317-912-1000

317-912-1000

In life, we may experience seasons where providing an annual income is not always possible. We may confront sudden illnesses or even a downturn in the job market. Especially during retirement, individuals’ annual income often drops significantly because they are no longer working. Finding a way to protect you and your family against life’s uncertainties is paramount in financial planning.

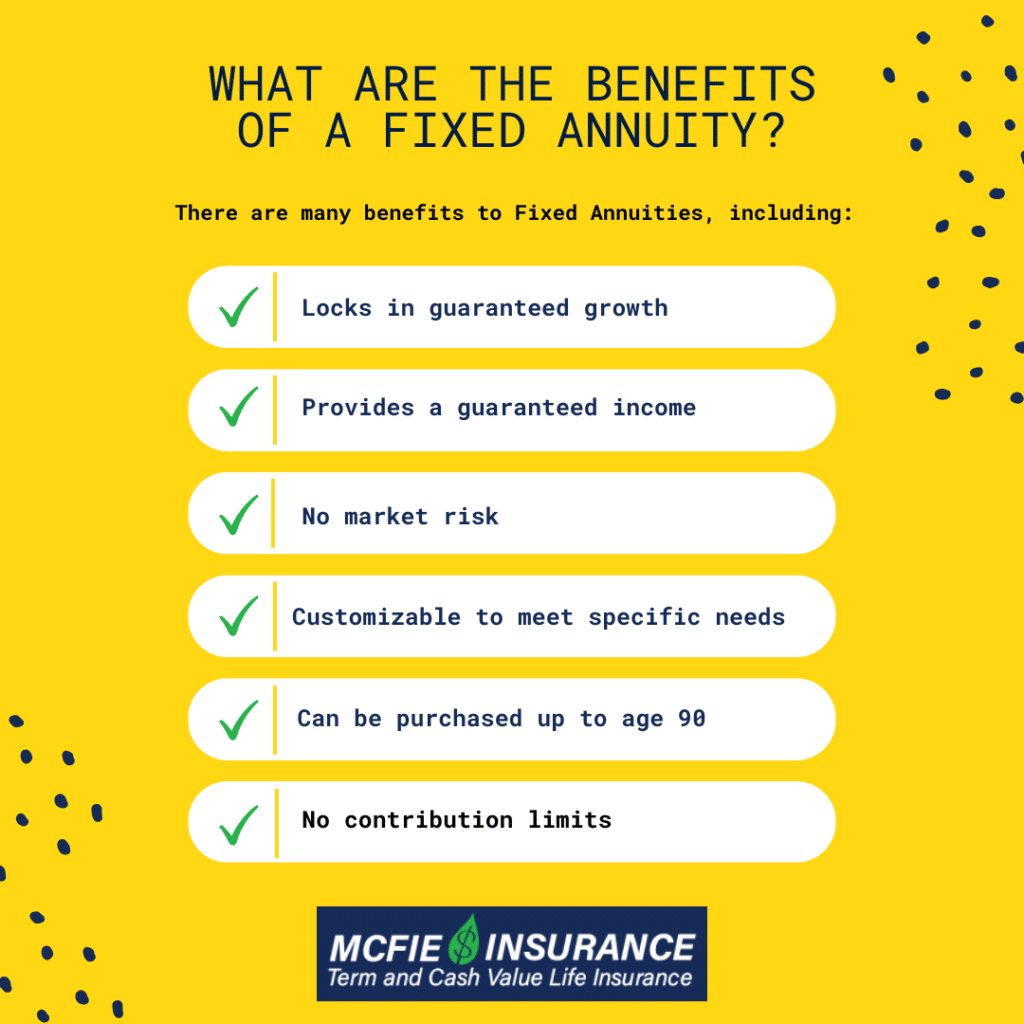

Typical forms of financial planning have a high market risk and are rarely able to supplement up to your previous income stream. A Guaranteed Fixed Annuity helps mitigate this risk by establishing an account that guarantees a fixed income stream. In this article, we are going to answer some of the most common questions about fixed annuities.

An annuity is a form of insurance that provides a person with an income for a lifetime, a specific period, or a combination of the two. A Guaranteed Fixed Annuity, or Fixed Guaranteed Annuity, provides a guaranteed income stream without any market risk. Other kinds, such as the Indexed and Variable annuities, carry market risk. Because of this, McFie Insurance only sells Fixed Guaranteed Annuities.

A fixed annuity consists of two phases: the accumulation phase and the annuitization phase (also known as the annuity phase). During the accumulation phase, the account holder pays a lump sum or recurring premiums to fund the fixed annuity, and it earns interest. During the annuitization phase, the annuitant receives payments from the annuity. Fixed annuities have a guaranteed principal and interest rate backed by the insurance provider.

Individuals can outline specifics for the payout phase when setting up the account. Account holders can choose between income payments that are immediate or deferred. If you choose an immediate payout, you could start receiving payments in as little as one year. However, people will often choose a deferred payment schedule that will begin payouts at retirement.

Fixed annuities don’t fall under the category of securities due to their guaranteed interest rate feature. Your earnings from a fixed annuity remain stable, unaffected by the ups and downs of the market, with the insurance provider shouldering any investment risks.

On the other hand, variable annuities are viewed as securities because your earnings are directly linked to how well the investments in your subaccounts perform. This setup places the investment risk on you. The U.S. Securities and Exchange Commission (SEC) oversees the regulation of variable annuities.

There are two primary methods to finance a fixed annuity: either through a single payment or through multiple premium installments.

These are financed through a one-time payment. This is commonly achieved by transferring funds from a 401(k) or an IRA, or by utilizing proceeds from the sale of another asset.

These are financed over time through regular premium contributions. With each payment you make, the value of the annuity increases according to the predetermined interest rate.

Annuity payments are based on your life expectancy. This means that the younger you start receiving payments, the smaller your payments will be. It’s not unusual to see 4-6%+ annual payout rates from a Guaranteed Fixed Annuity depending on age, and health factors.

In many cases, a fixed annuity can be passed on to beneficiaries at time of death. This ensures that your wealth continues to add value to your family even after death.

Fixed annuities are structured as insurance agreements provided by insurers. The funds from premiums are allocated to investment portfolios primarily composed of high-grade fixed-income securities from the public market, which serve to generate income and minimize fluctuations. To potentially boost investment outcomes or to pursue greater yields in a scenario of low interest rates, additional types of assets might be included. However, the results of these investments do not influence your returns. The fixed interest rate specified in your agreement is assured, regardless of how these investments perform.

Now that we better understand the answer to “How do annuities work,” you can start evaluating whether or not a fixed annuity would be beneficial for your financial future.

In general, annuities are for people who need to convert a lump sum of assets into a series of guaranteed payments or need a steady, guaranteed income for a period of years. They are often used by people in retirement to provide a guaranteed income stream for their lifetime.

If you are interested in seeing how a Guaranteed Fixed Annuity could fit into your financial plans, schedule an appointment with us to look at a Custom Annuity Illustration.