317-912-1000

317-912-1000

Disclaimer: Investing information provided on this page is for educational purposes only. McFie Insurance does not offer advisory or brokerage services, and does not recommend or advise investors to buy or sell particular securities.

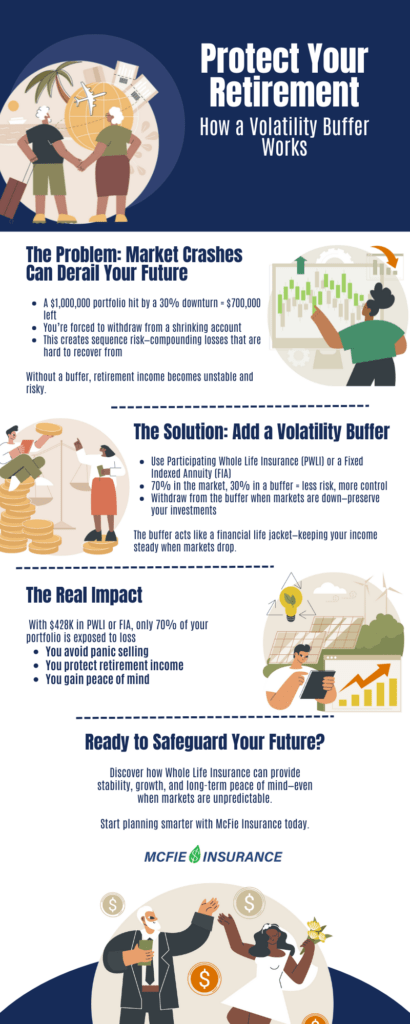

As you get closer to retirement, it’s just as crucial to keep your assets safe as it is to try and grow them. This is where a “volatility buffer” can be helpful, especially during the 10 years before you retire and the 10 years after you’ve retired.

Imagine being in this 20-year period. If you face a big financial setback, it could mess up your retirement plans big-time. For example, many folks who were about to retire in 2008 had to keep working for another decade to recover from the losses they faced during this financial crisis.

So, what exactly is a volatility buffer? It’s a strategy to protect your investments from big losses by keeping a portion of your portfolio in an account or an investment which is not subject to volatility. This can be super useful during shaky times, and even while you’re withdrawing money out of your investments to live on during retirement.

There are many ways to set up a volatility buffer. One method is through participating whole life insurance (PWLI) cash values. The best time to set up a volatility buffer through PWLI is sooner than later. Starting policies for children can be a great thing, but even starting a policy in your 50-60’s may still be in time to receive some of the benefits from this type of volatility buffer.

In this piece, we’ll dive deeper into what a volatility buffer is, how you can incorporate it into your retirement plan, its advantages and disadvantages, and how to decide if it’s right for you.

A volatility buffer, in the context we’re discussing, is a financial tool that helps protect against significant drops in market value. The exact financial products used can differ, but often ones with guaranteed promises, like life insurance or annuities, are best chosen.

Take a fixed index annuity as an example. This annuity gains interest based on a certain benchmark index. The good thing? Even if the market takes a dive, the money in a fixed indexed annuity typically doesn’t decrease in value, regardless of what happens to the benchmark index. But in scenarios where the index dips, fees could still reduce your account value.

Another thing to note is that, because a fixed index annuity guards against losses when the market goes down, its growth potential also is not as high.

So while a volatility buffer using a fixed index annuity might not promise sky-high growth, it can offer some stability. This promise of gaining “some when the market rises and losing nothing directly from market losses” is often attractive to those retiring or nearing retirement.

Now think about another example – using participating whole life insurance as a volatility buffer. Participating whole life insurance can provide a wonderful foundation in nearly any portfolio. On top of the obvious guarantees which are found in all whole life insurance contracts such as; lifetime protection for loved ones, and guaranteed cash value growth that can help to fund your retirement, participating whole life insurance cash values can be used as an effective volatility buffer for your investment portfolio.

Participating whole life insurance contracts are unique because the guaranteed tax-deferred growth which they generate over time can be easily accessed without pre-qualification, simply on the signature of the policyholder. Access to this capital can allow the rest of an investment portfolio, great or small, to recover from a market correction without having to experience further loss due to distributions beyond statutory minimums that might be needed to sustain lifestyle if all of your assets were invested.

Volatility buffers are pretty simple strategies in many situations. Their main job? To help lessen the blow when the market takes a dip and your invested accounts decrease in value.

Imagine you’ve saved up a retirement fund of $1 million, and you have also built $428,000 thousand of cash value in participating in a whole life insurance policy. This means only 70% of your portfolio is vulnerable to market fluctuations. 30% of your portfolio is steady and actually guaranteed to grow each and every year.

Let’s say the market drops by 30%. This could lead to a potential loss of $300,000 on the part of your portfolio exposed to the market – bringing it down from $1 million to $700,000. But the $428,000 you’ve built in whole life insurance cash values? It remains untouched.

Such a buffer can be especially useful when you’re retired and need to pull income from your assets during times when the stock market isn’t doing so well. During these downturns, you can draw more from the life insurance volatility buffer, giving your other investments more time to bounce back from their losses.

In simple terms, the volatility buffer offers a safety net for your income. When the market is flourishing, your other investments can step up to the challenge and help with the growth side.

Introducing a volatility buffer to your retirement plan can be a crucial defense against sequence risk. What’s sequence risk?

If you’ve saved up $1 million for retirement and a market downturn shrinks it by 30% as in our previous example, you’d be left with just $700,000 for your retirement years. To reclaim your initial value, the portfolio will need a rebound of nearly 43% not considering taxes or fees. Though markets can recover over time, such a substantial loss can seriously disrupt your retirement timeline.

Here’s another way to look at sequence risk: If your $1 million investment takes a 25% hit, you’re left with $750,000. If the following year sees a 25% market upswing, it might seem like you’d be back to your million. But that’s not the case. A 25% gain on $750,000 amounts to $187,500, making your total account only $937,500. That’s a $62,500 deficit even if your two-year average return appears to be break-even (-25%+25%) / 2 = 0%. And you probably had some taxes and fees to figure in on top of this.

Moreover, predicting market behavior is challenging. If you start with your initial million and withdraw income at a rate of 4%/year, you’d receive $40,000 annually. But, if you experience a 25% reduction in your first retirement year, your annual income drops to $30,000.

And there’s more to consider. Several financial experts argue that a 4% withdrawal rate might be too optimistic for an invested portfolio given today’s unpredictable markets. After the 2008 market crash, some suggest more conservative rates around 2.4%, while others believe rates higher than 4% could be viable based on potential market scenarios and their strategies.

A volatility buffer may help you to achieve a higher sustainable withdrawal rate in retirement. It’s good to consult with your financial advisor on this, as these decisions can significantly impact your retirement lifestyle.

A volatility buffer acts as a safety net, shielding you from significant market downturns during retirement. Picture this: You’ve amassed a retirement savings of $1 million. By strategically arranging half of this as a volatility buffer, you can have the comfort of knowing that a significant section of your funds are safeguarded against severe market fluctuations.

You can leave the remaining half exposed to the markets to tap into growth potential. This approach helps to anchor yourself in safety while still venturing into the unpredictable market “waves.” So, if the market tumbles by 25% soon after your retirement, your loss will be far less severe than if you didn’t have a buffer.

The main goal of volatility buffers, like participating whole life insurance and fixed annuities, is to mitigate potential losses caused by unfavorable market conditions. By allocating a serious percentage of your funds to such buffers, you’re effectively reducing your exposure to market risk and adding an extra layer of financial security for more peace of mind.

While there are several protective type investment and savings tools out there, none that we know of, can promise the same level of guaranteed security that life insurance and annuities provide.

If market fluctuations keep you up at night, a volatility buffer might be the perfect solution for you.

Even if you like taking big risks occasionally it’s usually wise to have a secure foundation that you can then build upon with riskier investments according to your preferences. By incorporating ‘safe money options’, you can shield a significant portion of your assets from severe market downturns and often open more options for using your money in a wider range of investments throughout your lifetime.

Each situation is different so be sure to engage with a knowledgeable financial expert to navigate these decisions. A good professional can help you assess the best volatility buffer solutions and help to tailor them to your financial situation and comfort level.

A volatility buffer, particularly in the form of participating whole life insurance or a fixed annuity, can be a strategic tool to minimize risk in your retirement planning. While it may not be advisable to invest all your savings into one product or account, aligning your choices with your long-term financial objectives can prove very beneficial.

It’s essential to explore participating whole life insurance, annuities and other options to determine their fit in your financial journey. Call McFie Insurance at 702-660-7000 or schedule an appointment here. We are ready and available to assist you.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.