317-912-1000

317-912-1000

When most people think about life insurance, they envision a death benefit that provides financial protection for loved ones after they pass away. While this remains an important function, it doesn’t tell the complete story of what life insurance—particularly participating whole life insurance—can offer during one’s lifetime.

The real question isn’t whether you need life insurance for death benefits, but whether you understand how it can function as a powerful financial tool while you’re alive.

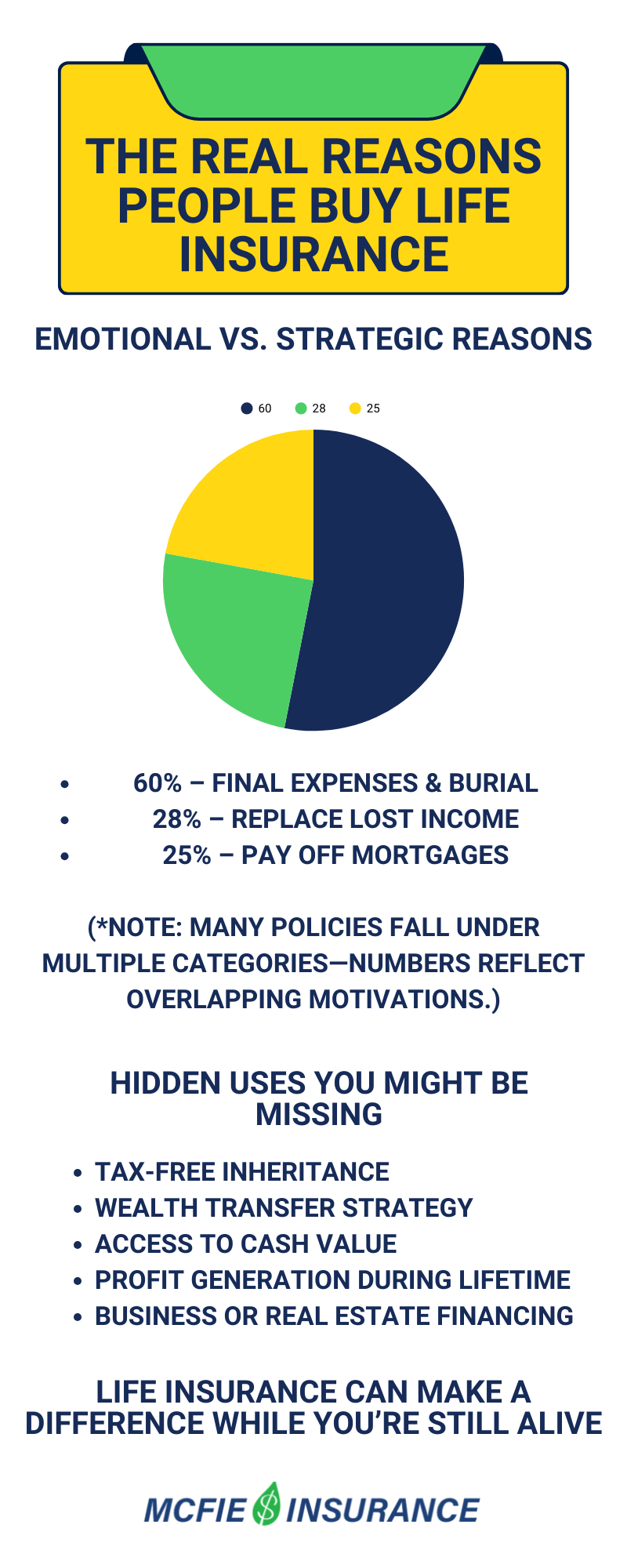

Insurance decisions are often driven by emotional rather than logical factors. According to industry research, about 60% of life insurance policies are purchased primarily to cover final expenses and burial costs. Only 28% of policyholders purchase life insurance to replace their income, while roughly 25% buy it to ensure their mortgage gets paid off when they die.

Beyond these common reasons, life insurance serves other important purposes. Some types are designed for estate planning, facilitating tax-free wealth transfers or inheritances. An increasingly popular application—especially among financially savvy individuals and business owners—is using life insurance to create higher cash flows and generate greater profits during their lifetime.

This approach focuses on the living benefits of certain types of life insurance, not just the death benefit.

To appreciate why life insurance can be such a powerful financial tool, we need to understand the concept of “cost of capital”—the money lost when purchasing something.

This cost manifests in two main ways:

Consider these examples:

Surprisingly, using your own money costs more than borrowing in this scenario! This occurs because the 5% interest on borrowed money applies to a steadily decreasing principal balance, while the 3% compounding growth on your money stops completely once you spend it.

Most people overlook this hidden cost when making financial decisions. Every dollar spent or invested carries this cost of capital unless that dollar can continue earning compound growth while being utilized elsewhere.

Participating whole life insurance offers a solution to this cost of capital problem. Unlike other financial products, these policies build guaranteed cash value over time, and this value continues to grow whether you access it or not.

When you take a policy loan against your cash value, you’re not withdrawing your money from the policy. Instead, the insurance company lends you money from its general fund, using your cash value as collateral. This distinction is crucial because it means your cash value continues to grow uninterrupted within the policy, even while using the loaned funds elsewhere.

Let’s examine how this works using the same $10,000 example:

If you borrow $10,000 against your participating whole life policy at 5% interest and repay it over 7 years, your $10,000 cash value continues earning the guaranteed growth rate in your policy. Assuming that growth rate is 3%, you would have preserved the $2,298.74 of growth that would otherwise have been lost had you withdrawn the money.

The interest paid to the insurance company would be $2,097.39 (at 5%), resulting in a net gain of $201.35 ($2,298.74 – $2,097.39) rather than a loss. Your original $10,000 remains intact within the policy, ready to be leveraged again if needed.

This shows a shift in thinking about how money can work. Instead of settling for a single use of your capital, participating whole life insurance allows for multiple uses simultaneously.

Taking this concept further, what if you invested the $10,000 borrowed from your policy (at 5% interest) and earned a 5% return over 7 years?

You would turn that $10,000 into approximately $14,071. After subtracting the loan repayments totaling $12,097.39, you’d have a profit of $1,973.61. Compare this to using your own $10,000 and giving up the 3% compounding growth, leaving you with only $1,772.26 ($14,071 – $12,298.74).

The policy loan approach gives you an advantage of $201.35—not a huge sum in this example, but the principle scales with larger amounts and longer time periods. This advantage comes without taking on additional risk, as your cash value continues growing at its guaranteed rate.

Many financial advisors focus heavily on rate of return when evaluating investments. This mindset leads to comparing whole life insurance returns against other investment vehicles like stocks, bonds, or real estate—often concluding that whole life underperforms.

This comparison misunderstands the purpose of participating whole life insurance in a comprehensive financial strategy. While rate of return matters, the return OF your money is arguably more important than the return ON your money.

As Charles Munger, the late vice chairman of Berkshire Hathaway once noted, “Once you’ve disciplined yourself to retain $100,000, the rest is easy.” His point underscores the importance of building and maintaining capital rather than constantly depleting it for new investments or expenses.

Participating whole life insurance supports this philosophy by preserving your capital while simultaneously allowing you to use it. Without this ability to maintain compound growth on money you’re leveraging elsewhere, the cost of capital will continually erode what you earn.

This strategy of using participating whole life insurance as a financing vehicle is often referred to as the “Infinite Banking Concept” or “Becoming Your Own Banker.” R. Nelson Nash popularized this approach in the 1980s during a period of extremely high interest rates.

Nash discovered that by leveraging his life insurance policies’ cash values at 5-8% interest, he could refinance debts that were costing him up to 23%. Once the debt was transferred to the insurance companies, he could repay it at his convenience with much better interest rates. Plus, the growth in his life insurance cash values offset the interest he paid on these loans.

What began as a debt management strategy evolved into a system for financing purchases without relying on traditional banks. The method works because of three principles:

Today, people use this strategy to finance everything from cars and education to real estate investments and business expansions. The applications are diverse precisely because the strategy is about recapturing the cost of capital—something that affects virtually every financial transaction.

For business owners, policy loans are a flexible source of capital that doesn’t require credit approval, collateral (beyond the policy itself), or adherence to strict repayment schedules. This flexibility can be invaluable during economic downturns or when rapid expansion opportunities arise.

For individuals, policy loans can create a personal financing system that becomes more efficient over time. As your cash value grows, so does your capacity to finance larger purchases or investments. And since you’re paying the interest to a mutual insurance company (in which you’re a participating policyholder), you’re indirectly benefiting from these payments through potential dividend increases.

Not all life insurance policies are created equal when it comes to the implementation of this strategy. The policy has to be properly structured to maximize cash value accumulation while maintaining its tax advantages.

Key features of an successful policy include:

A properly designed policy might have 60-70% of the first year’s premium translate to first-year cash value. By years 8-15, the guaranteed cash value exceeds the total premiums paid.

While premium costs for whole life are higher initially compared to term insurance, the difference becomes less significant over time as term rates increase with age. More importantly, whole life premiums eventually build substantial cash value that can be used during your lifetime.

Financial products can generally be evaluated along three dimensions:

Most financial products excel in one or two areas but fall short in others:

Participating whole life insurance offers reasonable performance across all three dimensions:

This balanced profile makes it an ideal foundation for a financial strategy rather than a standalone investment vehicle.

Critics of whole life insurance often focus on its higher initial premium costs and relatively modest internal rate of return compared to other investments. These criticisms miss several important points:

Whether you need life insurance ultimately comes down to whether you want to recover the cost of capital and have your money return so you can use it repeatedly throughout your lifetime.

If you’re tired of depleting your capital and starting over with each new purchase or investment, participating whole life insurance offers a systematic approach to building and preserving wealth while still accessing liquidity when needed.

This approach requires discipline and a long-term perspective. It won’t appeal to those seeking quick returns or willing to accept high volatility for the chance of outsize gains. But for those who value consistency, guarantees, and the efficient use of capital, it provides a foundation that few other financial products can match.

The Life Benefits Formula approach to financial management, which incorporates participating whole life insurance as a cornerstone, focuses on:

By properly implementing this strategy, you position yourself to keep more of the money you make rather than continuously transferring wealth to banks, financial institutions, and tax authorities.

Unlike typical retirement accounts that restrict access to your money until age 59½ (with penalties for early withdrawal), participating whole life insurance provides accessible liquidity throughout your life while still building long-term value.

Do you really need life insurance? If you’re only concerned with providing a death benefit for your family, term insurance might suffice for temporary coverage. But if you want a financial tool that provides death benefit protection while helping you recover the cost of capital during your lifetime, participating whole life insurance deserves serious consideration.

The traditional financial planning approach focuses on accumulating a large sum for retirement and then gradually depleting it. The Infinite Banking Concept using participating whole life insurance offers an alternative: building a pool of capital that continues growing while being used repeatedly throughout your lifetime.

This approach requires a shift in thinking—from viewing money as something to be spent once to seeing it as something that can be used multiple times through strategic leveraging. Not everyone will have the discipline or patience for this approach, but for those who do, it offers a path to financial sustainability that traditional investments alone can’t provide.

If you’re tired of paying the cost of capital on every dollar you spend and want to position yourself to recover those costs, participating whole life insurance might be the missing piece in your financial strategy. With proper design and implementation, it can help transform how your money works for you—not just after death, but throughout your entire life.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.