles in implementation:

Getting accurate EVA figures requires numerous accounting adjustments. This demands significant effort and expertise from financial teams.

Employees may resist EVA adoption if they don’t understand the concept or fear its impact on compensation. Clear communication and training help overcome these barriers.

EVA sometimes identifies value destruction in popular projects or business units. This can create tension between long-term value creation and short-term results.

Implementing EVA requires robust financial systems to track and calculate the metric. Many companies need to upgrade their capabilities to support EVA analysis.

While EVA is a powerful metric, it’s important to remember that it’s just one piece of the puzzle. To gain a full view of value creation, companies should consider other complementary measures as well. For instance, Return on Invested Capital (ROIC) provides insight into how efficiently a business is deploying its capital. Internal Rate of Return (IRR) sheds light on the true cash flow-generating ability of investments, revealing their profitability over time. And Free Cash Flow focuses on the actual cash a company generates, offering a clear picture beyond accounting profits.

The key to effective performance management is selecting the right combination of metrics that fit your unique business context and decision-making needs. By thoughtfully integrating EVA alongside other relevant indicators, companies can create a well-rounded approach to measuring and driving sustainable value creation.

As business environments evolve, value measurement continues advancing:

New tools make EVA calculation and tracking easier through automated data collection and analysis. This reduces implementation barriers while improving accuracy.

Companies are increasingly broadening their focus beyond maximizing shareholder value. Modern businesses recognize the importance of considering a wider range of stakeholders—including employees, customers, communities, and the environment—in their decision-making processes. This shift is prompting many organizations to adapt traditional financial metrics like Economic Value Added (EVA) to better capture social and environmental impacts alongside pure financial returns.

Looking ahead, EVA is poised to remain a tool for measuring business performance, but it will need to evolve to reflect these changing realities and the growing expectations of diverse stakeholders. Rather than being viewed as a static formula, EVA is becoming more dynamic—incorporating factors such as sustainability initiatives, corporate social responsibility efforts, and long-term environmental risks that can affect a company’s economic value.

By gaining a clear understanding of the strengths and limitations of EVA, companies can use it more effectively as part of a broader strategic toolkit. The real power of EVA lies in its implementation—aligning this metric with overarching business goals and the needs of stakeholders to foster genuine value creation. It helps businesses make smarter investment decisions, allocate resources more efficiently, and focus on activities that drive lasting profitability and growth.

It’s important to remember that EVA is only one of many tools available to guide business success. While it provides valuable insights into financial performance, relying on it exclusively can overlook other critical dimensions of value, such as innovation, customer loyalty, and environmental stewardship. Combining EVA with other metrics ensures a more balanced approach to measuring and managing performance in today’s complex, interconnected economy.

Creating real economic value requires more than generating profits in the short term. EVA serves as a powerful guide to make sure that your business meets the return expectations of investors and builds sustainable wealth that endures over time. By putting this tool to work wisely, companies can confidently navigate their value creation journey and thrive in a world where purpose and profit go hand in hand.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.