702-660-7000

702-660-7000

As you transition from active duty back to civilian life, you face a whirlwind of decisions and responsibilities. Amid the excitement of new opportunities and the challenges of forging a new path, it’s easy for an important task to slip through the cracks: securing life insurance to protect your loved ones.

For years, you’ve had the safety net of Servicemembers’ Group Life Insurance (SGLI). But that coverage expires 120 days after you leave the military. Suddenly, you’re faced with the sobering question: If something happens to me, how will my family cope financially?

Choosing the right life insurance as a veteran is a critical step in safeguarding your family’s future. But with so many options and factors to consider, it can feel overwhelming.

Life insurance for veterans ensures financial protection for their loved ones by providing a payout upon their passing. The Veterans’ Group Life Insurance (VGLI) program allows former service members to convert their SGLI into a renewable term policy.

Your SGLI coverage through the military only lasts for 120 days after you separate from service. That means you have a limited window to secure new life insurance before you’re left without coverage. For many veterans, this transition period is already filled with competing priorities, from finding a new job to relocating their family. It’s easy for life insurance to get lost in the shuffle, but the consequences of that oversight could be devastating.

Another key factor is the financial reality of post-military life. Many veterans, especially those who served for decades and are still in their prime working years, have families who rely on their income. Spouses, young children, aging parents – these loved ones could face significant hardship if a veteran were to pass away unexpectedly without life insurance. The loss of income, combined with final expenses and potential debts, can put survivors in a difficult financial position.

Veterans must also contend with the potential impact of service-connected disabilities on their life insurance options. Conditions like PTSD, traumatic brain injuries, or chronic illnesses can make it more difficult and expensive to qualify for coverage on the private market. Some insurers may deny coverage altogether or charge significantly higher premiums due to these health factors. This harsh reality makes it all the more important for veterans to explore policies designed with their unique needs in mind.

Ultimately, securing life insurance should be considered an essential part of a veteran’s transition plan. Just as you wouldn’t leave the military without lining up housing and employment, you shouldn’t leave your family’s financial future to chance. A well-chosen life insurance policy is a way to continue the mission of serving and protecting the ones you hold dear.

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

As a veteran, you have access to several life insurance programs through the Department of Veterans Affairs (VA). These policies are designed with your unique needs in mind and can provide a foundation of coverage as you transition to civilian life. Let’s take a closer look at the key options:

VGLI is the primary life insurance program offered to veterans, allowing you to convert your SGLI coverage to a civilian policy. Here’s what you need to know:

VALife is a program that replaces the Service-Disabled Veterans Insurance (S-DVI). It’s designed specifically for veterans with service-connected disabilities. Key features include:

VMLI is a unique program that provides mortgage protection for severely disabled veterans who have received a Specially Adapted Housing (SAH) grant to modify their home. Here are the essentials:

These VA life insurance programs can provide valuable protection for veterans, particularly those with service-connected disabilities or unique housing needs. However, they may not offer sufficient coverage for all veterans’ financial situations.

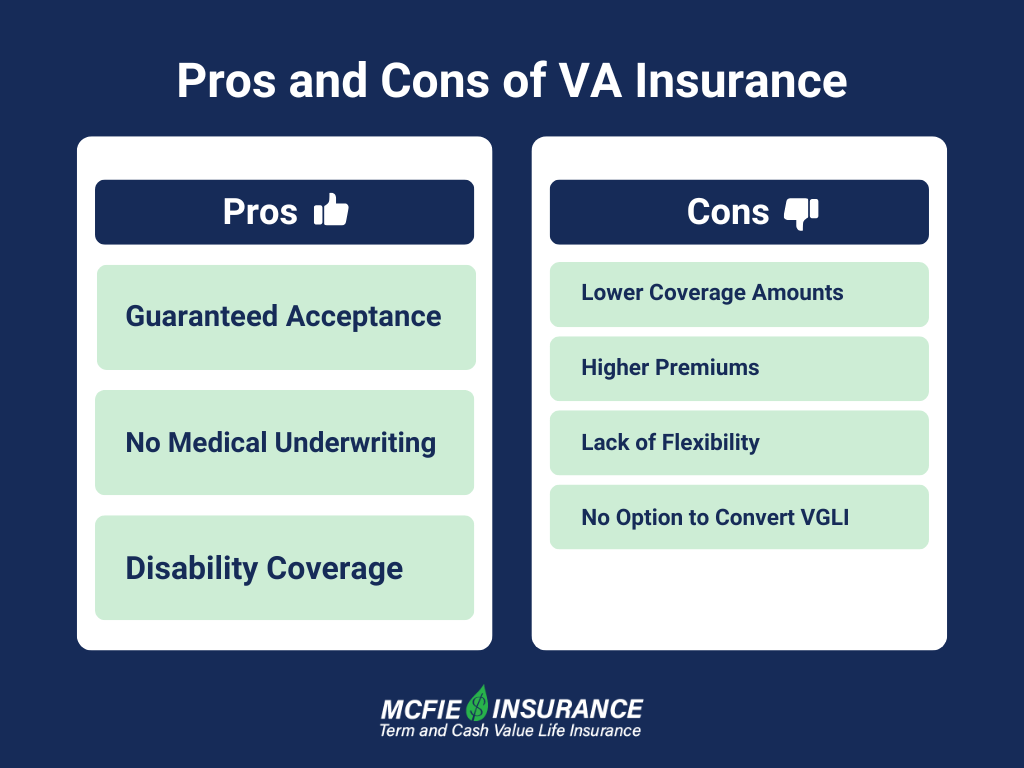

VA life insurance programs offer some distinct advantages for veterans, particularly those with service-connected disabilities. However, these policies also come with certain limitations that are important to consider when deciding on your coverage needs.

Weighing these pros and cons can help you determine whether VA life insurance provides sufficient coverage for your needs or if you should explore additional options. For some veterans, the guaranteed acceptance and disability coverage may outweigh the limitations. For others, the lower coverage amounts and lack of flexibility may be a sign that it’s worth looking into private life insurance alternatives.

Ultimately, the right life insurance solution will depend on your unique financial situation, health status, and long-term goals.

While VA life insurance programs can provide a solid foundation of coverage, they may not fully meet every veteran’s needs. Fortunately, there are many private life insurance options available that can offer more flexibility, higher coverage amounts, and additional features.

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive the death benefit. If you outlive the term, the policy expires and you’ll need to purchase a new one if you still need coverage. Here are some key advantages of term life:

Whole life insurance provides lifelong coverage and includes a cash value component that grows over time. As long as you pay your premiums, your policy will remain in force and your beneficiaries will receive the death benefit when you pass away. Some key benefits of whole life include:

It’s important to note that whole life insurance typically has higher premiums than term life, especially in the early years of the policy. However, for veterans who want lifelong protection and a forced savings vehicle, whole life can be a valuable tool.

When shopping for private life insurance, veterans may want to consider working with insurers that cater to military families. Companies like Navy Mutual and the Armed Forces Benefit Association have a long history of serving veterans and offer policies tailored to their unique needs.

These veteran-friendly insurers may offer more lenient underwriting for service-connected health conditions, as well as special discounts or rates for veterans. They also tend to have a deep understanding of the challenges and opportunities that veterans face, which can make the process of securing coverage feel more personalized and supportive.

Ultimately, the best life insurance solution for a veteran will depend on their individual needs, budget, and long-term financial goals. It’s essential to carefully assess your specific situation, compare policies and quotes from both VA and private insurers, and choose the option that provides the most comprehensive protection for your loved ones.

Choosing the right life insurance coverage can feel overwhelming, but it’s a crucial step in safeguarding your family’s financial well-being. As a veteran, you have access to unique options through the VA as well as a wide range of private insurance alternatives. Here are some key action items to help you make an informed decision:

As a veteran, you understand the importance of service, sacrifice, and protecting those you hold dear. Choosing the right life insurance coverage is an extension of that commitment, ensuring that your loved ones are financially secure no matter what the future holds.

At McFie Insurance, we’re dedicated to helping veterans like you navigate the complexities of life insurance and find the best possible coverage for your unique needs. Our team of experienced agents understands the challenges and opportunities that veterans face, and we’re here to provide personalized guidance and support every step of the way.

Don’t leave your family’s future to chance. Take action today to secure the life insurance protection they deserve. Contact McFie Insurance to schedule a complimentary consultation and explore your options. With our help, you can achieve the peace of mind that comes from knowing your loved ones will always be cared for, no matter what tomorrow brings.

Life insurance can provide veterans with essential financial protection for their loved ones. If the coverage offered through the Veterans Association doesn’t meet your needs, there are alternative options. McFie offers both whole life and term life insurance plans that may be available to veterans, providing flexible and transparent coverage. Explore our plans to find a policy that aligns with your financial goals and personal history.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.