702-660-7000

702-660-7000

In an unpredictable world, securing your financial future is more important than ever. But what if life insurance could offer more than just a safety net for your loved ones? Imagine a policy that not only provides a death benefit but also helps you build wealth, access funds when you need them, and support your financial goals throughout your lifetime. That’s exactly what cash value life insurance can do.

Unlike traditional term life insurance, which only provides a payout after you pass, cash value life insurance offers a built-in savings component that grows over time. Let’s take a look at how it works and why it might be a smart addition to your financial strategy.

Cash value life insurance is a form of permanent life insurance that provides lifelong coverage and includes an investment component known as the policy’s “cash value.” It builds equity, making the policy useful not just for the death benefit paid out to beneficiaries but also as a financial tool for the policyholder during their lifetime.

The policy consists of two core components: the death benefit and the cash value.

The death benefit is the amount that’s paid to your beneficiaries when you pass away, while the cash value is a separate account within the policy that grows over time. You can think of the cash value as a type of savings or investment account that’s funded by a portion of each premium payment you make. This cash value grows tax-deferred, meaning you won’t pay taxes on its growth until you start making withdrawals.

When you purchase a cash value life insurance policy, your premium payments are split into three parts:

The exact breakdown of your premium and how quickly the cash value grows will depend on the specific type of policy you purchase. With whole life insurance, for example, the premium remains the same for the life of the policy, and the cash value account grows at a guaranteed rate set by the insurance company.

Universal life policies, on the other hand, allowing you to adjust premiums and death benefit amounts, with cash value growth tied to a market index or other benchmark.

There are several types of cash value life insurance policies to choose from, each with its own unique features and benefits:

Also known as “ordinary life” or “straight life,” whole life is the most common type of cash value life insurance. It provides a fixed death benefit, guaranteed cash value growth, and consistent premiums for the life of the policy. The cash value grows at a rate determined by the insurer and can be accessed through policy loans or withdrawals.

Universal life insurance allows policyholders to adjust their premiums and death benefit over time (within certain limits). The cash value component typically earns interest based on current market rates.

With indexed universal life insurance, the cash value growth is tied to the performance of a market index, such as the S&P 500. While there is more growth potential than a traditional universal life policy, there’s also more risk involved, as the cash value can fluctuate with market conditions. Many IUL policies offer a guaranteed minimum interest rate to protect against market downturns. They also have a cap which can significantly limit earnings in market up years.

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

Variable life and variable universal life insurance policies offer the most investment flexibility and potential for growth, but also come with the highest level of risk. With these policies, you can allocate your cash value among a selection of investment options, such as mutual funds. If the investments perform well, your cash value can grow significantly. However, poor performance can lead to losses, which greatly impacts the death benefit and policy’s sustainability.

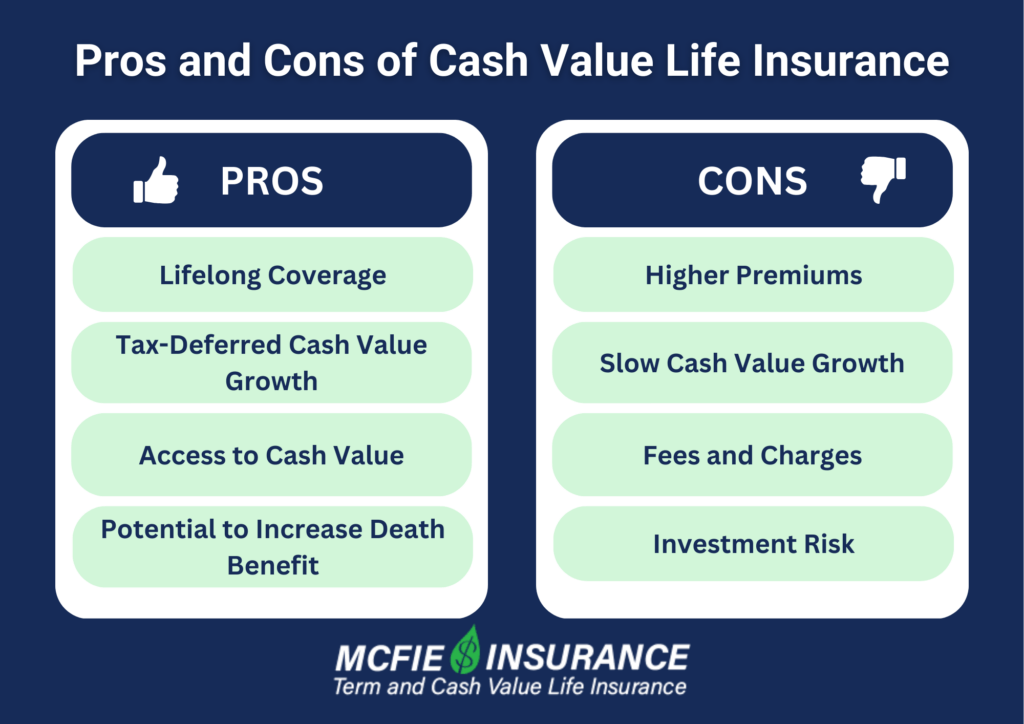

Cash value life insurance policies offer several advantages but also come with some drawbacks to consider.

One of the key benefits of cash value life insurance is the ability to access the life insurance cash value while you’re still alive. There are a few ways to do this:

It’s essential to understand the potential tax implications and impacts on your death benefit before accessing your policy’s cash value. Consult with an insurance professional to explore your options.

Cash value life insurance can be a valuable tool for those seeking lifelong coverage and a way to build tax-deferred savings over time. However, it’s not the right choice for everyone.

Cash value life insurance is a unique financial product that combines lifelong coverage with an investment component, offering policyholders both a death benefit and a living benefit. By understanding how cash value life insurance works, the different types available, and the pros and cons, you can make an informed decision about whether it’s the right choice for your financial needs and goals.

While cash value life insurance isn’t the best fit for everyone, it can be a valuable tool for those seeking to protect their loved ones, build tax-deferred savings, and access funds for retirement or other financial milestones.

|

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here> |

As with any significant financial decision, it’s essential to consult with a trusted advisor who can help you navigate your options and create a comprehensive plan tailored to your unique situation. With McFie Insurance Experts by your side, we can customize the perfect life insurance policy for you.

Cash value life insurance is used in infinite banking. Check out our ebook for more about how infinite banking can prepare you for retirement, along with providing the typical benefits of life insurance.

by Jesse McFie

by Jesse McFie

I have worked hard and saved from an early age. In 2018, my brother and I started our own welding and fabrication business and grew it to a full-time company. As taxes, fees and inflation ate away at my hard-earned income and savings, I quickly realized that the financial system in America is not designed to help you get ahead. Using participating whole life insurance and the principles we teach at McFie Insurance has helped me get ahead financially. I’ve used my life insurance policies to expand our business, debt free, to purchase equipment, and save for a piece of property. I love sharing with others how they can do the same.