702-660-7000

702-660-7000

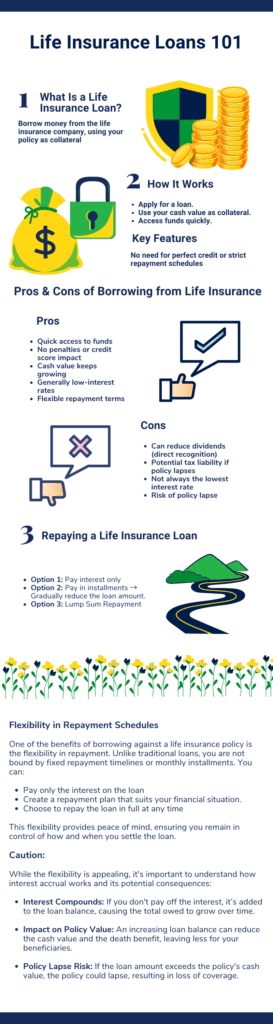

Borrowing from your life insurance policy offers a quick way to access funds for various purposes. You can utilize the money for purchasing a vehicle, making a down payment on a home, initiating a business venture, funding a vacation, or managing unexpected expenses. This borrowing option grants you greater flexibility compared to traditional lenders. With traditional lenders, there might be uncertainty about loan approval, and the repayment terms are predetermined. Borrowing from your life insurance policy empowers you with the ability to swiftly acquire funds without the hassle of extensive approval processes and rigid repayment conditions.

When considering borrowing against your life insurance policy, it’s important to note that you can only do so with policies that accumulate cash value. This category includes whole life insurance and universal life insurance, both of which are classified as permanent life insurance products. These policies build up cash value over time, providing a financial asset that can be accessed through borrowing. It’s essential to understand that term insurance, another type of life insurance, does not offer this option. Term insurance is temporary coverage without cash value accumulation, making it ineligible for borrowing purposes.

If you’re looking to access funds quickly and conveniently from your life insurance policy, you’ll need to have a whole life insurance or universal life insurance policy in place. These permanent life insurance options offer the flexibility to borrow against the cash value for various financial needs.

When banks lend money, they require collateral to secure the loan. For instance, in a car loan, the car itself serves as collateral, while in a mortgage, it’s the house. However, borrowing from life insurance works differently. Rather than directly borrowing from your policy, you’re borrowing from the life insurance company, which uses your policy as security. You’re essentially borrowing against your life insurance, leveraging your policy as collateral.

There are two main types of policy loans available: direct loans and Automatic Premium Loans (APL). Direct loans are initiated by the policy owner and have no impact on credit scores. They offer flexibility in usage and repayment timing, operating as interest-only loans where only the interest needs to be paid. Automatic Premium Loans (APL) do not impact credit scores either, but they automatically kick in if the policy owner fails to pay the premium. These loans cover the premium and accrue interest until the cash value is exhausted. Neglecting to continue premium payments or loan interest payments can lead to policy lapse and loss of coverage.

If the policy lapses due to negligence, there could be tax consequences. Any amount of the policy loan exceeding the cost basis (total premiums paid by the owner) may be subject to taxation as income. It’s important to understand these implications when considering borrowing against your life insurance policy.

Since you’re not directly withdrawing funds from your life insurance policy but using it as security to access the insurance company’s funds, the cash value in your policy can keep growing.

Policy loans come in two types: direct recognition and non-direct recognition, which impact dividend payments. In direct recognition status, policies with outstanding loans may receive a reduced portion of dividends compared to those without loans. In contrast, in non-direct recognition status, all policies receive the same dividend percentage, regardless of loan status.

While some prefer non-direct recognition companies to avoid reduced dividends with outstanding loans, it’s important to consider various factors when making this decision. Direct recognition companies often pay higher dividends because they consider every policy’s loan status. Personal preferences aside, both types of companies can offer benefits if the policy is well-designed.

Repaying a policy loan resembles repaying a car loan or a mortgage, but with a notable distinction: a policy loan necessitates only the payment of interest. You have the autonomy to establish your repayment schedule and determine the pace at which you settle the loan. In essence, there’s no obligation to fully repay a policy loan. As long as you cover the interest, there’s no requirement to repay the principal amount.

Policy loans operate on an interest-only basis, meaning you’re not obligated to repay the principal amount. At minimum, you must cover the interest. If you’re unable to meet the interest payments, the insurance company will augment the loan amount on your policy to accommodate the interest. While this arrangement may suffice in the short term, it’s not advisable as a long-term solution due to the accruing interest on the increased loan balance.

Should a policy loan become unmanageable, or if the policy owner wishes to eliminate the loan, several options are available. These include executing a 1035 exchange, converting to Reduced Paid Up (RPU) status, or opting for partial or complete surrender of the policy, or allowing it to lapse. Each option carries its own considerations and implications, necessitating careful assessment of individual circumstances and financial goals.

For those familiar with real estate, a 1035 exchange mirrors a 1031 exchange but within the realm of life insurance. In a 1035 exchange, the policy loan is entirely paid off, and the remaining equity is transferred into a new life insurance policy. Importantly, the new policy retains the cost basis of the original policy for tax purposes. However, this option necessitates the insured to undergo underwriting for the new policy.

The Reduced Paid-Up option provides an avenue for the insurance company to diminish the size of the policy and convert it into a paid-up status. While this choice significantly reduces the policy size, it effectively eliminates the policy loan, and the policy owner ceases premium payments as the policy becomes completely paid up.

In the case of a partial surrender, the policy owner can surrender a portion of their policy that was held as collateral for the outstanding loan. While this action eliminates the policy loan, it also diminishes the coverage provided by the policy.

Fully surrendering a policy or allowing it to lapse results in the elimination of the loan and termination of the contract. Any surrender value accrued will be paid to the policy owner. Notably, a lapsed policy differs from a surrender in that a lapsed policy did not receive the necessary funds to continue, remaining dormant until potentially reinstated under certain conditions such as payment of back premiums and maintaining similar health conditions. Unlike a surrender, a lapsed policy does not yield any surrender value and can be reinstated per the policy’s terms and conditions.

*Caution should be used with all these options as a taxable situation could occur. If you have questions, we can help you.

Borrowing from a life insurance policy may not always be the most financially wise choice. Depending on economic conditions, securing a loan from a bank might offer lower interest rates. Nonetheless, having funds readily available in your life insurance can provide a valuable safety net, offering the convenience of accessing money swiftly if urgent needs arise.

The cash value of a life insurance policy can serve as collateral for loans from banks or lending institutions. Through collateral assignment, the cash value can secure a loan, providing assurance to the lender. Once the loan is repaid, the collateral assignment can be revoked from the policy, allowing for the designation of a new beneficiary if desired. This flexibility underscores the multifaceted utility of life insurance as a financial tool.

To address this question, let’s consider another question: How much money can you withdraw from your bank account? The answer is straightforward: as much as you’ve deposited. Similarly, the amount you can borrow from your life insurance hinges on the contributions you’ve made over time, but there’s a temporal aspect involved.

In the initial years, the cash value of a whole life insurance policy typically constitutes only a fraction of the total premiums paid. However, with a well-designed whole life policy, the cash value tends to grow over time. Eventually, it may surpass the total premiums paid, enabling you to borrow more money than you’ve contributed to the policy. This dynamic underscores the importance of considering the long-term benefits and potential of a properly structured life insurance policy.

You can access cash value in your life insurance policy shortly after paying your initial premium—typically within a few days. In the initial years, the cash value may not reflect the total premiums paid. Building substantial cash value takes time, and in the early stages, it may be comparatively modest.

With a meticulously crafted whole-life policy, the cash value grows progressively over time, often exceeding the annual premium contributions. Witnessing the rapid growth of cash value in a well-designed whole life insurance policy can be quite exhilarating, showcasing the long-term benefits of such policies.

Borrowing from your life insurance policy offers unparalleled flexibility, allowing you to access funds for any purpose and repay them at your own pace, often at more favorable interest rates than other lending options.

Your insurance policy serves as collateral for the loan, ensuring that your policy’s cash values continue to grow regardless of whether you have an outstanding loan.

Although mismanaging a policy loan could potentially lead to tax implications, proper understanding and guidance can mitigate this concern.

In a well-structured policy, the cash value increases over time, surpassing the total premiums paid. This means you can eventually borrow more money than you’ve contributed to the policy. Additionally, your death benefit serves as collateral, fully securing any loans taken against the policy and potentially exceeding the borrowed amount.

Importantly, borrowing from your life insurance does not impact your credit score or tax rate, offering further advantages.

If you’re interested in acquiring a well-designed life insurance policy that you can borrow against, feel free to reach out to our office at 702-660-7000. We’re here to assist you.

by Steven McFie

by Steven McFie

Many people make bad financial decisions, not because they want to, but because they don’t understand enough to make good financial decisions. I like to make things as simple as possible. Simple things are easier to understand. And when you understand something, it’s easier to make good financial decisions. (Yes this is an old picture - need to get an updated one.)