702-660-7000

702-660-7000

Investing in self-storage means putting your money into storage facilities with the goal of earning returns through rental income from individual units. These facilities serve a wide range of customers, including everyday individuals who need extra space and small to mid-sized businesses looking for secure, affordable storage solutions.

As an investor, you can take one of two approaches: you might choose to be hands-on, overseeing the daily operations, managing tenants, and maintaining the property. You could also opt for a more passive role by investing in a facility managed by professionals, allowing you to benefit from the income without getting involved in the day-to-day tasks.

Tenants may lease storage units for a few weeks, several months, or even years. No matter the rental term, the main advantage is consistent cash flow—so long as a unit is occupied, you’ll continue to generate income. This predictable revenue stream, combined with relatively low overhead costs and steady demand, makes self-storage a compelling addition to many investment portfolios.

Experts widely regard self-storage as a booming sector and an attractive avenue for investment, thanks to its consistent performance and income potential. As the industry expands, more investors are recognizing the benefits it offers in terms of risk management and profitability.

While all investments come with some degree of risk, self-storage is often seen as a lower-risk option compared to many other types of real estate. One major reason is its low operational costs—there’s no need for elaborate build-outs, extensive staffing, or ongoing maintenance expenses typically seen in retail or multifamily housing. These low overhead costs reduce the day-to-day risks of running the business and help maintain healthy profit margins. As a result, you’re better equipped to absorb short-term revenue dips without seeing a big impact on your bottom line.

Another reason self-storage thrives is the growing demand from a wide array of customers. Everyone from college students and families in transition to startups and established businesses needs space to store belongings or inventory. This demand helps facilities operate near or at full capacity, generating steady and often increasing rental income. As occupancy rates climb, so does your revenue—leading to greater long-term returns on your investment.

To enhance profitability, investors can explore additional revenue streams. Offering services like packing supplies, loading and unloading equipment, or even on-site vending machines adds value for tenants and boosts income. Expanding tenant capacity or optimizing unit mix can also maximize the earning potential of your facility. Together, these strategies help create a more stable, diversified, and reliable cash flow.

One of the most attractive aspects of investing in self-storage is the opportunity to generate a reliable and consistent income stream. Because the need for storage space is ongoing—driven by life events like moving, downsizing, or running a business—these facilities tend to maintain high occupancy rates throughout the year. This steady demand helps guarantee that rental payments keep flowing in, even when other types of real estate investments may experience more noticeable dips in occupancy and cash flow. The recurring nature of rental agreements also adds predictability, making it easier for investors to forecast earnings and manage their finances.

Another advantage of self-storage facilities is their low maintenance compared to other forms of real estate. These buildings are designed for simplicity and efficiency, with minimal amenities and straightforward construction. Once built, they don’t require ongoing upgrades or major renovations. Maintaining clean, secure, and well-lit units—along with a dependable security system and fire protection—usually meets tenant expectations. This ease of upkeep keeps operational expenses low, allowing investors to allocate more of their revenue toward profit or future growth. In short, self-storage offers a hands-off, hassle-free investment experience for those looking to minimize their ongoing responsibilities.

If a self-storage facility integrates management software into its operations, it can streamline day-to-day tasks and reduce the need for on-site supervision. This type of software can automate a wide range of functions, like tenant onboarding, rent collection, unit availability tracking, and even customer service inquiries. By embracing automation, facility owners can cut labor costs, minimize human error, and improve operational efficiency. This results in smoother business operations and a more scalable model that can grow without the need for proportional increases in staff.

The self-storage business model is adaptable, offering a great deal of flexibility for investors. You can start small—converting an underutilized warehouse or commercial space into a basic storage facility—and then expand your offerings as your profits grow. Beyond self-service kiosks that allow customers to rent units and make payments independently, more advanced service options like valet storage can be introduced. These services, which involve picking up, storing, and returning a customer’s items, can also be managed efficiently through the same software platforms, allowing for a seamless user experience.

Many facilities are now offering value-added services like truck rentals or moving assistance to attract a broader customer base and increase revenue per tenant. This type of flexibility makes self-storage a resilient investment across various economic climates. During economic booms, investors can focus on acquiring and developing more storage units to meet growing demand. In economic downturns, when people are more likely to downsize or consolidate, the demand for affordable storage solutions increases. This built-in adaptability helps investors maintain steady returns and maximize ROI regardless of the economic cycle.

No investment is ever risk-free. So, watch for the following pitfalls:

Although self-storage can be a profitable and stable investment, its long-term success hinges on how well the facility is positioned within the local market. Identifying the ideal location and understanding the needs of your target customer base isn’t always straightforward. A poorly chosen location or misjudged market can lead to underperformance and missed revenue opportunities.

Several factors contribute to the complexity of market positioning:

Accurately identifying existing competitors and their offerings

Understanding the unique storage needs of your potential tenants, such as students, families, or business owners

Choosing the right mix of unit sizes and features to meet local demand

Offering desirable amenities, such as 24/7 access, climate-controlled units, or enhanced security

Securing a highly visible, easily accessible piece of real estate that attracts attention and convenience-seeking customers

Neglecting to fully research and incorporate these elements into your strategy can result in lower occupancy rates and reduced profitability. For investors looking to make the most of their self-storage venture, a well-researched and clearly defined market position is essential to ensuring long-term success and maximizing ROI.

Contrary to popular belief, managing a self-storage facility isn’t entirely hands-off.

Even with the latest self-storage management software to automate many functions, active management is still required to oversee certain aspects of the business. While automation can streamline tasks like billing, access control, and tenant communication, it doesn’t eliminate the need for human oversight.

It is crucial to make sure that security systems, management software, and other utilities are updated regularly. Routine maintenance and inspections are necessary to keep everything operating smoothly and to avoid service disruptions that could frustrate tenants or harm your facility’s reputation. A business plan is essential, along with an expert team capable of executing this plan effectively. Whether you’re handling operations yourself or working with a third-party management company, experienced personnel are critical to long-term success.

The simplicity of constructing and maintaining storage facilities attracts a growing number of investors to self-storage investing. This increasing popularity, while a sign of the sector’s appeal, also brings a potential downside: market saturation. When too many facilities enter the same region, the supply of available units can exceed demand, leading to stiffer competition.

This oversaturation can diminish occupancy rates, force rental prices down, and reduce the profitability of your investment. To avoid this, thorough market research and careful site selection are essential before launching or expanding a self-storage operation. Being strategic about location, target demographics, and differentiating your facility can help safeguard your investment from these competitive pressures.

Class A self-storage facilities are those that have been newly constructed within the last 10 to 15 years. These properties are situated in prime, highly accessible locations that attract a steady flow of tenants. They offer a wide range of modern amenities designed to enhance the customer experience, like climate-controlled storage units to protect sensitive belongings, state-of-the-art storage management software for seamless operations, and advanced security systems including surveillance cameras and electronic gate access. Thanks to these premium features, Class A facilities enjoy low tenant turnover rates and high occupancy levels, making them desirable investments in the self-storage market.

Class B storage facilities refer to those that are older than 15 years. While they still provide adequate maintenance and basic amenities, they fall short of the high standards set by Class A properties. For example, these facilities may not offer climate-controlled units, and their maintenance schedules might not be as frequent or thorough. As a result, Class B facilities often appeal to a different tenant demographic that is more price-sensitive. The rental rates for these units are moderate, reflecting the more limited features and older infrastructure. Despite these differences, Class B facilities can still generate steady income, especially in markets where affordable storage options are in demand.

Storage facilities that are older and situated in less desirable locations are classified as C-class storage. These facilities tend to offer only basic or limited amenities, lacking features like climate control, modern security systems, or updated management technology. As a result, rental rates for C-class facilities are lower compared to Class A and B properties, reflecting their reduced appeal to tenants. The security measures at these locations may be minimal or outdated, which can impact tenant confidence and occupancy rates.

As an investor, it is crucial to carefully evaluate the specific features, amenities, and location quality of each storage facility class before making investment decisions. Understanding the differences among Class A, B, and C properties will help you align your investment goals with the risk and return profile of the facility you choose to invest in.

If you wish to invest in the self-storage market, here are three popular ways to do so. You can analyze each closely to decide which one to choose.

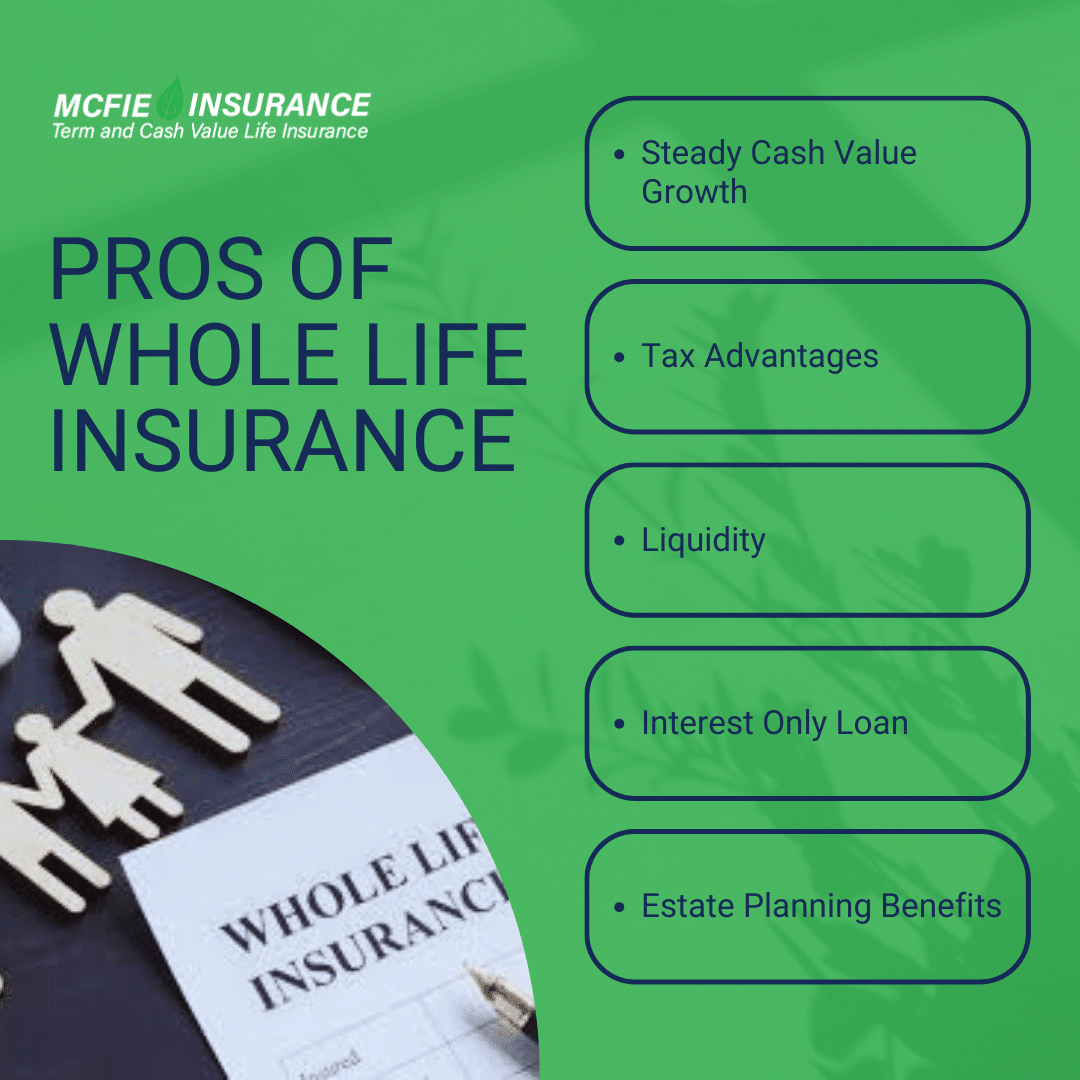

Utilizing the cash value of a whole life insurance policy to fund the purchase of storage rental properties, comes with a unique set of advantages:

Pros of Using Whole Life Insurance:

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

Cons of using Whole Life Insurance:

Another way to enter the self-storage industry is by investing in real estate investment trusts, commonly known as REITs. Self-storage REITs specialize in owning and managing a portfolio of self-storage facilities. They generate profits by leasing storage spaces to a wide range of customers, including individuals and businesses. By pooling resources from multiple investors, these REITs can acquire and operate numerous properties, benefiting from economies of scale.

REITs have gained a reputation as one of the top investment options within the self-storage sector due to their strong performance and attractive returns. One of the main advantages of investing in self-storage REITs is their relatively low capital requirement, which allows investors to participate without the need to manage day-to-day operations. This makes them appealing for those seeking exposure to the self-storage market without hands-on involvement.

Investing in a well-managed and high-performing self-storage REIT that has promising profitability projections can offer returns comparable to those seen in the stock market. Self-storage REITs generate income from multiple revenue streams, including rental fees paid by tenants, management charges, reinsurance revenue, and penalties for late payments. This diversification of income sources helps stabilize cash flow for investors.

Pros of Investing in Self-storage REITs:

Investors benefit from the increasing demand for self-storage units across demographics.

There is potential for high profit margins and attractive returns on investment due to the efficiency and scale of REIT operations.

The passive nature of the investment allows investors to avoid the operational complexities involved in managing individual storage facilities.

REITs require a relatively small initial capital outlay, making self-storage investment accessible to a broader range of investors.

Cons of Investing in Self-storage REITs:

The risk of market oversupply and intensified competition can impact occupancy rates and rental prices.

Passive investors have little to no control over day-to-day business operations or strategic decisions.

Achieving growth targets within anticipated timeframes may be hindered by external market factors or management limitations.

It is vital for investors to carefully identify and navigate existing and emerging competition in the local markets where the REITs operate. This analysis is often challenging but essential for making informed investment decisions in the self-storage sector.

Many active investors choose to construct a self-storage facility from the ground up as a way to achieve their investment and operational goals. Building a storage facility from scratch requires a significant amount of time, effort, and capital investment. Before breaking ground, market research is essential to identify the most strategic location and select the ideal site that will attract sufficient demand.

Once construction is complete, the success of the facility depends heavily on implementing effective marketing strategies to attract a steady stream of customers. Providing high-quality services and maintaining excellent customer relations are key factors in retaining tenants and creating long-term profitability.

Pros of Building a Self-storage Facility:

Construction costs can be lower than the price of purchasing an existing, fully operational facility, offering cost savings upfront.

Investors maintain full control over every aspect of the construction process, including the facility’s layout, design, and specific features, allowing for tailored customization.

Building new enables the investor to create a customized mix of storage unit sizes and types that meet current market demands and customer preferences.

Brand-new facilities tend to be more attractive to renters, as they often come with modern amenities and a fresh appearance, which can lead to higher rental rates and increased income.

Cons of Building a Self-storage Facility:

There is higher market risk when building new compared to purchasing an established facility with an existing tenant base and proven cash flow.

The process requires specialized industry expertise to avoid costly mistakes in construction, design, or site selection that could impact profitability.

The construction phase is time-consuming and labor-intensive, requiring ongoing management and oversight.

It may take several years to reach full occupancy and realize the facility’s fair market value, which can impact cash flow in the short term.

Effective and ongoing marketing efforts are crucial to build awareness, attract tenants, and maintain occupancy rates over time.

Building a self-storage facility can be a rewarding investment, but it demands careful planning, patience, and strategic execution to achieve long-term success.

To create a favorable investment environment, it is important to conduct thorough market research. This research should focus on identifying regions where demand for self-storage units is strong but supply remains limited or insufficient. Factors to analyze include population growth trends, shifts in local economic conditions like employment rates and business activity, and the competitive landscape with a focus on the number and quality of existing storage facilities. By carefully studying these elements, you can pinpoint areas that offer the most promising opportunities for successful self-storage investments and minimize the risk of entering an oversaturated market.

A critical step in any self-storage investment is a detailed financial analysis. This involves evaluating the purchase price of the property or construction costs, estimating operating expenses like maintenance, security, and management fees, and projecting achievable rental rates based on current market conditions. You should also calculate the expected return on investment (ROI) by factoring in potential income streams and any financing costs. Partnering with a financial advisor or an experienced real estate professional can provide invaluable insight, helping you navigate the complexities of investment valuation and making sure that you have a well-rounded understanding of the financial viability and risks associated with the project.

Location remains one of the most pivotal factors in the success of any self-storage business. When selecting a site for your investment, prioritize areas with population density, commercial activity, or expanding residential developments. Convenience and accessibility are considerations for attracting potential renters, so look for locations with good transportation links and easy access.

Avoid relying solely on market projections or short-term trends—ground-level knowledge and site visits can offer practical insights. Evaluate the features of the storage units themselves. Offering amenities like state-of-the-art security systems, climate control options for sensitive belongings, and a variety of unit sizes ensures that you can meet the diverse needs of different customer segments. By balancing location choice with facility features, you enhance both the appeal and overall functionality of your self-storage investment, setting the stage for long-term success.

Understanding the habits, needs, and preferences of your target customers is crucial for any self-storage investor aiming to make informed decisions and maximize return on investment. By developing an understanding of consumer behavior, you can tailor your services, marketing strategies, and resource allocation to best meet the demands of specific user groups. This approach not only improves customer satisfaction but also enhances facility occupancy and profitability.

The primary target demographics for self-storage include residential users, commercial clients, students, and military personnel. Each group has distinct motivations and expectations when it comes to storage solutions.

Residential Customers

Residential customers represent the largest share of the self-storage market. These individuals or families need storage during life transitions like moving, downsizing, home renovations, or managing estates. They tend to rent medium-sized units that can accommodate furniture, household items, and personal belongings. The average rental period for residential customers ranges from 6 to 13 months, though some may stay longer depending on their circumstances. To attract and retain these customers, make sure the facility is clean, secure, and easily accessible, and consider offering flexible rental terms.

Commercial Customers

Small and medium-sized business owners utilize storage units to manage excess inventory, store business records, or house seasonal items and equipment. These customers require medium to large units and tend to rent for shorter durations, between 2 to 4 months—coinciding with business cycles or inventory fluctuations. Because they value convenience and security, it’s important to offer features such as extended access hours, drive-up units, and advanced security measures. Targeted marketing to local businesses and offering business-specific packages can help build this clientele.

Students

Students are a unique and valuable customer segment, especially in areas near colleges and universities. They usually rent storage space during summer breaks, academic holidays, or internships when they temporarily vacate campus housing. These renters look for small, affordable units and are price-sensitive. Rental durations are generally short, averaging 3 to 4 months. To successfully attract students, consider marketing campaigns timed around the academic calendar and offering discounted or bundled pricing, especially during peak move-out seasons.

Military Personnel

Military members often need storage solutions during deployments, reassignments, or extended training exercises. These individuals seek storage facilities located near military bases and may require short-term and long-term solutions. Units rented by military personnel often contain household goods, uniforms, and personal effects, and rental periods exceed six months. To cater to this group, offering discounts for active-duty service members and emphasizing security and accessibility can make your facility more appealing and trusted.

By aligning your facility offerings with the specific needs of each customer segment, you position your business to attract a diverse range of tenants and maintain strong occupancy rates year-round.

To maximize your return on investment in the self-storage sector, it’s essential to take a proactive approach to risk management. Strategic planning, due diligence, and thorough market research are key to avoiding common pitfalls and ensuring long-term profitability.

Security Considerations

One of the most critical aspects to assess is the frequency of break-ins and theft at storage facilities in your target market. High crime rates can deter prospective renters and lead to reputational damage, increased insurance costs, and liability concerns. Before investing, research local crime statistics, speak with neighboring businesses, and visit the area at different times of day. If the region has a higher incidence of break-ins, implement robust security measures such as 24/7 surveillance cameras, gated access with keypad entry, motion-sensor lighting, and on-site personnel to deter criminal activity and instill confidence in your tenants.

Value-Driven Upgrades Over Cost-Cutting

While keeping operating costs low is important, relying on cost reduction can compromise the customer experience and limit your revenue potential. Instead, focus on value-driven upgrades that can justify premium rental rates and attract long-term tenants. Examples include:

Enhanced lighting for safety and visibility

Climate-controlled units for sensitive items

High-quality unit doors and locking mechanisms

Contactless rentals and online payment capabilities via management software

Convenient features such as drive-up access and extended hours

These enhancements can increase the perceived value of your facility, improve tenant satisfaction, and boost occupancy rates—all of which positively impact your bottom line.

Location Strategy and Market Saturation

Market saturation is another risk to consider, especially in urban centers or areas with a high concentration of established self-storage operators. In such locations, new facilities may struggle to gain traction due to stiff competition and limited demand.

To mitigate this, explore investment opportunities in secondary or tertiary markets—areas just outside major cities or in smaller communities experiencing population growth. These regions often have unmet demand, lower land acquisition costs, and fewer large-scale competitors, making them ideal for entering or expanding within the self-storage market. A well-placed facility in an underserved area can yield strong returns and face fewer barriers to occupancy growth.

Incorporating these risk mitigation strategies into your investment plan will help safeguard your capital, improve operational efficiency, and position your self-storage venture for sustained success.

This is entirely dependent on your financial situation. Storage units are a great investment if you follow sound financial principles to ensure you don’t fall into any sticky situations. Give the team at McFie Insurance a call and we can help you understand if leveraging whole life insurance is a viable path for investing in storage units. Schedule a consultation today!