702-660-7000

702-660-7000

The craze in insurance sales these days is Index Universal Life Insurance (IUL). And for good reason. The insurance companies that sell the stuff, reduce their risk by passing that risk on to you (Whereas they willingly assume this risk when they issue a Participating Whole Life Insurance Policy (PWLIP) to you).

Insurance companies are masters at avoiding risk so this should be your first cautionary piece of information. This risk is not something the insurance company wants to assume, but they are willing to push it off onto you, why?

To understand why, study the following:

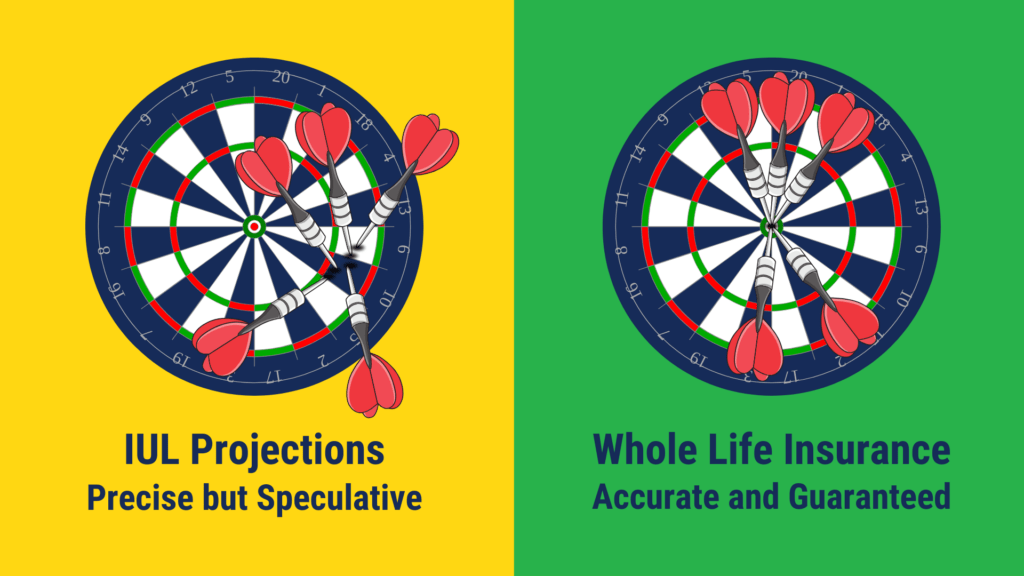

Index Universal Life Insurance (IUL) is sold using minimal to zero guaranteed growth values. This obviously is NOT IUL’s most marketable attribute. But where you might get hung up is in the attractive tables used in the sales process. In these tables, you will be shown precise historical data on the S & P 500, the Russel 2000, the Nasdaq, or maybe the Dow, all of which are Indexes that have widely published historical data showing past annual returns. You’ll be shown, for example, how over the past 10 years a specific index has had a positive return. It might be 11.384% or 9.658% or any other rate over a precise period of time. Of course the table is precise (after all it is historic data) and you can’t fib about historical data. But, precision and accuracy are not the same thing.

In order to be accurate, you have to be able to reproduce the same results every time you repeat a specific process. For example, when you bake a cake you might precisely, but inaccurately, measure all the ingredients and follow the directions. But your results will not be consistent each time you bake that cake unless you can accurately measure all the ingredients and follow the directions. Same is true in finance.

It’s been said, “Figures don’t lie, but liars do figure.” And when some company or salesperson has precisely selected data to illustrate what an IUL contract might look like over time, you are not looking at accuracy but rather speculation. Not knowing the difference between precision and accuracy, you may be hoodwinked into assuming the risk that the insurance company didn’t want to assume, which will put you at odds of making that IUL a profitable purchase.

Here’s why.

Over the last 10 years (depending on which month you enter and exit the market) the S & P 500 Index has provided an average rate of return ranging precisely between 6.869% to 13.579%. That’s a broad range! With $100,000 invested at the beginning you could easily triple your money… if you earn 13.579% over 10 years…ending up with $357,257. But, if your 10-year average rate of return is only 6.869% you won’t even double your money! After 10 years you’ll only have $194,320.

So, which data do you think the sales force for IUL contracts uses to project future policy values? The 6.869% and 13.579% are both precise figures. But remember, precision and accuracy are not the same thing; and NO IUL projected values are accurate! They can’t be because nobody can determine what market returns are going to be.

Timing is everything when it comes to investing. And even though IUL is not considered an investment, it does mirror the invested returns of specific Indexes. That means you become subject to the helter-skelter returns of the Indexes that your IUL mirrors. If you purchased your IUL on January 1, 2008 and exited on December 31, 2017, your return would have been 6.869%. But if you purchased your IUL a month earlier on December 1, 2008 and exited a month later on January 1, 2018 then your return would have been 13.579%. That’s a huge difference in returns only accounted for by a couple of months! Of course, each day is as unique as each month, and each hour is as unique as each week, making any accurate projection impossible.

Obviously, the time you begin is critical. But so is the time you exit. If you exited the IUL policy 2 months earlier (in November) the policy depicted above, which started December 1, 2008 merely 2 months shy of the 10-year mark, would have dropped your returns from 13.579% to 12.923%. Likewise, if you decided to hold on for two months longer than 10 years your return would also have dropped to 12.931%. Both of these precise dates and returns are less than what they would have been if you exited precisely on the 10-year anniversary.

But who knows if that will happen? And will the market even come close to mimicking the month by month, day by day, hour by hour, history of the past ten years? Highly unlikely. The bold truth is that market returns can precisely be determined historically, but they cannot be accurately determined futuristically, regardless of past returns. NEVER!

That leaves only one solution to accurately know what you will have in your permanent life insurance policy 10, 20, 30 or 40 years from now. You need to stick with the tried and true product called Participating Whole Life Insurance (PWLI). With PWLI, you enter a unilateral contract with the insurance company when you purchase the policy. You enjoy contractually guaranteed cash values that will be there for you, next month, next year, in 10 years and even when you are 100 years old.

These contractually guaranteed values will grow every year and will exceed the price of what you have paid for your PWLI faster than you realize. Thus providing you with life insurance coverage at virtually no cost and without you having to assume the risk that the market most likely will not accurately perform as well as it was “precisely” illustrated to do in that IUL policy illustration.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.