702-660-7000

702-660-7000

There are several ways life insurance can help you buy a home. For starters, you can use the cash value in your policy as collateral to secure a loan or to negotiate better interest rates. If you own a participating whole life insurance policy, you may also borrow or withdraw from the cash value directly to fund a down payment, make monthly mortgage payments, or even purchase the property outright—without the red tape of a traditional lender.

This kind of flexibility makes life insurance more than just a safety net—it becomes a financial tool you can use while you’re still alive.

With a collateral assignment, you can pledge part or all of your policy’s cash value to a lending institution. This added security can help you qualify for a loan faster or secure a more favorable interest rate.

Any cash value assigned as collateral will be unavailable for loans or withdrawals until the loan is paid off or the assignment terms are fulfilled and the lender formally releases the claim.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

If you were to pass away while your life insurance policy has a collateral assignment in place, the process for distributing the death benefit changes. Instead of the entire benefit going directly to your named beneficiaries, the lender who holds the assignment would be paid first. Whatever amount is still owed on the assignment would be deducted from the death benefit and paid directly to the lending institution. Only after that obligation is satisfied would your beneficiaries receive the remainder of the policy’s proceeds.

The same principle applies if you decide to cancel the policy. The policy’s surrender value doesn’t go straight into your pocket. Instead, the life insurance company would first pay off the collateralized portion to the lender, and then any remaining funds would be released to you. It’s an important detail to understand, because until the assignment is officially released by the lender, you don’t have full control over that portion of your policy’s value.

Permanent life insurance policies like whole life insurance, come with a valuable feature: they build cash value over time. With a well-designed participating whole life policy, cash value steadily grows year after year, often becoming more than the total amount paid in premiums over the life of the policy. This growth happens on a guaranteed basis and is enhanced by dividends in many cases.

The accumulated cash value belongs to the policyholder and can be accessed at any time through policy loans or withdrawals, depending on how the policy is structured. This flexibility allows the policy owner to tap into their policy to fund a variety of financial needs. While it’s not limited to these purposes, the cash value can be used to help purchase a home, cover a down payment, or even make monthly mortgage payments—giving the policyholder a level of liquidity that’s overlooked in traditional financial planning.

It’s crucial to note that this benefit is exclusive to permanent insurance. Term life insurance, by contrast, doesn’t accumulate cash value and offers no opportunity for loans or withdrawals. Still, some lending institutions may require the borrower to purchase a term policy as a form of collateral to protect the loan in case of untimely death. While this offers some financial security to the lender, it doesn’t provide the same long-term financial flexibility that comes with a permanent policy.

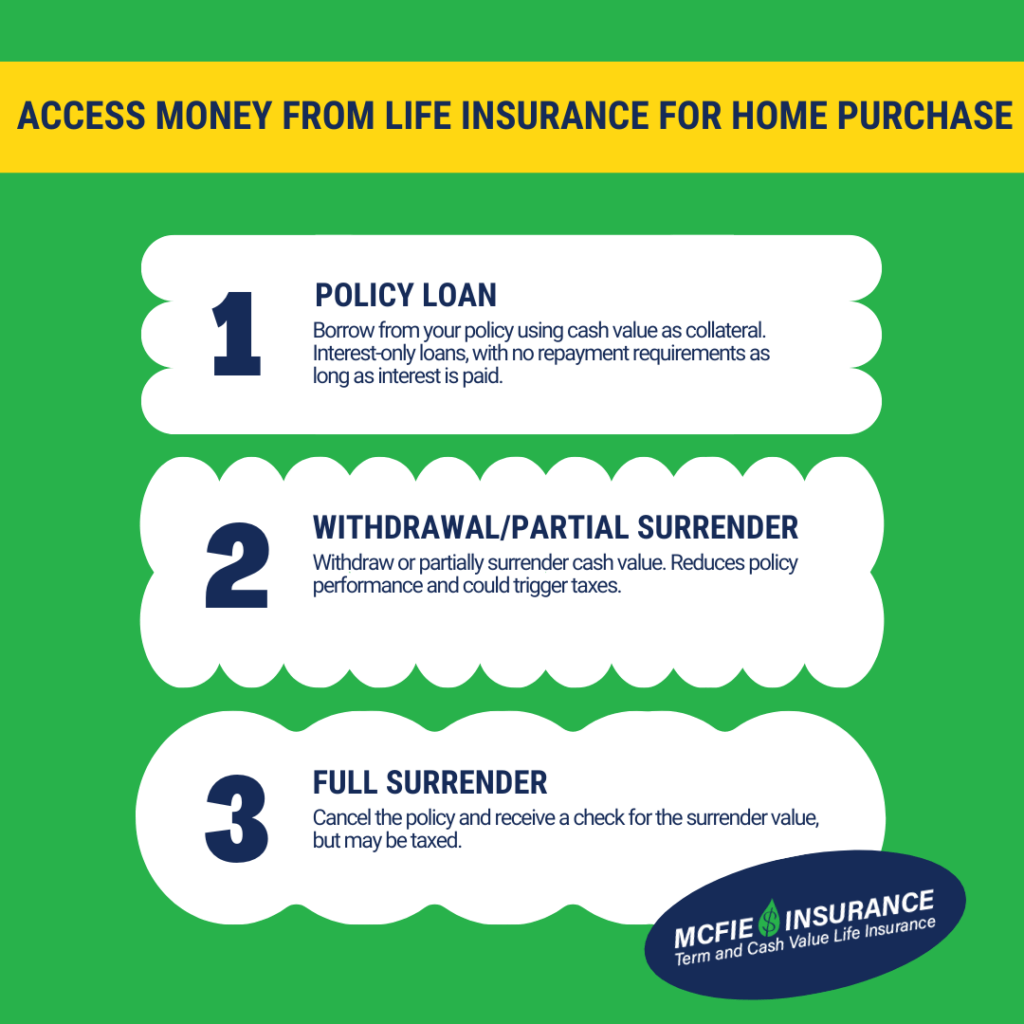

There are three different ways to access the cash value in a life insurance policy.

You can access the cash value of your permanent life insurance policy through a policy loan, where you borrow against the value accumulated within the policy. When you take out a policy loan, you are borrowing funds from the insurance company, using the cash value within your policy as collateral to secure the loan. One advantage is that the cash value inside your policy remains intact and continues to grow, even as you use it to secure a loan.

Policy loans are generally structured as interest-only loans. As long as you continue to pay the interest on the loan, you aren’t required to make principal repayments. This provides flexibility in managing your cash flow. There are also no formal requirements or restrictions on how you use the loan proceeds, which means you can use the funds for virtually any purpose, such as paying for education, covering emergency expenses, or making a large purchase, like a home.

In the unfortunate event that you pass away with an outstanding policy loan, the insurance company will subtract the loan amount from the death benefit before paying the remaining balance to your beneficiaries. This ensures that the loan is settled, and the remaining death benefit can be distributed.

It’s important to keep in mind that policy loans are not taxable. That said, if you fail to pay the interest on the loan, the insurance company may take additional loans from the policy to cover the unpaid interest. This can create a compounding effect, where the loan balance continues to grow, jeopardizing the policy’s value. If the loan becomes large enough, it could cause the policy to lapse, leading to tax consequences and a loss of coverage. It’s crucial to stay on top of loan interest payments to avoid these risks.

Another way to access the cash value of your permanent life insurance policy is through a withdrawal, also known as a partial surrender. Unlike a policy loan, where you borrow against the value of the policy, a withdrawal involves permanently removing a portion of the cash value from the policy. Once you make a withdrawal, it cannot be repaid, and it will reduce the overall performance of your policy. This means the available cash value and the death benefit will both decrease, which can affect the future growth of the policy.

If you withdraw more than the total amount of premiums you have paid into the policy (the cost basis), the excess amount will be considered taxable income. This is important to keep in mind, as it can have tax implications, especially if you withdraw a large sum.

Another option for accessing the cash value is to fully surrender the policy. When you surrender the policy, the insurance company cancels your coverage and issues a check for the available cash value, minus any applicable fees or charges. A full surrender, like a partial withdrawal, is a permanent action. Once you surrender the policy, it cannot be reinstated, and you lose your life insurance coverage.

Similarly to a partial withdrawal, if the amount you receive from the full surrender exceeds the cost basis (total premiums paid), the excess amount will be treated as taxable income. This could result in a tax liability, so it’s essential to weigh the pros and cons of fully surrendering a policy before making such a decision.

As soon as your permanent life insurance policy accumulates cash value, you can begin to take a policy loan. Cash value usually becomes available shortly after you pay your first premium. It’s important to note that the growth of cash value is generally slow in the first few years of the policy. With a well-designed whole life insurance policy, though, the cash value will grow steadily over time, eventually surpassing the total amount of premiums you’ve paid into the policy.

You can borrow up to the full amount of the cash value that has accumulated in your policy. Some insurance companies may charge interest on the loan in advance, which means that the amount available for borrowing would be slightly less than the total cash value. In cases like this, the loan amount you can access is reduced by the amount of the first year’s interest. It’s important to keep in mind that while borrowing from your policy can be a flexible and convenient way to access funds, you will be required to repay the loan, plus interest, to avoid any potential impact on your policy’s death benefit or cash value growth.

Whole life insurance is one of the best tools for wealth accumulation. Policy cash values are guaranteed and continue to grow regardless of market fluctuations And with a well designed policy, cash value will grow to far exceed the total premiums paid. This money can be accessed with an interest only policy loan at any time for any reason, without damaging policy performance. On top of this, if you should die, your loved ones will be taken care of with the death benefit you leave them.

Cash value is usually available not long after you pay your first premium. Cash value growth is slow in the early years, but with a well designed policy, cash value will grow to far exceed the total amount of premiums paid.

Well designed life insurance can be an excellent tool when buying a home. It can be used as collateral to secure a loan, it can be borrowed from to make a downpayment and of course it provides a way your family could pay off the mortgage if something were to happen to you.

Our family has been designing, selling and servicing life insurance policies for years. It would be our pleasure to help you with all your insurance needs. Schedule an appointment or call us: 702-660-7000 we can help you.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.