702-660-7000

702-660-7000

Credit card debt can feel like an insurmountable obstacle on the path to financial freedom. What begins as seemingly inconsequential charges can quickly snowball into thousands of dollars of high-interest debt that keeps you financially bound for years. But what if there was a way to eliminate credit card debt more efficiently and transform it into a wealth-building opportunity?

Joey and Nicki found themselves in a situation that’s all too common in America today. Without proper financial planning, they had accumulated credit card debt equal to 25% of their annual income.

It started innocently enough: Joey buying lunch when he forgot to pack one, Nicki purchasing some professional attire for the office, and finally, the tipping point—concert tickets and airfare to see Taylor Swift in Paris. Though they knew they couldn’t afford the international concert trip, social pressure pushed them to put the entire expense on their credit cards.

With a combined take-home pay of $80,000 annually, they now faced $20,000 in credit card debt spread across three cards:

Making only minimum payments ($30 on Joey’s card, $270 on Nicki’s, and $300 on their joint card), they faced 69 months—nearly six years—of payments totaling $41,052. More than half of this ($21,052) would be pure interest. They would pay more than double their original debt.

Like many people in their situation, Joey and Nicki first considered debt consolidation. They thought combining their debts into a single loan with one monthly payment of $600 seemed like a logical solution.

Upon further investigation, they discovered an unsettling truth: despite a lower interest rate of 24%, consolidation would actually cost them more in the long run—$38,887 in interest instead of $21,052—and extend their repayment timeline.

Why? Consolidation would eliminate their ability to target and eliminate smaller debts first. With their current arrangement, they could pay off their joint credit card in 56 months, freeing up $300 to accelerate payments on Nicki’s card. This effect of freed-up cash flow would allow them to eliminate all debts in 69 months.

Just as Joey and Nicki decided against debt consolidation, a friend introduced them to a concept that seemed too good to be true: using participating whole life insurance to pay off their credit cards and recover the $20,000 they owed. This concept, known as The Infinite Banking Concept™, offered a path not just out of debt but toward building sustainable wealth.

Their friend explained how she had used this system to finance her own Paris trip to see Taylor Swift, and rather than ending up in debt, she had increased her wealth in the process. Intrigued, Joey and Nicki decided to learn more.

When Joey and Nicki met with a life insurance agent from McFie Insurance, they were introduced to the 10-20-70 principle—a vital component of The Infinite Banking Concept™:

The agent pointed out that Joey and Nicki were currently spending only 9% of their income ($600 monthly) on debt repayment when it should be 20% ($1,333). More alarmingly, they were saving nothing—0% instead of the recommended 10% ($667 monthly). This lack of savings was undermining their financial security and was the root cause of their financial stress.

Infinite Banking works on the principle that money should never stop working for you. Unlike traditional debt repayment methods where money disappears into interest payments, this approach creates a system where your money grows and compounds even while you’re using it to eliminate debt.

Following the 10-20-70 principle, Joey and Nicki committed to:

This approach produced remarkable results:

The result? Joey and Nicki eliminated their credit card debt in just 14 months—a far cry from the 69 months it would have taken using the debt snowball method popularized by financial gurus like Dave Ramsey.

When Joey and Nicki paid back the $5,000 policy loan at 5.2% interest (dramatically lower than their credit card’s 24%), it took them just four months. In total, their debt elimination journey lasted 18 months rather than 69 months.

Instead of losing $41,052 to credit card payments as they would have with traditional methods, they ended up with $20,803 in cash value in Nicki’s policy, along with a death benefit of $342,132. They had not only eliminated their debt but had begun building wealth in the process with The Infinite Banking Concept™.

This approach turned non-performing debt (credit cards) into a wealth-generating asset (cash value life insurance), allowing them to recover the whole amount of their original debt while establishing financial protection through life insurance.

To understand the power of this approach, let’s look at how Joey and Nicki’s friend had used The Infinite Banking Concept™ for her Paris trip:

In essence, Joey and Nicki’s friend:

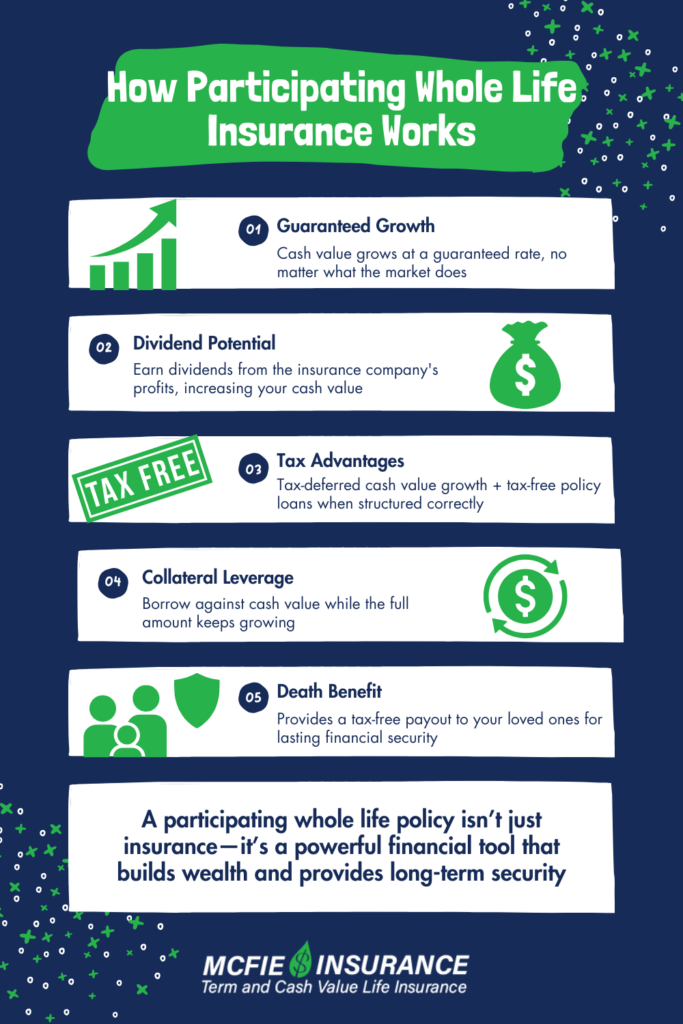

Participating whole life insurance is the foundation of Infinite Banking because it offers advantages that other financial vehicles don’t:

Now that Joey and Nicki have eliminated their credit card debt and are following the 10-20-70 principle, they can use The Infinite Banking Concept for wealth creation rather than debt elimination.

They’ll start with their existing $20,803 in cash value and can:

Over time, this approach creates a personal banking system where Joey and Nicki become their own source of financing. Rather than paying interest to banks and credit card companies, they’ll recover interest through their policies’ growth, transforming financing costs into wealth.

Most financial advisors recommend approaches like the debt snowball or debt avalanche to eliminate credit card debt. While these methods are better than making minimum payments, they still have drawbacks:

Infinite Banking, by contrast, addresses all these issues:

While Infinite Banking offers powerful benefits, it requires:

For those willing to make these commitments, the long-term benefits are substantial. Instead of just eliminating debt, you can transform debt repayment into a wealth-building strategy.

If you’re intrigued by how Joey and Nicki transformed their financial situation, here are steps to consider:

Joey and Nicki’s journey from credit card debt to financial empowerment illustrates the transformative potential of Infinite Banking. Rather than spending years making payments that disappeared into credit card companies’ profits, they built a system that eliminated their debt in less than a third of the time while creating an asset that will keep growing for decades.

Infinite Banking isn’t just about getting out of debt—it’s about changing your relationship with money. By becoming your own banker through participating whole life insurance, you can recapture the interest you would otherwise pay to financial institutions and redirect it toward building sustainable wealth.

Stories like Joey and Nicki’s are common at McFie Insurance because this approach changes the financial trajectory of individuals, families, and business owners. It provides debt elimination, financial stability and sustainability that traditional methods can’t match.

If you’re struggling with credit card debt or looking for a more efficient way to manage your finances, explore how The Infinite Banking Concept can transform your financial future.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.