317-912-1000

317-912-1000

Purchasing high cash value life insurance for the purpose of “Becoming Your Own Banker”, which R. Nelson Nash christened The Infinite Banking Concept (IBC), has been marketed by many agents just to sell more life insurance with little regard to the need of building the high cash values required to implement IBC.

Nash explicitly states in his book that whole life insurance is the product which provides the guarantees for IBC to work. Furthermore, the whole life insurance used needs to be a participating contract so the policyholder will be eligible to earn dividends the life insurance company pays to policyholders. This is critical if the policyholder wants to keep more of the interest lost to the cost of finance. Without dividends, 100% of interest paid will be lost to the insurance company just like with traditional loans. With dividends, much if not all the interest lost or paid when financing can be recovered. Of course, everything purchased is financed. One either gives up interest they could have earned on their money when they pay cash, or they use someone else’s money and end up paying interest to that somebody else.

But beyond these basics, each whole life insurance policy purchased for implementing IBC must have the highest premium possible, with the lowest death benefit possible and the maximum cash value possible! As simple as these guidelines are, many policyholders have been, and continue to be, deceived or misinformed and end up purchasing whole life policy(s) which do NOT match up to Nash’s criteria for use in “Becoming Your Own Bank”.

Let me explain a better way to think about managing your own money through participating whole life insurance. This isn’t about “becoming your own banker” – that kind of terminology can be misleading and potentially problematic with regulators. What we’re really talking about is using a proven financial tool that’s been relied on by successful individuals and businesses for generations.

With a properly designed participating whole life insurance policy, you gain control over your financial decisions through guaranteed access to your policy’s cash value. You’re not dependent on banks or traditional lenders to finance your needs and opportunities. Here’s what makes this approach powerful:

Early on in my trek to developing and applying what we now call the Perpetual Wealth Code™, I learned about R. Nelson Nash’s work with participating whole life insurance. Nash’s book “Becoming Your Own Banker” helped many people understand how participating whole life insurance could be used as a powerful financial tool. While Nash did important work explaining these concepts, it’s worth noting that successful business leaders had been using participating whole life insurance effectively long before his book.

We see examples throughout history of visionary entrepreneurs like J.C. Penney leveraging their participating whole life insurance policies. When Penney lost everything in the 1929 market crash, he was able to use the cash value in his life insurance to rebuild his business empire. This wasn’t a new concept – just one that hadn’t been widely understood by the public.

Even earlier, John Wanamaker, who conceived of and owned the first department store, kept substantial money in participating whole life insurance. He recognized how it allowed him to leverage capital while still earning returns on his initial principal. Andrew Carnegie considered life insurance one of the key pillars that made America’s financial system strong.

While the specific products and dividend rates have evolved over time, the core principles of using participating whole life insurance to build and preserve wealth remain the same.

Let me explain how to properly design and use participating whole life insurance to build sustainable wealth. The key is starting with a well-designed policy that maximizes early cash value while maintaining strong guaranteed growth for the long term.

We work to design policies that efficiently build guaranteed cash value by properly structuring the base policy and paid-up additions rider. This allows you to build equity in your policy that you can leverage when needed, while keeping your money working for you with guaranteed returns plus any dividends the company may pay.

When you need access to money, taking a policy loan rather than withdrawing allows your cash value to continue earning guaranteed returns and dividends. The insurance company simply holds your cash value as collateral. This helps maintain the compounding growth curve of your policy over time.

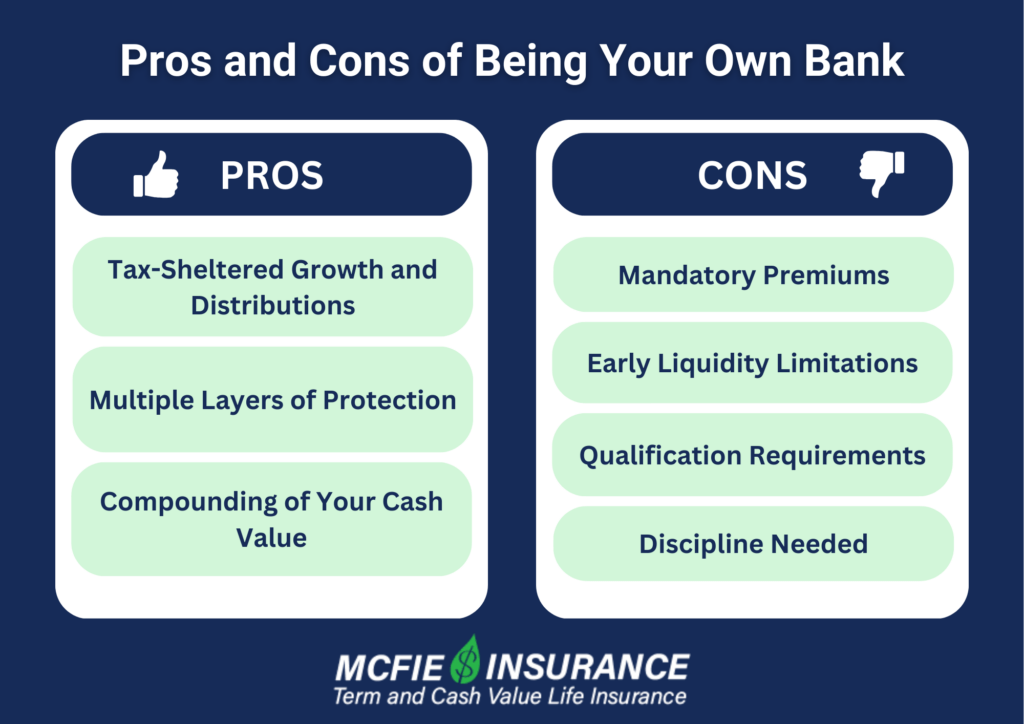

Importantly, cash value in a participating whole life policy grows tax-deferred. You can access this money through policy loans without triggering taxes. Even the growth can be accessed tax-free through loans as long as you follow IRS guidelines. This makes participating whole life insurance an efficient tool for building sustainable wealth.

The real power comes from being able to leverage your policy’s cash value through loans while your money continues earning returns. Rather than withdrawing and having to start over, policy loans let you maintain the momentum of compounding growth. And since participating policies can earn dividends, keeping more money in the policy may lead to higher dividend payments over time.

Yes, it’s entirely possible to “become your own bank” by borrowing against the cash value of a properly designed whole life insurance policy. Much like a traditional bank, you first need to fund the policy with sufficient reserves. Afterward, rather than making withdrawals that reduce its value, you can borrow as needed against the cash value, which continues compounding over time.

Using a Whole Life insurance policy as your personal banking system—rather than relying on traditional banks—can lead to stronger growth rates, tax benefits, and multiple layers of protection. Most notably, your cash value continues to compound uninterrupted, even when you borrow against it for emergencies, expenses, or strategic investment opportunities.

Using a Whole Life policy for personal banking is not inherently a scam. Some individuals, unfortunately, do get taken in by poorly structured policies sold by either uninformed or unethical agents who push inferior products or designs.

Even if you end up with a lackluster Whole Life policy, it can still function as your own banking system—albeit with reduced early access to capital and a slower cash value growth trajectory.

Because you control how you use your policy’s cash value, the only genuine “scam” would be if you borrow against it for a misguided investment. In other words, the concept itself isn’t at fault; it’s how you choose to apply it.

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

It’s often helpful to view your personal numbers modeled out so you can fully appreciate the benefits of using a Whole Life insurance policy as your own banking system. Here are a few key advantages:

Although these benefits are all significant, the most impactful one is uninterrupted compounding: your cash value continues to grow even if you take out loans. Since we only have so much time and money to invest for the future—and most of us inevitably spend more than we can save—structuring your cash flow through a Whole Life policy designed for personal banking secures compounding on funds that would otherwise be lost once spent. Meanwhile, single-purpose accounts like 401(k)s or 529 plans lose their financial momentum when you withdraw funds for their designated uses.

A lot of the negative commentary surrounding Whole Life insurance stems from biased or uninformed perspectives simply echoing other criticisms. In truth, the two main concerns—slower growth and higher commissions—can be significantly mitigated by incorporating term insurance riders and paid-up additions (PUAs), when structured by knowledgeable agents.

Still, even with an optimally designed Whole Life policy, be aware of these four potential drawbacks before committing to the “be your own banker” strategy:

This approach works best for dedicated savers with a track record of good financial habits—especially those holding a lump sum of idle cash in the bank. If that’s your situation, these four drawbacks may prove inconsequential. Otherwise, if you’re starting from scratch, you’ll need extra discipline and should choose a policy that remains manageable under all circumstances.

Our entire mission focuses on why Whole Life insurance is the premier way to become your own bank and how to design your policy for the best results.

Here are the eight key reasons Whole Life insurance is ideal for creating your own banking system:

No other financial product combines these powerful guarantees, which is what makes Whole Life insurance so effective for self-banking.

Although Whole Life is sometimes criticized as costly, that cost typically hinges more on how much death benefit is purchased rather than premium size. By “shrink-wrapping” the policy—minimizing the death benefit as allowed by the IRS—you can significantly reduce expenses.

Finally, you can optimize an “infinite banking” Whole Life policy with strategies like adding term riders and paid-up additions (PUAs). This ensures maximum cash value growth and flexibility while still preserving all the advantages of using Whole Life to become your own bank.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

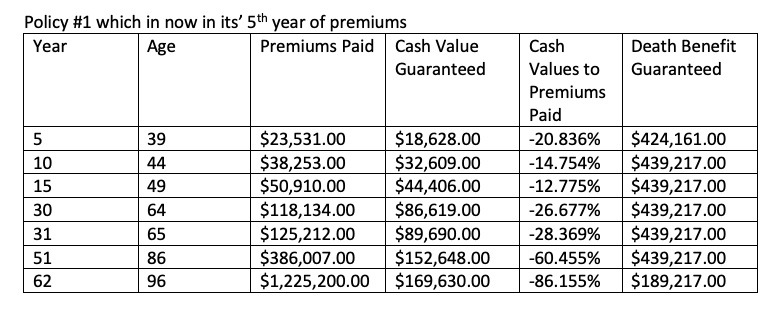

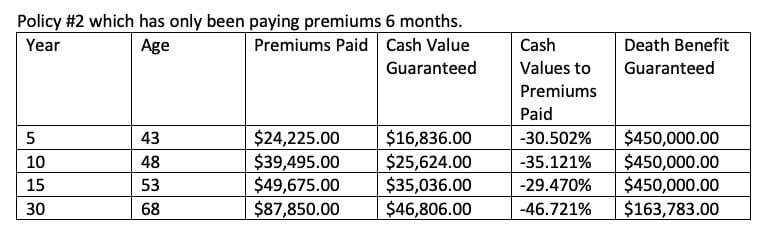

Recently, a policyholder called our office for a policy review on a couple of policies which he had purchased through another agent. Here is a snapshot of what these two policies looked like.

Both of these policies paid large first year premiums, nearly 80% more than needed, compared to the premiums in years 2-121. Yet, the cash values in both policies NEVER exceed the total cost of premiums! Furthermore, in policy #1, premiums paid by age 96 are 84.556% more than what will ever be paid out in a death benefit claim.

It is obvious that neither one of these policies were designed for IBC even though the agent who sold them said they were. The policyholder came to us when he realized he will never have more cash value than what he has been required to pay in premiums. Unfortunately, these policies where both designed for the highest premium to be paid in year one because the agent selling these policies earned a higher commission, as agents earn the majority of their commissions in the first year a policy is sold.

Whole life insurance policies designed for IBC would NEVER have guaranteed cash values which perpetually are LESS than total premiums paid. Instead, there would be a specific date in the contract where the cash values would be guaranteed to exceed the cost of premiums. On top of this, dividends paid by the insurance company to the policyholder would add to these guarantees each and every time dividends were paid.

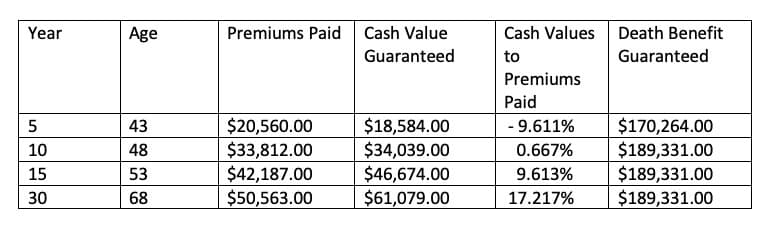

In this case, by lowering the death benefit to comply with Nelson Nash’s IBC guidelines on how to design a whole life policy, we can get something that looks like the following:

In this policy illustration, designed to implement IBC, there is more cash value than what has been paid in premiums by year 10. And by year 30 there is 17.217% more guaranteed cash value than premiums paid and 73.294% more death benefit than what has been paid in premiums.

Just remember, you want the highest premium possible, which you can afford, with the lowest death benefit possible because the death benefit will grow over time, along with the maximum cash value possible in the policy right from the very start of a new policy. If you can combine all three of these things together, while complying with the modified endowment contract stipulations the IRS has outlined, you will be off to a great start. You will indeed have a whole life policy which will serve you well as you begin to finance the things you purchase in life using policy loans, instead of losing the interest you would normally pay to others.

IBC is a way of life. You must use it, or you will lose it. Without using IBC, you will continue to lose interest or pay interest to others for the rest of your life. At McFie Insurance we specialize in helping people keep more of the money they make by designing, selling and servicing whole life insurance policies. But we go beyond this! We mentor our policyholders so they can maximize the use of their policies and build the sustainable wealth they need for their future.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.